The property market in India is bursting with potential. The real estate – residential or commercial – is selling like hotcakes, especially seeing the post-pandemic revival prospects.

Non-Resident Indians (NRIs) find these opportunities lucrative and may wish to sell their inherited or acquired property and invest it overseas. But the estate laws for NRIs governing real estate and tax & sundry other laws governing NRI affairs make the matters complicated.

Check – NRI Investment in Commercial Property

Can An NRI Buy Property In India?

Yes, NRIs can acquire property in India. They can acquire it in the following three ways.

Direct Purchase

As an NRI, you can invest in commercial or residential properties. But certain types of properties like plantation, agricultural lands, or even a farmhouse cannot be bought if your current status is that of an NRI.

Inheritance

You were not an NRI from the beginning and you have your deep roots here. You may inherit any movable or immovable property (residential, commercial, or even agricultural) in India.

There is not even a legal bar on from whom you can inherit the property. It can be your parents, in-laws, relative (close or distant), or even a person who is not related to you by blood relations. The person bequeathing the property can be an NRI or a PIO (Person of Indian Origin).

Gift

Again, just like inheritance, to receive a property as a gift there is no bar. Once again in addition to close or distant family, you can receive a gift even from strangers. But when it comes to taxation, there is a significant difference between the property received in inheritance and as a gift. The provisions of the Gift Tax Act may apply depending on the case.

Read – Can NRIs buy Agriculture Land in India

Read – NRI Real Estate Invetment Outside India

Some Important Estate Laws For NRIs Regarding Tax

While Acquiring

There is no income tax applicable on the property acquired by way of purchase or inheritance. But, on the property received as a gift the value of the gifted property is added to your gross income under the head “income from other sources” and is taxable at the marginal tax rate.

This is applicable on the face value, fair market value or registered value on the date of gift exceeded Rs. 50,000.

You may receive a gift from the following people anytime, for any value, without any tax implications:

- Husband or wife

- Grandparents, parents, and parents-in-law

- Siblings

- Children or grandchildren

Similarly, gifts/shares received on certain occasions from anyone, and for any amount, are not taxed. Such occasions include marriage, from a HUF to its members, at the time of divorce, or a share in the joint family property.

On Continued Ownership

If you do not sell your property and continue to be its owner, then any income – real or deemed – arising out of that property is taxable. There are certain exceptions, deductions, and allowances to reduce your tax liability, but they vary from case to case.

For example, if you have an unoccupied residential property, left vacant to reside in it on your return, then it is exempted. However, in case you own more than one house property, including the inherited property, and even if they are vacant, you can declare only one of them as self-occupied. But on the others, you must declare deemed rental income and include it in your gross income.

Similarly, dividends from stocks and interest income from deposits would attract tax according to prevailing laws and rules.

While Selling or Gifting

You can sell or give as a gift any property that you have a title for. You can also remit the sale proceeds outside of India but within the limits prescribed by the Income Tax Act and the RBI.

To sell the inherited property to another NRI/PIO, you need permission from the RBI. You can sell your property to any Resident Indian (RIs) without such permission. Agricultural land acquired in inheritance can be sold only to RIs.

If you acquired or inherited the property while you were an RI, then you can deal with the property in any way you wish – sell, rent, transfer, or gift.

Documents Needed

The NRIs must present the following documents (as the case may be):

- The death certificate of the deceased.

- A registered will and a succession certificate to execute the transfer of title of inherited property.

- Address proof of the deceased.

- Property papers and registration certificate.

- Address, Age, and ID proof of the legal heirs.

- Any document showing relationship with the deceased – ration card or an Aadhaar-based family linkage.

- Bank statement of the legal heirs.

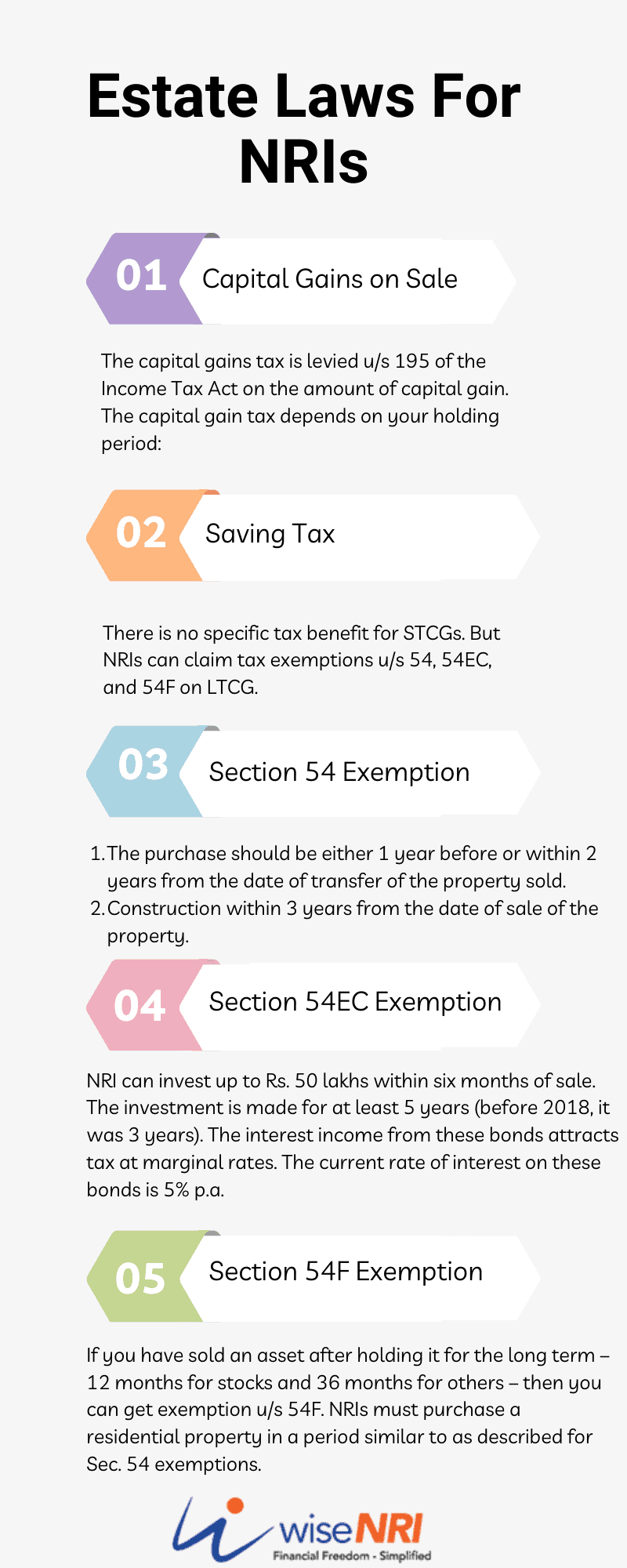

Capital Gains on Sale

The capital gains tax is levied u/s 195 of the Income Tax Act on the amount of capital gain. The capital gain tax depends on your holding period:

- Short-term Capital gains – for self-acquired properties with a holding period of fewer than 36 months and STCGs are included in your income and taxed accordingly.

- Long-term Capital gains – for a property held for more than 36 months, the tax rate on LTCG is 20% on the capital gains (with indexation benefit) and 10% (without it).

Saving Tax

There is no specific tax benefit for STCGs. But NRIs can claim tax exemptions u/s 54, 54EC, and 54F on LTCG.

Section 54 Exemption

If you sell a house property and either buy or construct another house property within a window of three years. The specific rules are:

- The purchase should be either 1 year before or within 2 years from the date of transfer of the property sold.

- Construction within 3 years from the date of sale of the property.

You can purchase/construct only one house property, within India, from the capital gains to claim this exemption. If the cost of the property is greater than the capital gains, then the property value can be claimed as an exemption.

While you are waiting for the right opportunity to buy/construct the residential property, you must deposit the amount in a special account opened under the Capital Gains Account Scheme of 1988.

Section 54EC Exemption

If you do not wish to buy another property in India, but want to save the tax on the gain, then you can invest the capital gains into specific bonds. The infrastructure bonds are issued by the National Highway Authority of India (NHAI) or Rural Electrification Corporation (REC).

You can invest up to Rs. 50 lakhs within six months of sale. The investment is made for at least 5 years (before 2018, it was 3 years). The interest income from these bonds attracts tax at marginal rates. The current rate of interest on these bonds is 5% p.a.

NRIs must make these investments beforehand and can show the proof to the buyer so that they do not deduct TDS. Otherwise, you always have the option to claim the refund while filing your ITR.

Section 54F Exemption

If you have sold an asset after holding it for the long term – 12 months for stocks and 36 months for others – then you can get exemption u/s 54F. NRIs must purchase a residential property in a period similar to as described for Sec. 54 exemptions.

However, there is one major difference. If the entire sale proceeds are not invested, then capital gains are exempt proportionately.

Repatriation of the Sale Proceeds

Under the Liberalised Remittance Scheme (LRS) of the RBI, an NRI can repatriate up to 1 million dollars annually, without any permission. If such sums were from the sale proceeds of a property in India, then you can pay applicable taxes and repatriate them.

NRIs must ensure that the following conditions are met:

- The property sold must comply with the FEMA regulation applicable at the time of sale.

- You can repatriate sale proceeds of up to two such properties if they were residential.

- There is no limit on the funds in the NRE account but for the NRO account, it is fixed at $1 million per annum.

Check – Good Time to buy property in India?

Conclusion

The property market in India offers diverse opportunities – to buy as well as to sell here. The complexity of Estate Laws For NRIs may make it seem cumbersome.

It is important to stay updated, negligence is not an option when it comes to investing in properties. With proper guidance and knowledge, one can make the right decisions.

Please share your experiences regarding estate laws and difficulties you faced during transactions…

Is this LRS for RI still legal to transact UpTo 250000$/anually to NRI/oci/PIO abroad from India.And is this true that amount exceeding 7 lacs RS/anually. TCS will be implicated at the rate of 5%??Thanks in advance.

If I sell unlisted shares of a company which I am holding for the last 10 years, being an nri what is the tax implications ,Without indexation is it 10 % plus surcharge?Is there any upper limit like say 5 crime before any other tax implication applies

I live in USA andI own two flats in India. Do I need to file tax in India also

I want to sell my property and bring the money overseas

US citizen having OCI and is also having ancestral Agril. land in India and presently Resident status in India as living in India for more than 6 months every year.so can he buy Agril.land as being farmer by ancestral aquired agril.land?Pl. guide.ThanksD K Patel

Educative

Thanks

Very informative and helpful articals for NRI.

Thanks

Good article

Thanks