This is again a very common question that we hear while doing Financial Planning for NRIs “I Am an NRI. Do I Need Health Insurance in India?”

Buying the Best health insurance in India is an important financial decision. You have to consider factors like your age, health status, family members’ policy details, etc. Health insurance for NRI is a tricky policy to buy.

Many people do not want to buy it when they are young and healthy and, the insurance companies won’t provide it to people who are old and sick.

Must-Read- Life Insurance for NRI

Can NRI buy the Best Health Insurance in India?

As an NRI, you are allowed to purchase a health insurance policy in India. NRIs will need ID & address proof – insurance companies can collect premiums in all forms cash to credit cards. Even OCI can buy health insurance.

The crucial question is – Do you need health insurance in India? Here are some factors that you need to look at to arrive at a decision –

1) Duration of Stay and Family Status

You will have to think about the following –

- How long do you intend to stay abroad?

- What is your expected time of return?

- Where is your family residing?

- Will your family be changing their residence to India/abroad anytime soon?

- What is the expected time of your return or your family’s return to India?

If you are already abroad or if you are going abroad and you know you might be moving back to India in 2 to 3 years, it is a no-brainer. You must buy health insurance or NRI life insurance in India. It might be an expense, but the waiting period for many illnesses will be completed by the time you return.

If you have a family in India that has members who are financially dependent on you or has older persons who might find it difficult to get health insurance, you can buy family floater insurance policies.

If you and your family are abroad and will continue to reside there for more than 4-5 years, avoid buying health insurance in India. In that case, it is better to buy it in the country of residence.

“For NRIs moving back to India in 2 to 3 years, buying Health Insurance in India is a no-brainer.” wiseNRI

2) Geographic Restrictions

Many insurance policies provide coverage only within India. Check your policy details. If you have a policy that does not cover overseas health issues, do a rethink on the policy. You may want to port to a different insurance provider who provides coverage abroad as well.

You should also consider that if you have sufficient insurance abroad – either from your employer or you have purchased, then even if your policy is not covering you outside India is fine.

Must Read- Beware of Rampant Mis-selling of Expensive Insurance to NRIs

3) Tax Benefits for NRI Health Insurance

Under Section 80D of the Income Tax Act, a taxpayer (NRIs included) gets a tax deduction on payment of health insurance premiums. The deduction is as follows –

- ₹ 25,000 for a policy for oneself, spouse, and dependent children

- ₹ 25,000 for policies covering parents under the age of 60 years

- ₹ 50,000 for policies for parents who are senior citizen parents

- ₹ 50,000 for policies if the main proposer’s age is 60 years or more

If you have income in India, and you plan to return, it will be a good idea to have health insurance in India. If you have financial dependents or insurance dependents in India, it might be better to take a health insurance policy in India in that way your medical expenses are taken care of and your tax liability is reduced too.

4) Regular Travel To India

If you travel regularly for work or business to India, or you are a pilot or are in the Merchant Navy who has regular visits to India, it might make sense to purchase an insurance policy in India.

It can be useful in case of emergencies. Moreover, medical facilities and quality of treatment in India are better compared to many countries. Medical treatment in India is cost-effective too, as compared to many other countries. From both health and economic perspectives; it makes sense to have health insurance for NRI in India.

Must Read- NRE Vs NRO Account

Mediclaim policy for NRI

I am sharing the names of a few insurance specialist companies in India that are offering health insurance to NRI

- HDFC ERGO Health Insurance

- Max Bupa ( Now NIVA Bupa)

- Star health

- Religare Health

Health Insurance for Parents India

Most of the NRIs live in nuclear families & their parents stay in India. For NRI parents health care is also very important as in many cases their decision of coming back to India is influenced by their parent’s health.

Check – Medical tourism in India for NRIs

Few policies for Health insurance for parents in India:

- Apollo Munich Optima Senior (HDFC ERGO)

- Bajaj Allianz Silver Health

- New India – Senior Citizen Mediclaim Policy

- Star Health – Senior Citizen Rec Carpet

Read – NRIs want to return to India

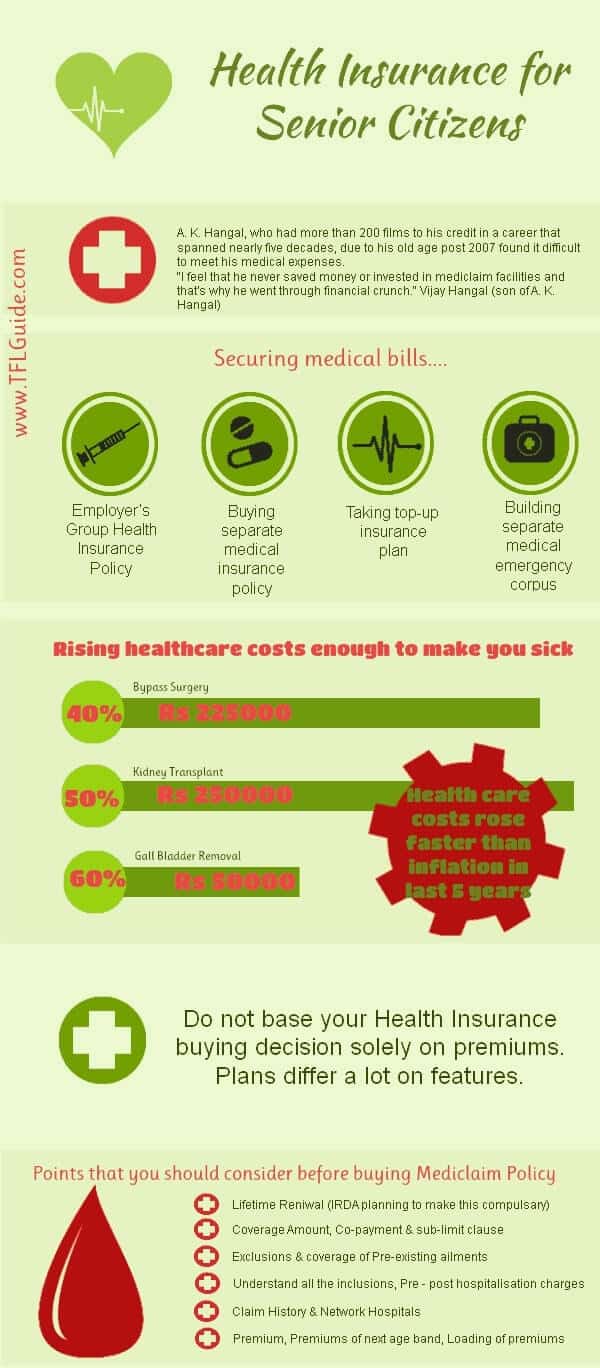

The Importance of Health Insurance for Senior Citizens

If you are an NRI, it is important that you protect the health of your elderly parents in India by obtaining appropriate insurance for NRI. This might involve choosing a senior citizen insurance policy that specifically caters to the needs of your parents. This is because elderly people are more likely to suffer from chronic diseases and critical illnesses than younger people, and many senior citizens often benefit from having more than one type of insurance policy. For example, you might purchase a policy for your parents.

NRIs should consider these points before buy health insurance for NRI in India-

- Insurers take extra precautions when they have to issue a policy to NRIs. Some of them have stringent practices for claims.

- Before buying an insurance policy, check the geographical coverage and the extent of the geographical coverage as regards illness and accidents.

- FEMA rules say that the claim amount to be repatriated should be only to the extent of the total premium paid in foreign currency.

NRIs should consider the policy coverage, tax laws, residency, and the location where medical treatment will be taken; to decide on the purchase of insurance.

Your parents are more vulnerable to health risks considering their age factor, you should opt for a higher sum insured amount.

“Financial matters are complex, more so if you are an NRI. But managing them is not impossible.“

Talk to us about your Financial Plan

Know you have better knowledge of health insurance for NRI in India. If you already have insurance or planning to buy it – please share our views in the comment section.

Does an OCI requires to provide proof of address in India to apply for health insurance?

I am an OCI card holder, am I eligible to buy health insurance in India for Indian hospital use?

I have an oci. My wife does not. We both British citizens. I am of indian origin but wife is English. We go for our medical issues to India. We live in Kenya. We want to buy medical insurance in India valid in India . Any advice

I am a US citizen & want to retire in India. I have OCI card. Do I have to have aadhar card before I can buy health insurance?

I am Canadian citizen wants to visit India and stay 3 months can I buy travell insurance

I wanted to know that do you provide health insurance for NRI who is going to study in india under self financial category.

I am an NRI senior us citizen. Looking for health insurance while traveling in india

Is there a health insurance that covers OCI holders who are seniors.

Can oci card holder have an medical insurance in India

I liked to shiift from uk to india with in 5 year.i like to take a mediclaim policy it’s sum assured increasing if we not claim it

Which is the best medical insurance for a OCI holder in India

Which medical insurance to buy for OCI

Can overseas citizens of India buy health insurance in India with foreign passport

Can oci card holder purchase mediclaim policy of national insurance company

I am a rezident of Bangalore I hold an OCI and tge US oassportCan i get tata gedlth insurance

How can I buy an insurance for an oci

I am visiting India for 52 days. I Canadian citizen with oci holder . How do I buy healthcare insurance during my stay ?

Visiting India in Friday looking for a travel insurance in India

Can NRO with OCI have medical insurance in India

How can an MRI get health insurance in India

Can you suggest me the best Term insurance as a NRI in kuwait? My age is 41..

I âm a NZ citizen( OCI card holder but have been living in India from Jan 2021 to look after my aged mom. I went to Europe to visit my son in March this yr for 90 days .I got back to India on 1st June Now I want to buy travel insurance to go to the US for 89 days to see my grandchild( leaving next week) . Am I eligible to get travel insurance in India. None of the travel insurance companies are giving clear answer . Hope I can get some info from you

Me and my wife are Dual citizens Of India and looking for health Insurance in IndiaI am daiabetic and my wife is hyper tension patient can we get the health insurance

Health Insurance – 67 years old man

I need a quote for OCI card holder residing in India travel insurance to USA

We are NRI based in london, we are looking for medical insurance in india??

I am an OCI holder. I want to buy a short term health insurance policy for my trip to India in May. I am also having a day surgery which is paid for. Is there a policy that covers complications from the surgery

I want to buy travel insurance from Mumbai to africa

As an OCI if I travel to India and plan to stay there for more than a month can I get health insurance locally.

Is a Mediclaim policy premium for a NRI subject to GST ?

medical insurance for oci holder

I have mediclaim insurance in national insurance company since last many years but now i am resident of usa holding greencard so can i continue this policy as it is and can i give payment from nro account and claim amount can be deposited in nro account??

I am newzealander and oci traveling india via Dubai n back

Can an NRI buy travel insurance in India while visiting india

Is there medical insurance for nri seniors

I am from Tanzania and I got oci so was just asking can I get health insurance?

I and my wife are Singaporeans aged 69 & 68 , we are OCI , have a house in Vadodara ,Gujarat , for medical, is there a policy for us to settle permenantly in India ,and covered until what age?

I have an PCI card can my sister in india buy a family floater health insurance for me for when I travel to india?

Can an USA citizen with OCI card buy short term health insurance in India

I am in USA at present green card holder

can person of Indian origin staying abroad but planning to relocate to India buy mediclaim policy

I am Australian citizen holding OCI. Can i buy a health insurance policy in india? I am moving to live in India

Need individual senior citizen (83-year-old) health insurance options – moving to India from abroad.

I am looking for Travel and Health insurance worldwide…I’m India Citizen living in NZ

Hi Siddhi,

You can check with HDFC Ergo, Star or Max Bupa for the travel & health insurance plan.

hello. do you know if oci holders can take medical insurance in india?

Hi Shubh,

Yes OCI Holder can take medical insurance in India.

can an oci card holder have medical insurance in India?

I am US citizen living in India with OCI card. Can I get health insurance?

Hi Sunil,

As per my knowledge you can go with any health insurance policy.

Hi Hemant. Have close friend who just turned 60. He and his wife (3 years younger) are planning to go to India for 6 months and stay in the USA 6 months starting late ’22. They currently pay for their own insurance since they are retired. Do thay have to continue full year of insurance in the USA? Can they buy and what type/where for the 6 months each year that they stay in India? Thank you.

I am NRI and planning to stay in india for 6months in 2022. what will be the cost of health insurance. no health issues. i will be 69 yrs old.

Hi Shama

The insurance premium would wary for different insurance companies.

It would be approx 30-40K.

Is there an age limit after which a person of indian origin returning from the US will not be able to buy private heath insurance in india.

Hi Roy

Usually, the max age is 60 but few companies do give insurance for people above that age as well. You can check them with the insurance companies.

We are citizens of the US, our kids and grandkids are also citizens of the US. The question is is it possible for us grandparents to buy insurance for our grandkids in India?

I âm an OCI holder, do I have plans for medical insurance?

Hi Suresh

Yes you can go for any health insurance policy.

I am a Canadian .will move to India in 2023 with oci what are the policies for health insurance.

Hi Sameer,

You can go for any health insurance policy in India.

My name is Raymond Peter OCI Cardholder and Citizen of Australia. I am now 73 years of age. I want to buy health insurance.

Hi Raymond,

Its difficult to get a health insurance coverage at this age but still you can contact any health insurance company for this.

I am settled in oman . Can I buy health insurance from India and get treatment in Oman and get reimbursing?

Hi George,

Many insurance policies provide coverage with in India. so you have to check details before buying it.

I want to purchase health insurance for my short visit to India.

Hi Amit,

Yes, you can.

I need to know more details about the Mediclaim Policy for NRI?

Hi Murugaswamy,

You can contact any health insurance company or agent for more details about policy.

I have OCI with Australian Passport & wife is an NRI, currently I am based in Australia but will back to India in 3-4 years.

May I eligible to buy health insurance right now & which one?

Thanks.

Hi Ani,

As per my knowledge after coming back to India you will be eligible for Health Insurance.

I am NRI from Uk and i am visiting India for 3 to 6 months can i buy a medical insaurance there for 6 months to make my self safe?

Hi Darsh

No, you cannot buy it for 6 months. The term of the Policy is minimum 1 year.

If you are a frequent traveler to India, you must go with the Health Insurance and regularly renew it.

Our family in singapore currently will go back to india in 5-10 years. I want to buy an insurance policy in India.

Hi Jyothi,

Yes, you can buy health insurance in India.

I am oci card holder living in india for more than 5 years wants a health insurance which covers covid.

Hi Dicky,

As per my knowledge above mention policies cover COVID.

Hi Hemanth

I am an OCI, 60 years. I am insulin dependent Diabetic Type 2

I do not have any other preexisting health conditions such heart, BP , eye or kidney issues

Perfect health other than diabetes

I am planning on returning to India on permanent basis .

What type of health insurance I am eligible

Which company I should chose if I am going to move to Hyderabad

Hi Lakshmi,

The above mention companies are the best for you. But I suggest you go through the policy conditions once then go with a suitable one.

Hi Lakshmi,

You can contact any health insurance company which is mentioned in article. they will better tell you that what type of policy you are eligible for.

I am Canadian with oci status, visiting India for 3 months . Please advise which and where to buy insurance, I am 66 yrs old

Hi Kuldip Ji,

I will suggest you can check HDFC Ergo Policy

I would like to know if healthy insurance policy can be available for a child with oci studying in India

Yes Madhupalan.

As an NRI can i get health insurance in india for me and my wife?

Hi Jacob,

Yes.

I am an NRI and I want a maternity insurance.

Hi Revathy,

Yes, you can but there are certain terms and conditions which you have to check out.

Which is the best health insurance policy in India?

Hi Monica,

You can check HDFC Ergo policy.

1.health insurance policies having life long renewal 2. Is it good to buy a separate policy for an elder parent or including in the existing health insurance in our policy?

Hi Jagadeesha,

According to me go with the separate policy.

HOW MANY DISEASE ARE COVER IN ANY PLAN?

Hi Nadeem,

It depends on the plan but if I talk about vanilla health insurance products – it covers most of the diseases other than pre-existing & in a few cases there is a waiting period.

What is your opinion on SBI LIFE. I am an NRI AND is planning to return this year. I have medical policy with SBI. I am above 65.

Hi Jose,

You can continue & may also think of increasing sum assured.

Thanks for very useful information. I am an 84 year old OCI getting pension in India. Could you please let me know if I can get tax deduction U/S 80D in Indian Tax for my health insurance premium paid in USA.

Hi Charanjit Ji,

Sorry to disappoint but I don’t have an idea about this.

You can only claim the insurance premium paid in India.

I have Star Health Comprehensive Policy (Floater for me, spouse and kids {covered up to the age of 25) for 15 Lakhs plus I have taken Senior Citizen Health Policy (Red Carpet) for 5 Lakhs for my mother. Since last three years I have been renewing this policy. Star Health states all pre-existing illness will be covered from 4th year.

My suggestion is one Health Insurance should be accepted Worldwide, just like the Credit Cards. Currently, I have a Health Insurance in India. When I travel abroad, I have to take a short period Health / Medical Insurance called Travel Insurance. If I am staying on deputation in a foreign country, both these insurance will not be valid , again I have to get a Health insurance in that Foreign country. Instead of the all this, I suggest one Health Insurance should suffice your Medical needs where ever you are e.g. My SBI Credit Cards (Visa and Master) works anywhere in the world. Likewise my health card should be acceptable in any hospital around the world.

Hi Reji,

Thanks for sharing your views.

Now Indian health insurance companies are providing global covers but people must read fine lines. For Example in the case of Tata AIG they say we provide global cover but fine print reads “provided that the diagnosis was made in India.”