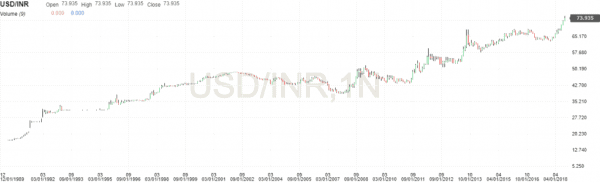

The Indian rupee has been on a downward slide for some time now. It has been above the Rs. 70 to 1 US Dollar mark for the last 3 months.

Almost depreciated 20% in the 2021 calendar year and came very close to the psychological level of 75. This was sharp & painful after few years of stable currency.

List – Best Mutual Funds in India for NRI

In the past too, this has happened a few times and the government takes different kinds of steps to stabilize the rupee. One step is to mobilize dollar funds through NRI Bonds. This is done by wooing NRIs to make dollar deposits in different instruments.

This step has been successful in the past.

NRI Bonds in Past

The Resurgent India Bonds were issued in 1998. The RIBs had a rate of 7.75 percent and only NRIs could subscribe to these bonds. Due to the NRIs’ faith in the Indian economy and the attractive interest rate, India was able to raise US $4.8 billion and helped to push up the country’s foreign exchange reserves.

In 2000, another bond offer was made to NRIs. It was called the India Millennium Deposit (IMD). These were 5-year bonds and were available in three currencies – US dollar, UK Pound and Euro. The interest rates were 8.5 percent, 7.85 percent, and 6.85 per annum respectively.

In 2001, $5.5 billion was raised as a result of these bonds. They were of a five-year tenure, aimed at channelizing NRI savings into India to stabilise the rupee. This raised about US$5.5 billion.

Check – When is the best time to send money to India?

Foreign currency non-resident deposits (FCNR-B) were floated in September 2013 when the rupee fell sharply against the US dollar. The RBI gave a swap deal to the banks to issue fresh deposits to NRIs. RBI offered the banks the feature of swapping the US dollar funds received from NRIs at a fixed swap rate of 3.50%. NRIs got a higher interest rate on these new deposits than the prevailing LIBOR rates. A total of about US$ 34 billion was collected. (as NRIs were allowed to leverage 5 times – returns were higher)

Read – Why should NRI Invest in India

NRI Bonds In India

Since the rupee has been on a downtrend now, there are reports that the Government is considering to issue NRI bonds again of worth US$ 50 billion.

How that benefited the Indian Economy in the past

“When in 2013 NRI Bonds were introduced – in less than 2 months Indian rupee appreciated 10% & even stock market rallied by 20% in the same period.” wiseNRI

Must read – Mutual Fund investment in India for NRI

Such bonds/deposits are advantageous to NRIs –

- Interest earned on these deposits is exempt from tax in India.

- The deposit and the interest amounts are freely repatriable to the country of residence of the depositor.

- The investor does not have to bear any foreign exchange risk.

NRIs should remember to understand the tax implications on the interest in the country of residence on NRI Bonds. These investments are illiquid and therefore the NRI should only invest the amount that is not required in the short-term and understand the penalties related to premature withdrawal if any.

If the RBI gives an attractive rate like the previous time and also supports the banks in the endeavour by sharing some risk and cost, it has the potential to become a success. (last time they shared a cost of 3.5% per year) But at the same time, it has to be put in action quickly. In a couple of months, the situation might change and the issuance of these deposits might not benefit RBI immensely and lead to unnecessary costs.

In case if you ever invested in NRI bonds in past – please share your views in the comment section.

Can nri invest shor term corporate bonds

Do u have bonds of rs 3 lacs of credit grameen or spandan

Since I am an NRI – Can I buy tax-free RBI bonds?

Any NRI bonds are available as of today. I am a citizen of Australia.

Need to invest about $10000 what interest rate i can get for a lock in period of 6 months to 1 year?

What is NRI Bond? I am staying abroad,how to invest?

What corporate bonds can NRI invest in?

A bunch of tax free bonds (NHAI, REC, PFC etc.) and some Bank Bonds like Karnataka Bank Bond.

For NRI returning for good, Will the interest on FD still to mature will be fully taxed or only the portion after returning and on what percent

Hi Roy,

It will be taxed from the day you have returned – rate will depend on your Indian tax slab.

need to know how the NRIs can buy the government bOnds and what is the rate of interest

what are the RBI bonds in which an NRI can invest and what is the rate of interest on these

How to buy the upcoming NRI Bonds in India?

Hi. Mouli

You can invest through online or through a stockbroker.

How long we have to invest in NRI bonds. whats the rate of RbI has fixed .