Be an NRI or be a Resident Indian, financial planning is a must. The basics of financial planning are the same but the plan has to be tweaked for different people depending on circumstances, goals, and financial assets and liabilities. Similarly, financial planning for NRI has to take certain factors into consideration.”

Check – How NRIs Can Choose The Financial Planner in India

This is a detailed post on NRI Financial Planning & will cover

| Ø Goal Setting is complex for NRIs | Ø NRI Investment Planning |

| Ø NRI insurance issues | Ø Residence decision for NRIs |

| Ø NRI Taxation – Oops | Ø Estate Planning for NRIs |

| Ø Financial Planning Process | Ø Right Financial Planner for NRIs |

Financial Planning for NRI

After working with more than 15 years with NRI families – I can say Financial Planning Service for NRIs is a lot more complex in comparison to resident Indians. It’s not about more money, more choices, more confusion but it’s multidimensional & very dynamic.

Financial Planning is a process of developing strategies to help people manage their financial affairs to meet life goals.

Let us look at financial planning specifically for NRIs –

NRIs should List Down their Goals

What are your goals? Here are common goals that one thinks about –

Children’s Education

Build a corpus for your child’s education. It depends on the course, place of study whether India or abroad, and how you want to finance it.

For example, an engineering course in an NIT today costs between Rs. 5,00,000 to Rs. 8,00,000. You will have to factor in an inflation rate of 8-10%.

A lot of NRIs want their kids to study abroad. A Masters’s degree in Australia can cost between Rs. 20,00,000 to Rs. 35,00,000 per year today depending on the specialization – in US & UK it will be more. The inflation rate there has been in the range of 2%-5% in the last five years.

Goals – How it’s different for NRIs

Just to share how complex things can get when it comes to financial planning for NRIs.

NRI students in India also get a special quota in premium colleges in India but fees will be much higher – that number should be considered while preparing the plan. Inflation is 10% but what about currency depreciation if your investments are in FCNR or international investments?

If as an NRI you are considering your kids should complete higher education abroad – a few questions you have to answer…

- Will he be studying in the country where you are staying right now?

- Will he go to some other country?

- What will happen if you will retire before his college education?

- Should you invest in India for this goal or keep this money in foreign assets?

- If you are investing in India – inflation in educations costs should be considered 3% or 8%?

- How to handle currency depreciation or how that can impact this goal?

There are lot more questions that a financial planner has to handle before making the financial plan. These complexities are not limited to child education – in every goal NRIs bring more dimensions.

Must Read – How Can NRIs do early financial planning?

Children’s Marriage

It is an important milestone for parents. You have to decide if you want to spend on it and how much you want to spend on it and accordingly plan for it. What if kids are foreign nationals or marrying foreign nationals?

Retirement Planning

You have to plan for the retirement funds. Your income might reduce or cease but expenses will continue. Therefore you need to check how much money you would need in your retirement depending on the kind of lifestyle you want and invest accordingly. Retirement for NRIs is a long topic so you should

Actually, the above 3 are not goals but responsibilities & there is n number of other goals depending on individuals’ values & financial condition. Financial Planner can explore that while building a financial plan for NRI.

Check – Planning for Retirement in India by NRIs

NRIs Must Plan Their Investments Wisely

Many NRIs are underinvested. They are not sure of how to invest in India and are hesitant to invest fully in the country of residence.

Many NRIs get dollar salaries but all the money lies in the savings/current account without earning much or even losing value after inflation.

Other NRIs invest on the basis of emotions and put a lot of money in real estate in the place they were born or where they stayed in India when recommended by their relatives or friends. Some others invest in products that they are not eligible to invest in.

Some of the products that NRIs can invest in –

FDs in NRE and NRO accounts – NRIs can transfer their earnings to FDs in NRE and NRO accounts and earn better interest rates.

You know that NRI FD is tax-free in India but what about taxation in a country where you are living right now?

Check – NRE vs NRO Accounts

Equity

If you are ready to take risks in the stock market, you can invest in shares for the long term to earn returns. Investments in stock markets are risky especially direct stocks. Understand your risk capacity and risk tolerance and research and analyze the stocks that you want to buy or sell and then go ahead.

The BSE Sensex (30 companies that constitute the index) has given returns substantial higher returns in comparison to other asset classes in long term but with volatility. So there is a lot of potential in the stock market provided you invest smartly.

Real Estate – NRIs favorite

NRIs can invest in real estate as prices have bottomed out in most places in India if they need a place to stay or want to bring in diversification to their portfolio.

Mutual Funds (NRIs residing in the US and Canada have some restrictions and regulations)

NRIs can invest in mutual funds as long as they follow rules and regulations prescribed by FEMA. Mutual funds are managed professionally and have the potential to give better returns than debt products. Mutual Funds invest in a variety of assets and securities and therefore provide ample diversification in your portfolio. Funds can be repatriated based on certain regulations.

List – Best Mutual Fund for NRI

NPS

NRI can invest in the National Pension Scheme (NPS). It is a retirement savings scheme. One can contribute at least Rs. 6000 per annum to the NPS account. The funds received from all subscribers will be invested in different securities like equity, corporate bonds, and government securities. There are different investment options based on one’s preferences and exit regulations based on the type of account. There are no restrictions on repatriation.

Investment – How it’s different for NRIs

You must be wondering how it can be different or complex when it comes to investing for NRIs. And I am scratching my head while writing this post that we as financial planners do so much for NRIs even without realizing – let me think to increase the financial planning fees for NRIs 😉

- Half of the NRIs are still continuing their normal savings account – it’s illegal.

- NRIs are not allowed to make investments in all instruments

- There are limits when it comes to equity

- Tax on investment products is a lot complex

- Investment through NRO or NRE?

- Investment in the name of parents – hmmm

- Transaction-related issues

- FATCA – FEMA – FBAR & what not

- Currency fluctuation, exchange charges, inflation

- Regular change in-laws

- This list is never-ending

NRIs cannot make fresh investments in products such as PPF, certain PSU bonds, post office schemes, etc.

Check before investing if you satisfy the eligibility criteria. For most investments in India, it is important that one follows the KYC norms, and details such as identity, address, income, etc. need to be provided along with documented proof.

Check – Investment schemes for NRI

Over and above the financial planner has to make sure that NRIs map these investments with the goals.

Insurance for NRIs

Just because you are an NRI, it is assumed you have enough money to take care of financial emergencies. You are sold ULIPs or Endowment plans in the guise that they provide insurance and give high returns. Bankers keep waiting for you in the airport lounge – just to achieve their targets.

Insurance has to be taken based on risk management and current financial status. The right insurance product has to be bought so that financial emergencies can be managed appropriately.

Insurance issues for NRIs

Insurance is a very important aspect of financial planning as it’s your plan B.

Other than misselling NRIs face regularly in India – I have seen in many middle east countries & even in other countries they are trapped for buying expensive life insurance policies by Zurich, Friends Prudential like companies.

Buying a term plan in India is not easy as you have to present for the medical test here – if NRI bought an international term plan, again his family will have to handle claim settlement in the unknown territory if the claim happens after coming back to India. What about premiums if NRI returns before the premium paying term?

Health insurance & accidental buying decisions should also be done after giving proper thought.

All these things & handholding are done by financial planners.

Must Check – Beware of Rampant Mis-selling of Expensive Insurance to NRIs

NRIs should Plan their Residence

It is difficult to predict the future considering changes that can happen in your career, family situation, and economic and political situations in countries. But have a broad plan in mind as to where you will live about 5 years from now. Think about where you want to live post-retirement. Your retirement corpus depends on this decision. If you plan to live in a country different from India, think of visa and residence rules, investment options, and a retirement lifestyle.

As an NRI, you have to plan your finances such that you get the most optimum returns and build a good corpus. You have to invest on the basis of where you and your family are going to live and where will you achieve your life goals. For example, if you are living in Singapore and your family is in India, then you will need to build a corpus such that your needs of staying abroad and your family’s needs while staying in India are catered to. The inflation rate is different in both countries. There will be trips between India and Singapore at least 2-3 times a year. In India, you will have to invest in products that are available only for NRIs. But your family members can invest in all products that resident Indians are allowed to invest in.

Oops – NRI should consider Taxation

Even though we do not like taxes, taxation is an important aspect of financial planning. You have to ensure your tax returns are filed properly as applicable in India and in the country of Residence. The income earned in India from rent, interest, the sale of investments are taxable. Pay your taxes as applicable and file your income tax returns. Take advantage of DTAA. Ensure your family members also pay tax and file returns as per their residency status and income.

NRIs should also remember that there can be double taxation.

Estate Planning for NRIs

Estate or succession planning is important so that the NRIs can ensure that their heirs get the wealth smoothly. NRIs’ wealth is across countries so it is important that the estate is planned such that the succession laws of both countries are followed and all assets are in the plan.

To start with as an NRI, write one will that takes care of assets in India and one will that takes care of assets in the country of residence. NRIs who get assets in inheritance have to consider laws in India and their country of residence. For example, if you are an NRI who gets a property which earns rent, you will have to pay taxes as applicable. If you are an NRI living in the US who gets assets in India that generate income, you are liable to pay tax in the US too. So if you pay tax in India, you will get a foreign tax credit (depending on DTAA) that will reduce your tax liability in the US.

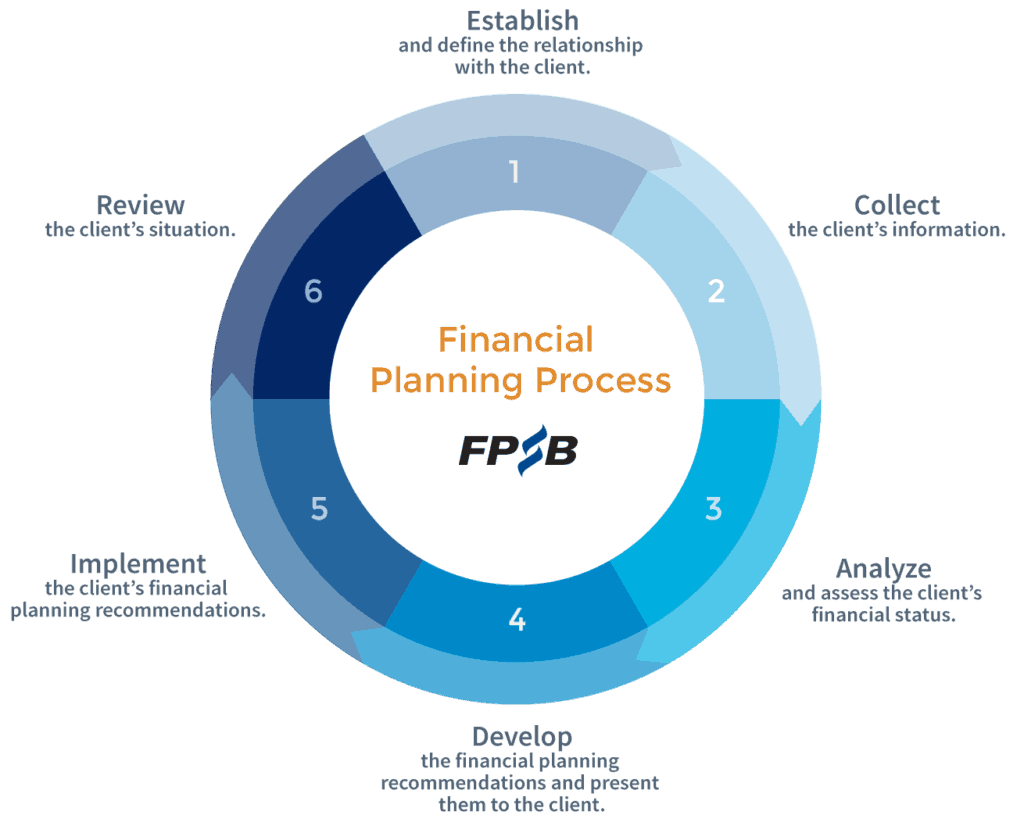

Financial Planning Process

Most of the financial planners follow the standard 6 step process defined by FPSB but as Maruti 800 is different from Audi Q7 – the quality of advice can be different.

Right Financial Planner for NRI

A competent financial planner creates a proper and unbiased financial plan to grow your wealth and earn optimum returns. As an NRI, select a financial planner who is well-versed with the financial markets, investments, and tax laws in India. The other option is to choose a financial planner for India and another planner in the country you live in. The financial planner/ planners should be aware of taxation laws, residential status rules, investment eligibility, FEMA, and DTAA.

Choosing a SEBI Registered Investment Advisor who is also a certified financial planner can be a good start. But being an NRI you should also look at someone who is specialized in working with NRIs & can understand your requirement better.

Your bank might provide you with some professionals that give you advice on investments but you might just end up buying products that are not suited to your needs but the bank’s needs.

Financial Planning is important whether you return to India or not so that your hard-earned wealth is taken care of and it earns more money for you to meet your financial goals and provides for your comfortable retirement.

If you have reached the end of this post – I can safely assume you liked the post 🙂 Please share this with your friends or on social media & help us to spread this message.

If you have any questions on Financial Planning for NRIs – feel free to add them in the comment section.

Schedule a Call Today for More Information

I would like to repatriate PPF maturity funds to UK.

Hi Jnanesh,

You have to transfer the funds into your NRO account & then transfer this to your NRE account & from there you can transfer this to your Uk account.

Currently they are in my NRO account.

Is it necessary to transfer them to NRE first? Is it okay if I directly arrange a transfer to UK current account?

Secondly, once this sum reaches UK, I believe it does NOT attract any tax in UK (as it was already taxfree in India). Could you please confirm if my understanding is correct?

Hi Jnanesh

As per my knowledge you must transfer it first to your NRE account only then you will be able to transfer it to your UK account.

And for the second question kindly consult a CA.

We had bought NRI bonds in 1992 where can I cash those in USA?

Hi Susheel,

The bonds are listed on the stock exchange after allotment and they can either be held till maturity or can be sold before maturity on which the issuer pays the face value of the bond. For the bonds bought and sold using an online Demat account, the proceeds of the sale/redemption and the interest earned shall be credited to the bank account linked to the Demat account.

Hi Susheel,

You should consult with a local tax advisor in US

Do you provide online financial planning planning advise

Hi Rajesh

Yes. We provide

Income from NRO and NRE a/c how it is taxed in UK e.g two FD accumulation interest credited in the account on 1/05 2019 and other one credited on 1 11 19 in Indian accounts to declare on my tax returned in which exchange rate to use. although not actually converting in pounds.

Hi Mahadev,

I think a UK based tax consultant would be able to help you with this.

In the current situation, is it good to have money in INR or USD?

Hi, Ramachandran

As per my knowledge,

In The current situation it is good to have the money in USD.

NRE FD taxation after returning back I am planning to return back to India by Aug 2020 after working for 14 years in the gulf. My status for FY 20-21 will be RNOR, I have NRE FD, maturity by April 21, as RNOR if I convert my NRE account (maintained on INR) to RFC account will the interest earned in RFC-NRE FD be taxed, after August 2020?

Hello Prince, did you get an answer to this? I am also curious to know.

NRIs in USA, if they invest in NPS – are they required to declare these in USA (FBAR or PFICS?)

Hi Harish,

US tax laws are too complex so I can’t comment on this. I will suggest you should have a word with CPA. Must share his response here.

My daughter is an us citizen and we r planning her education in india .do we have any kids education savings policy for her in india.

Are there any rules on insurance payment outside India

Hi Murali,

Can you share – what exactly you want to know..

Note recent changes announced on NPS: no tax (EEE) on withdrawal at retirement, more equity contribution possible, etc. ARE NRIs get all these benefits? Please clarify.

Hi Seetharama,

Yes, NRIs can avail all the benefits in NPS.

P.s. NPS will make sense only if the investor is sure of coming to India after retirement, due to the restrictions on withdrawal.