Investing during a bull run is like riding a roller coaster – thrilling and exhilarating. Almost every other trade makes you a lot of money. In the euphoria, investors tend to brag about their impressive gains on social media – giving the impression that the returns are a result of their skills and not luck. The overall highly positive market sentiment makes them feel that they can do no wrong and will continue to make money forever.

Must Read – Guide for Mutual funds for NRI

The euphoria in the stock markets also catches up with mutual fund (MF) investors as they are closely linked. The mutual fund investments, at least many of them, too show a rising NAV (net asset value) and hence positive returns for a continued period.

The Noise Distracts You

There are many reasons for mutual fund investors to get swayed by the market noise during a bull run. Some of the most notorious ones are:

- Asset Management Companies (AMCs or fund houses) advertise on every available platform the rising NAVs and short-term returns of their schemes.

- The MF distributors too frantically call their clients to tell them how “this time it’s different” and how they cannot miss the opportunity.

- The mainstream media, and not only business papers & channels, but also start screaming about how everyone is making moolah and you cannot afford to miss the bandwagon.

- Every Rakesh, Suresh, and Jignesh will tell you how they are making money by switching their MF schemes or flipping their MF units for trading in the markets directly.

- Finally, you cannot ignore the roles of the “finfluencers” (financial influencers) on social media who become demigods in such a market.

Most investors get carried away by the euphoria and commit mistakes that can harm their wealth. It does not matter whether you are a Non-resident Indian (NRI) or a Resident Indian (RI). It also does not matter whether you mostly invest in the country of your residence, India, or other markets. The problem does not lie in the markets or your tax status, but in your behaviour.

It hurts the NRIs more, especially if they invest in India, as they are at a particular disadvantage compared to RIs. This is because many NRIs do not have all investment avenues available to the citizens of their home country, and they are distant from the Indian markets to keep track of details. Therefore, the more you heed the noise and cacophony of the markets, the more likely you’ll make mistakes and deviate from your well-thought-out financial plans.

Check – Best NRI Investment Options

We are listing some of the most common mistakes that you need to avoid while in a bull market:

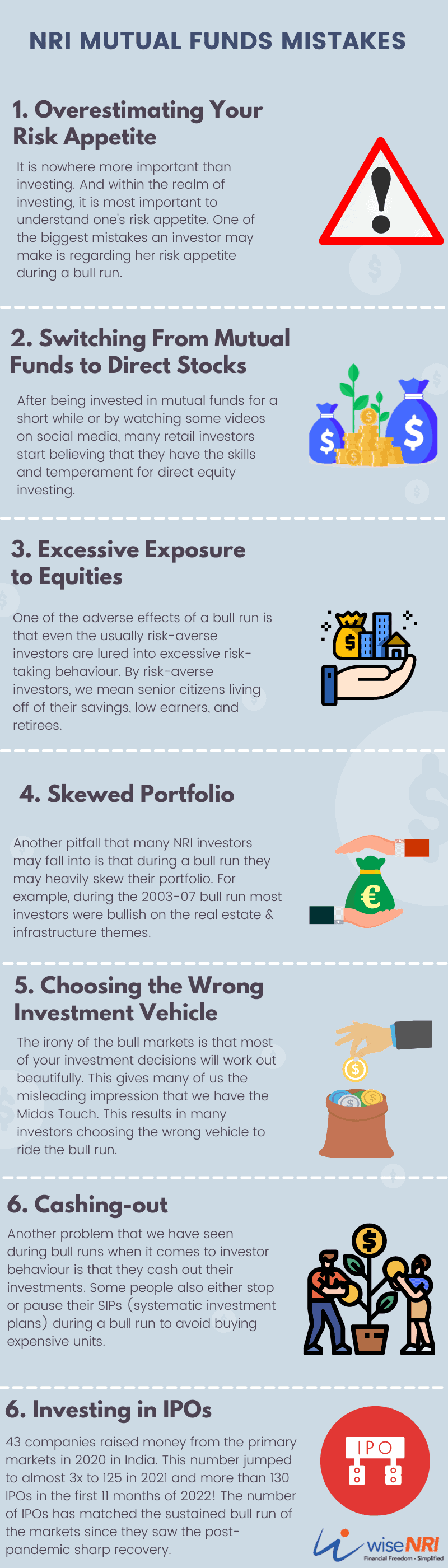

1. Overestimating Your Risk Appetite

“It is better to be roughly right than precisely wrong.”

~ John Maynard Keynes

It is nowhere more important than investing. And within the realm of investing, it is most important to understand one’s risk appetite. One of the biggest mistakes an investor may make is regarding her risk appetite during a bull run.

Investors may feel restless about the healthy returns their MF schemes are offering and may start chasing extraordinary returns. They forget that the returns they are chasing are temporary and may vanish at any moment. Discussing such matters with your financial advisor may help you reevaluate your risk tolerance. After much discussion, you can take a call on investing more, switching the funds, or even redeeming them.

2. Switching From Mutual Funds to Direct Stocks

After being invested in mutual funds for a short while or by watching some videos on social media, many retail investors start believing that they have the skills and temperament for direct equity investing. We have even seen many mature investors get lured in by the bull market where they sell their mutual fund holdings and invest directly in stocks.

They forget the many advantages an MF offers and their limitations that led them to invest in the former in the first place:

- A professional team to manage your funds

- Diversification to balance overall portfolio risk-reward ratio

- Discipline in investment

- Rupee-cost averaging

The halo effect of the rapid gains made by acquaintances adds to FOMO (fear of missing out) and a misplaced sense of invincibility. The lure of double-digit returns makes future gains look very real and losses improbable. Investors forget that trading in the markets is a sure-shot way to lose money on most occasions.

If you cannot see up to a third or sometimes, even more, of your capital evaporate within a few sessions, then stock market trading is not for you. A bear phase, even a temporary one, feels like a bucket of ice-cold water.

Must Read- Mutual Fund SIP for NRIs

3. Excessive Exposure to Equities

One of the adverse effects of a bull run is that even the usually risk-averse investors are lured into excessive risk-taking behaviour. By risk-averse investors, we mean senior citizens living off of their savings, low earners, and retirees.

The single-tap trading facility offered by broking apps adds to the addiction as the physical costs and inconveniences of executing a trade are all things of the past. In simply 2-3 steps you can execute the trade on your mobile app and will not even realize what you have done. Recently this has led to a major shift in the asset allocation of such investors in favour of equities. This is primarily drawn by the expectation of making a quick return.

What most of the new equity investors don’t realize is that in the long-term equity gains can beat inflation by a healthy margin, but there are many caveats. The wealth compounding happens in a very haphazard manner and will occur only over a long period. There will be times when you might see your portfolio returns are in deep red. Another thing that they fail to realize is that short-term gains in a bull run may evaporate as quickly as they came.

When the markets are breaching all-time highs regularly, it is the right time to re-balance your portfolio by reducing the allocation to equity and increasing the allocation to high-quality debt.

4. Skewed Portfolio

Another pitfall that many NRI investors may fall into is that during a bull run they may heavily skew their portfolio. For example, during the 2003-07 bull run most investors were bullish on the real estate & infrastructure themes. Not only the subscription to the existing MF schemes in these sectors saw record inflows, even the NFOs were lapped up by investors.

The markets were so pumped up by the January of 2008 that anyone who did not invest in these sectors was considered either timid or a fool! The gains made in the MF returns of the real estate and infra funds far outpaced the returns of most other sectors and broader indices.

Whenever you see frenzy in the markets in general, on for a particular sector (pharma, IT, or BFSI) or theme (consumption, EVs, or digital) then it is better to stay away from them. Always remember these golden words of the Oracle of Omaha:

“Be fearful when others are greedy and greedy when others are fearful.”

~ Warren Buffet

As Buffett himself suggests, diversification and automatic investing is the best course of action for a lay investor and patience is the most potent ammunition in her arsenal. Disregarding the noise during the dream run of a sector is your biggest virtue.

5. Choosing the Wrong Investment Vehicle

The irony of the bull markets is that most of your investment decisions will work out beautifully. This gives many of us the misleading impression that we have the Midas Touch. This results in many investors choosing the wrong vehicle to ride the bull run.

This vehicle could be F&O (futures and options), CDO (collateralized debt obligations), a thematic MF scheme, investing in penny stocks, applying to the ever-increasing number of IPOs, making lumps-um investments near peak, and even leveraged investments.

Once again, these investment vehicles can prove to be another dampener when the music would stop. And it is not a matter of “if” it will ever stop, but only a matter of “when.”

Must Check – How NRIs can complete KYC for NRI Mutual Fund

6. Cashing-out

Another problem that we have seen during bull runs when it comes to investor behaviour is that they cash out their investments. Some people also either stop or pause their SIPs (systematic investment plans) during a bull run to avoid buying expensive units.

Theoretically, it may seem logical to reduce investments while the markets are peaking and increase them while they are tanking. This is the textbook implementation of the “buys low, sell high” strategy. But they forget that they are trying to time the markets – something which even the most seasoned traders and investors could not do.

Consider the scenario, where you cash out your MF units that have risen too high and even stop the SIP thinking that you will restart them once the markets are correct. It may so happen to you, like so many of our clients, that instead of parking the proceeds in a liquid fund for redeployment, you may use them up. Also, with the automatic SIPs stopped, you may start a new recurring expense (or an EMI) that may tighten your budget.

Therefore, by the time markets correct to a reasonable level, you now neither have lump-sum cash to invest nor steady savings to restart your SIPs.

You sold high, but now cannot buy low!

7. Investing in IPOs

43 companies raised money from the primary markets in 2020 in India. This number jumped to almost 3x to 125 in 2021 and more than 130 IPOs in the first 11 months of 2022! The number of IPOs has matched the sustained bull run of the markets since they saw the post-pandemic sharp recovery.

Why do you think that most of the IPOs (initial public offerings) hit the markets during a bull run? Is it because the company management thinks that as “investors” you will be able to make quick listing gains?

The answer is an emphatic no.

It is because in the frenzy of the bull run companies can demand even a crazy valuation and in the guise of an IPO many Follow-on public offers (FPOs) and Offers for sale (OFS) also get sold out! YES, most companies treat the bull run as the festival sale period when they can market anything and everything at any price as the “investor” will always look away.

The so-called “investors” also believe that they can make quick gains on listing and apply through as many accounts as possible. Many of them even take personal loans to apply for IPOs.

Valuation-wise, investment bankers do not leave anything “on the table” for the investors. Their motive is to bring in as much money as possible to justify their sky-high commissions.

Therefore, it is best that you stay away from IPOs as you will always get the chance to own the stock in the market later. And if you have chosen your MF well, then your fund manager will do it for you.

“IPO = it’s probably overpriced.”

~ Warren Buffett

Conclusion

The process of investing is ongoing. And like any other endeavour requiring long-term commitment – be it business, studies, or relationships – the fear of making mistakes should not prevent you from investing. Learning from our own mistakes, and more importantly from the mistakes of others is what will stand us apart. You can make smart decisions by exercising discipline and keeping an eye on the big picture. Opportunities exist in both bull and bear markets, and more so in the latter.

We have to remember that mutual funds investments are best suited for goal-based investing and will require aligning our expectations with realistic returns. You should not equate MF investments with equity investing only as there is so much more to it.

More importantly, MF investments are there to give you professional advice, discipline, goal-based investments, and diversification benefits. So heed the sagacious advice from your financial planner and stick to your asset allocation.

All want is my father’s pension and donate all of his stocks and mutual funds and the balances of his banking accounts

How do I identify the mutual funds in my portfolio that I cannot invest in as an NRI ?

Even Warren Buffet cannot predict the future.