Credit cards are one of the safest and most secure ways to make payments globally – be it online or offline. As the card companies and banks have their own money on the line, they ensure that transactions using these cards are not only convenient but also safe.

Not only can you make purchases in India or abroad, but you also get access to emergency funds in case of need, especially while traveling overseas. It becomes easier to track and manage expenses using detailed credit card statements. Moreover, with an add-on card for family members, you can give them freedom.

Many Indian banks offer international credit cards with superb privileges to Non-Resident Indians (NRIs). NRI Credit Cards have many added advantages over regular credit cards. National/International travel & hotel booking, fine dining, entertainment, lounge access, online shopping, and international transactions on these cards are often more rewarding.

Must Check – Best Bank for NRI In India

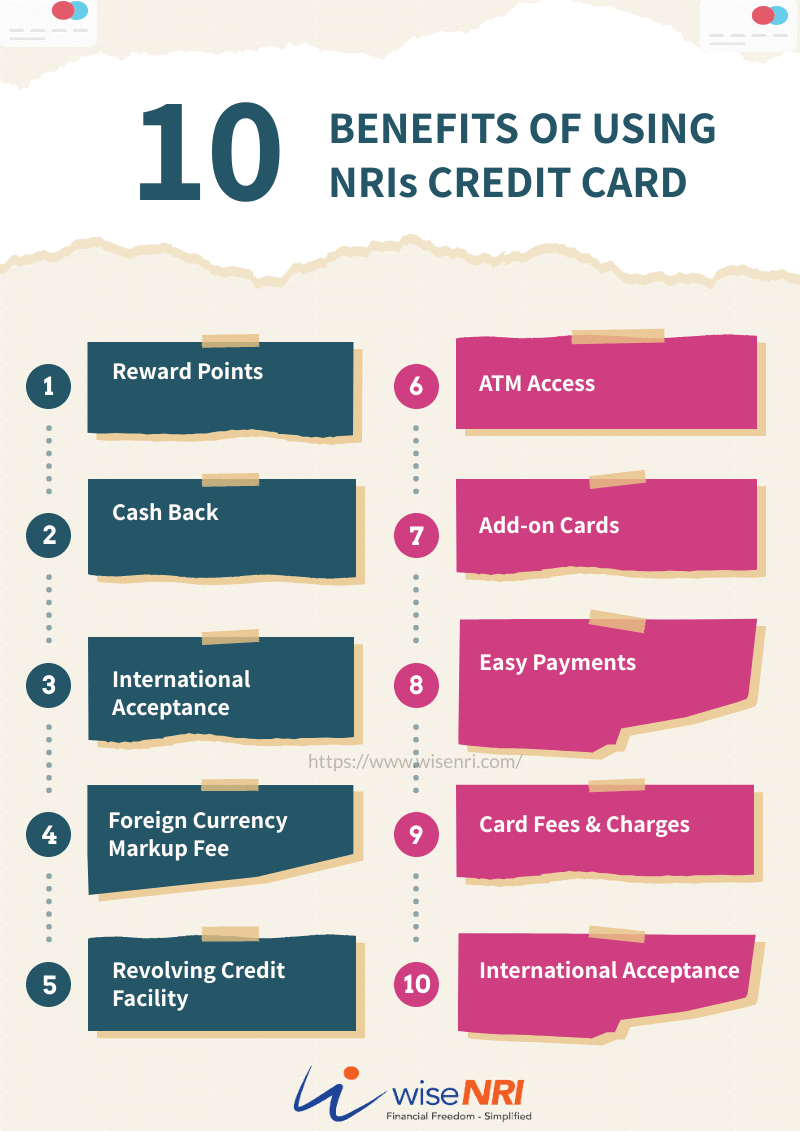

Benefits of using NRI Credit Cards in India

As NRIs, as a class, are considered to be well-off and big spenders, the banks offer extra benefits to attract new customers.

Reward Points

Making purchases with an NRI credit card can get you 1.5x to 2.5x reward points compared to a regular card.

Cash Back

One of the most gratifying offers, cashback on bill payments, purchases made at partner stores, flight & hotel bookings, and sometimes on refueling makes it a USP for many cards.

Avoid Forex Charges

With NRI credit cards, you can avoid paying foreign exchange conversion charges and save a substantial amount.

Surcharge Waiver

Many merchants do not bear the card processing charges, but with an NRI credit card, the bank may offer a surcharge waiver, in the form of reward points or cash backs.

Revolving Credit Facility

You can avail a revolving credit facility on your NRI credit card, to help you in financial emergencies. You can repeatedly borrow money – up to a pre-defined limit, interest-free – and pay it back later. (but it should be avoided)

Must-Read – Issues NRIs Face With Their Banks

ATM Access

Credit cards for NRI offers ATM access at most International ATMs, operated by MasterCard or VISA, to withdraw cash in local currency.

Add-on Credit Cards for NRIs

With add-on cards for your family members, they can share your credit limit and avail the benefits irrespective of their credit score.

Must Check – NRI personal loan

Easy Payments

You can easily make payments from anywhere in the world using online banking with your linked NRI bank account. More importantly, you can make payments in INR or an international currency.

Points to Remember when applying for an NRI Credit Card in India

Like any financial instrument, credit cards for NRI need precaution, and awareness on your part. Therefore, before you sign the dotted line and start using the card, check the following points thoroughly.

Card Fees & Charges

Different fees are applied to a credit card – annual fee, processing fee, joining fee, cash withdrawal charges, cancellation fee, etc. Be sure that you understand each of these components completely, and never forget to ask if these could be waived. Most companies and banks offer fee waiver in case you spend beyond a limit in the first few months of joining.

Finance Charges/ Interest

As credit cards extend an unsecured credit, there are heavy finance charges or interest applicable, if you fail to pay the dues even by a day. You cannot claim that you were traveling, or did not understand the timezone differences and missed the deadline. The card company has already given you 15-25 days to pay your card bill.

The finance charges could range upwards of 36% pa (3% pm). Cash withdrawals are charged from the day of withdrawal, so double-check the interest rates on a cash advances by different banks.

International Acceptance

If you travel often and to many parts of the world, then more than anything, you need that your card is accepted at most of the countries your visit. Get a detailed list of all the countries and country-wise limits before you apply for the card.

Card Protection

Check all the protection mechanisms that your bank offers while you are traveling against lost or stolen cards, card jacking, and card replacement services.

Foreign Currency Markup Fee

If your card is issued in INR but allows your international transactions in foreign currency, then check for a foreign currency markup fee on your international transactions.

Check – All About Mandate Holder In Bank Account – by NRIs

Payment Process

You must know all the possible modes of card bill payment, including from abroad. You may link your bank account to the card for direct debit of the monthly bill, but it can also lend you in trouble if the balance is insufficient.

Banks that offer credit cards for NRI

The following banks offer NRI Credit Cards from Mastercard, VISA, and American Express networks. The Mastercard network has recently been prohibited by the RBI to take on new customers, though their existing customers remain unaffected.

- Axis Bank

- HDFC Bank

- ICICI Bank

- Kotak Mahindra Bank

- State Bank of India

- Yes Bank

Eligibility Criteria to apply for an NRI Credit Card

Check the following point to see if you are eligible to apply for an NRI Credit Card:

- An operational NRO, NRE, or FCNR account with the bank.

- Some banks require a minimum balance in the linked account.

- For some cards, banks may require you to make a term deposit with them.

Documents Needed

You can apply through online mode or by visiting the branch. You should read the following documents before you apply.

Identity Proof

- PAN Card

- Aadhaar Card

- Passport

- Voter’s ID Card

- Driving License

- Ration Card

- Arms License

- Freedom Fighter’s ID Card

- Photo ID proof certified by a Judicial/Gazetted Officer.

Address Proof

- Passport

- Voter’s ID Card

- Ration Card

- Driving License

- Property Documents

- Lease/Rent Agreement

- Recent Utility Bills

Income Proof

- 3-months’ Salary Slip, if salaried

- 6-month’s Bank Statement

- Latest ITR/Form-16

Must Read – Wealth Planning Checklist for NRIs

How to Apply for Credit Cards for NRI in India?

Apply Online

- Visit the official website of the preferred bank and fill the inquiry form with your details including name, email, contact number, income, address, etc.

- Once the email and phone are verified, you may be directed to an online application form. A bank executive may also call you to guide through the process.

- Upload the documents online for verification.

- Bank executives may visit you for In-person Verification and collect your documents.

Apply Offline

- Visit the bank branch where you operate your NRO, NRE, or FCNR accounts as the process would be must faster. You can always go to another bank, but they will first have you open an NRI bank account with them.

- Fill the offline application and submit the original documents and their copy for verification. Originals would be returned back to you.

Your application would process and approve in a few days, and you would receive the card and instructions at your home.

Conclusion

Credit Cards give you a high credit limit, secure transaction facility, and international access to products and services of your choice. Their exclusive offers can also help you get bargain deals and exclusive access. International travel necessitates that you carry an NRI credit card on you.

But unruly credit behavior can also be the reason for your financial problems. Use the card as if you are using cash – ultimately, today or 50 days from now, you have to pay for the bills.

Please share your experience of using an Indian Credit card as an NRI. If you have any questions add them in the comment section.

I would like to apply for a credit card in India and I’m in abroad!!!!!

I want NRI credit card my job is in Saudi Arabia

Need to know more about international credit cards for NRIs!

Do your card have airport launch access?

I want credit card in India

Hello Shaik Anwar,

To obtain a credit card in India, begin by researching and selecting a card that suits your needs. Complete the application form, which can be done online or offline, and submit the necessary documents, such as identification and income proof. After undergoing verification, wait for the bank’s approval. Once approved, the credit card will be issued and delivered to your registered address.

How to get NRI credit card

Hi Pradip,

Research and select a bank or financial institution in India that offers NRI credit cards.

How to check my nri credit score

Hello Amit,

Start with Contact the relevant credit bureau directly via their website or customer service. Provide the necessary identification and documentation as required.

Request your credit report and score.

How to apply for Indian credit card

Hey Mohammad Javed Siddiqui,

Choose a credit card issuer that suits your needs.

Visit the issuer’s website or branch.

Fill out the credit card application form.

Submit the required documents, such as proof of identity, address, and income. Wait for the bank to review your application and conduct necessary verifications.

If approved, you will receive the credit card at your registered address.

Want to apply for a credit card

Hello James,

Choose a credit card issuer that suits your needs.

Visit the issuer’s website or branch.

Fill out the credit card application form.

Submit the required documents, such as proof of identity, address, and income.

Wait for the bank to review your application and conduct necessary verifications.

If approved, you will receive the credit card at your registered address.

Please note that the specific application process and document requirements may vary between different credit card issuers in India. It’s recommended to visit the issuer’s website or contact their customer service for detailed instructions.

Does kotak bank require a term deposit for applying an NRI credit card

Hello Manoj

in general, banks may require customers to maintain a fixed deposit or savings account as a part of their application for a credit card. This requirement may vary from bank to bank and may also depend on the type of credit card being applied for. It is best to check with Kotak Bank directly or review their website to understand their specific requirements for NRI credit card applications.

I want credit card as I am nri

Hello Varun

in general, banks may require customers to maintain a fixed deposit or savings account as a part of their application for a credit card. This requirement may vary from bank to bank and may also depend on the type of credit card being applied for. It is best to check with Banks directly or review their website to understand their specific requirements for NRI credit card applications.

How u get credit card i am staying in UAE

Hi Savio,

To get a credit card while staying in UAE, you can follow these steps:

Gather necessary documents: You will need to provide proof of income, proof of identity, and proof of residence. Common documents include a passport, Emirates ID, and salary statement.

Compare credit card options: Look for credit card options that best suit your needs and compare the rewards, benefits, and fees of different cards.

Apply online or in person: Many banks in UAE offer online applications for credit cards, or you can visit a bank branch to apply in person.

Wait for approval: Once you’ve submitted your application, the bank will review it and determine whether you’re approved for a credit card.

Activation and use: Once your credit card is approved and activated, you can start using it for purchases and transactions.

Please note that the above steps are a general guideline, the process of getting credit card may vary from bank to bank and country to country. It’s always advisable to check with the bank for the process and requirements for getting a credit card.

I am based in dubai how to apply credit card in india

Hi Savio,

If you are based in Dubai and wish to apply for a credit card in India, you can follow these steps:

Gather necessary documents: You will need to provide proof of income, proof of identity, and proof of residence in India. Common documents include a passport, PAN card (Permanent Account Number), and salary statement.

Compare credit card options: Look for credit card options that best suit your needs and compare the rewards, benefits, and fees of different cards.

Apply online or through NRI services: Many banks in India offer online applications for credit cards, or you can visit the NRI services of the bank to apply.

Wait for approval: Once you’ve submitted your application, the bank will review it and determine whether you’re approved for a credit card.

Activation and use: Once your credit card is approved and activated, you can start using it for purchases and transactions. You may have to give a Power of Attorney (PoA) to someone in India to activate the card on your behalf

Please note that the above steps are a general guideline, the process of getting credit card may vary from bank to bank and country to country. It’s always advisable to check with the bank for the process and requirements for getting a credit card. Also, Indian banks may require additional documents from NRIs as per their policy.

I apply NRI credit card

Hi Sandeep,

If you wish to apply for an NRI (Non-Resident Indian) credit card, you can follow these steps:

Gather necessary documents: You will need to provide proof of identity, proof of residence, and proof of income. Common documents include a passport, visa, and salary statement.

Compare credit card options: Look for credit card options that best suit your needs and compare the rewards, benefits, and fees of different cards.

Apply online or through NRI services: Many banks in India offer online applications for NRI credit cards, or you can visit the NRI services of the bank to apply.

Wait for approval: Once you’ve submitted your application, the bank will review it and determine whether you’re approved for a credit card.

Activation and use: Once your credit card is approved and activated, you can start using it for purchases and transactions.

Please note that the above steps are a general guideline, the process of getting NRI credit card may vary from bank to bank and country to country. It’s always advisable to check with the bank for the process and requirements for getting a NRI credit card. Also, Indian banks may require additional documents from NRIs as per their policy.

Can a nri get loan in india

Hello Sayyam

Thank you for msg

yes NRI can get a loan in India. SBI NRI Home Loan allows many NRIs (Non-Resident Indians) to get home loans when investing in properties.

I am a USA citizen interested in getting an Indian credit card for use in india without any fees

Hi Karan,

NRI Credit Card Provides you the services in India as well as in Foreign countries (although Transaction in Foreign Currencies could mean you will be charged additional fess for the services.)

Enquiry about nri credit cards

Can a NRI get a credit card from a bank in India and then use it to spend overseas?

Hi Karan,

Yes, you can do so.

Nri account and credit card

Nri credit card application

Hi Priyanka,

You can apply for the card via Bank’s official web site.

How can NRI purchase agricultural land?

Hi Preetham,

As per notification No. FEMA21/2000 RBI , NRI or PIO cannot acquire agricultural land or plantation (property or farmhouse) in India.

How can I apply for indian credit card while residing in japan

Hi Priti,

The process to apply for an NRI Credit Card is simple. Individuals can apply for the card on the bank’s official website.

I am an NRI based in Kuwait I have NRO and NRE account in Federal bank ….how can I apply for a credit card in india

Hi SangeethLal,

By vising this link, You can apply for a credit card.

https://www.icicibank.com/nri-banking/credit-card/index.page

Can I apply for a Indian credit card from Canada? If yes on which site ?

Hi Divya,

Yes. From here you can apply for the same.

https://www.icicibank.com/nri-banking/credit-card/index.page

Nre credit cards

can apply credit card from singapore?

Hi Kumar,

Yes.

Your Email is always interesting with many useful articles on specific issues for NRIs. Please do include some information related to PIOs / OCIs also. Information for this category of non-residents is difficult to find.

I would like to add some points regarding Eligibility for Credit Cards in India: –

1. Indian banks do not issue credit cards to PIOs whatever their income or financial status in India. This is strange as high networth PIOs are a safe category for banks.

2. Banks do not issue Credit cards to seniors above 65 years. This bar is also illogical as banks abroad do issue cards to all seniors. Many seniors are better off financially than younger generation.

3. Some banks and do not issue credit cards if you don’t have Indian address even if you have NRO / NRE account.

4. Most difficult part is that some banks do not respond at all for months for on-line customers. SBI (atleast my branch) responds only if you register a complaint through Customer service, which is not easy, considering that their complaint form does not have any options for subject for your problem.

Please correct me if I am mistaken in any of the above comments.

very good info and keep it up Hemant

Thanks Syed ?

Hemantji, useful topic, but the content seems to have picked from the respective websites. I have checked with ICICI and Axis Bank and theybhave not been able to issue a credit card to NRI( Indian citizen) .