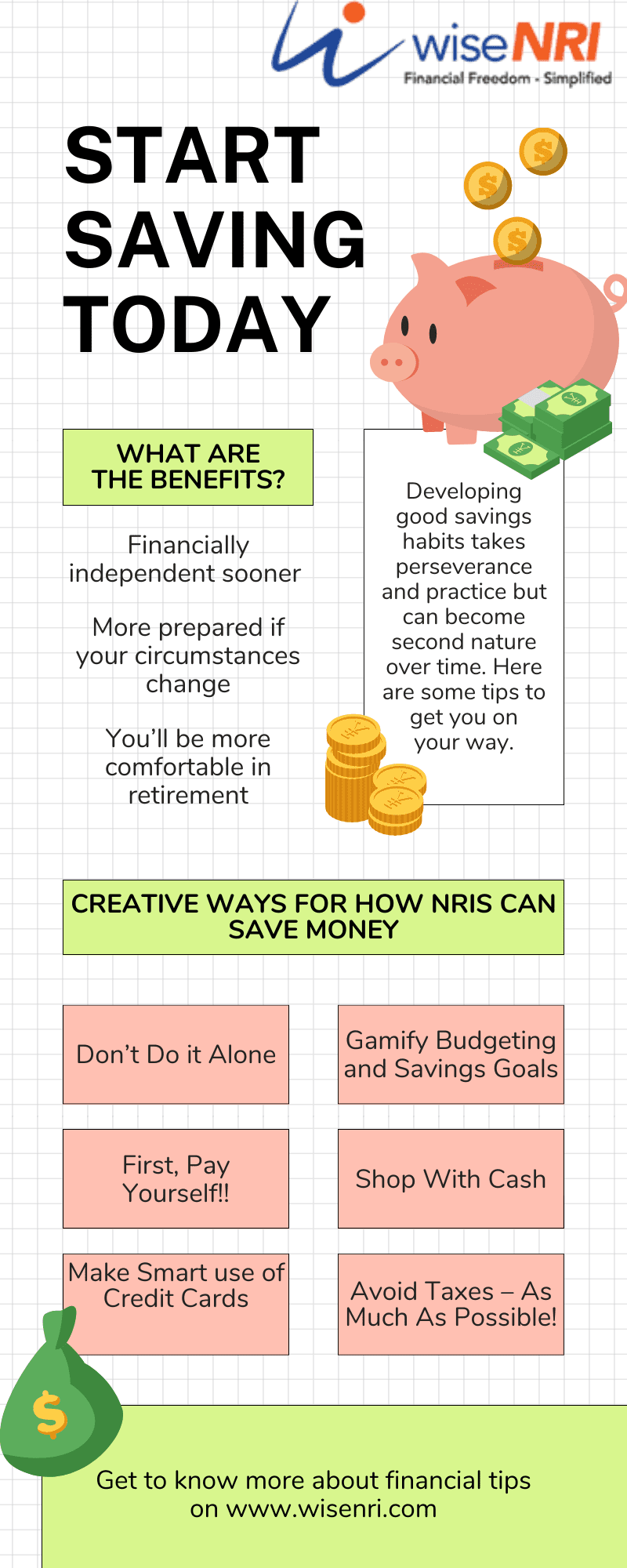

Pay off Your Debt, Get Rich, Meet Goals, and Achieve Financial Independence

Money matters occupy the minds of many people – whether they’re trying to make it, spend it, save it, or invest it. Everyone knows that to save money one must spend within their income, stick to a strict budget, and lead a frugal life.

NRIs (non-resident Indians) have it tough when it comes to saving and investments. They are not only paying taxes in their country of residence but possibly in India as well. Moreover, most countries where the NRI populace is concentrated have a much higher cost of living, education, medical, and other amenities.

Must Read- 6 ways NRIs should NOT spend their money

Also, many NRIs have the added responsibility to take care of their dependents back home and maintain their property. The frequent cost of travel and hosting their families visiting them can make a serious dent in their savings and financial plans.

Add to this the steep inflation and financial uncertainties the world is witnessing for the past year, and you have a turbulent passage with little recourse to normalcy.

This may seem that all an NRI does is think about money 24×7 and become a dull and boring version of self.

Not necessarily. Having goals to save money do not mean you cannot lead an exciting life full of laughter; it certainly does not imply all work and no play.

There are many Creative Ways for How NRIs Can Save Money that can add to the cushion or become part of their disposable income that can be spent on experiences and invested wisely.

Continue reading to know how you can spice up your finances and make saving money a fun activity.

1. Don’t Do it Alone

What are the most memorable things you have done? What are the best experiences you have had? When you achieved something great, did you celebrate it alone or shouted from the rooftops to announce it to the world?

Yes, we are social animals, and we constantly need the validation, confirmation, and support of others. Family and friends are the first ones who share our joys, victories, and even pain & suffering. So why not make them equal partners in our journey to financial nirvana?

No, we are not asking you to reveal everything to everyone. But certainly, you can share most of the things with your most trusted partners in life – spouse, parents, mature children, and closest friends. When you make financial decisions with your family involved, you not only share your outlook about money with them but also gain from their perspectives.

Moreover, it is one of the best ways to involve your spouse and children in one of the most important aspects of one’s life – without missing out on spending quality time with them!

Must Read – Financial Tools NRIs Must Use

2. Gamify Budgeting and Savings Goals

Once you have set out to involve others in financial decisions, the next step is to make it easy for them to understand, and exciting enough to follow through.

When everything from fitness goals to calorie intake has been gamified, why can’t you gamify your budgeting, expense sheets, and investments?

For example, you can set a target value for eating out expenses every month. If you spend less than that in a month, then everyone in the family gets a reward! It can be as extravagant as a trip to the nearest ice cream parlour or as frugal as a movie night at home.

Giving kids and everyone, simple and attainable targets – with clear knowledge of the upside and downside elements for achieving or missing them, respectively – can be a great motivator.

Make it a point that with every penny they save, or help you save, they are getting closer to that coveted theme park vacation or latest gadget! And in the process, you will have inculcated in them the founding principles of delayed gratification and goal-based investing.

3. First, Pay Yourself!!

Once the expenditure targets are decided – you can bucket them as necessary, good-to-have, can-be-delayed, and avoidable. In most cases the necessary items are fixed for most of the time either weekly, monthly, or annually – rent, utility bills, tuition, insurance, and grocery.

The good-to-have items are casual eating out and small vacations with a splash of luxury here and there. The can-be-delayed items can be big-ticket expenses such as home renovation, a new car, or a foreign trip.

Finally, the avoidable lists would be the toughest to crack – for your teenage daughter/son the latest iPhone 14 Pro is a must but you think otherwise. Help them realize that just to achieve great results over time, one has to work hard every day, to get great returns, the money has to work hard for a long time as well.

It means, every time they are dipping into their savings (technically yours) for avoidable luxury, they are putting their long-term financial well-being at risk!

To help you and even young teenagers overcome impulsive buying habits, you can start paying yourself – not the current you, but the future you.

By automating savings – the moment your salary hits your account, a large part of it is transferred to term deposits or mutual funds – you would always see less money in the bank. The simple fact that there is little in the savings account makes it mentally tough to spend more.

Must Read – 6 Tips to Help NRIs Boost Their Retirement Savings

4. Shop With Cash

Yes, we are asking you to go primitive!

The biggest trick the market has played on consumers is to hand them over a plastic card, that makes them feel like they have an unlimited supply of money. As many NRIs are well off, they tend to have multiple cards as well as they have add-on cards for family members.

By forcing yourself to spend only cash, every time you’ll access an ATM to withdraw money, and take out your wallet, it gets registered strongly by your mind – especially when it comes to big-ticket or impulsive purchases.

Most people, who switch to cash from cards have reported that they spent less and less on non-essential items.

5. Make Smart use of Credit Cards

Yes, you heard us right! We are not against credit cards at all. If used judiciously, they are a great money-saving tool.

First, when you are traveling abroad having a credit card is beneficial because it is less likely to suffer permanent loss of capital with it. Cash and travellers’ checks can easily be stolen or lost. With a card, you can just hotlist it immediately from any phone.

Second, if you can pay for something in cash and it is absolutely necessary to spend on it – for example insurance or bills – then use the card to simply defer the bank debit. Make sure that you always have enough to pay off the card dues.

Third, never revolve the card debt! If you are in the habit of paying only the minimum due, then soon you’ll be in a hot, hot soup.

Finally, use the card to get reward points, cashback offers, and flash deals for the items that you would have bought anyway.

6. Cook More at Home!

Yes, cooking is a great way to save money.

Many NRIs, especially those who are living alone or where both spouses are working find it easy to order food or eat out.

This is not only bad for your health, but also your wealth. Home-cooked food is not only fresh and more palatable but also almost up to 7x to 10x economical. This is if you consider the long-term medical costs that you could have avoided just by eating less junk food!

Once again, this can be a fun and family activity where everyone participates making it a lifelong habit and a great time to spend with them.

7. Avoid Taxes – As Much As Possible!

NRIs have it tough when it comes to taxes as well – they might end up paying double tax on their incomes. They not only pay taxes on their incomes and gains in their country of residence but also here in India.

However, if you live in a country that has signed the Double Tax Avoidance Agreement (DTAA) with India, then you can save a significant sum. You must disclose the fact in your income tax returns in both countries for collation and verification.

To save tax on income earned in India, you can always choose to invest in small savings schemes, tax saving investments, take insurance, and make payments of eligible and deductible expenses from your Indian income.

Bottom line

These creative tricks can not only help you save more, but also spend more quality time with your family. The bonus is that you’ll be able to impart lifelong financial habits to your children this way.

Living within your means doesn’t have to all boring and dull after all!

I would love to hear your thoughts and any additional creative ideas you may have, so please don’t hesitate to share in the comments section.

Money transfer fee from July 2023 to outside of India

SHOP WITH CASH….Withdraw your entire household budget for the month in cash (since currencies abroad are strong you will not have to store a very thick wad of notes). This way as every day of the month passes you can see the cash pile shrinking. If anything remains at the end of the month go out for a nice family meal or splurge it on something else. Credit card points constitute approximately 0.7% of your spending amount. To benefit from 0.7% is it it really worth spending 100% ?

Thanks Mr Rao for sharing 🙂