Many NRIs are drawn towards investing in India due to multiple reasons. They can diversify their global portfolio with investments in India. They can create a corpus for their family staying in India or for themselves when they return to India. And India is a fast-growing economy with the potential to offer good returns. We focus on investments that will help NRIs get a monthly source of income.

Must Read – NRI Investment Options in India

Here are The Top 4 Monthly Investment Options for NRIs and Taxation Rules

1. Monthly Income Plans

A monthly income plan (MIP) is a mutual fund scheme that invests in equity and debt instruments. (you may find this in the conservative hybrid fund category) It invests primarily in debt and equity securities with the objectives of producing cash flows, preserving capital, and providing a steady stream of income in dividends and some appreciation. Normally these funds have 10-25% equity.

MIPs earn profits or income from 4 sources

- Interest on debt instruments

- Profits from debt trading,

- Dividends on equity and

- Profits from equity appreciation

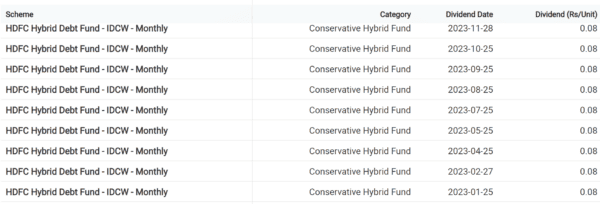

NRIs can invest in mutual funds – USA & Canada NRIs have some limitations. NRIs seeking regular income from investments in low-risk investment options can consider MIPs. MIPs typically invest in fixed-income instruments, preferred shares, and dividend stocks. It is important to remember that while MIPs aim to give regular returns, they do not guarantee regular dividend, as the returns are based on their performance in the market. Check dividend consistency of a Mutual Fund MIP

Taxation Rules

Before 31st March 2023, if the investor sold the units before three years, the short-term capital gains (STCG) will be added to their income and taxed as per the investor’s tax bracket. If the units are held for more than three years, the long-term capital gains (LTCG) tax is applicable at 20%.

After 31st March 2023, there is no difference between short-term & long-term tax. Any gains in the debt fund will be added to your income and taxed at a marginal tax rate.

There will be no tax on the dividends in the hands of investors. The fund house pays the dividend distribution tax at 25% before distributing the dividends to the investors.

Must Read- Best Mutual Fund to Invest in India

2. Systematic Withdrawal Plans

NRIs can invest a lump sum or make regular deposits in a mutual fund scheme of their choice to get regular payouts, which can be monthly, quarterly, or even annually. Investors can choose the withdrawal amount, the frequency, and the duration according to their needs. You have to choose the withdrawal amount in SWPs – this can depend on your requirement, investment corpus & expected returns.

With an SWP, NRIs can receive a fixed flow of income regularly and also build capital as the investment in the scheme has the potential to grow. In most cases, the minimum balance in the mutual fund scheme should be Rs.25,000, and the minimum withdrawal amount has to be Rs. 1,000.

The frequency of withdrawal can be monthly or quarterly.

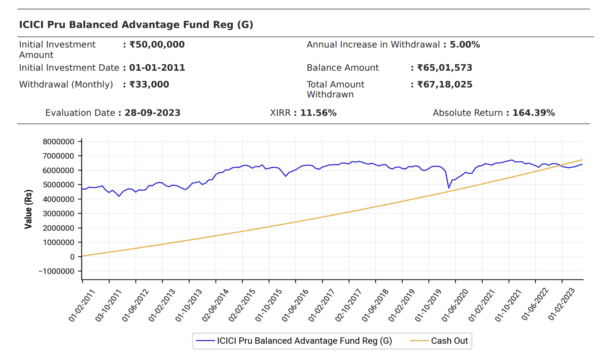

Many investors choose the Balance Advantage type of funds to give them some stability & expected higher returns than debt funds. We did a study on one BAF fund where we invested Rs 50 Lakh & withdrew 8% in the first year & increased that withdrawal by 5% every year. Still after 13 years Balance amount is more than the invested amount. (But I will suggest you to keep the withdrawal rate lower – in these USA they call 4% a safe withdrawal rate)

Taxation Rules

Gains withdrawn from equity-oriented funds within 12 months are treated as short-term capital gains and taxed at 15 percent. Gains on investments withdrawn after 12 months are treated as long-term capital gains and taxed at 10 percent. Long-term capital gains on equities up to Rs 1 lakh are exempt from taxation every financial year.

Gains on debt funds is similar to tax mentioned in MIP.

TDS applies to NRIs.

Must Read – NRI Investment Habits in India

3. National Pension Scheme

National Pension Scheme (NPS) is a voluntary contribution pension scheme in India. It allows investments in four asset classes—equity, corporate debt, government bonds, and alternative investment funds. NRIs can invest in NPS but only contribute to the mandatory NPS Tier I account. Tier I is a non-withdrawable retirement account. Money can be withdrawn only upon meeting the exit conditions prescribed under NPS.

At the time of maturity, a maximum of 40% of the total NPS corpus has to be used to buy an annuity plan from a life insurance company. This annuity amount will provide a regular pension after retirement. The remaining 60% can be withdrawn as a lump sum.

The NRI should have an NRO/NRI account in India to invest in NPS. Therefore, they should inform the pension plan provider and the corresponding bank about their residency status if they have an existing India-based account. The bank will convert it to an NRO account. NRIs have to provide a life certificate from the Indian Embassy or the bank in the country where they are residing once every year in November. The bank handling the pension plan for NRI will credit the pension to your NRO account.

Taxation Rules:

Contributions earning returns have no tax implications, and withdrawal up to 60% is tax-exempt. NRIs can claim up to INR 1,50,000 as deductibles u/s 80C of the Income Tax (IT) Act. They can further claim a tax deduction of INR 50, 000 u/s 80CCD 1(B) annually on the NPS investment.

4. Rental Income

NRIs can rent out property that they own in India. It is an excellent source of monthly income and also takes care of the maintenance of the property. The rent proceeds can be credited to the NRE (if rent is paid from NRE) or NRO account, and the rent proceeds received in these accounts can be freely repatriated. The proceeds can be directly remitted abroad if the NRI does not have an NRE or NRO account. An appropriate certificate from a chartered accountant certifying that all taxes have been duly paid needs to be presented.

Many NRIs are also considering investments in commercial property that too through fractional ownership companies.

Taxation Rules:

The tenant who pays the NRI rent is responsible for the 31.2% TDS deduction. They must complete Form 15CA (or 15 CB) and pay it.

Between investments in Fixed deposits also give regular income in the form of interest, it is not always a monthly source, and there are conditions around the interest payments.

Check – NRI Investment Habits

Conclusion

Each investment option for NRI comes with its own set of taxation rules and risks. NRIs must carefully consider these implications to optimize their returns and comply with regulatory requirements. Ultimately, the choice of investment depends on the NRI’s financial goals, risk tolerance, and the need for a consistent monthly income stream.

Please share how you are planning to generate Monthly income after or before retirement – add in the comment section.