A few days back we were working with a new NRI client on his financial plan. He had a very well-diversified portfolio including international equity & debt – prima facie this was the best allocation that I saw in the last couple of years.

Our observation – this portfolio must be performing very well.

Then we started going into details & tried to understand how he took these decisions. He mentioned in 2020 he built this portfolio after looking at the great performance of these funds. Oops…

Oops – the most common mistake that most investors do. Buying recent performing asset classes or funds… But there was even a bigger mistake in his case – he invested in long-term debt funds of developed countries.

Must Read- How NRIs can earn more by investing in themselves

Impact of Falling Interest Rates on NRIs

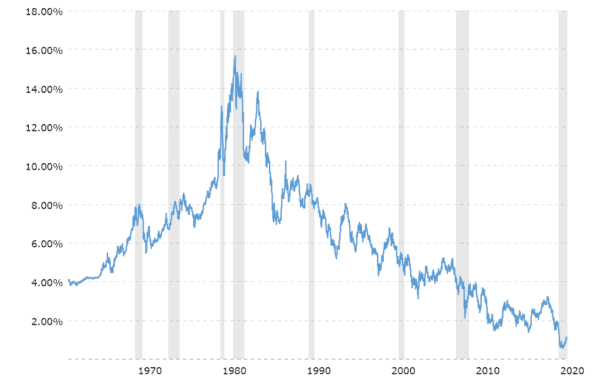

Interest rates impact everything in this world. If you look at the below chart you can observe that how interest rates in the USA (this is more or less similar in all developed countries) have gone down in the last 40 years. (16% to .5%)

In the world, almost 40% of debt is giving negative rates right now. Just imagine what will happen if the trend reverses & how it will impact the financial world + you.

Must Read – Status of NRE FD after Returning to India

Direct Impact

Interest rates are inversely related to returns. To simplify when the rate goes down long-term debt funds generate great returns & when Interest goes higher they generate lower or even negative returns.

US long-term debt funds are giving phenomenal returns in the last few years. The last 1-year return is 17% & the last 10 years is 7.7% CAGR + if we add dollar appreciation, that’s huge.

But what will happen if interest rates increase?

In this client’s portfolio, there was major exposure in long-term debt funds where the expense ratio was higher than portfolio yield. This can be justified when portfolios are performing but will hurt more when returns will be lower or negative.

We suggested him to trim that exposure. You don’t have to follow this advice – talk to your financial planner.

Note – Many NRIs, whether they know or not have long-term debt funds in their pension plans like 401k or Qrops. (Floating rate home loans will also be impacted if interest rate increase)

Must Read – 401k moving to India

Indirect Impact

I don’t want to go into details but rates are like a gravitational force for all the assets. If the interest rate is lower all assets can fly including equity, real estate & even commodities. If rates are higher there’s pressure on all these asset classes.

We don’t know when this reversal will happen but someday it will without alarming us.

NRIs & Falling Interest Rates in India

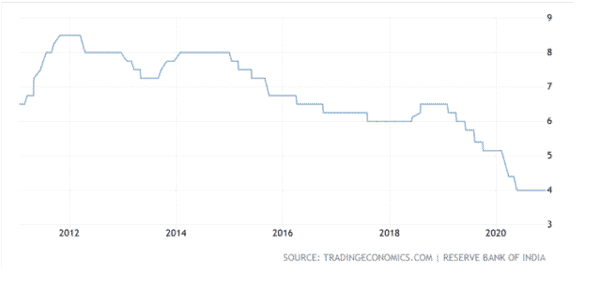

The graph below shows the movement of the repo rate in India over the last 10 years –

It has been falling since around 2015. It is an important figure to track as the repo rate has a direct bearing on the rates of deposits that we invest in and loans that we take. When the repo rate falls, commercial banks can get money from the central bank at a cheaper rate which means, they reduce the interest rate on deposits. At the same time, they can afford to provide loans to their customers at a lower rate.

Read – How can NRIs Manage financial uncertainty?

The movement of interest rates affects the personal finances of NRIs. NRIs have to not only track interest rates in India but also in their country of residence –

- Falling interest rates will lead to lower returns on NRO and NRE fixed deposits. NRIs will have to decide if they want to stay invested in these FDs or move to more lucrative products.

- On the other hand, they have to compare the rates in the country of residence and India. As mentioned above, in countries like the US and the UK, interest rates are lower than those of India and have further fallen in 2020. Depending on the difference in interest rates and the time and effort in transferring money to India and investing in India, NRIs have to take a call on their FDs and the movement of money to India.

- In a falling interest regime, the yield from bonds is lower. NRIs who have invested in bonds will get lower returns when the interest rate reverse.

- NRIs who are in the Gulf countries take advantage of the Interest rate difference in India and the Gulf. The interest rate in the UAE ranges from 2%-3%. People borrow from banks in the Gulf and invest in India to make money via arbitrage. (we don’t suggest this)

Read – Home Loan Checklist For NRIs

It is difficult to predict the movement of rates. But we can decide on a course of action for interest rate movements.

- When interest rates are falling, your returns from debt instruments will be lower. (from traditional products like FDs that you are buying now) But that does not mean you should exit from bonds, FDs, and other debt investments. The investment portfolio should have a balance of all assets based on your risk capacity and risk tolerance levels.

- Consider the risk-reward relationship. If you want less volatility and stable returns, be prepared to pay a price for them in terms of accepting lower returns.

- You must be hearing this “If you can stomach volatility, consider investing in equity and equity-based investments to get the potential of earning higher returns.” Our advice is to stick to the plan & asset allocation.

- Floating interest rates on loans move in sync with the market interest rate. When there is an increase in the benchmark rate, it rises and when there is a fall in the benchmark rate, the floating interest rate goes down. Home loans can be taken on a fixed interest rate or floating rate. You can go for the floating rate home loan if you think the interest rates will fall further down or want to stay in tandem with the market interest rate. Many banks keep the rate of interest on fixed-rate loans slightly higher than that of floating-rate loans. This is to protect themselves from interest movement risks. If you want to save some quick money or save in the near term, consider taking a floating interest rate loan. But do remember that when interest rates move up, the interest rate on your home loan will also rise. (according to me floating interest rate is one of the biggest risk in developed countries right now)

- Floater funds are debt funds that invest at least 65% of their money in floating-rate bonds. The interest these bonds pay is reset as per changes in the market rate. You should invest in them if you think interest rates will go up so as to earn better returns.

It is not easy to invest in the markets today with so many factors (local and international) affecting them. When you design your investment portfolio, think about asset classes to invest in like real estate, equity, etc. timeframe for different investments, and the risk vs. reward metrics for each investment. You will also need to review your portfolio regularly to manage the effects of parameters such as interest rate movements.

If you would like to discuss your personal finance with us – check this.

If you have any questions or observations – feel free to add them in the comment section.

Which form do I need to submit under FEMA and when to inform to bank permanently coming to India?