Have you recently got a job abroad? Have you got a work visa in a foreign country and are hoping to spend a few years there? It might mean that you will become a Non-Resident Indian (NRI). You need the NRI Checklist.

The status of an NRI is different from a resident Indian under the Foreign Exchange Management Act (FEMA) and the Income Tax Act and you have to take certain steps to transition smoothly to the new status.

Must Check – NRI Questions and Answers

NRI Checklist: 8 Must Things to Complete Before Becoming NRI

What are the important things to be taken care of before becoming an NRI?

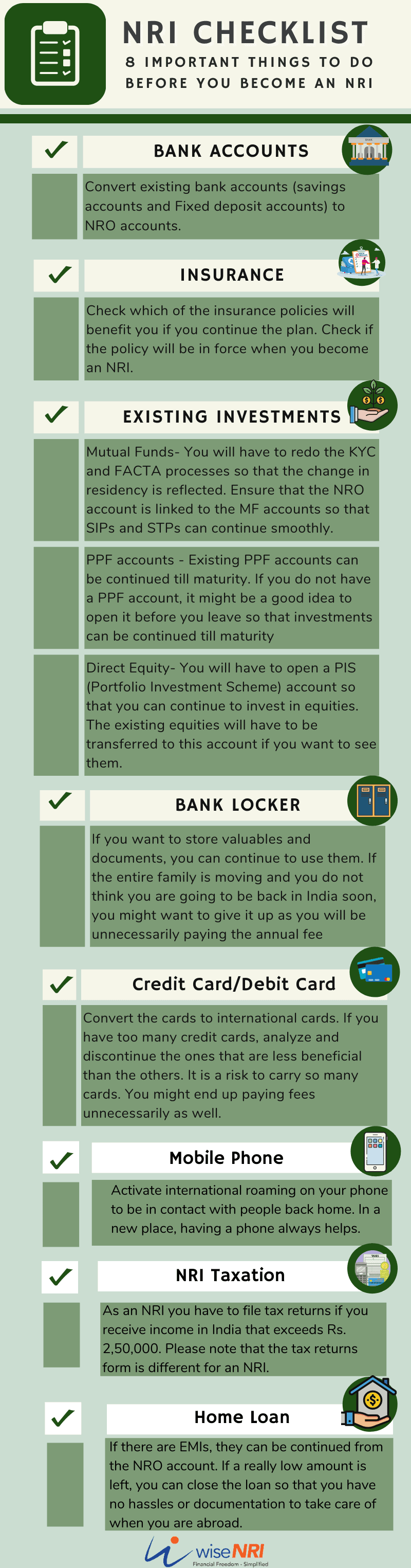

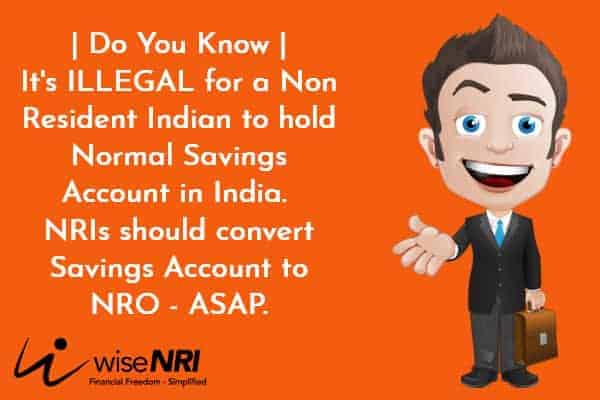

1. Bank Accounts

Convert existing bank accounts (savings accounts and Fixed deposit accounts) to NRO accounts.

It might be better to consolidate many accounts to a few and then convert them to NRO accounts as it might be difficult to manage so many accounts from another country. NRO account can be used for transactions in India such as receipt of dividend/rent or payment of EMIs as well.

An NRE account can be opened to deposit money from a foreign account. Interest earned in NRE accounts is tax-free. It can be a savings account and/or a fixed deposit account.

Read More – Best bank for NRIs

2. Insurance

Check which of the insurance policies will benefit you if you continue the plan. Check if the policy will be in force when you become an NRI.

Usually, term plans continue to be valid when you become an NRI. It is prudent to inform the insurance company and also check if there are additional riders or any different conditions regarding the coverage for an NRI.

Medical Insurance plans – Some illnesses or medical conditions require a waiting period. Many of us prefer to have medical treatments done in India. Therefore, it might be better off to keep the medical insurance plan in force.

“It is prudent to inform the insurance company when your status change from resident to NRI or vice versa.” wiseNRI

Check – Life Insurance for NRI

3. Existing Investments

- Mutual Funds – You will have to redo the KYC and FACTA processes so that the change in residency is reflected. Ensure that the NRO account is linked to the MF accounts so that SIPs and STPs can continue smoothly. Check the rules regarding MF holdings and ensure that you are allowed to invest in MFs. NRI Mutual Funds India

- Other Investments – You may have other investments like Bonds, PPF, Gold, and Real Estate. If you expect transactions in real estate, you might be better off by nominating a Power of Attorney (PoA) unless the joint owners are in India. The PoA will be able to transact on your behalf.

- Existing PPF accounts can be continued till maturity. If you do not have a PPF account, it might be a good idea to open it before you leave so that investments can be continued till maturity. The current rate of return is 8% which is attractive.

- Direct Equity – You will have to open a PIS (Portfolio Investment Scheme) account so that you can continue to invest in equities. The existing equities will have to be transferred to this account if you want to see them.

4. Bank Locker

If you want to store valuables and documents, you can continue to use them. If the entire family is moving and you do not think you are going to be back in India soon, you might want to give it up as you will be unnecessarily paying the annual fee.

Moreover, it has to be operated regularly. As an NRI, you may not be able to do that. If you want to continue with the locker, ensure there is a joint account holder who can operate it.

5. Credit Card/Debit Card

Convert the cards to international cards. If you have too many credit cards, analyze and discontinue the ones that are less beneficial than the others. It is a risk to carry so many cards. You might end up paying fees unnecessarily as well.

You can also check – NRIs should consider before buying a gadget abroad

6. Mobile Phone

Activate international roaming on your phone to be in contact with people back home. In a new place, having a phone always helps. You may not be able to get any communication facilities in the new country quickly. I don’t want to promote Reliance Jio but they really have good plans for international roaming. (only use for calls – not internet surfing)

7. NRI Taxation

As an NRI you have to file tax returns if you receive income in India that exceeds Rs. 2,50,000. Please note that the tax returns form is different for an NRI. This is separate from your tax liability in the country where you live. It has to deal with separately.

8. Home Loan

If there are EMIs, they can be continued from the NRO account. If a really low amount is left, you can close the loan so that you have no hassles or documentation to take care of when you are abroad.

Read – How to renew Indian passport online

Other important considerations

- Avail of Internet Banking facility if you have not done till now.

- Automate payments in India as much as possible.

- Ensure you discontinue subscription for things like additional phone, cable, newspapers, gym membership, etc.

- Ensure that all-important financial documents are in place. If possible e-document them and store them in a digital locker.

When you go abroad, there will be many things to take care of there. It is important that you tie in all the loose ends here in India so that you can have a smooth and peaceful transition from being a resident to being an NRI. (NRI Moving back to India can check this)

Looking for a Comprehensive Financial Planning Solution?

Click here to Schedule a no-obligation Free Call

If you have any questions related to NRI Checklist or you would like to share additional points – please add them in the comment section. Don’t forget to share this with your friends 🙂

What is the common mistake done by non resident

I have opened a NRI Trading DMat account. Along with this ICICI Bank has opened two NRO accounts in India. Both these accounts are ‘Frozen’ and ICICI Bank is asking me to send ‘Initial funding’ thru wire transfer. I tried International transfer via Barclays which charged £4/- which was returned. I transferred using Wise App. It was returned by ICICI Bank. They are asking me to use ‘Money2India’ which doesnot have GBP option. Normal Wire transfer with Barclays Branch will cost me £25/-. Any idea & help will be appreciated. THANKS.

send in usd barclay will convert and dr your account in £

My son is out of country for study for 8 month’s Is he indian or nri

I would like to know the procedures to change status to NRI

Can an Indian resident give a loan to NRI cousin?

Good information as always. However you need to update on the PPF section. NRIs now have an option of closing PPF account from the time they become NRI. If they choose to keep it, the interest is lower (not 8 %) and therefore it might not be a good move to open a new PPF if one doesn’t have one already.

my query is regarding taxability of certain income from indian sources in the hands of a green card holder dual-resident tax payer under India-USA DTAA.

Beautiful article on NRI checklist! Thanks

Thanks 🙂

Need help with application for my NRI daughter for UK tax residency certificate from UK Revenue Service.

I want to know if I am to convert my NRE/NRO account to a resident account then do the account numbers change.

I have a residential plot bought before I became NRI. If I sell it now, can I remit the proceeds to my foreign destination? What is the tax liability?

I just got my PR approved for a foreign country. I hold a PPF account with SBI (not a savings+PPF, but a standalone PPF account).

I do not intend to come back to india in the foreseeable future.

How do I close my PPF account before I leave and withdraw my investments?

Hi Shiv,

A PPF can be closed prematurely before 15years but only under specific circumstances. You can close the account after completing 5 years for specific reason such as higher education or expenses towards medical treatment.But premature closure attract penalty- you will get 1%less interest. And option of partial withdrawal is available which starts from 7th year.

Subject: TRANSFER FROM NRO TO NRE ACCOUNT

Dear Sir,

I am NRI and having NRO and NRE Saving bank accounts in India. I want to transfer my fund in NRO account to my NRE account in the same bank. As per CBDT notification, NO 93/2015 dated 16th December 2015 effective from 01.04.2016 FORM 15CA and or 15CB is not required. However, the bank asking for FORM 15CA and 15CB.

I have gone through various rules and notifications of RBI and CBDT as per these provisions Transfers/ remittances from NRO Accounts to NRE accounts for the specified 33 purposes covered under CBDT Notification No 93/2015 dated 16/12/2015 not taxable and certificates 15CA and/or 15CB are not required.

But some of the banks do insist for such certificates from CA and account holder/remitter.

Generally, banks ask for submitting 15CA/CB certificates even if they are not required as per rule. The bank takes this position and justifies that due to strict penalties and disclosures required by RBI and banks don’t want to take chance. When banks insist on these unnecessary and required certificates, account holders have no choice but to submit these certificates to banks so that they transfer funds from NRO to NRE.

What is the correct position? Is there confusion in circulars/notifications of RBI/CBDT?. Which authority should clarify the correct rule position? Any good article clarifying correct rule position. How should I proceed to transfer the balance from NRO to NRE account in the same bank?

kindly guide me on this matter. I would like to know the correct requirement as per rules and regulations

With regards,

A.L.Chaudhary

Hi A.L Chaudhary,

An NRI can transfer funds from NRO to NRE Account only if the amount is within USD 1 million in a financial year.

You have to submit Fema declaration and request letter to transfer funds from NRO to NRE to bank.

For Transfer of Funds NRO to NRE, NRIs need to submit Form 15CA ( Online Application form) and form 15CB ( chartered accountant application) to the bank branch.

What types of documents would I need for an NRI account?

Hi Ryan,

I will suggest you to contact any Indian bank for NRE account formalities.

Please give a checklist for the students going abroad for studies and becoming NRIs

Hi Padnya,

That’s a good idea – I will definitely work on this.