Legendary investor Warren Buffet once said, “I started building this little snowball at the top of a very long hill. The trick to having a very long hill ahead is either starting very young or living to be very old.”

You must be wondering why we are talking about snowballs and starting early. Is it that time of the year when we make new year resolutions?

Well, yes and no.

It is not January. But it still would be a new year in India on April 1.

No, we are not talking about April Fools’ day either.

India starts its new financial year every 1st April. From this date, the new rules and tax rates come into effect. The companies start a new cycle of investment and sales.

So should you. You can make financial resolutions for the coming new year and revisit personal financial choices, habits, and investment portfolios.

Read More – Financial Planning For NRI – How it’s Different & Complex

Being a Non-resident Indian comes with its challenges. You must juggle between the taxes and financial commitments in two countries – India and the country of your residence.

With early planning, you could achieve both long- and short-term goals, paying off liabilities, and building a corpus. It can help you come closer to financial independence one year at a time.

Benefits of Early Financial Planning for NRIs

We have all heard about how the early bird catches the worm.

But does this apply to only our daily lives or to our long-term financial planning too?

Let us find the answer.

1. Benefit FROM Compounding

Albert Einstein said, “Compound interest is the eighth wonder of the world. He who understands it earns it. He who doesn’t pay it.”

A tiny pebble rolled down from the snowy hilltop gathers snow and turns into a giant snowball. The snowball effect very elegantly sums up the benefits of starting practicing anything early.

No one can guarantee how long you can stay invested or how much the rate return will you earn.

Sometimes, even the investment amount is also so meager that it seems inconsequential. But you do have one thing in your hands – starting early.

By starting to invest early and continuing to invest for a long time, even a small sum can turn into your personal snowball.

Warren Buffet started investing at the age of 11 with only around $225 investment. He made sure that the hill in front of him had a long slope. With a long slope, you can achieve any financial goal.

Must Check – How NRIs Can Choose The Best Financial Planner in India?

2. Beat Inflation

Just like compound interest, inflation also compounds. The headline inflation figure reported in news is the annual rise in general prices. It does not add up, it multiplies.

Say, something was costing Rs. 100 in 2019 and since then the inflation has been 5% in 2020 and 7% in 2021. Then the price of that article in 2022 would not be Rs. 112 (100+5+7), it would be Rs. 112.35 (100*1.05*1.07).

Though it may seem a rounding error here, when you scale this to your annual expenditure over many years, you will see the burden of inflation. If you start investing early, at the end of the year, you will be in a better position to beat this hidden tax.

3. Increase Your Risk-appetite

Age is a big factor in deciding your risk appetite. As you age, and near retirement, you cannot afford to lose your nest egg. At that time, you must preserve it, even if it means investing in low-yield securities.

At a young age, you can take more position in aggressive and volatile assets like equities. As you have long a runway you can benefit enormously from it. Also, even if you, there is ample time to recover and recoup.

4. Form Better Habits

Habits are regular tendencies that are hard to give up. Once you form them, they tend to guide your life on autopilot. It may seem like a bad thing, but habits can be a powerful tool to use for your benefit.

The savings can become investments, but for that, there must be savings. With an early financial plan, you will save first and then spend. You can earmark your income in envelopes for fixed expenses and bills. And finally, treat yourself for a job well done.

By forming positive and powerful habits, like budgeting and planning, you can turn around your lives.

5. Tax Planning

Come January, Indian newspapers and TV shows are filled with last-minute tax-saving schemes. Every Mutual Fund house, Insurance company, bank, and now Fintech companies give you tips to save paying taxes.

In the last-minute rush, you opt for the most convenient option, rather than the best or even an optimal solution. The FOMO (fear of missing out) compels you to sign on the dotted line without making sure if it is the right financial instrument for you.

When you start in April, you will get enough time to check multiple options. Also, as the advisors and distributors are not rushing, they will give you more time.

6. Prepare for Contingencies

The ants save the food grains in their underground homes for winters when no food grows in fields. Similarly, with early saving and planning, you can create an emergency fund to meet any contingencies. There would be no need to borrow.

7. Why 1st April?

Most organizations and individuals see significant changes in their financial matters from April 1, every year. The two most important things happen – appraisals and budgetary implementations.

Must Check – Common Financial Mistakes Of NRI

8. Annual increments

Most corporations and organizations schedule their annual appraisal and increment cycles around this time of the year. It can be a one-time bonus as well as an increment in your take-home salary.

Instead of blowing up the entire bonus, make a lump-sum investment in line with your financial goals. Similarly, a major part of your increments must also go towards increasing your recurring investments through SIPs.

9. Budget Effect

Most of the budget announcements – especially related to the income tax slabs, rates, and deductions – come into effect from April 1st. Therefore, you can plan your investments u/s 80C and other relevant sections in a more nuanced manner.

How Can NRIs do Early Financial Planning?

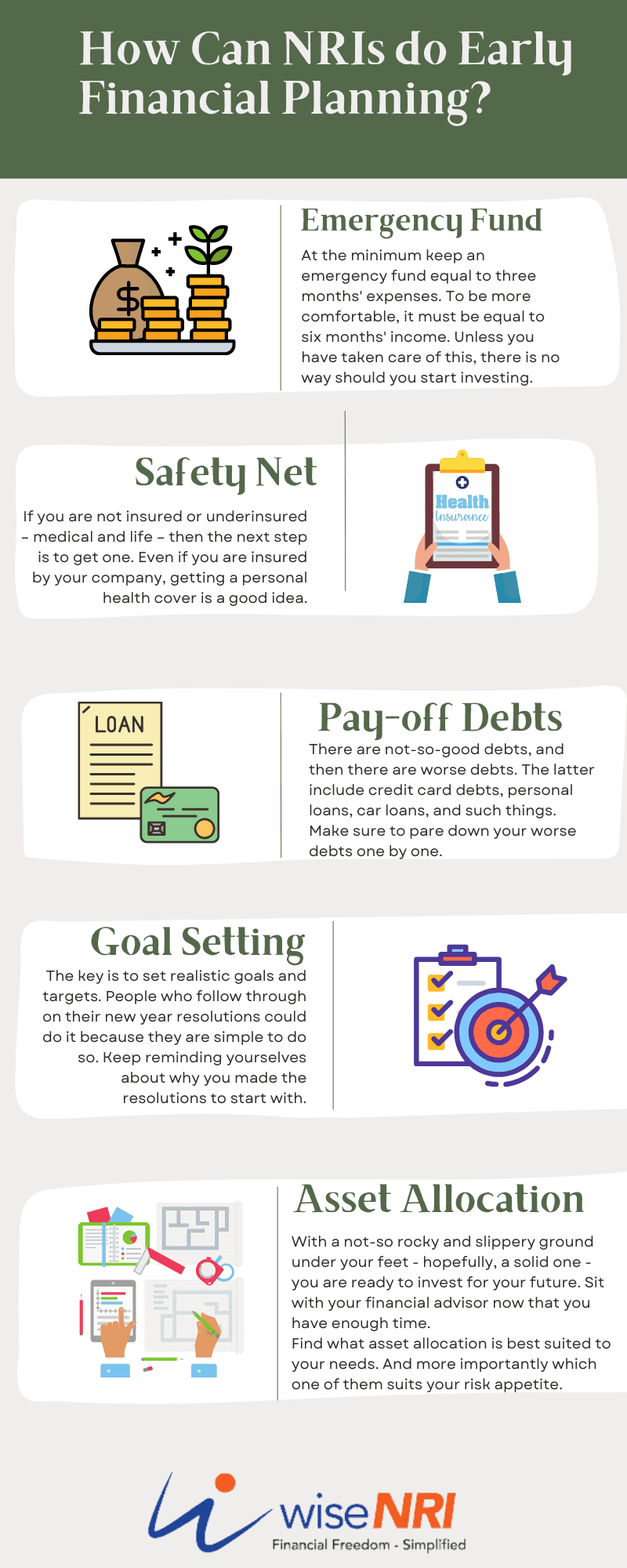

1. Emergency Fund

At the minimum keep an emergency fund equal to three months’ expenses. To be more comfortable, it must be equal to six months’ income. Unless you have taken care of this, there is no way should you start investing.

2. Safety Net

If you are not insured or underinsured – medical and life – then the next step is to get one. Even if you are insured by your company, getting a personal health cover is a good idea. You never know when you’ll leave the company and maybe without a cover when you need it the most.

Must-Read – Health Insurance for NRI in India

3. Pay-off Debts

There are not-so-good debts, and then there are worse debts. The latter include credit card debts, personal loans, car loans, and such things. Make sure to pare down your worse debts one by one.

Make a habit of spending only what you would if done in cash. If you cannot control impulses, then block and cut off all cards.

4. Goal Setting

The key is to set realistic goals and targets. People who follow through on their new year resolutions could do it because they are simple to do so. Keep reminding yourselves about why you made the resolutions to start with.

5. Asset Allocation

With a not-so rocky and slippery ground under your feet – hopefully, a solid one – you are ready to invest for your future. Sit with your financial advisor now that you have enough time.

Find what asset allocation is best suited to your needs. And more importantly which one of them suits your risk appetite.

Conclusion

Taking care of your financial well-being on the first day of the new financial year is the first step in the right direction.

So, why not start planning the year when it starts, rather than working backward when it is about to end. Why not make a new year resolution that we will look forward to and not regret by looking at the past inactions or poor choices?

If you need professional help to improve your financial life – let’s have a call.

As a NRI, should I need to pay tax in Uk if I earn more than 1lakh in my NRO account?

My both children abroad , my wife expired . I went to meet children. They got GC for me . I am 67 , not earning anything except interest & a mere pension all put together only about 2 laks per annum. I thought of going & coming every six months . This NRo status, mere pension or 1000/- , kly advice

Do you arrange office accommodatiion in Bangalore Sarjajapur area