Indians – residents or NRIs – have been captivated by gold for ages. NRIs are not only some of the largest buyers of gold in the countries they reside in. Back home, they are a major driver of gold consumption.

Check – Best NRI investments in India

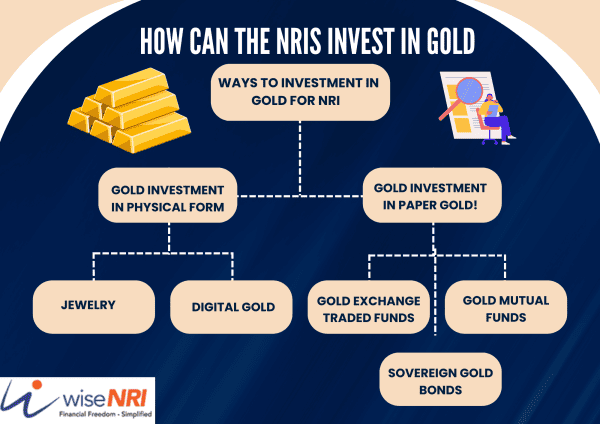

How Can the NRIs Invest in Gold?

Earlier if someone had to invest in gold, it was possible only by buying physical gold from a jeweler you trusted. But as the financialization of every aspect of investing advances, gold investments are also available in the form of marketable securities.

Gold Investment in Physical Form

Jewelry

The most common form of gold buying done by NRIs is in the form of gold jewelry with 16 to 22-karat purity. The problem is as an investment, jewelry is one of the worst forms of gold to buy.

Let us show you an example. We are making assumptions for ease of understanding. The price for 24-karat 10g gold is taken at ₹60,000.

| Expense Head | Amount |

| 10g 22-karat (91.6% purity) gold | ₹54,960 |

| Making and Wastage charges @ 6% | ₹3,298 |

| GST @ 3% on Gold + 5% on Making charges | ₹1,814 |

| Total Purchase Price (A) | ₹58,258 |

Let us assume that after one year the gold prices rally by 10% and you wish to sell this piece of jewelry. If you are expecting a profit of ₹5,826, i.e., 10% on your purchase price, you are utterly mistaken. The making charges and the tax are not GOLD!

The appreciation is in the price of the gold component of the jewelry, i.e., only ₹54,960. At 10% appreciation, it now costs ₹60,456. But wait. The purchase price of jewelry for a customer is different from its reselling price. Most jewelers will charge 2% of the current gold price as the buying spread!

So, your net take-home would be ₹59,247 only – a gain of a mere ₹989. When you subtract from it the cost of transport, time, and tax liability, it might actually be a loss-making proposition!

Bullion

Purchasing gold coins and bars has advantages over jewelry. You can buy pure gold, there are no reselling charges, and the making charges are 3% at max. Moreover, they are available in different weights starting from 0.5g for coins, and 10g for bars.

Let us continue our example if this investment makes financial sense or not.

| Expense Head | Gold Coins | Nuggets/Bars |

| 10g 24-karat gold | ₹60,000 | ₹60,000 |

| Making and Wastage charges @ 3% | ₹1,800 | – |

| GST @ 3% on Gold + 5% on Making charges | ₹1,890 | ₹1,800 |

| Total Purchase Price (A) | ₹63,690 | ₹61,800 |

Just like jewelry, you need to pay making charges in the case of gold coins too, but not on other bullion. In the case of bullion too, usually the reseller price is ½ to 2 percent less than the prevailing market price.

Therefore, if in a year the gold prices rally by 10% your pre-tax net realization would be ₹2,310 for gold coins, and ₹4,200 for gold bars – which is decent.

Check – PIS for NRIs

Digital Gold

NRIs wishing to avoid making charges and storage costs associated with gold can invest in digital or e-gold. The 3% GST is still applicable, though.

You can start investing in digital gold with as little as ₹10. Literally TEN rupees! When you make an investment, the gold equivalent to your investment is kept aside in their central lockers. You can sell it any time you wish – the buy-sell spread applies here too but at a nominal rate. If you want, you can also take physical delivery of gold after paying making and delivery charges.

There are three major players in this arena – SafeGold, Augmont Gold, and MMTC-PAMP. Their services like gold SIPs, gold savings plans, and gold leasing facilities allow you to systematically add to your gold reserves and make some money from them.

One caveat, however, is that this space is not regulated by the RBI or the SEBI – it is all about trust.

Gold Investment in Paper Gold!

Digital gold offers you the possibility of converting your investments into physical gold. But with paper gold, you are investing in the securitized form of gold – an instrument that tracks its price in the bullion market.

Gold ETFs, Gold Mutual Funds, and Sovereign Gold Bonds by RBI are three ways in which one can invest in paper gold. These are gaining popularity as they do away with concerns around purity, GST, and storage costs.

Read – NRI investment in Commercial Property

Gold Exchange Traded Funds

Gold ETFs are issued by mutual funds investing in physical gold and are freely traded on the stock market, offering very high liquidity at the least cost. They offer many advantages like trading in the denomination of per gram of gold, dematerialized units, and no hidden charges. To invest in Gold ETFs, NRIs must have a Demat account with a registered broker of either the NSE or the BSE.

Gold Mutual Funds

For NRIs who wish to avoid maintaining a demat account and trading to invest in gold can choose gold mutual funds. These funds invest directly in physical gold or indirectly via Gold ETFs through the Fund-of-Funds mechanism. This results in a higher expense ratio for gold funds than ETFs.

Some gold MFs also invest in the stocks of listed companies engaged in the gold business – mining, refining, import/export, jewelry, etc. This may capture a higher value for your investments at the risk of being more volatile compared to gold prices.

Check – NRI Mutual Fund Tax in India

Sovereign Gold Bonds

India is a net importer of gold which adds to a forex burden causing the INR to depreciate. The Indian Government launched the SGBs to offer the security of gold while reducing gold imports. To invest in SGBs one can visit their bank, nearest post office, or their stockbroker.

Investors can invest in SGBs denominated in per gram of gold that track the price of gold and have an 8-year holding period. To make them more attractive, the government offers a 2.5% annual interest on them. However, if one wishes to sell them in the open market, it can be done only after 5 years.

NRIs cannot invest in SGBs, but previous investments before their residential status changed can continue till maturity. (few NRIs invest in the name of their parents or other resident family members – we don’t recommend)

Tax Implications on NRI Gold Investment

When NRIs trade in any form of gold they must always keep income tax, in addition to GST paid, in mind at each stage.

While selling gold – physical, digital, or paper – its holding period decides the tax implication. If it is sold within 3 years of purchase, a short-term capital gain is assumed and charged at your marginal income tax rate. In the case of a longer holding period, the effective tax rate is 20.4% (with cess/levy) on long-term capital gains.

In the case of physical gold, gold funds, and SGBs a TDS is deducted by the jeweler/issuer. While in the case of ETFs, it is your responsibility to declare the gains and pay taxes while filing your IT returns.

Read – NRI tax in India

All That Glitters…

For an NRI investor with a moderate to low-risk appetite, making long-term investments in gold is a good strategy. Simply put, NRIs buying gold in India can be a good asset allocation strategy for providing a cushion to your overall portfolio.

I’d like to resolve my problem with mutual funds, related to pan Aadhar link. I do not have Aadhar as I’m NRI. Yet, mutual funds do not consider this. What is the solution?

Are NRIs eligible to invest in Sovereign gold bonds?

A father can gift MF to NRI son?