Navigating the world of dividend income as an NRI comes with its own set of challenges and considerations. Let’s explore some common issues faced by NRIs in managing their dividend earnings.

Dividends are your share of profit in a business venture. If you have invested in quality stocks directly or through a good mutual fund scheme, then the company (or the fund house) would share with you their profits from time to time.

With the size of the portfolio, your dividend income also grows over time – as the underlying fund or the company performs better. So much so that, dividends can become a significant part of your overall income and can help you meet your regular expenses.

Must Read- NRI Investment Options in India

Therefore, it is necessary to track your dividends from all investments – stocks, mutual funds, or REITs- and to claim them. For most investors, this is easy as they are the normal residents of the country where the mutual fund, the company, or the REIT are registered.

But for an NRI with investments in India, it may be difficult, even challenging sometimes, to claim your dividend earnings if you lose the claim window.

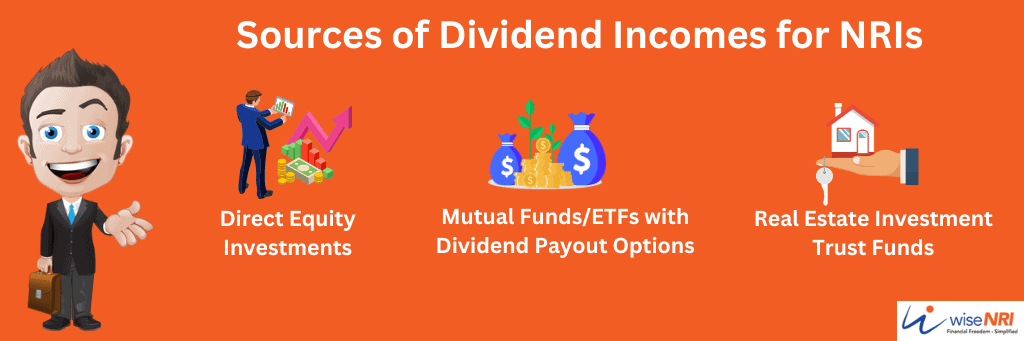

Sources of Dividend Incomes for NRIs

Direct Equity Investments

When a company earns profits after taxes it may use the earnings for one of the following purposes – share it among its shareholders or retain it for future capital needs. Most of the time, dividend warrants, drafts, or cheques (collectively DW) are directly deposited in the bank accounts, but sometimes they are sent via postal services.

Mutual Funds/ETFs with Dividend Payout Options

Mutual funds schemes and exchange-traded funds – both debt and equity –pay annual dividends from the NAV of their units. A debt fund that regularly receives interest payments may decide to pay out a dividend to the unitholders.

Similarly, an equity fund may pass on its partial or full dividend income to its unitholders. In both cases, the NAV is reduced by the amount of dividend paid out on the ex-dividend date.

Real Estate Investment Trust Funds

A REIT invests directly into the real estate and mortgages to earn rental income, interest payments, and capital appreciation from them. REITs are required by the law to distribute their 90% income as dividends therefore, you may expect a steady flow of cheques coming your way.

Must Read- Income Tax for NRI

Tax Treatment of Dividend Income in India

Even if you are an NRI, your income arising in India is taxable here. If you only have dividend income in India and the company has deducted 20% withholding tax (plus applicable surcharges and cess), then you need not file an IT return. The maximum marginal rate of such tax liability comes is 28.5%.

Availing DTAA Benefit

If you live in a country that has signed a Double Taxation Avoidance Agreement with India, then the tax rate applicable for dividend income is only 10%.

To avail of DTAA benefits, you must submit to the company or the MF/REIT registrar:

- a Tax Residency Certificate issued by the local tax authorities in your country of residence.

- Completed form 10F.

- Declaration of beneficial ownership.

The RNOR Status

If your tax status is “Resident but Not Ordinarily Resident” or RNOR in India, then your dividend income is taxed according to your tax slab.

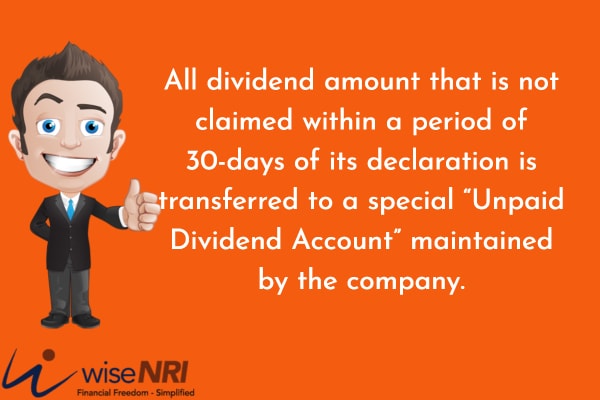

The Puzzle of Unclaimed Dividends

Unlike interest, once a company, an MF scheme, or a REIT declares dividends, the investor must claim them. If the investor does not claim the dividends within 30 days of the payment date (ex-dividend date), they are treated as unclaimed dividends.

Getting Dividends Credited to your Bank Account

As an NRI, you have an NRO account – the earlier bank account would b converted into one – or may have opened an NRE or an FCNR account with your bank. If your NRI bank accounts are linked to your Demat account (for shares, MFs, and REIT units), then the dividends are directly credited to it.

Recall that the FCNR account takes deposits in foreign currency, the NRE account is for INR deposits but from income from foreign, and the NRO account is for income earned in India. Therefore, ensure proper mapping of your Demat accounts with your NRO or NRE accounts.

The total sum (including dividends) in the NRE account can be repatriated to the country of your residence, but only up to $1 million can be repatriated from the NRO account.

Reasons behind Unclaimed Dividends by NRIs

There are many reasons why the dividends become unclaimed:

- If you do not map your NRI bank accounts to your Demat accounts, or the MF/REIT portfolio then you will not get an automatic credit of the dividends.

- You must link the proper bank account with your Demat account and portfolio to get dividends directly credited to them. You cannot link the NRO account with the Demat account opened with the NRE account.

- If an NRO/NRE bank account is closed and you forgot to open and link a new account, then also your dividends would become unclaimed.

- A signature mismatch is a common reason, especially if you have taken a new name in the country of your residence.

- Change of home or office address, change of country, and change of the NRI status could also put your dividend payments in limbo.

- If you have given a power of attorney to someone in India to make investments on your behalf, and you do not have the updated records of all current investments, then also you may lose track of dividend income.

- Finally, if you prefer to receive dividends via DWs, now very unlikely, then also your dividends would remain unclaimed. This happens as all cheques would be forwarded to only an Indian address, and if at that address no one checks your mail regularly, your cheques will ‘expire’ or get outdated.

Must Read- How to avail of DTAA benefits

What Happens to Unclaimed Dividends?

All dividend amount that is not claimed within a period of 30-days of its declaration is transferred to a special “Unpaid Dividend Account” maintained by the company. If the amount is still unpaid and unclaimed for seven years, it is automatically transferred to the Investor Education and Protection Fund maintained by the Ministry of Corporate Affairs, Government of India.

Claiming the Unclaimed Dividend

From the “Unpaid Dividend Account”

You can follow one of the two modes:

1) For outdated dividend warrants

Send the outdared DW to the Registrar and Transfer Agents (RTA) of the company with an application to renew them. You must always enclose documents to prove your identity (like PAN and Aadhaar), a canceled cheque, the latest bank, and address details, and contact details.

You can also request the RTA to deposit all your dividend income directly into your bank accounts with a direct credit and provide you an email intimation of the same.

2) If the DW is not available

You can still claim your dividend by sending a request to the RTA with the following details and documents:

- Folio number.

- Demat Account Client ID & DP ID.

- Details of the period for the unclaimed dividend.

- Indemnity Bond in the prescribed format (available on the websites of all RTAs).

- Identity and address proof.

- Bank details with a canceled cheque.

After verification, the RTA will update your details as well as initiate the payment for the claim.

From the IEPF

After being for 7 years in the company’s Unpaid Dividend Account, the dividend is transferred to the IEPF. You can claim your unclaimed dividend in the following steps:

- Download and complete the electronic IEPF-5 Form to file the refund claim.

- Save the completed form and upload it on the IEPF portal, free of cost.

- A unique SRM would be generated as an acknowledgment of receipt of your refund claim.

- Print the completed IEPF-5 and the acknowledgment for hard copy submission.

- Enclose an indemnity bond and other documents mentioned in the IEPF-5 form before sending it to the Nodal Officer (IEPF) of the company.

- Mark the envelop with “Claim for a refund from IEPF Authority.”

- After thorough verification, the company initiates the refund process with the IEPF Authority to release your amount.

In conclusion, understanding and addressing the dividend income challenges faced by NRIs is crucial for optimizing financial returns and ensuring compliance with applicable regulations. Stay informed, seek professional advice, and empower yourself to make the most of your investment