Whenever I ask an NRI about their investments in India – most of them share a list of properties that they have purchased in the last few years. NRIs simply have to understand Real Estate is an asset class like any other – there are pros & cons. Let me stick with the Comprehensive Guide for How Can NRI invest in mutual in India.

Must Check – Benefits of Investing through mutual funds

Can NRI Invest in Mutual Fund in India?

NRIs are allowed to invest in mutual fund schemes in India.

Availability of MF schemes for NRIs to invest

NRIs from all over the world can invest in most of the Mutual Fund Schemes in India except for some restrictions on NRIs based in the US and Canada.

There are restrictions due to compliance requirements.

They can invest only in the schemes of some of the fund houses such as Birla Sun Life, DHFL Pramerica MF, ICICI Prudential, L&T MF, PPFAS Mutual Fund, SBI, Sundaram, UTI Mutual Fund, TATA Mutual Fund, Reliance Mutual Fund, and Franklin Templeton Mutual Fund.

How to Invest in Mutual Funds for NRI in India

- Non-Resident Indians can invest through their Demat account linked to the NRE/NRO account.

- They can also open an account in an online platform such as MF Utility (MFU) and manage their investments.

- Non – Resident Indians can also buy and sell MF units directly from the fund house using their online services or paper-based application forms.

“NRI can also invest in Indian Mutual Funds by giving Power of Attorney (POA) to a family member in India.” wiseNRI

Must Check – Best Mutual Fund to Invest in India

Details on investment amount and repatriation

- Investments in mutual funds can be done in INR only. The amount has to be debited from the NRE or NRO account. Other remittances being used require a Foreign Inward Remittance Certificate.

- Redemption proceeds on the sale of MF shall be credited to the respective NRE/NRO bank account of the investor. The redemption will be done in INR only. Redemption proceeds of investments can be fully remitted back abroad on a repatriation basis assuming the investment was done as a Non-Resident Indian and from an NRE account. Redemption proceeds to an NRO account cannot be repatriated easily.

Requirements for an NRI Investment in Mutual Funds in India

KYC for NRIs

Non-Resident Indians have to be KYC compliant to invest in Mutual funds. They have to file in for a fresh KYC even if they were KYC compliant as resident Indians.

We have a detailed article on- How Can NRIs Do Mutual fund KYC

Redemption

Non-Residents Indias need to have an NRO or NRE account for the transfer of funds to and from the MF for the investment. The bank account operational in a foreign country cannot be used for Mutual Fund investments in India.

Other Requirments

Non-Resident Indians have to give the FACTA and CRS self-declarations too.

The form can be downloaded from AMFI, any MF, or KRA websites. The necessary documentation such as PAN, passport, and overseas residence proof should be submitted. An In-person verification can be done by the advisor or Indian embassy in the country of residence or in many cases online.

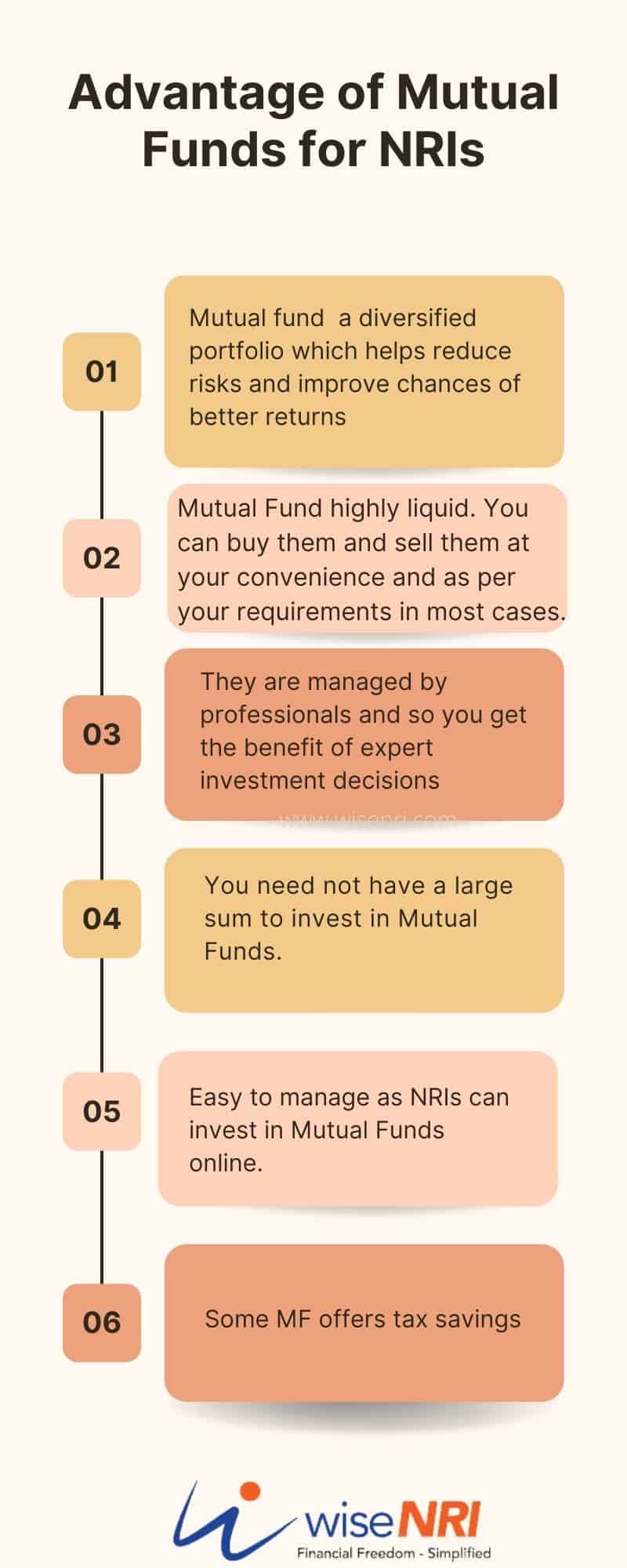

Advantage of Mutual Funds for NRI

MF schemes are apt investment vehicles for NRIs to invest in India. The main advantages of investing in Mutual fund schemes are –

- They offer a diversified portfolio which helps reduce risks and improve chances of better returns

- They are highly liquid. You can buy them and sell them at your convenience and as per your requirements in most cases.

- They are managed by professionals and so you get the benefit of expert investment decisions.

- You need not have a large sum to invest in Mutual Funds.

- Some MF offers tax savings.

- Easy to manage as NRIs can invest in Mutual Funds online.

Must Check – Smallcase Stock Investing For NRIs

Mutual Fund taxation for NRI

Equity Mutual Funds for NRI in India

– Short-Term Gains – 15% of the gains is payable as tax

– Long Term Gains – Gains up to Rs. 1,00,000 per year are exempt from tax. 10% tax is payable on gains over and above that amount.

Non-Equity Funds

– Short-Term Gains – 30% of the gains is payable as tax

– Long Term Gains -If it is a listed MF, 20% of the gains is payable as tax (with indexation). In the case of unlisted MF, 10% of gains are applicable (without indexation)

Fixed Maturity Plans

– Tax on Short Term Gains

– If the FMP matures in less than 3 years, tax is applicable as per the income tax slab of the individual.

– In the case of long term gains, 10% tax, without indexation is applicable and 20% with indexation

You can read our detailed post on Taxation of MF for NRI

Nominees and joint ownership

- NRIs can make joint investments in mutual funds in India with another NRI who is KYC compliant. (his/her bank details are not required)

- A Non-resident Indian can appoint an NRI or a resident Indian as a nominee for his investments in mutual funds.

There are many MF houses that offer numerous schemes. As an NRI, you should pick up the right funds to invest in. The choice depends on factors such as the performance of the fund, your financial status, financial needs, cost of investment, and market conditions.

If you are unsure on how to pick up the right investment, consult a professional financial adviser.

Talk to us about your Investments & Goals.

Hope this post gives you an idea about can NRI invest in mutual fund in India. if you have any questions feel free to add them in the comment section. If you think I have missed any major point in this post – just let me know & I will revise.

I am NRI living in UAE , i made some investment in Mutual funds in India and converted NRI status in KYC by NRO account, Do i need to link my PAN and Adhaar card, Mutal fund compnay sending email to link

Is nre account holder pay tds on mutual fund

Can an NRI give his mutual funds to his parents or relatives, without any tax?

You mentioned about “Power of Attorney” to a Resident Indian. I left India in August 1962 and was coerced by my mother to give a P.O.A. just in case of emergency. I didn’t trust any one after my Father’s business partner wanted an irrevocable POA to run the business. Although she was uneducated my mother learnt to sign in English. I was 15 at that time but because I was careful I wanted the POA checked by a High Court Advocate who provide a “Pro Bono ” service for me. He immediately asked me why my uneducated mother signed it in English if she didn’t understand a word of English like “Irrevocable” what it means ! I told him that she was jealous of her Governess educated sister who was married to a Civil Surgeon in British Raj and socialised with British society including playing “Bridge” in their parties. Although I saved her then but before leaving for London wrote a “POA” against my will. I found later he sold all our houses and lands to finance my naive youngest brother who leased 2 floors to SBI to open their Naihati Branch @ 35 p/ sq.ft for 6421 sq.ft

of Office space without any research about market prices. I’ve NO Place in India to stay or to visit. My 2 brothers enjoying the benefits of my hard earned money, mortgage free from income

receiving from SBI using my Pan Card paying 10% tax only. When I contacted some Kolkata High Court Advocates they told me it is now common practice and as a 84 year old I have to put up with it. I only did my duty to look after my old mum and aunt.

They both died in 1986 one after the other broken-hearted !

I am planning to sell my flat in Delhi, which I have inherited from my parents. Builder is ready to buy but he is making payment partly through bank and partly cash. How should I deal with this, espacially with the cash part? I am 80 yrs. old London based NRI, Thank you for your help.

i am nri and 5 days ago i withdraw my mutual fund but i charged TDS.

I have come back to India on exit in Dec 2018, my sponsor was to issue a visa once again to go back but it was delayed and I’m 2020 due to covid could not go back, nre and nro act in SBI is still there but recently bank told me to close nre act since I have not gone back, they have stopped honoring money transfer from nre account, what should I do?

I have invested in a mutual fund in the NRI category, now I am returned no NRI how to redemption or change status.

I have a zerodha – coin account for Mutual Fund SIP’s with auto debit from my HDFC savings NRE account in India. I have recently shifted from India to Singapore now on long term basis. Please advise on steps to undertake with both HDFC and Zerodha so I can continue with the SIPs.

My residence status has changed to NRI (UAE) and I have investments in Mutual Funds as resident individual. I have converted my HDFC savings bank account linked to MFU (Mutual Fund Utility) as NRO account.

Can I change my resident status in the existing MFU CAN to NRI? If yes, then what is the procedure? If no, do I need to close the existing CAN which I opened when I was resident individual? If I am required to close my existing CAN then what will happen to my investments?

I have just immigrated to Canada on PR. I want to know that if I invest in the stock market and the mutual fund from Canada in India will there be restrictions/ compliance issues. I have an operational Demat account in India.

I am NRE and would like to do investment on my spouse (Indian resident), so is there any tax implication

If I would invest MF invest as NRI oci card holder , at the Maturity of term such as 5 years transfer to my NRO a/c should payable tax for returns.

Hi SAV,

TDS is deducted in the case of NRI/OCI. So yes – you have to pay the tax.

What are the restrictions for NRIs based in US for investing in Indian mutual funds?

Hi Bharat,

Most fund houses in india don’t allow NRIs from US and Canada because of the cumbersome compliance requirement under Foreign Account Tax Compliance Act. Under FATCA, it is compulsory for all financial institution to share the details of transactions involving US citizens including NRIs with the US Govenment

I am currently an nri since 3 years but till now using normal saving account. I have recently invested in MF (75000 INR) and Stock (150000 INR) back from 2 months. What should I do now Can I carry on with normal saving account?

Hi Santosh,

It’s illegal to hold saving account for NRIs. As per FEMA regulations, when a status changes to NRI, resident saving account have to be converted to NRO Account.

For this, you need to inform bank within a reasonable period of time( time is not defined but you can assume up to 3 months)

Thanks. Could you please update the article with information on how PINS and non-PINS accounts work. Also mechanism and knowledge about repatriation.

Thanks for the suggestion – I will do that…

Let me know some investment plan for future settlement.

Dear Vinoth,

I will suggest you to check this https://www.wisenri.com/nri-investment-options-in-india/

I am an Nri, please suggest me the investment plan