Owning a home in your home country is a dream shared by many Non-Resident Indians (NRIs). Whether it’s for investment purposes, as a retirement haven, or simply a place to call home during visits, the prospect of owning property in India is an enticing one. However, turning this dream into reality often requires careful planning and securing the right financial tools.

In this comprehensive guide, we delve into the world of NRI home loans in India, providing you with a detailed checklist to navigate the process seamlessly. Join us as we embark on the journey to make your NRI home ownership aspirations a reality.

NRI Home Loan

NRIs can buy residential as well as commercial property in India but they can’t buy agricultural land. NRIs can also buy multiple properties too.

Non- Resident Indians can take a loan to buy the property just like Resident Indians. Just like for resident Indians, 70%-90% of the value of the property can be funded by a loan. The remaining amount has to be funded by the NRIs personal resources. It is important to note here that the remaining amount has to be paid in INR. It cannot be in any other currency.

Check – Can NRIs get a Car Loan In India?

Home Loan Checklist For NRIs

NRI Home Loans are provided by most major banks in the country and financial institutions. Here is a checklist of requirements for NRI home loans.

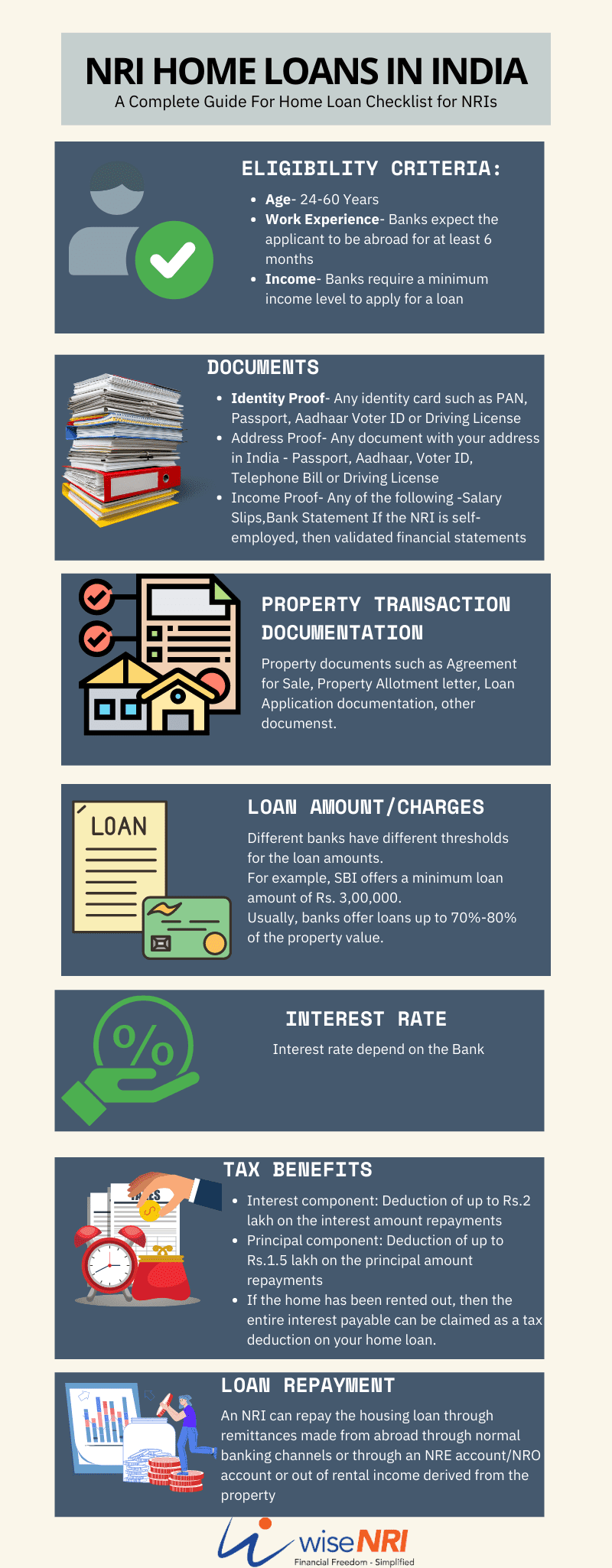

NRI Home Loans in India Eligibility Criteria:

Age – Most banks expect the applicant to be between the ages of 24-60 years. For example, Axis Bank wants the applicant to be at least 24 years old and ICICI bank has the minimum age at 25 years.

Work Experience – Banks expect the applicant to be abroad for at least 6 months. ICICI Bank expects a one-year period before applying for a loan. Different banks have different tenure expectations.

Income – Banks require a minimum income level to apply for a loan. Axis Bank expects the income to be equivalent to at least AED 5000 per month for GCC countries and income to be equivalent to at least USD 3000 per month for the USA and Other Countries The income level is different for different countries and types of employment.

Must Read – Best Bank for NRI In India

Documents Required for Home Loan in India

Identity Proof:

Any identity card such as PAN, Passport, Aadhaar Voter ID or Driving License

Address Proof:

Any document with your address in India – Passport, Aadhaar, Voter ID, Telephone Bill or Driving License

Income Proof:

– Any of the following –

Salary Slips (Salary Credits), Appointment Letter, Bank Statement where salary is received

If the NRI is self-employed, then validated financial statements.

– IT Returns

Must Read – NRI personal loan

Property Transaction Documentation:

– Property documents such as Agreement for Sale, Property Allotment letter

– Permission for construction (if applicable).

– Loan Application documentation

– Receipts of payment made if any.

– Insurance policy documentation

Must Check – Gift by NRI to Resident Indian

Loan Amount/Charges:

Different banks have different thresholds for the loan amounts.

For example, SBI offers a minimum loan amount of Rs. 3,00,000.

Usually, banks offer loans up to 70%-80% of the property value.

Processing fees range from 0.25% to 3%. There are penalties for late payment and for pre-payment of the entire loan amount

Check – Power of Attorney In India For NRI

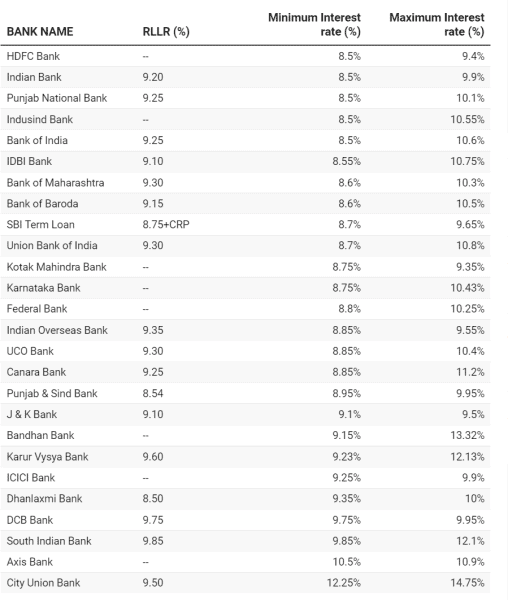

NRI Home Loans In India Interest Rate

What is RPLR?

RPLR stands for “Retail Prime Lending Rate.” It is the benchmark interest rate at which commercial banks in India lend money to their creditworthy borrowers. The RPLR is typically used as the reference rate for setting the interest rates on various types of loans offered by banks, including home loans, personal loans, and business loans.

Banks may offer loans at an interest rate that is linked to their RPLR. The actual interest rate offered to a borrower may be the RPLR plus a certain margin or spread determined by the bank. This margin is based on factors such as the borrower’s creditworthiness, the type of loan, and prevailing market conditions.

The Reserve Bank of India (RBI) periodically reviews and publishes the RPLR for various banks. Borrowers should be aware of the RPLR and the terms and conditions associated with loans linked to it when considering borrowing from a bank in India.

Tax Benefits of NRI Home Loans

Section 80C of the Income-Tax Act, 1961 allows for tax benefits if one is an NRI and is filing taxes in India. The tax deduction is for both interest and the principal portions of the loan.

If your house, the property is lying vacant in India, and you have a bank loan against it. You can avail the following tax benefits.

Interest component: Deduction of up to Rs.2 lakh on the interest amount repayments

Principal component: Deduction of up to Rs.1.5 lakh on the principal amount repayments

If the home has been rented out, then the entire interest payable can be claimed as a tax deduction on your home loan.

NRI Home Loan Repayment:

An NRI can repay the housing loan through remittances made from abroad through normal banking channels or through an NRE account/NRO account or out of rental income derived from the property.

The loan can be repaid in Indian Rupees only.

Repayment tenure can be between 20 years -30 years. For example, the loan tenure in the case of ICICI Bank depends on educational qualifications.

PNB has a repayment tenure of a maximum period of 15 years in case of home purchase/construction and 10 years in case of home improvement.

There might be some other requirements or documentation depending on the bank from where the loan is disbursed. Check with your bank to understand the exact requirements, eligibility, features, and conditions.

If you are an NRI & have any questions regarding a Home loan for NRI in India- add them in the comment section.

I ( and my wife) are US Citizens. I have House in India in my name, wish to add my wife’s name and obtain a loan for renovation, as we think to return to India for good.. Please narrate the procedure.. Thanks

Hello Bhadresh Joshi,

To add your wife’s name to the property in India, execute a gift deed or sale deed with her as the co-owner. To obtain a renovation loan, approach Indian banks with joint ownership documents and apply for a loan against the property. Ensure compliance with Indian property laws and loan criteria, considering both of your US citizenships while planning your return to India.

how to claim tax benefits on NRI housing loan

Hi Vishnu,

Kindly consult with your CA.

I want to home loan

How much Salary required for NRI GCC countries for home loan

Hi Shagun,

As per my knowledge, If you work in any of the Gulf Cooperation Council (GCC) countries then you need to have a minimum monthly income of 5,000 AED (United Arab Emirates Dirham) and for working in the US and other countries $3,000 per month is the minimum salary to be earned if you want to take an NRI home loan.

I have sent a question about 3 days regarding availing home loan by an NRI for property purchase in India vs availing loan by local person & NRI daughter sends money for the EMIs. Which is ideal option? Any tax implications for my NRI daughter is my worry.

Kindly take advice from a tax consultant.

I’d avoid a very intricate/ tiresome Bank (and all other agencies) procedure. I’d prefer that an Indian buy a house and outsider help repay..

Can I apply for NRI home loan even if I do not have indian bank account?

Can NRI gift the house property bought by him to resident Indian sibling?

Hi Ramakrishna,

Yes, you can.

Can NRI home loan be transferred to name of spouse’s who is resident of India?

Hi Abhijit,

Consult with your CA regarding this.