World over college education is considered one’s ticket to economic salvation and a chance to become someone who matters in society. The obsession for the best higher education is more pronounced in Indian-origin parents, as they now know what difference good education can bring.

Every family knows of an anecdotal relative who could make it big because they were well educated from a premier institute. It is now in our wiring that education from IITs, IIMs, or Ivy-League universities is a golden ticket to success, wealth, and social mobility.

Must Read – 10 Best NRI Investment Options in India

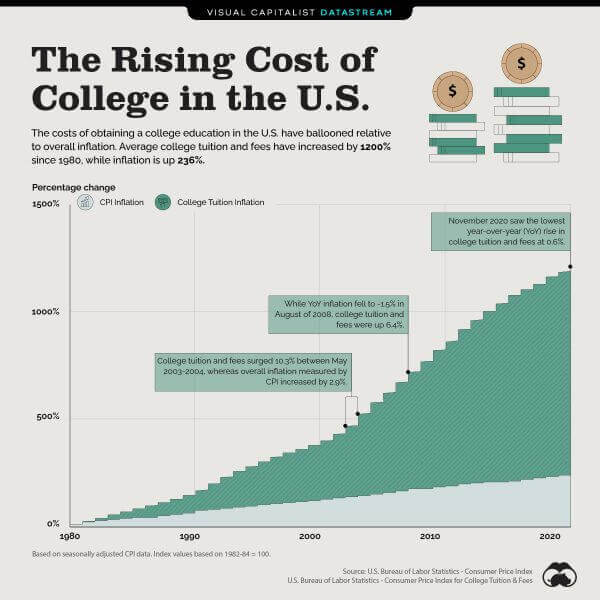

The Rising Cost of Education

The USA

The cost of education in many US universities has increased between from close to 1.5x to more than 2x in the past two decades, or a generation, according to a USNews.com report. The average annual tuition and fee that was $3,583 for In-state Public Universities in 2001, jumped to $11,171 in 2021 – an increase of 212%!

Similarly, the average annual tuition and fee costs at Private National Universities were $16,987 which is now $41,411 – a jump of 144%. Moreover, these costs do not include other expenditures like room and board, books, trips back to home, and incidentals.

That translates to roughly $95K for a 4-year bachelor’s at In-state Public University, and a whopping $210K at a Private National University, for the tuition, fees, room, board, travel, books, and incidentals.

Read about – OCI in India

India

In India, too, quality education is hard and expensive to come by. Today, the fee for B.Tech programs at IITs is a minimum of Rs. 2-lakhs/year up from a mere Rs. 25,000 in 2008. Hostel (room and board), books, travel, and incidentals can all add up to another Rs. 100,000 to Rs. 150,000 per year.

The UK

The scene in the UK is no better, as according to Statista, average student graduation in England will have a debt of £40K+ compared to a mere £3K back in 2000. Education in Northern Ireland, Wales, and Scotland is relatively economical, but by no means affordable.

Plan ahead

These numbers are overwhelming and can stress you or your child. Also, you must remember that these numbers are for 2020 or 2021, and not when your child will look for a college!

Real inflation that we feel daily is far higher than the headline CPI numbers, and education inflation is much higher, sometimes even double, than the reported CPI figures.

Merely savings will not be enough but proper financial planning, with an assessment of requirements, availability of funds from multiple sources, and an investment plan are needed.

One stumbling block to prepare yourself is that being an Indian citizen, your child may not be eligible for many scholarships, grants, and aids available to US Citizens. Even in India, being a child of an NRI/PIO parent, she may be charged the NRI/Foreign-quota fee.

If you wish a decent college education for your child, then you must plan to chip in financially to their college fund.

Must Read – Who is NRI?

Estimate the education costs

Planning begins with knowing what is? You need to find out current education costs, lifestyle costs, travel and living expenses, and the inflation rate for the country where your child wishes to go.

To account for inflation in education costs, use the thumb rule of taking it at 1.5x to 2.5x of the long-term CPI of that country. For example, in India, the CPI is between 4 and 6.5% but the cost of education is rising by 8 to 10% per annum.

Calculate the net costs

Find if your child can become eligible for scholarships, affirmative action grants, or financial aid from federal and state governments. Explore options for part-time paid assignments via the University or making some big money. Check with family elders if they would like to contribute towards the college fund of your child.

By exploring all these options and preparing the young ones for them you will come closer to the net costs by substantially reducing the overall burden on yourself and your child.

Must Read – Smallcase Stock Investing For NRIs

Plan to make your contribution.

A lumpsum contribution

Fidelity Investments suggests following a thumb rule of investing $2,000 each year for the education of the child. That way by the time she is 18, there will be a corpus between $64K, at 5% annual returns, and $79.5K, at 7%, to springboard.

If you expect a steeper rise in the cost of education and limited scholarships for your kids, NRI can contribute more than $2K /annum, say $3K/annum. If you are starting late, then put aside a starting sum equal to the annual contribution times the age of the child. With an annual investment of $3k, you can have a fund of close to $120, at 7% returns, in 18 years.

Check – What Should I Know About Studying Abroad?

A share in total costs

Alternatively, you decide to share a percentage, say 60% of the total education cost, giving you a clearer target amount. This way you will have a defined goal and with goal-based investing, you can work backward with the help of a financial advisor. For example, to amass $150k over 18 years at 7%, you will have to invest $1,160 a month.

Investments for an NRI child education must be a proper mix of growth and stability changing over time. With a goal at least 3-5 years away, focus more on growth and gradually shift to a more conservative investment portfolio for capital preservation.

The 529 College Savings Plan

If you are a permanent resident or a citizen of the USA, then 529 plans are best for you. These are state-sponsored education savings plans offering significant tax advantages on the gains made on investments if used for education only.

For other NRIs, like H1B visa holders, who may return to India eventually, a 529 plan is not a great option as the tax breaks will not apply.

Must Read – Why NRI moving back to India?

Traditional Investment Options

With advice from a financial planner, you can always invest in common investment avenues like bonds, stocks, mutual funds, or even property. Each of them has its pros and cons and can be easily done either in India or in the country of residence.

Child Plans

Child plans from insurance companies are hybrid instruments – a combo of investments and insurance. We usually do not advise mixing the two, but in a rare scenario like this, you may find these helpful.

Following features are found in most NRI child plans making them attractive:

- Return of life cover as maturity benefit.

- Flexible pay-outs at the important milestones during a child’s education.

- Single or limited period premium options.

- In case of death of the earning parent, the following benefits may accrue:

- life cover amount in a lump sum.

- Waiver of future premium payments for the remainder of the policy term.

- Income Protection for the child.

- Partial withdrawal for coaching and to enhance talent.

- Riders available are:

- Accident benefit.

- Critical Illness benefit.

- Tax Benefits.

Conclusion

This only a mom could have said, “Your child will keep building castles in the air; you better start buying bricks for those castles today.” When you want the best of everything for your child, then compromising on their education is not an option.

Having a financial plan today can save you many sleepless nights and can save your child from solely bearing the burden of an expensive education loan. A financial plan can help your child live her dreams.

Let’s have a call to discuss Step-By-Step Approach To Plan Your Child’s Education Needs

If you have any inputs related to a child’s higher education in your country or if you have any questions – add to the comment section.