Cross-country migration is an age-old phenomenon and Indians have been the most industrious of the lot. Today the Indian diaspora is the largest migrant block in the world. The contributions of the Indian diaspora to the Indian economy are well-documented. Even amidst the peak of lockdowns in 2020, India saw merely a 0.2% drop, to USD 83 billion, in inward remittances.

Must Check – NRI Investments in Commercial Property

HSBC, in partnerships with Ipsos MORI, convened one of the largest online surveys amongst the Indian diaspora to gauge their mood between August and September of 2021. The study titled “The Global Indian Pulse” was released recently. The Global Indians include Non-Resident Indians (holding an Indian passport) and Persons of Indian Origin (possibly holding a different passport).

Some key highlights of the study are:

- It surveyed 4,152 Global Indians refer to Indians living across the USA, Canada, the UK, the UAE, Saudi Arabia, Hong Kong, Malaysia, Singapore, and Australia.

- The survey participants were spread across three generations with strong Indian connections.

- First-generation/Born in India – 53%

- Second generation/A parent born in India – 30%

- Third generation/A grandparent born in India – 17%

- 74% of the participants are Indian citizens.

- The participants were mostly urban, educated, and affluent.

The study reflected on many aspects affecting the lives of Global Indians as individuals and as a group. The questions dwelled on their social and cultural ties to India, India’s Global standing, their role in India’s future, and their financial ties to their homeland.

The study, its accompanying country-specific pulse reports, and a few individual case studies make for an interesting read.

In this article, we will focus only on the financial and investment plans of Global Indians – in India or their Country of Residence (CoR).

More than 80% of Global Indians take a keen interest in India’s economic growth and global standing. 68% of participants feel deeply invested in the country’s future – the feeling that “India has arrived” is pervasive.

Returning To India

Among the survey participants, only 4% never visited India, close to 69% visited India once every couple of years, and 10% visited frequently twice a year.

The notion of brain drain has come full circle and Indians with global exposure are coming back to work here. They bring back with them:

- International best-practices

- Global contacts and networks

- Technology

- Financial resources

Of the Indians living abroad, more than three-fifths (61%) are planning to move to India. Almost one-fifths would come back in the next two years.

| Coming Home in | Percentage |

| 1 Year | 10% |

| 2 Years | 11% |

| 5 Years | 14% |

| 10 Years | 14% |

| More than 10 Years | 6% |

Those who plan to return, have different reasons, like:

- Families – 51%

- Care of relatives – 43%

- Indulging in Indian culture, festivals, and food – 32%

- Retirement – 28%

- Children’s education – 22%

- Work opportunities – 17%

Indians returning home wish to change the status quo and 32% plan to employ their experience, education, skills, and resources to bring the change.

Returns On Investments

Most of the respondents have substantial investments in their CoR with 85% of them invested in local businesses, 47% in stocks, and 45% in real estate. Environmental and Social considerations are a key driver for investment decisions for three-fourths (76%) of them.

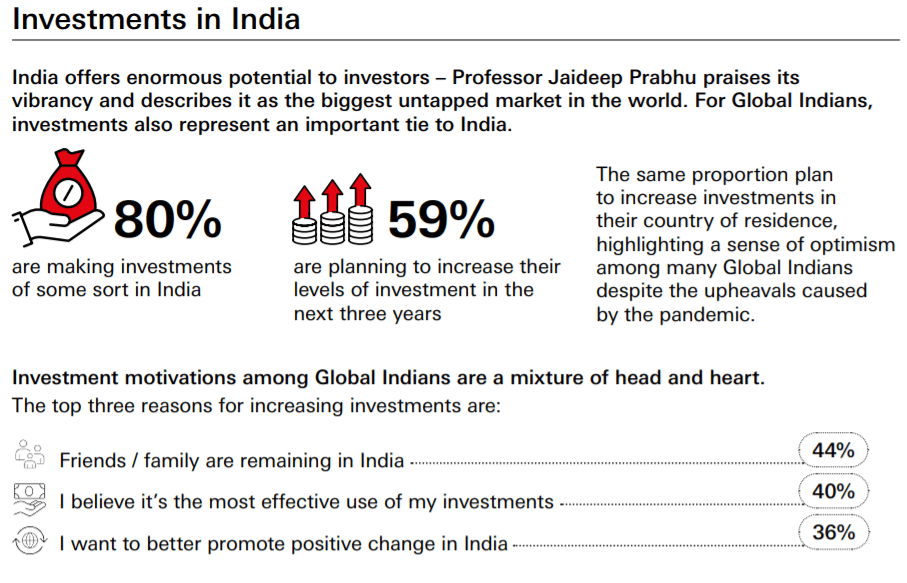

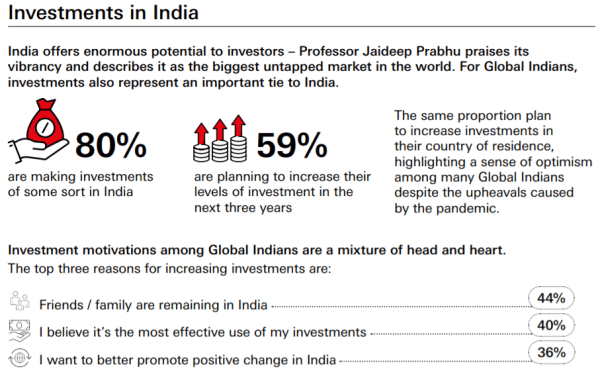

The past was rewarding as more than half of them (56%) increased their investments in the last three years. And the future seems bright with 59% planning to increase their investments in the next three years. It does not mean that COVID-19 did not have any impact. 13% reported that their investments declined, and their condition worsened.

Global Indians are among the investors who see the enormous potential of India. It is one of the largest “untapped markets in the world,” said Prof. Jaideep Prabhu, one of the lead analysts for the study. The investments in India give them a reason to keep coming back, to actively bring change, and to become partners in its future.

Check – Best investment options for NRIs in India

Why Invest in India?

It does not mean that the heart has won over the head in matters of finances. Dr. Omkar Goswami, another lead author of the study, observed that Global Indians are savvy and find value with higher returns in their Indian investments. Some of the common reasons to invest in India were a combo of head and heart:

- 44% had family and friends in India.

- 40% find it to be the most effective use of their investments.

- 37% plan to go to or return to India.

- 36% wished to promote change.

- 35% are investing in ESG opportunities in India.

- 34% have more investible surplus.

- 29% sent back money to aid in COVID relief and recovery measures.

- 22% moved their investments from their countries of residence to India.

According to the survey:

- 80% of respondents had some sort of investment in India.

- 71% understood the importance of investing in India.

- 30% of them support an Indian charity.

- A quarter invests in Indian businesses, with those who have plans to move to India, have more investments at 30%.

- 60% are planning to increase their investments in India from a marginal increase (35%) to a great deal (25%).

- At 21%, Mumbai was the most preferred destination for Indian investments, followed by Chennai at 9%.

The vibrancy and interest in India are palpable with the incredible opportunities and the huge untapped potential.

Read – How NRIs can Invest in Indian Stock Markets

Emerging themes

The two themes that emerged from the survey were:

- Global Indians, like other world citizens, are affected by the matters of climate change. And,

- Given a chance, they wanted to come back to India, albeit for different reasons for different generations.

Sustainability

More than three-quarters of Global Indians are already investing in or plan to invest in companies with sustainable practices. They are betting big on such businesses in India, their CoR, and globally. The key barriers to such investments are lack of knowledge of such investment opportunities in India (24%) as well as their CoR (24%).

Other reasons include doubts about the impact of such projects in India (22%) or their CoR (20%) and the returns on investments. Still, there are a plethora of opportunities in this space, as Prof. Jaideep Prabhu remarks, “Global Indians can do good while doing well.”

Retirement

First-Gen (53%): Close to two-thirds (64%) plan to retire in their CoR and one-third (34%) in India. Of the latter, 19% (~7% of total third-gen Indians) will retire in the next one to two years in India and 38% (~13% of total third-gen Indians) in the next 5 or more years.

Second-Gen (30%): A higher ratio of respondents (at 78%) wish to retire in their CoR and only 22% in India. Of the latter, 28% (~6% of total second-gen Indians) will retire in India in the next 5 or more years, while 20% (~4.5% of total second-gen Indians) in the next 2 years.

Third-Gen (17%): The highest number of global Indians (at 85%) wish to retire overseas and only 15% in India. But they plan to visit India more often.

Check – Best place to retire in India for NRI

Indians living in the USA, the UK, Australia, and Canada are more likely to retire there compared to other countries. The most important facets governing this decision were the quality of life (47%), safety (34%), healthcare coverage (27%), and economic security (25%).

All successful investing is Goal Focused & Planning Driven. All failed investing is market-focused & return-driven.

If you agree – let’s talk about YOUR Goals & Plan.

If you have any questions or views related to these findings – add them in the comment section.