There are more than 3 crore NRIs residing outside India & all of them who would like to continue their financial relationship in India NRIs should understand NRE vs NRO Accounts.

Must Check- Best Bank for NRIs in India

NRI Account In India

When you are moving abroad for a long stint for employment, business, or other reasons, it is important to manage the status of your bank accounts in India. Typically you might have savings accounts, FDs, joint accounts, etc. in Indian banks. These cannot remain as-it-is when you become an NRI.

You cannot have bank accounts that you had as Indian residents. At the same time, it might not be in your best interest to close all accounts as you might have expenses in India like EMIs being paid, etc. You will have investments that earn income in India. It is also helpful to have a bank account in India when you are back on short visits.

NRE Vs NRO Accounts

You should have the right legal bank accounts & the ones that will help you to reduce tax & transaction hassles. Here are the details of various bank accounts that NRIs can hold in India but we will mainly focus on the most common accounts that NRIs prefer – NRE Accounts and NRO Accounts.

Check – Status of NRE FD after return to India

What is an NRO Account?

NRO account is Indian rupee accounts that can be current, recurring, savings, or fixed deposit accounts. They allow credits from different sources. They are suitable to receive money and withdraw money in India.

Indian NRO Account – Features & Benefits

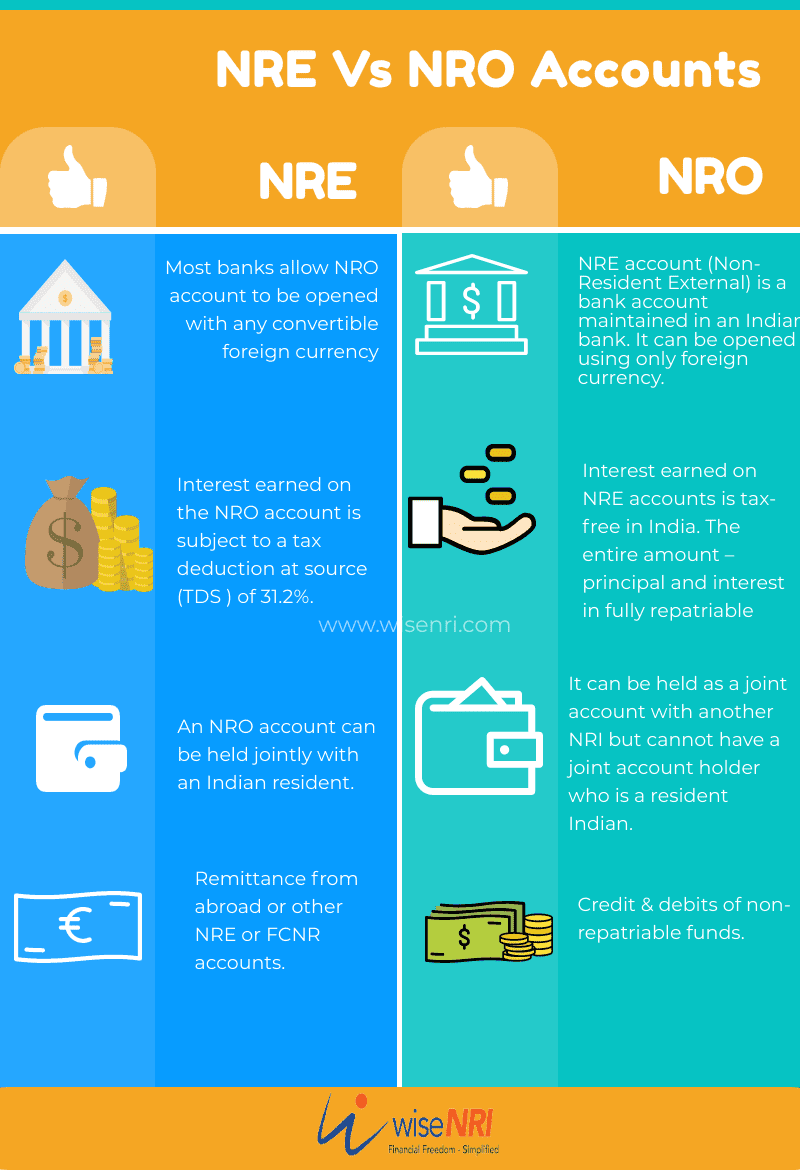

- Most banks allow NRO accounts to be opened with any convertible foreign currency. They will convert it into INR and open the NRO Savings Account and maintain it in INR.

- Interest earned is subject to a tax deduction at source (TDS ) of 31.2%. You can avail of concessions if there is a DTAA in place between your country of residence and India. You have to complete some documentation and formalities as prescribed by the RBI to avail of this.

- An NRO account can be held jointly with an Indian resident. This is helpful if you have family in India who are financially dependent on you.

- Money up to the extent of USD 1 million in the NRO account can be repatriated (transferred abroad) subject to certain conditions and documentation.

- Your existing accounts can be converted to NRO accounts with suitable documentation. You need not open new accounts. You will typically have to fill some forms and submit proof of identity, proof of foreign address, and other KYC-related documents. Some documents may need to be notarized.

- When you become a resident Indian, the account has to be converted back to a resident account.

“An NRO account is useful for those transactions to be done in India that will continue even when you go abroad such as receipt of rent or dividends and payment of EMIs or insurance premiums. If you want to have a source of funds for family members in India, it can serve the purpose.”

What is NRE Account?

NRE account is a bank account maintained in an Indian bank. It can be opened using only foreign currency. The amount is converted to Indian Rupees. It can also be a savings account, current account, or term deposit account. It can be held as a joint account with another NRI but cannot have a joint account holder who is a resident Indian.

NRE Accounts – Features & Benefits

- It can be used for investment and business purposes.

- Interest earned on NRE accounts is tax-free in India. The entire amount –principal and interest in fully repatriable.

- The funds in the NRE account are open to risks related to currency exchange fluctuations

- You can open an NRE account with suitable documentation. You will have to fill in relevant forms, submit proof of identity, proof of foreign address, and other KYC-related documents. Some documents may need to be notarized.

“Some NRIs require fund repatriation. The NRE account is suitable for that. Interest earned in this account is also tax-free in India.”

Difference Between NRE and Indian NRO Accounts

If we talk about NRE Vs Indian NRO accounts differences there are 6 key differences – let’s check that in the below table…

|

Difference |

NRE Account |

NRO Account |

| Purpose & Suitable | If you want to hold your foreign income in INR or you want to make investments in India NRE account should be preferred. | If you receive income in India like rent, dividend it will be better to have an NRO account. |

| Opening | You are required to open a new account with any bank. | You can also convert your existing resident savings account to NRO. |

| Tax | Any income from this account including FD interest is exempted from tax. | The income from the NRO account is taxable. (There will also be TDS) |

| Repatriation | Balance held in Indian Rupee but fully repatriable. | It’s not repatriable but after paying taxes & completing few formalities – funds can be repatriated. |

| Fund Transfer | Remittance from abroad or other NRE or FCNR accounts. | Credit & debits of non-repatriable funds. |

| Joint Holder | With an NRI/PIO or any Resident “Relative” defined by FEMA | With NRI/PIO or with a resident can be opened on a former or survivor basis. |

Check – Outward Remittance – How can NRIs transfer Funds Overseas

Other NRI Accounts

FCNR – Foreign Currency Non-Resident Account

- The FCNR account is only for fixed deposits ranging from 1 year to 5 years. It can be maintained in designated foreign currencies such as the Australian Dollar, Canadian Dollar, Euro, Japanese Yen, UK Pound US Dollar

- The interest and principal are tax-free in India, and the entire amount is fully repatriable.

- There is no currency risk as the deposits are maintained in the foreign currency itself.

- NRIs or PIOs can open FCNR accounts. It cannot be held jointly with resident Indians.

- The FCNR account can be maintained until the deposit matures, even if the person’s residency status changes from NRI to Resident Indian. When it matures, the amount can be transferred to another valid bank account.

Why Should I Have A FCNR account?

You can keep the money in the currency of your choice and earn higher interest rates as compared to savings accounts.

Must Read- TDS refund for NRIs & Simple Process Of Tax Refund

RFC Account

RFC Account is Resident Foreign Currency account – they are bank accounts that are mainly opened by returning NRIs in foreign currency similar to FCNR.

RFC accounts are helpful for NRIs as NRIs might have money in foreign currency in bank accounts abroad that they would like to bring to India while returning back for good & at any point of the time in Future would like to take that back abroad – or send that abroad or use for kids foreign education after they become resident Indian.

Special Non-resident Rupee (SNRR) Account

- The SNRR account can be opened by a non-resident for business purposes in India. It can be used for rupee-denominated external commercial borrowing, trade credit, and trade invoicing.

- The account will not earn any interest. The amount in this account is freely repatriable.

- Transfers from the NRO account to the SNRR account are not permitted.

- Transactions done in the SNRR account are subject to taxes in India.

Why Should I Have a Special Non-resident Rupee (SNRR) Account

This account is used for trade and business purposes in India. If you are an NRI with business interests in India, you can use this account.

There are different types of accounts available for Indians earning income abroad. Check out your requirements and open the requisite accounts on time.

Hope you got a clear idea about NRE Vs NRO Accounts – if you still have any questions add that in the comment section.

Can I deposit funds from India into NRE? e.g. a gift from my mother?

AS per new TCS rules, (which says resident to NRO transfer attractsTCS) if i become NRI and I convert my resident account to NRO account would I need to pay TCS

1. I transfer money via Transferwise app from Japan to my Indian bank account in which service fee will be deducted automatcially? will there be any tax applicable on the money I sent to my own savings bank account?2. Transfrwise automatically deposits my Japanese yen in INR to my Indian account. Will it attract tax in this case also?3. I was unable to convert my savings bank account to either NRE or NRO account after change in status of my residence. Is it mandatory for me to convert it?4. I have to invest in mutual funds and stocks and also I need some portion of money in the bank to support my family. which account is suited for me in between NRE and NRO?

If I am an NRI living in Canada and I receive an income from a company in USA as a contract employee in my NRE account is that taxable in India?

I have nri account now I want open fix diposit account can you please help me

I have resident Dmat account which is connected to Resident SB account . Bank said it is ok keep it . I don not want to sell my stock they are in red.. what is your advice . Can I get another NRO account and Dmat transfer all stocks then close ??

It is regarding buying travelling medical insurance as an OCI card holder

Me 70 & my wife 67 are Canadian citizens with OCI cards and are planning to visit India for about 5 months so weddings and travelling and are wondering if there’s any medical travelling insurance we can buy in India ? Will much appreciate your assistance.

I am nri since 2017.my sb account is in india. shoul i convert it to nro account.

I am an US Citizen and have an OCI. If my uncle (mothers brother) gives me a gift of more than INR 5 lakhs by transferring money into my NRO account in India, will I have to pay any gift tax in India? Same question as above but what if my mother transfers money into my NRO account? Thank you.

I will be moving to Canada next year. I have invested in few mutual funds through the Groww app, I would like to hold on to my units and redeem it later in time. Moreover I would like to continue my SIP. Is it possible as I have heard investment for Canada resident is not allowed. For redemption is it enough to just convert my registered bank account to an NRO account and redeem it?

Can an NRI Open a HUF account in an Indian bank?

Hi Kas

No, NRI cannot open HUF account.