It may not be easy for us to accept the fact that our parents, who were the ones to support us, need help. But we have to grow up to understand that our ageing parents reach a point where they need our help in different aspects – physical health, security, emotional well-being, and personal finances.

The bigger problem is they will not ask for this help.

Must Read- Financial Tools NRIs Must Use

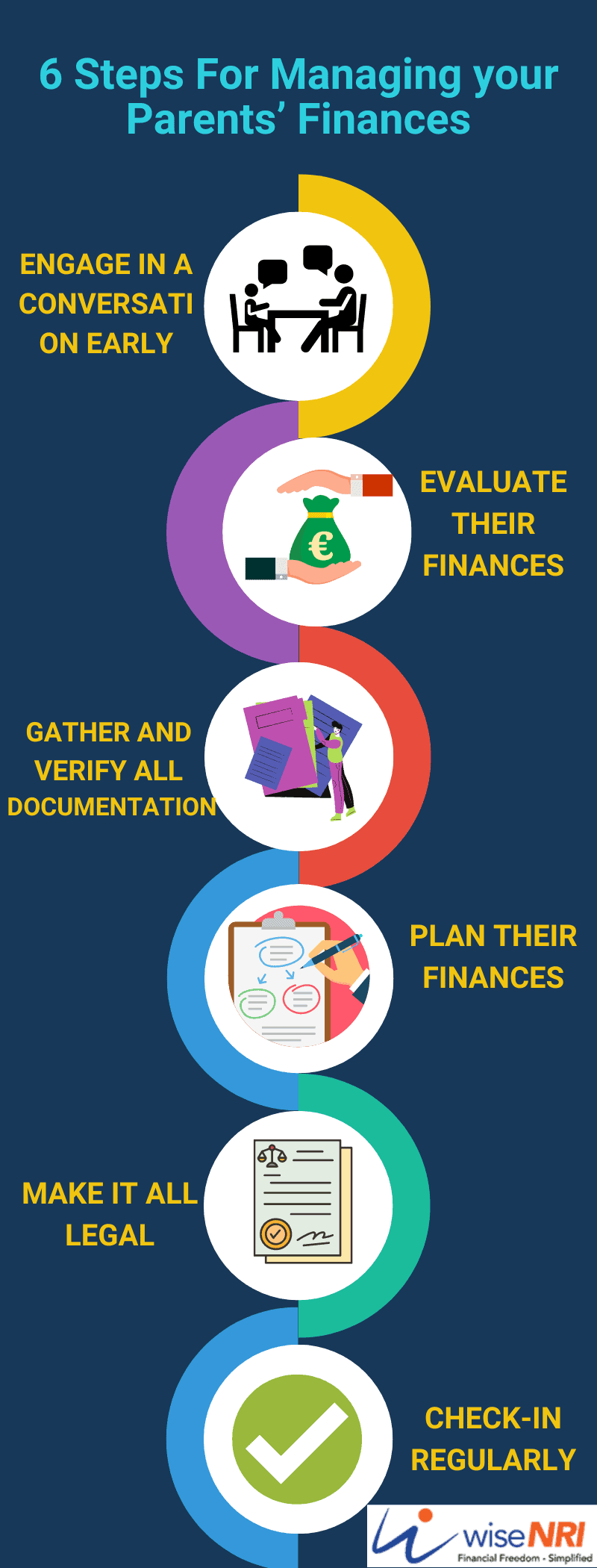

6 Steps For Managing Your Parents’ Finances

When you are an NRI, there is also worry and guilt as for most NRIs, parents live in India, and there is always the concern of not being available at short notice for their parents. With age, people need help in different aspects of life, including personal finance. The extent of support required gradually goes up and may not be visible early on. But it will be in the best interests of your parents if NRIs take concrete steps to manage their finances such that their financial independence is taken care of and their wealth is managed in a fair and legal manner. It is also essential that they feel comfortable with others handling their money and do not feel insecure or think that the job is not being done in the best manner. So how can you help your parents with their finances?

Engage in a conversation early

Money is a tricky conversation. Some parents might feel they do not need help. Depending on the strength of family bonds or mental frame of mind, others might be suspicious. So you have to be gentle and ensure that control of their finances will be in their hands. You can start off by asking them about their expenses and if they are financially comfortable. Check with them if they have thought through the long-term plan and your intent they have decided how to distribute their assets or thought of making a will. Tell them clearly that your intent is to ensure their financial independence.

Evaluate their Finances

Mrs. Aartiben Mehta was holding on to the shares of the company, her deceased husband worked with. She was too emotionally attached to them and did not care about their value or how the company was doing. Similarly, many of the older generations are unaware of automated subscriptions, and mobile bills and find it challenging to handle tax matters that are mostly online now. Check if they have been paying utility bills and credit card payments. Find out if they are in sync with their online accounts and if these accounts are secure. See to it that unnecessary subscriptions are cancelled.

From a broader perspective, check if they have the means to live their life comfortably and can cover unexpected big expenses. It will not be easy to get all the information. So, start small by asking them about their bills or if you can help with filing their taxes.

Must Read – Two Opposite Worldviews: The Stigma of being an NRI

Gather and verify all documentation

Make a list of your parents’ contact numbers and those of doctors, lawyers, financial planners, care workers, etc. List out various account numbers and check if documents related to investments and liabilities are in order. Be aware of where they store legal documents such as birth certificates, insurance policies, deeds, and will. Evaluate if all documents are valid and up to date or update as required.

Check – NRI Financial Planning in the 40s

Plan their Finances

If your parents have existing relationships with financial planners or brokers, ask if you can meet them to better understand the services they are currently providing. If not, you may suggest the services of a financial planner so that advice will be unbiased and information will remain confidential. You can even give them more than one reference and ask them to choose one if it helps them be more comfortable.

If they are amiable discussing their finances with you, evaluate their financial plan, and check if they have the funds to support them in their old age, relevant medical insurance, and the extent of debt. If they have time for retirement, encourage them to set up their long-term financial goals and work towards building the kitty for it. If you realise they are broke, look for solutions to support them while keeping in mind to keep your finances separate and being mindful of your short-term and long-term financial goals.

Read-Money lessons for NRIs from the Movie Soul

Make it all legal

A power of attorney is a document signed by a competent adult, that grants another person the power to make decisions on their behalf. Execute a power of attorney for your parents so that you have the legal authority to make financial, medical, or legal decisions. This is a sensitive matter and discuss it openly with them, an attorney that your parents are comfortable with, and your siblings. It is also critical that they make and register a will or set up a trust when their cognitive abilities are in order. Check – Power of Attorney for NRIs

Check-in regularly

Keep an eye on their health, behaviour, and financial actions. If there are unusual purchases, unpaid bills, physical issues, cognitive decline or complaints about money, you will have to jump in to take concrete steps.

Caring for elderly parents can become challenging – emotionally and financially. Therefore, take time to plan. You will be able to utilize the right resources to make the optimal plan and save the family money, time, effort, and the health of your relationships.

Please share any other thought that comes to your mind which can help other NRIs. If you had followed a few of the steps – please share your experience in the comment section.

my children who are NRIs gives aproperty as gift, can i sell that property immidiatly for my use