Many business persons and professionals relocate out of India for better career growth opportunities, lucrative job prospects, and an appealing lifestyle. Many employees are also sent by their employers on long-term work visas to manage their overseas and global operations.

Though international exposure means better pay, lifestyle, opportunities, and growth potential, that does not mean you have not done well here in India. Your successes here helped pave your way to an international assignment.

In this Article –

- What happens to the EPF Account for NRIs?

- EPF withdrawal NRI

- NRIs Indian EPF

- Rules of EPF withdrawal for NRI

- The Process to Withdraw for NRI Indian EPF when going abroad

Check – Wealth Planning Checklist for NRIs

And, in the long journey of your career in India, you may have contributed a significant sum towards your retirement corpus, the Employee’s Provident Fund, or the Indian EPF accounts. The contribution, including your employer’s contribution, and the accrued interest on it may have become a substantial amount over the years. It would be foolish to just let go of it, as this money can help you start a better-than-good life abroad or can be invested for better returns.

Your relocation can change your status from a Resident Indian to a Non-resident Indian (NRI) for many financial years before you come back or permanently settle abroad. As per the Employees’ Provident Fund Act, if you are not employed in India, you will no longer be eligible to contribute to the EPF Indian!

So, you have a corpus accumulated in your EPF account and do not know what to do with it.

Rules of EPF withdrawal for NRI

Usually, one can withdraw the EPF amount on or after their 58th birthday or on retirement. Also, if a person is unemployed for more than two months, they can also withdraw their entire contribution and interest accrued on it.

But none of the above cases apply to you – you are still in a job but are relocating out of India. As per the EPF act, if you are going to become an NRI as you are relocating for a job out of India, you can withdraw the entire EPFs balance immediately, without any waiting period, and close the account! This includes your and your employer’s contribution, and the interest earned on that amount.

However, like anything involving finances, you are required to prove that you are in fact leaving India to work and/or settle abroad.

Check – NRIs Should Read This Before Making a will

The Process to EPF withdrawal India when going abroad.

Your Passport and Visa must be all in order before your start the process of PF withdrawal. The process can be carried out offline as well as online.

Offline Process

- Ask for the “EPF Withdrawal Form” from your employer or download it from the EPF Organization’s (EPFO) portal. There are two types of forms:

- Aadhaar based form – if your Universal Account Number (UAN) is linked with your Aadhaar you can bypass the employer and directly go to the local EPFO office.

- Non-Aadhaar Form – If your UAN is not linked with your Aadhaar, then you will require endorsement from your employer before submitting the application at the EPFO office.

- Fill the form legibly and give the reason for parting from the job as “Abroad Settlement.”

- Attach self-attested copies of all documents and submit the completed form at the local EPFO offices.

Must Read – Who is a non-resident Indian?

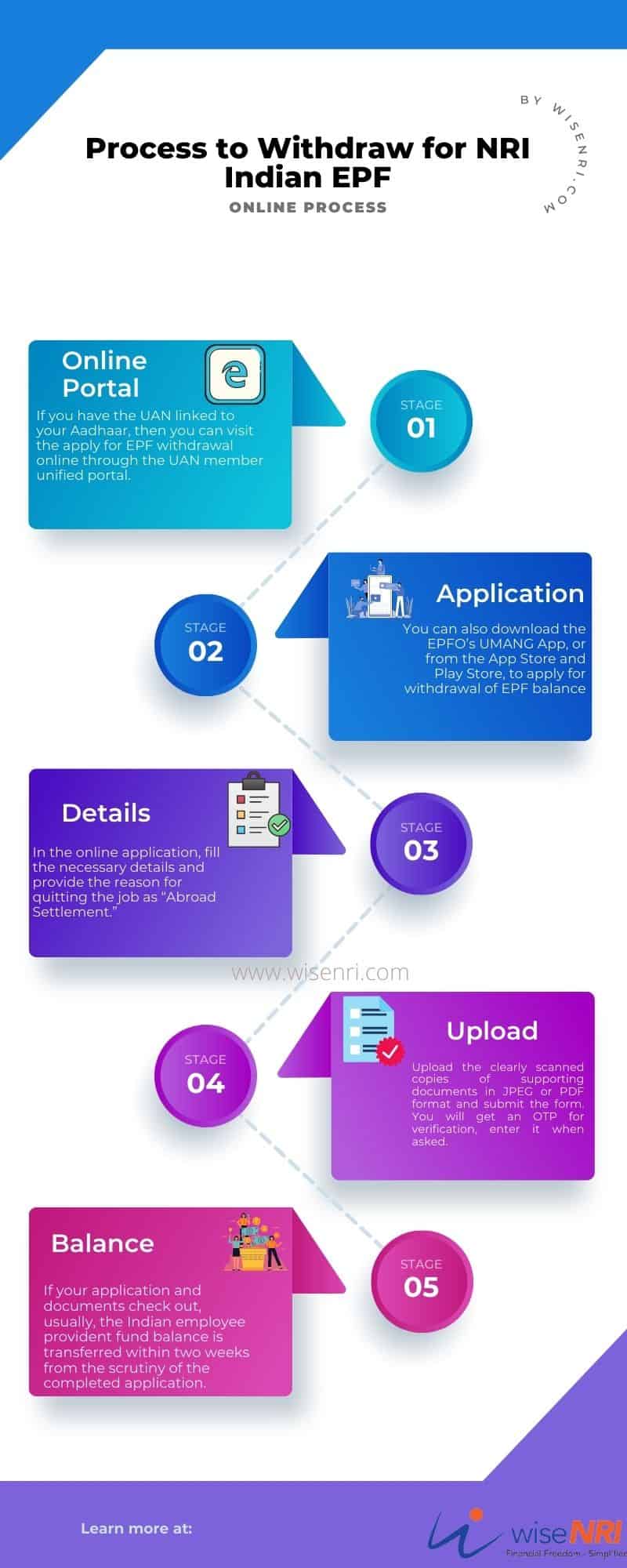

Online Process

- If you have the UAN linked to your Aadhaar, then you can visit the apply for EPF withdrawal online through the UAN member unified portal.

- You can also download the EPFO’s UMANG App, or from the App Store and Play Store, to apply for withdrawal of EPF balance.

- In the online application, fill the necessary details and provide the reason for quitting the job as “Abroad Settlement.”

- Upload the clearly scanned copies of supporting documents in JPEG or PDF format and submit the form. You will get an OTP for verification, enter it when asked.

If your application and documents check out, usually, the Indian employee provident fund balance is transferred within two weeks from the scrutiny of the completed application.

Check – Financial Planning Moves for NRIs

Documents Needed

Documents (self-attested copies) required for EPF withdrawal India are:

- Aadhar Card for Identity.

- Date of birth proof.

- Local Indian Address proof.

- If UAN is not allotted, then a certified copy of the EPF passbook for EPF no. from the last employer.

- Proof of Date of exit from last employment.

- Bank’s details with IFSC code – canceled cheque.

- PAN Card.

- Marriage certificate, for female members only, in case if they were previously unmarried.

Must Read – Pension Plans for NRI’s in India

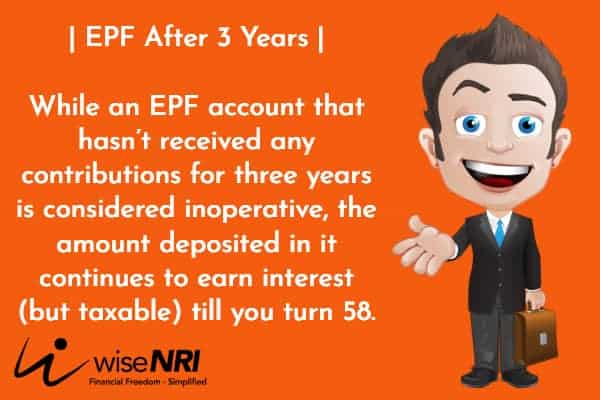

Inoperative EPF Account – Confusion

In the year 2016 or 2017 EPF introduced a few changes & employees started thinking that if they don’t contribute for 3 years they will not get interest on the balance amount. But in July 2017 Ministry of Labour & Employment issued a clarification

As per paragraph 60(6) of EPF Scheme, 1952, interest shall not be credited to the account of a member from the date on which it has become an inoperative account under paragraph 72(6) of EPF Scheme, 1952. However, as per amended definition, an account shall be classified as Inoperative after the member attains the age of 58 years. Hence, interest shall be credited to the account of a member upto the age of 58 years.

When you are going abroad temporarily.

What happens in case you are relocating for an international assignment only temporarily, for a few months to years, and will return and continue your job in India? You would not like to tamper and withdraw with your EPF balance and would like to continue contributing to it when you come back.

In such a case, just do not apply for withdrawal of the balance – your account will remain operative (for three years), and the last balance would continue earning interest. Once you are back and have joined a new job, your balance can be transferred to a new EPF account, using your UAN.

If your account has remained inoperative for more than three years, you must get its status updated by visiting the local EPFO offices.

Final words

When you are relocating and starting a new life, it is always better to tie up loose ends and have control over finances, else you might stumble on them. If you have a small corpus, withdrawing the NRI EPF balance and closing the account is not only a smart financial decision, but it also means you will spare yourself worrying about one more thing.

But if you have a larger corpus & you are sure you will be coming back to India – it will be wise to continue EPF.

Please share your experience if you have tried to withdraw EPF after becoming NRI or if you decided to retain EPF.

I am an NRI and want to full PF withdrawal.

I require to withdraw my PF, but I don’t have an Aadhar card. I am an NRI.

How to activate my UAN?

I settled in Canada and my previous company no longer exist how can I withdraw my EPF from India?

Hi Raghesh,

You can withdraw your EPF online via the UAN portal using Form 19 and Form 10C. Since your company no longer exists, get your KYC Aadhaar, PAN, and bank details verified and submit a self-attested request to the EPFO office.

Hi Deepa,

What form(s) should be self-attested? Or do we need to write a covering letter and then attest it? Can you kindly explain in detail a bit?

Also, my PF accounts need to be merged across three employers. I couldn’t do it before I left India. How do I do it now?

Can you help me withdraw EPFO funds on my behalf?

Hi Peush

I can’t withdraw EPFO funds on your behalf, but I can guide you through the process. You can withdraw online via the UAN portal or submit a manual claim to EPFO with necessary documents if your employer is unavailable.

How can I change my mobile number in my Aadhar card?

Hi Priyamol,

You can change your mobile number in your Aadhaar card by visiting an Aadhaar Enrolment/Update Center. Carry your Aadhaar card and request a mobile update. No documents are needed, and a ₹50 fee applies.

I have tried EPF withdrawal using the non-Aadhar offline process through the company that I worked for when I was in India. I was told that when the pf balance is above a certain limit, there is a circular from EPF that says only online process is allowed. However as do not have Aadhar card, I cannot start the online process. Do you have a solution for this situation?

Hi Krishnaji,

Since you don’t have an Aadhaar card you can submit a physical withdrawal request directly to the regional EPFO office with Form 19 and Form 10C along with identity proof, bank details and a request letter explaining your situation.

why is it not possible to open my EPF account after 2 and half years?

Hi Tom,

Your EPF account may be inactive after 2.5 years of no contributions, as EPFO marks accounts dormant after 36 months of inactivity. You can still withdraw the funds by submitting a claim through the UAN portal or EPFO office.

I want to transfer my pf to London and wanted an advisor to help?

Hey Mridual,

EPF funds cannot be directly transferred to London but you can withdraw them and then transfer the amount abroad. You may consult a financial advisor or EPFO helpline for guidance on withdrawal and remittance options.

About PF removal?

I have moved abroad, and I don’t have access to the phone number which is linked to my EPFO account. how can I change my contact number to Australian contact number so, that I can withdraw my PF.

What are the documents required to withdraw full pension below 58 years ?

What happens if I have-not closed EPF account after becoming a citizen of other country?

I moved to abroad 3 years back, I’m planning to withdraw my EPF amount and have submitted the joint account cheque, the team has rejected it. Currently I have only NRO cheque, will they accept that, and amount will be transferred to NRO account?

I have already moved to Canada 6 months back and I want to withdraw my PF. How would I do so?

For NRI, which form should be applied to withdraw complete money?

I need help in the withdrawal of my pf. (I’m an NRI)

I need help in withdrawing my PF

Why is my EPF account not getting interest credit?

My registered mobile number which is linked to pf account is now inactive. I am unable to login to pf portal as otp needed

I want someone to help me withdraw my EPF with interest. I do not see interest being credited. So, I help in getting the interest credited first. Do you help in that?

I am an NRI, and I want to withdraw my EPF. Can you please provide me information regarding this?

“I want to withdraw EPF, I have all the other documents but do not have the cancelled cheque book. How can I still apply?”

Hello Mohammed Serwer,

If you lack a cancelled cheque for EPF withdrawal, consider submitting a recent bank statement with your account details, a self-declaration, or a letter from your bank confirming your account. You may also generate an e-cheque via online banking. Check the EPFO portal for accepted documents.

I am NRI and I am trying to withdraw my old EPF amounts via the EPFO website online. However, the reason for leaving is automatically appears as CESSATION (SHORT SERVICE) – Any other reason and is not editable to mention that I have moved abroad. How can I apply for my PF withdrawal with the reason as I have moved Abroad?

Can you help me with EPFO PF withdrawal?

Hello Pranshu,

To withdraw your EPF, first confirm your eligibility and log in to the EPFO portal using your UAN. Update your KYC details, complete the withdrawal form, and submit alternative documents if you lack a cancelled cheque. Track your application status online, and funds will be credited to your bank account upon approval.

I need help with EPF withdrawal

I used to work in India, and I did job from Feb 2017 to Feb 2019 for 2 years and then I moved to Australia. I am PR in Australia now and I want to withdraw my pf from India. How can I get that?

Do NRI’s have to pay the taxes in EPF Withdrawal?

Can you guys help me to withdraw my of a/c bcoz m shifting abroad?

Where can fill out the online application form to withdraw EPF from UMANG app?

If the EPF account of NRI becomes inoperative after 3 years, will it earn interest or should we withdraw?

I was an expat in India for 6 years and paid into the provident fund. Will I be able to withdraw it now?

I left India in 1999 after 25 years service.I am 65 years now I am keen to know if I can claim.

I have shifted to Switzerland just two months back and yet to change my status after 182 days , I have closed my EPF account with my employer , since the sum is a large amount ,can I gift 50% to my wife to save tax or repatriate this amount . Pl advise

Do an NRI need to submit Form 15G for PF withdrawal?

I and my wife had contributed towards epf account when working in corporate in India . Now I have become NRI. Now how to withdraw whole money

I am NRI, last 6 years I am working in abroad. Now I wish to withdrawal my PF amount

Withdraw 15 year old EPF have only account number

I am an NRI and need to withdraw my EPF

What would like to withdrawn full amount from my PF account because I am an NRI now

To withdraw your full PF amount as an NRI, log into the EPFO portal using your UAN, fill out the withdrawal form, and ensure your KYC details are updated. Submit required documents, then track your application. The funds will be credited to your registered bank account upon approval.

I worked in India form 2008 through to 2011 and had a providence fund. I have since moved on to work in different countries and tried several times to withdraw my orovidence fund with no success. Are you able to assist me to complete this process?

Hi, now that am an NRI and i want to withdraw my EPF amount, is it taxable in India and abroad?

I have a PF account in India and want it to be withdrawn. Can you help in that ?

I am a NRI having two pf account under my UAN …one active another dormant. Can i transfer amount from my dormant to active account. ? If yes how ?

HI,

I am a NRI and have 2 pf accounts under my UAN. One account is dormant while other is active. How can I transfer amount from my dormant account to active one. As I am not working in India I don’t have any employer for this transfer and it is difficult for me physically visit the local office.

I am a British national expat in India and returning back to UK. Can I withdraw my PF ?

How to claim PF?

I have shifted in Canada .how i can withdraw my PF amount

I am a NRI and want to withdraw my PF from India. How can i do so?

How to withdraw my pf money when I am in abroad

I have a refund from IT dept, but haven’t got yet ..

I plan to withdraw my PFcan you help me with it

How to withdraw pf after moving abroad? In the epfo portal there is no option for relocating to another country?

I want to contact pf inquiry customer support for that I need toll free number. I am in usa now

I already moved abroad 1 month ago. Can I withdraw epfo

Got PR and going abroad but not leaving my India job. Can I withdraw my PF.

How raise a EPF withdrawal directly to my employer

I’m a foreign worker here and I’m planning to leave for good in India.how I can get my pf?

I want help in withdrwaing PF from India

How can I withdraw my epf. I am not working since 10 months.

I am an NRI living in Canada for the last 8 years. I want to withdraw from my Indian EPF. Which documents do I need to submit?

For how long EPFO account accrue interest after leaving the job in India?

I left my job in india one year back and I dont have any details of UPN number or any salary payslips.how i can get back my PF amount ?

EPF withdrawal can be done after giving up Indian citizenship?

Can i withdraw my pension conribution after 12 years of service as i have moved abroad

Hey Daniel,

If you have contributed to the Employee Pension Scheme (EPS) under the Employees’ Provident Fund Organization (EPFO) for at least 10 years, you become eligible for a pension after attaining the age of 58. However, if you have moved abroad, you cannot directly withdraw the pension contribution. You may be able to apply for a Scheme Certificate which can be used to claim the pension benefits later.

Is pf a/c withdrawal is taxable for NRI. Withdrawn on 4th year.

Hello K Ganesh,

Yes, PF withdrawal is taxable for NRIs. If withdrawn before 5 years of continuous service, it’s subject to taxation in India. However, under the Double Taxation Avoidance Agreement (DTAA) between India and the NRI’s residing country, there might be provisions to mitigate double taxation.

How to withdraw PF from Australia, if I left 10 years back

Hey Hasan,

Get in touch with the Australian superannuation fund where your PF might be held. Provide them with necessary details and documents to initiate the withdrawal process.Fill out the necessary withdrawal forms provided by the superannuation fund. These forms might include a Departing Australia Superannuation Payment (DASP) application.Provide proof of your non-residency status, such as visa details and a copy of your passport. This is essential to qualify for a DASP.Submit the completed forms along with the required documents to the superannuation fund.The processing time for DASP can vary, but you should receive the payment in your nominated bank account once the application is approved.

K Ganesh

My daughter worked in India for four months ( Apr- July) in FY 2022 – 23 and later moved abroad post her wedding with the same company on transfer. She closed her PF account on 4th year of operation. Now she is an NRI now the question is the PF amount is taxable in AY 2023 – 24. The very purpose of closing the PF account is moving abroad. Is there any exemption in the rules.

Hey K Ganesh,

If your daughter closed her PF account after working for four months in India and then moved abroad, the PF withdrawal is generally taxable in India. However, under the Double Taxation Avoidance Agreement (DTAA) between India and the country she’s residing in, there might be provisions to reduce or eliminate taxation on the PF withdrawal.

I am relocating to Uk so does there is any way I can transfer EPF balance to Uk Pension fund

Hey Aditya,

There is no direct provision to transfer EPF balance to a UK pension fund. However, you can consider withdrawing your EPF balance or keeping it dormant in India while contributing to a pension scheme in the UK.

I have become a US citizen but still hold EPF Account in India. Can I withdraw my money from EPF to my Indian Bank Account?

Hello Richa,

Yes, as a US citizen with an EPF account in India, you can withdraw your EPF money to your Indian bank account after meeting the specified eligibility criteria and completing required paperwork. Apply for withdrawal through the EPF member portal or Form 19/UAN-based claim form, ensuring accurate banking details.

How can a NRI withdraw epf from India

Hey Sapna,

Fill out the EPF withdrawal form available on the EPFO (Employee Provident Fund Organization) website or from your employer. Attach necessary documents like Aadhaar, PAN, bank details, and a canceled cheque to the form. Submit the form to your employer or the regional EPFO office, depending on the withdrawal reason (e.g., retirement, unemployment, marriage, etc.). The EPFO will process your application, and the funds will be transferred to your linked bank account.You can track the status online using the EPFO portal.

I need a help to withdraw the epf

Hello Leoambika,

Fill out the EPF withdrawal form available on the EPFO (Employee Provident Fund Organization) website or from your employer. Attach necessary documents like Aadhaar, PAN, bank details, and a canceled cheque to the form. Submit the form to your employer or the regional EPFO office, depending on the withdrawal reason (e.g., retirement, unemployment, marriage, etc.). The EPFO will process your application, and the funds will be transferred to your linked bank account.You can track the status online using the EPFO portal.

Hi, I am a NRI, is there any way to withdraw my EPF if mobile on adhar card is not updated(old number, doesn’t exist now)Please advise

Hey Sapna,

As an NRI, if your Aadhaar card’s mobile number is outdated and inaccessible, you can update it through the UIDAI website or Aadhaar enrollment center abroad. Once updated, link your Aadhaar to EPF account and apply for withdrawal online through the EPF member portal, Form 19 or UAN-based claim form. Alternatively, you can also visit the Indian embassy/consulate for guidance.

How can i withdraw pf being nri if my phone number is not working

Hi Meenakshi,

Update your phone number and email address through the EPFO’s online portal or contact your previous employer’s HR department and make sure that you have a regularly checked email address linked to your PF account.

Communication related to your withdrawal might be done via email.

Hey Meenakshi,

If you have an alternative contact number, update it with your EPFO account online or through your employer. Reach out to your regional EPFO office via email to explain your situation and request alternative communication methods. If email isn’t feasible, consider sending a written communication via post to your regional EPFO office. If your PF was managed through your employer, ask them for assistance in updating your contact details and facilitating communication.

My PF withdrawal request has been rejected

Hi Priyanka,

There could be several reasons for the rejection, like incomplete information, documents, mismatched information, Aadhaar-related issues and any pending dues or loans related to your EPF account, your withdrawal request might be rejected.

If your withdrawal request was rejected without a clear reason provided, you should reach out to the EPF office or the relevant authority to inquire about the specific reason for the rejection. This will help you understand what needs to be corrected.

Hey Priyanka,

Your PF withdrawal request was rejected due to possible reasons such as incomplete documentation, mismatched details, or non-eligibility. Review your application, rectify any errors, and resubmit with accurate information to ensure successful processing. If the issue persists, contact your employer or the provident fund office for assistance.

How can NRI without his EPF from India if they do not have aadhaar number?

Hi Swapnita,

You need to reach out to the EPFO or the concerned regional EPF office to inquire about the latest procedures for EPF withdrawal for NRIs who do not have an Aadhaar number.

Hey Swapnita,

NRI EPF withdrawal without an Aadhaar number could be possible by submitting Form 15H/15G, if eligible, and a Self-Declaration Certificate as an alternative to Aadhaar. Additionally, submitting a copy of your passport and a letter explaining the reason for not having an Aadhaar could be required.

Can you help me in supporting how to withdraw EPF ?

Hey Rahul,

Depending on your reason for withdrawal, choose the appropriate withdrawal form, from the EPFO website or your employer’s HR department. Fill out the form and attach any supporting documents required. Submit the filled-out form to your employer or directly to the nearest EPF office. Some withdrawal forms can be submitted online through the EPF member portal, the withdrawal amount will be transferred to the bank account linked to your UAN.

Hey Rahul,

Fill out the EPF withdrawal form available on the EPFO (Employee Provident Fund Organization) website or from your employer. Attach necessary documents like Aadhaar, PAN, bank details, and a canceled cheque to the form. Submit the form to your employer or the regional EPFO office, depending on the withdrawal reason (e.g., retirement, unemployment, marriage, etc.). The EPFO will process your application, and the funds will be transferred to your linked bank account.You can track the status online using the EPFO portal.

I need assistance in withdrawing PF

Hi Simon,

Collect all the necessary documents that might be required for the withdrawal process, fill out a withdrawal application form. Submit the filled-out application form along with the required documents to the appropriate authority. This could be your employer’s HR department or the regional provident fund office.

Hey Simon,

Fill out the EPF withdrawal form available on the EPFO (Employee Provident Fund Organization) website or from your employer. Attach necessary documents like Aadhaar, PAN, bank details, and a canceled cheque to the form. Submit the form to your employer or the regional EPFO office, depending on the withdrawal reason (e.g., retirement, unemployment, marriage, etc.). The EPFO will process your application, and the funds will be transferred to your linked bank account.You can track the status online using the EPFO portal.

I am 60 years old, a non resident of India and I do not have an aadhar card or uan number. I am a citizen of another country. I want to know what is the process to be followed. I also don’t have an active bank account as my pension was stopped since I could not physically attend the bank. I am currently living abroad. Please advise me what I should do?

Thank you in advance.

Hey Royston.

As a non-resident of India and a citizen of another country, you are not eligible for an Aadhar card or UAN number. However, you can visit the official website of the Unique Identification Authority of India (UIDAI) at https://uidai.gov.in/ to gather information , and for your UAN number contact your previous employer or the Employees’ Provident Fund Organization (EPFO) for guidance on how to access or reactivate your account.

I am working in Dubai and not planning on returning back to India, I want to withdraw full PF and gratuity How can I get help With this

Hey Amruthan,

Start with contact your employer’s HR department to initiate the withdrawal process and obtain the necessary forms. Fill out the forms and submit them along with the required documents, coordinate with your employer to complete the necessary paperwork and follow any specific procedures outlined by the Employees’ Provident Fund Organization (EPFO) in India for PF withdrawal.

I left India last year in June 2022 and I am based outside India currently , Can I withdraw PF legally?

Hey Ishaan,

Yes, you can legally withdraw your PF even if you are currently based outside India.

Nri how claim or withdrawal of epf in india procedures required

Hello S T Ravi Kumar,

First of all Complete Form 19 and submit it to the EPFO office along with supporting documents. After that Monitor the status of your withdrawal request through the EPFO portal and ensure that the funds are transferred to your designated bank account.

Hi, I am an NRI, need help to withdraw my PF amount

Hey Sivakumarr ,

First of all Complete Form 19 and submit it to the EPFO office along with supporting documents. After that Monitor the status of your withdrawal request through the EPFO portal and ensure that the funds are transferred to your designated bank account.

What is the PF withdrawal form type (19 or 31) for NRI to withdraw the PF completely in EPFO website.

Hey Karthikeyan,

For NRI PF withdrawal on the EPFO website, use Form 19 to withdraw the PF amount completely. Form 31, on the other hand, is used for partial withdrawals and advances.

I have UAn linked EPF account but my member passbook is inactive

How to take my pf amount

Relocating outside india… And want to covert EPF to PPF…. Is it possible?

Hello Jay,

No, it is not possible to directly convert EPF (Employee Provident Fund) to PPF (Public Provident Fund). EPF and PPF are separate schemes with different rules and regulations.

I am a citizen of different country now and need to withdraw my pf and my adhar card is not valid

Hey Shweta,

First of all Complete Form 15G/15H (if eligible) and Form 19 to initiate the PF withdrawal process. After that provide supporting documents. Submit these documents to the EPFO office along with a letter explaining your situation and requesting PF withdrawal.

Can I withdraw my PF after surrendering my Indian citizenship and passport?

Hey Manish,

Yes, you can still withdraw your Provident Fund (PF) after surrendering your Indian citizenship and passport.

Indian employee worked for a foreign company now indian caompany is able to withdraw the pf amt in india?

Hello Nishant,

the Indian company may not be able to directly withdraw the PF amount on behalf of the employee. PF withdrawal is typically processed through the Employee Provident Fund Organization (EPFO) in India, and the employer needs to initiate the withdrawal process on behalf of the employee.

I had EPF and last contribution happed on 2016 and I moved overseas and now I am back as in Australian citizen living in India since August 2022, do I get interest in EPF till reach age 58 ? as my account is inoperative.

Hey Pooja,

NO, you will not earn interest on the account. As per EPF rules, an account becomes inoperative if there are no contributions made for 36 consecutive months. However, you can still claim the accumulated balance in your EPF account by following the withdrawal process specified by the Employee Provident Fund Organization (EPFO

I worked in India between 2009 and 2012 and contributed to EPF during this period. I relocated outside India and was non resident from 2013 upto 2023. I obtained an overseas citizenship in 2019 and hold an OCI. I have recently returned back to India and have taken up an employment in India. I now intend to stay in India for long term. What is the status of my EPF contributions (including accumulated interest) and what are my options at this stage (withdrawal, transfer to my new employer, tax implications, etc.)

Hey Sunit,

Your EPF contributions (including accumulated interest) should still be intact. As for the withdrawal start with transfer your EPF balance to your new employer’s EPF account, avoiding any tax implications. Following choose to withdraw the EPF balance and the accumulated interest, which may be subject to tax if withdrawn before five years of continuous service.

I have an EPF account in india and I moved to USA on H1B and have plan to come back to india. ShouldI keep my EPF account and will I get interets

Hey Vishal,

Keep your EPF account active. Because EPF accounts continue to earn interest even if you are residing outside India. It is important to regularly update your EPF account with your current contact information and keep track of any changes in EPF rules and regulations.

Can you help with withdrawing epf for NRI?

Hey Vinod,

First of all Complete Form 19 and submit it to the EPFO office along with supporting documents. After that Monitor the status of your withdrawal request through the EPFO portal and ensure that the funds are transferred to your designated bank account.

I am recently moved to abroad and would like to settle my PF account by withdrawing. Should I be submitting form 15G as an NRI during withdrawl?

Hey Ram,

You may need to submit Form 15G or Form 15H to the Employee Provident Fund Organization (EPFO) .

I’m moving abroad for higher education for 2 years. After studies I will work there for 3 more years. So can I claim the entire PF Amount?

Hello Vishnu,

You may not be able to claim the entire PF amount. Generally, premature withdrawal of PF is allowed only under specific circumstances such as retirement, unemployment, or certain medical conditions. However, there are provisions for partial withdrawals for certain purposes, including higher education.

I worked in India few years back and I want to check if I can withdrawal my PF

UK Resident and worked in India for 6 years and now returning. Can i withdraw my EPF when i leave or do i need to wait till retirement age ?

I moved to Canada few years ago on PD. If I do nothing, will I keep earning interest on my epf till 58 years?

Hey Vinodh,

If your EPF account remains active and updated, than your EPF account will continue to earn interest until you turn 58 years old, regardless of your residency status.

I am working abroad and My PF withdrawal claim has rejected due to non submission of form 15G. How can I declare myself as NRI to exempt from 15G?

Wrt the below excerpt in your website, Quote When you are going abroad temporarily. What happens in case you are relocating for an international assignment only temporarily, for a few months to years, and will return and continue your job in India? You would not like to tamper and withdraw with your EPF balance and would like to continue contributing to it when you come back. In such a case, just do not apply for withdrawal of the balance your account will remain operative (for three years), and the last balance would continue earning interest. Once you are back and have joined a new job, your balance can be transferred to a new EPF account, using your UAN. If your account has remained inoperative for more than three years, you must get its status updated by visiting the local EPFO offices wanted to know how can i keep the EPF account operative even after working for 3 years outside India. Can you help?

My friend is a UK Citizen and dont have Aadhar card as he left India in 2009 and since then he is working in UK , now he wants to withdraw his PF from his Indian Company , what is the process for that

I am working in abroad, here don’t have epf for me, i pay my epf amount every month in india

If i leave india after doing 8 year job in mnc and came back after 5 year in india can i get interest on my pf account those 5 year too my age is 47 can i get interest on pf account till 58 age

Thanks for the informative article.

I became a Canadian PR 3 years ago, can I withdraw my money now with reason as “ Abroad Settlement.” ? Also, will there be an issue if my bank account is not a NRE/NRO account ?

Secondly, since interest will accrue till the age of 58, can I leave the money in epf even if I become a citizen of Canada ?

Hi Gaurav, same with me. Did you get an answer?

Yes you can withdraw amount but as you said you are settleing to canadian so that you can’t keep money as epf

I have to withdraw my EPF balance and I’m currently working outside of India

In my EPF withdrawal application, I dont see an option to change quit job reason – Abroad Settlement

Does my epf gain interest after 3 years?

For Nri when withdrawing epf, do i neex to pay taxes ?

Want to withdraw PF from India

For nri cases pf cheque from account only

Can I withdraw my 100% PF ( employee & employer share) , job duration in India was 19 years , Moved to the UK in 2021. Please suggest the process

Has interest been credited for FY 2022-23?

I am moving to Europe for a new job. For how long will my PF earn interest

Hello Jude

As per the rules set by the Employees’ Provident Fund Organisation (EPFO), your Employees’ Provident Fund (EPF) account will continue to earn interest for up to 36 months (three years) from the date you become an “unemployed member” of the EPF scheme.

I am currently in USA and have some money accumulated in EPF. I want to are there any companies that can onboard employees in India and just contribute to my EPF on my behalf.

Hi Anand

If you are currently employed by a company in the USA, you can check with your employer if they have a partnership with an Indian company that can facilitate EPF contributions on your behalf. Many companies have tie-ups with Indian companies for payroll processing and HR services, and some of these companies may also offer EPF contribution services for their employees.

Alternatively, you can also consider setting up a voluntary contribution account (VCA) with the EPFO. A VCA is a separate account that allows NRIs to contribute to their EPF account voluntarily. To set up a VCA, you will need to fill out a Form 15G/15H, which is a declaration for non-deduction of tax, and submit it to the EPFO. You can also make contributions to your VCA through wire transfer or other online payment methods.

I have relocated to US as a student and back in india i used to work and have some provident fund.I want to withdraw that now. Is it possible?

Hello jahanavi

Yes, it is possible for you to withdraw your Provident Fund (PF) balance if you have left your job in India and are no longer contributing to the PF scheme. To withdraw your PF balance, you will need to fill out and submit a Form 19 (for PF withdrawal) to the concerned regional Provident Fund Office along with supporting documents such as your PAN card, Aadhaar card, bank details, and a cancelled cheque.

However, if you have worked in India for less than five years, the PF withdrawal amount will be taxable as per Indian tax laws. Additionally, if you have already claimed tax benefits on your PF contributions during your employment in India, the PF withdrawal amount may be subject to tax withholding by the PF office.

looking for withdrawing PF from India. I don’t have UAN account.. is this something you can help with?

Hello Sir

To activate your UAN, you will need to follow these steps:

1.Go to the EPFO Member Portal website

2.Click on the “Activate UAN” link on the right-hand side of the page

3.Enter your UAN, name, date of birth, mobile number, and email ID

4.Click on the “Get Authorization Pin” button

Enter the authorization PIN received on your registered mobile number

5.Click on the “Activate UAN” button

Once your UAN is activated, you can submit your PF withdrawal claim through the EPFO Member Portal by following these steps:

1.Log in to the EPFO Member Portal using your UAN and password

2.Click on the “Online Services” tab and select “Claim (Form-31, 19 & 10C)” from the drop-down menu

3.Enter the last four digits of your bank account number and click on the “Verify” button

4.Click on the “Proceed For Online Claim” button

Select the type of withdrawal claim (full or partial) and enter the amount to be withdrawn

5.Upload scanned copies of your Aadhaar card, PAN card, cancelled cheque, and other supporting documents (if any)

6.Click on the “Submit” button

Your PF withdrawal claim will be processed by the EPFO, and the withdrawal amount will be credited to your bank account.

If you face any issues during the process, you can reach out to the EPFO’s customer service helpline or visit your nearest EPFO office for assistance.

How to contact Indian PF office from outside India …I am settled in Australia since 2016 ,but not withdrawn my pf in India…now became Australian citizen..Is it ok to keep my PF in India till I retire ?

Hello Ashwin

To contact the Indian PF office from outside India, you can visit the official website of the Employees’ Provident Fund Organisation (EPFO) and use their online services such as “Contact Us” or “Help Desk” to submit your query. You can also email them at [email protected] for specific assistance related to Australia.

Regarding your second question, it is possible to keep your PF account in India until you retire. The account will continue to earn interest until you withdraw the funds. However, it is important to keep your account updated and ensure that your KYC details are correct and up to date. Also, note that tax laws and regulations may change over time, so it’s a good idea to keep track of any updates related to PF withdrawals for NRIs.

I traveled abroad on one time via entry and now i got PR card. What document should i show as proof to withdraw as the Visa is no longer valid

Hello Shakeel

If you traveled abroad on a one-time entry visa and have now obtained a Permanent Resident (PR) card, you can use your PR card as proof of your status to withdraw money. Your PR card serves as proof of your permanent resident status in Canada.

I am was NRI for 5 years now one month back m back to India and wanna withdraw my pf with my old company in India

Hi Aashi

As a former NRI who has returned to India, you may be eligible to withdraw your Employee Provident Fund (EPF) with your old company. However, there are some rules and regulations that you should be aware of:

1.Eligibility

2.Application

3.Tax Application

4.Withdrawal Process

Will there be tax liability for nri , when withdrawing pf

Hi Mamta

Yes, there may be tax liability for NRIs when withdrawing their PF balance from India.

If an NRI withdraws their PF balance before completing 5 years of continuous service (including the period of service rendered as a resident), the amount withdrawn will be taxable in India as per the income tax rules. The tax will be deducted at source (TDS) at the time of withdrawal by the EPFO.

can an expat do a partial withdrawal ?

Hi Sonali

Yes, an expat or NRI can do a partial withdrawal of their EPF balance under certain circumstances. The EPF scheme allows partial withdrawals for specific purposes such as:

1.Medical treatment of self, spouse, children or dependent parents.

2.Purchase/construction of a house or a flat.

3.Repayment of home loan.

4.Funding education for self or children.

5.Marriage of self, children or siblings.

6.Meeting expenses due to a disability.

7.Other special circumstances, subject to certain conditions.

I moved to US 5 years ago and I am trying to access EPF account but it is not letting me sign in due to unlink adhaar. How can I access EPF account ?

I do have an NRI Bank account that account want to link to my uan? can i do that

Can EPFO be withdrawn if employee settled abroad after service of 17 years in co

It is regarding epf for nri

Can I continue my EPF account for more tan 3 years of working outside India?

Do nri need to submit 15G while applying for pf withdrawal

Hi Amit

No

how can NRI can enroll for EPF?

Hi Amol,

You can enroll it online.

Hi I moved to Australia in 2010. I totally forgot about my PF until now. But i dont have an Aadhaar or Indian bank account as I am an australian citizen now. How to withdraw my PF and close the account?

I want to withdraw my pf

Hi Swathi,

You have to visit the bank for the same.

For withdrawl of EPF as an NRI what specific document needs to be submitted as a proof

Hi Shayantan,

1. EPF Withdrawal Form

2. Passport

3. Bank Account Proof: You will need to provide proof of your NRE (Non-Resident External) or NRO (Non-Resident Ordinary) bank account. This can be in the form of a canceled cheque, bank statement, or certificate issued by your bank.

4. Residence Proof

5. Form 15CA and 15CB: You may also need to submit Form 15CA and 15CB, which are required for tax purposes. These forms certify that taxes have been paid on the income being remitted out of India.

Please note that the specific document requirements may vary depending on the rules and regulations of the EPFO and the country where you reside. It is best to check with the EPFO.

I have an PF account in kochi, kerala

Can i withdraw epf while staying outside india, but web portal does not allow me with previous password

Hi Harpreet,

To reset your password, you can follow these steps:

Go to the EPFO member portal website and click on the “Forgot Password” option.

Enter your UAN (Universal Account Number) and the captcha code, and click on “Verify.”

Enter your registered mobile number or email ID, and click on “Get OTP.”

You will receive an OTP (OneTime Password) on your registered mobile number or email ID.

Enter the OTP and click on “Verify OTP.”

You will then be prompted to create a new password.

If you are still unable to reset your password or face any other issues with the EPFO portal, you may need to contact the EPFO customer service center for assistance. You can find the contact information for the EPFO customer service center on their official website.

Dear Mr. Hemath

Thanks for your detailed info. Am living abroad for 8 months now and wish to close my PF, withdraw the full balance and interest accrued. Will there be tax levied on the interest paid for this 8 month period post closure of PF account in India? Can I submit Form 15G (although NRI) to avail the benefit of tax exemption?

I don’t have UAN No. , Aadhar and PAN card also I am currently out of India since last 12 year and wants to withdrawal my PF which was deducted

Hi Nirmala,

You should contact your former employer.

Can i withdraw EPF into a NRO account? is that taxable?

Hi Ashwin,

Yes it will be taxable

How to withdraw PF amount. i moved abroad 3 years back

Hi Srinivas,

You can apply online.

Hi Mr.Beniwal,

I moved to New Zealand in 2001 as Permanent resident and became citizen in 2008. I do not have aadhar and I cannot take one.My Ex employer says I need an UAN number. PF office says they can’t see my details because it was manual.How to go about. Can you help me out please.

Thanks,

Jana.

Can I Withdraw PF after moving abroad ?

Hi Roopam,

Yes, you can through online mode.

I have moved to Singapore for a new job. let me know what form do i need to fill for withdrawal of my PF through offline.

Dear Raghu,

You need to fill the EPF (Employees’ Provident Fund) withdrawal form, also known as Form 19, if you wish to withdraw your Provident Fund savings in Singapore. This form is used to apply for a full or partial withdrawal of your Provident Fund savings. The form is available online on the Central Provident Fund Board (CPFB) website, or you can also obtain a copy from your last employer.

reason for quitting job need to be changed how can i do it

Hi S Date,

If you need to change the reason for quitting your job, you should speak with your human resources representative or your direct supervisor. Explain your situation and why you need to change the reason for your resignation. They may be able to help you update your employment record or provide guidance on how to proceed. It’s important to be honest and transparent in your communication, and to keep in mind that the company may have their own policies and procedures in place that you will need to follow.

My Turkish friend worked in India and left India just before covid how can he withdraw his pf amount

Hi Tejaswini,

Your Turkish friend will need to follow the process for withdrawing their provident fund (PF) amount if they are no longer working in India. This process typically involves submitting a claim form to the Employee Provident Fund Organization (EPFO).

In order to withdraw their PF amount, your friend will need to submit a claim form along with certain documents such as their passport, PAN card, and the UAN (Universal Account Number) number. Your friend can also track the status of their claim online through the EPFO website.

If your friend is no longer in India, they may be able to submit the claim form and necessary documents online or by mail. They should contact the EPFO for more information on the specific process for withdrawing their PF amount as a non-resident Indian.

It is also important to note that withdrawal of provident fund balance is subject to certain conditions and may be taxable. So, it would be better for your friend to consult with a tax advisor before withdrawing the amount.

NRI PF withdrawal

There is contradiction in the article when mentioned –

>>your account will remain operative (for three years), and the last balance would continue earning interest.

On the other hand, it is mentioned that –

>>an account shall be classified as Inoperative after the member attains the age of 58 years.

Can you please clarify?

I also had the same question. No reply yet:-)

I am in australia on a Bridging Visa A and the mobile number linked to my adhaar card is with Jio and does not work here. I am unable to withdraw my pf through the unified portal as it wants to send me an OTP to the number that does not work here. I cannot update the mobile number linked to an adhaar card by attending an office in India as I am not allowed to fly out of Australia on my bridging visa. also adhaar would not accept international mobile number to be linked. Please help if you know what I can do about this.

I am in australia on a Bridging Visa A and the mobile number linked to my adhaar card is with Jio and does not work here. I am unable to withdraw my pf through the unified portal as it wants to send me an OTP to the number that doesn’t work here. I can’t update the mobile number linked to an adhaar card by attending an office in India as I’m not allowed to fly out of Australia on my bridging visa. also adhaar won’t accept international mobile number to be linked. Please help if you know what I can do about this.

Hi Narjit,

You can only withdraw the amount through the OTP which you will receive on your Indian number. I suggest you to withdraw the amount in your next visit to India as you don’t have Indian number.

My son left India in 2019, for doing MS and now employed in USA. How can he withdraw his accumulated EPF?

Hi Sunil,

He can withdraw the amount online through epfo website.

Hi Sunil,

You can do it online.

How can I know if I have attached with UAN

Hi Udayan,

You should visit EPFO website to know.

I need help withdrawing my PF, as I am residing outside of India

Hi Rajdeep,

You can do it either offline or online.

I am living abroad but I have my EPF fund in India which I want to withdraw how can i do that

My son in law in USA since last years and like to know ,how to withdraw the amount ,has aadhar,but is not linked with mobile etc.

Hi Sushil,

You can withdraw the amount offline

I am settled in dubai since last 3 years. now i want to withdraw my PF & pension funds online. How to claim and will there be any tax deduction?

Hi Kunjan,

You can claim online.

withdraw of epf for US citizen

Will pf withdrawl taxable for NRI ?

Hi Mayank,

Yes, it is taxable.

Thanks. Is the full amount taxable or only Interest earned? How tax is calculated?

Is the PF amount taxable if withdrawal at the time of moving abroad permanently ? And will it be taxable in India or in Foreign country?

Hi Mayank,

Yes, it will be taxable in India.

Thanks. Is the full amount taxable or only Interest earned? How tax is calculated?

I want to withdraw partially the PF from USA?

Hi Harish,

You can withdraw the same online

We are emplyee in indian compny and want to release our PF Fund and epassbok

Hi,

Thanks for nice write-up, its very informative. I have PF account with UAN number and linked with PAN and AADHAR number. I left India from 2016 for job in another country and since then no contribution in my PF account from employer. Am I going to get interest on my PF amount if I will not withdraw PF amount ? Will there be any problem in future if I keep my PF account open without any amount withdraw ? I am not 100% sure if I will back India for any job but wanted to keep my PF account alive just incase I have to return India for job.

Also, if I withdraw my entire PF amount now, will there be any tax on total amount ?

Thanks

I am an NRI and would like to withdraw PF

How can I withdraw my EPF completely?

Hi Naveen,

You can withdraw the EPF amount by two ways either online or offline

I am a NRI and want to withdraw pf amount. Tried online to claim and my claim got rejrcted. It was not specifying any reason.Also the reason closing is already populated as short service and nit letting me update to status as NRI

Hi Balakrishna,

An NRI who had a PPF when they were living in India can no longer contribute to it after moving abroad. Withdrawal can only occur after the maturity of the fund. Contributions will continue to gain interest only for 3 years. The interest earnings will not be taxed in India.

It would be wise to clear the account and close it before leaving the country.

I was employed in India till Aug 2018. From Sept 2018 no EPF contributions. Now I’m working in Indonesia as an NRI. will my EPF account continue to get interest

Yes, you will continue to get interest.

I have indian UAN no but from 2018 I’m working abroad. Can I permanently close my UAN no

Hi Nirad,

An email must be sent to [email protected]. The old and the new UAN must be mentioned in the email. A verification will be conducted by the EPFO to resolve the issue. Once the verification is completed, the old UAN will be deactivated.

I don’t have a UAN id number to withdraw EPF

I am in Dubai and want to withdrawl my pf amount

Hi Jyoti,

If you have the UAN linked to your Aadhaar, then you can visit apply for EPF withdrawal online through the UAN member unified portal. You can also download the EPFO’s UMANG App, or from the App Store and Play Store, to apply for withdrawal of EPF balance.

Can I transfer my closed pf account amount to my NRI account which I opened in India

Hi Elizabeth,

It would be wise to clear the account and close it before leaving the country. If the account does not receive any contributions it stops operating.

I’m working abroad, how can I submit full EPF withdrawal

If you are settling in another country, you can withdraw your complete EPF balance even before your retirement date and close your account. However, you will be required to provide proof that you are leaving India to work and/or settle abroad.

What is the PF with drawl procedure for a dormant account for an NRI

Hi Shambhu

You can claim your EPF amount through online submission at the EPFO portal. You can also apply through UMANG App. Aadhar is seeded with UAN.

How can an OCI without Aadhar withdraw EPF online

Hi N. Vijaya

If you have the UAN linked to your Aadhaar, then you can visit apply for EPF withdrawal online through the UAN member unified portal. You can also download the EPFO’s UMANG App, or from the App Store and Play Store, to apply for withdrawal of EPF balance.

I have resigned after 17 yr of service. Have epf in india and now planning to settle in uk. If I decide not to withdraw PF now at age of 40, will I get interest in india on epf? Will I be able to withdraw PF after my 60age? Will I get taxed on that amount at 60age?

Is EPF withdrawal to NRO Account taxable ?

Hi Prakash

You can withdraw the money online. And whenever you will withdraw the amount in India. It will be taxed as per the normal slab rate applicable to you.

I am moving abroad. I want to withdraw EPF amount from my PF account

What Option I should choose if I am an NRI and I want to withdraw my full pf and epf amount.

Hi Bhupendra

If you have the UAN linked to your Aadhaar, then you can visit apply for EPF withdrawal online through the UAN member unified portal

I live in US , dont have an india phone number . The previous number linked to my EPF account is not operational or is with someone else . What should i do in this case?

how can i withdraw my EPD when i’m outside India for 5 years?

Hi Shiva Ram

If you are settling in another country, you can withdraw your complete EPF balance even before your retirement date and close your account. However, you will be required to provide proof that you are leaving India to work and/or settle abroad.

Hi Hemant- Being an NRI I still get my salary in India and my employer and me are contributing to EPF from last 7 years, I do have intent to come back to India. What will you advise.

Need to withdraw amount from EPF after 3 years account being inoperative

Hi Deepika

If you have the UAN linked to your Aadhaar, then you can visit apply for EPF withdrawal online through the UAN member unified portal

Hi. Thank you for the reply. But my question was can I withdraw the amount online even if there was no transaction happened in last 4 yrs by any employer in my

epfo account

Hey,

I am trying to withdraw EPF, as I have moved Abroad for work. I dont see an option to provide the reason for quitting the job as “Abroad Settlement.” when I try to submit for the claim both online and Umang app. Any help?

I have a big corpus on my epf and ppf and moving to us. And not thinking of coming back. What should i do with ppf and epf. Should i cintinue or withdraw

Hello Ish,

This is subject to tax liability and your money requirement.

If the EPF account becomes inoperative will the interest credited to account until I withdraw which should be more than 3 years

Hi Mohan,

No.

I am an overseas citizen of India and wants to withdraw & close my PF account. I do have UAN which is linked with my aadhar.

Hi Durgesh,

You can do this online.

how to close EPF NRI’s account

I want to understand the process of taking out India EPF corpus from India to Netherlands

Hi Rajat,

Yes, you can do the same.

Do I need to submit form 15g for pf withdrawal?

Hi Krishan

You should consult with a CA for this

Hi Team –

I have over 15 years of service in India and have moved aboard permanently, I want to withdraw my EPF balance along with my pension amount. I worked in 2 organizations in India and trasnfered my EPF balance between the accounts, however there is a pension amount still in the older account.

Can I apply online for the complete withdrawal of both pensions amounts from both organizations?

Hi Greg

Yes You Can

I worked with infosys in year 2010 n 11.. I am NRI now but never withdrawn pf for my job in infosys. If if visit India, am i able to withdraw pf now

Hi Sonali

Yes you can

I’m an NRI. I want to withdraw my pf and i dont have address proof in India.

NRI PF withdrawal

I am 70 and have ccontributrd to EPF till July 2022. My status has changed to NRI since 2021. Do I have to withdraw my EPF amount or can keep it for next three years without contributing to EPF. Will I get interest on my amount lying in EPF accoint

Hi Urvashi,

As per my knowledge, you can continue with the same and you can Withdraw.

you will get interest on the EPF amount only upto 3 years.

Withdrawal of pf without having aadhar and mobile number person relocated to australia

Hi Venu,

You can apply through offline mode.

I relocated to Australia in 2008 and became Australian citizen. I would like to withdraw EPF and do not have Aadhar card and UAN. Can you please advise me the process the withdrawal of EPF?Thanks Sudhakar

Hi Sudhakar,

You can visit the EPFO website.

I am also in the same situation. I raised a grievance through the EPFO online portal and was advised to use manul forms 19 and 10c through my last employer. I am still working on it, will keep you posted.

I was provided with a list of documents, but some of them are irrelevant, in other words, there is no process that is customized to the situation. There might be some back and forth explaining my situation.

I have worked 3 years and had epf then went aboard and come back now after my 60tb year I withdraw my epf now is this amount taxable and they have deducted 10 percent

Hi B Sheshagiri,

TDS is deducted @ 10% on EPF balance if withdrawn before 5 years of service. Remember to mention your PAN at the time of withdrawal

My son is studying abroad and will be employed there. He has some amount in EPF. What should we do?

Hi RK Gulati,

you can ask him to withdraw his PF or cantinue with the same.

EPF withdrawal for NRI

Hi Atul,

You can do the same online .

I am moving abroad to UK. I have EPF account, home loan and equity investments. I need help in understanding how can I manage these from UK?

Hi Rahul,

Kindly drop yur mail Id or any other contact, we will help you out.

After 3 years completion of moving out of india, is PF withdrawal taxable ?

Hi Abhishek,

TDS is deducted @ 10% on EPF balance if withdrawn before 5 years of service. Remember to mention your PAN at the time of withdrawal

Hi Abhishek,

As per my knowledge, Yes it is taxable.

I am about to apply for pf withdrawal. I am an NRI and I have heard that I cannot submit 15G form. So will I be taxed?`

Hi Suhas,

Kindly ask to your CA.

What happens to the EPS corpus if I switch to aboard for another job??

Hi Vivek,

As per my knowledge, there are two alternatives to you for dealing with corpus.

First, you can withdraw the entire accumulated amount and close it before moving abroad.

The second option is to let his account continue. However, if you are likely to come back in a few years to India and work, it is better to let the account continue.

NRI can clain deduction under section 80C for contribution towards EPF if his salary is not taxable

Hi Shivani,

As per my knowledge, yes, you can claim.

I have become US Citizen recently. I have not withdrawn my PF balance yet. Will that be a problem?

Hi Malaya,

No.

No it wont be.

I am moving to Denmark. Once my EPF account becomes inoperative will i still earn interest

Hi Gagan,

You can earn interest on EPF for three years after inoperative.

I had to marry and settle abroad and couldn’t claim my pf before leaving india. Now that i have been an NRI for more than 10 years can i claim pf if i visit india?

Hi Baishali,

Yes you can.

I need to know all the rules that are related to PF withdrawal for a person resigned job in India and settled abroad

Hi Kanakasabapathy,

The EPF rules provide two alternatives. First, you can withdraw the entire accumulated amount and close it before moving abroad.

The second option available to you is to let your account continue.

The rules provide that even as an NRI you will continue to earn interest on your EPF account until you attain the age of 58. After that, you can withdraw the EPF money. However, if a subscriber is likely to come back in a few years to India and work, it is better to let the account continue.

Can pf amount credited to NRE account.

I am looking for the answer whether PF amount can be credited to NRW account. in case you receive any response pls let me know too

Hi Thanuja,

Yes, NRIs can transfer the amount on their PF account to their NRO (Non-Resident Ordinary) bank account.

And you can transfer the amount from NRO to your NRE A/c.

EPF withdrawal from India

Hi Baldeo

yes,You can

Can I withdraw Pf online? And do I need to pay tax on that amount if I am NRI?

Hi Jay,

You can withdraw the money online.

And whenever you will withdraw the amount in India. It will be taxed as per the normal slab rate applicable to you.

Should I close pf account before moving abroad

Hi Sadhna,

You can continue contributing to your PPF A/c

i have moved abroad , i want to withdraw my entire PF however i cant get the OTP as my sim is not working here

I left India and settled overseas 23 years ago. My PF is still held in India when I worked. How can I withdraw that. I do not have a pan or Adaar card

Hi Ajit,

If you make a PF withdrawal without linking PAN Card, then you will have to pay TDS of 34.608%. This is the current maximum marginal rate.

So, it is wise to link your EPF A/c with your PAN.

considering i am NRI and staying abroad more than 3 years , but like to come back to india after 6 years and start working in india , in this scenario will the EPF account will be operative and fetch interest till the age of 58 years ?

Hi Prashant,

Yes, it will fetch the interest till the age of 58 years.

I have to withdraw PF from one of my complany i used to work for 10 years back. I was told tht I need to use online portal for withdrwal but when I try to activate UAN it says its not linked to any establishment

Hi Poonam,

In this case, you have to contact your existing company’s HR.

Many thanks for this very informative article. I have a question please – if an Indian employee who had an EPF account after a few years of working in India travelled abroad and was an NRI for over 15 years and is now going back to India and starting a new job, would that employee have to re-activate the old EPF account or does that employee not have to be part of the EPF scheme now, as he is starting a new job where his basic salary + DA is more than Rs.15k per month? Your response would be greatly appreciated. Thanks in advance!

Hi Samantha,

As per my opinion, employee can reactivate his old account.

Can i get my pf amount transfered to nri account

Hi Rajesh,

Yes, NRIs can transfer the amount on their PF account to their NRO (Non-Resident Ordinary) bank account.

Maximum deposit annually for nps

Hi Mahesh,

There is no maximum limit for contribution, you can contribute as much as you want.

I have become citizen of different country. Now how can i get my Indian PF amount

Hi Narayanan,

Here are the steps to withdraw your PF amount :

1. If you have the UAN linked to your Aadhaar, then you can visit the apply for EPF withdrawal online through the UAN member unified portal.

2. You can also download the EPFO’s UMANG App, or from the App Store and Play Store, to apply for withdrawal of EPF balance.

3. In the online application, fill the necessary details and provide the reason for quitting the job as “Abroad Settlement.”

4. Upload the clearly scanned copies of supporting documents in JPEG or PDF format and submit the form. You will get an OTP for verification, enter it when asked.

If your application and documents check out, usually, the Indian employee provident fund balance is transferred within two weeks from the scrutiny of the completed application.

Hi Hemant / Team –

I’m an NRI and looking to close my EPF account. My EPF account is 10+ years old so it will not trigger a taxable event if I withdraw the amount.

I find that the Central Govt has officially declared there will be an 8.10 interest rate for 2021-22.

I was not able to find a stipulated timeframe when the EPF interest gets credited (updated in the member passbook) to the accounts yearly.

Leading to my question what happens if I close the account before the 2021-2022 interest gets credited (reflects in my passbook)?

TIA,

Greg

Hi Greg,

Once you left the job, your EPF will only attract interest only for 3 Years. After that, the EPF balance remains the same. It is better to withdraw your EPF as soon as possible and invest the same somewhere else like Mutual Funds so that your money will grow.

Hi Yash – Thanks for your response. Its my understanding that the regulation of 3years has been revised and the addendum has been updated in this article as well. The EPF account will continue to attract interest until maturity, i.e untill 58 years or graduation from earth.

In my case this year (2022) will be the third year since I left India and no additional funds were added to the account. I want to withdraw the money in full however do not want to miss out the interest earned over last year. Hence I wanted to know if there was a stipulated time (month) when the EPF interest gets credited to the accounts.

suppose we withdraw the EPF amount, will we get the interest for 4-5 months of the year?

at present I am British National but in the past work in India for Atul products from 74 to 76, can I claim my Pf

Hi Shivi,

Yes, you can claim.

Thanks for this much needed article.

Since there is no interest earned after 3yrs, do I have no other option but to withdraw?

If i plan to return in 10yrs, then there is no benefit in keeping the EPF account open? Is it better to move that money somewhere else where atleast it will grow?

Please advice.

Hi Nischal,

Yes you can move the amount.

Hi Nischal,

Yes, It will be good if you withdraw your EPF and invest somewhere else. Like, Mutual Funds.

So that your money will keep on growing.

Kindly drop your mail Id, We will guide you more clearly.

I left India 3 years ago and want to check and possibly withdraw from my EPF account. The only information I have is my PAN CARD number – I don’t have UAN or any other information. I do not have an Aadhar either.

Hi Michelle,

You can check with your previous employer if he get it done this procedure offline.

I am foreiner worked in India for aprox 5years, i left India in 2018. How can i claim my PF whithout going back to India

Hi Johan,

You can contact your previous employer.

withdraw my Provident fund

Hi Vaibhav,

You can follow the above given procedure to withdraw the funds.

Can you ping me Indian PF customer care number to sail in from UK?

Hi Kishore,

This is Indian PF customer care no. 1800118005

What is the tax implication if I withdraw my PF balance and funds gets transferred to my NRO account?

Hi Tanvi,

If the amount is withdrawn to an NRO account then one has to pay tax, as the withdrawn amount would appear as income in NRO and might be taxable.

It seems like an idealistic article. There’s absolutely no option to mention option for leaving job in the online claim form. It is asking for form 15G which is only applicable for resident Indians. How would EPF website know whether a person is in India or Abroad?

I’d like to know whether an NRE account be converted to normal account

Hi J. Narayanan,

Yes.

Do you provide help with EPF withdrawals in India?

Hi Prajwala.

We do not provide such services. You can do it by visiting EPF’s official website.

PF withdraw NRI process

Hi Kishan,

If you have the UAN linked to your Aadhaar, then you can visit the apply for EPF withdrawal online through the UAN member unified portal.

You can also download the EPFO’s UMANG App, or from the App Store and Play Store, to apply for withdrawal of EPF balance.

In the online application, fill the necessary details and provide the reason for quitting the job as “Abroad Settlement.”

Upload the clearly scanned copies of supporting documents in JPEG or PDF format and submit the form. You will get an OTP for verification, enter it when asked.

If your application and documents check out, usually, the Indian employee provident fund balance is transferred within two weeks from the scrutiny of the completed application.

Before becoming NRI I opened a ppf account, can i continue it

Hi Rajita,

As an NRI you will continue to earn interest on your EPF account until you attain the age of 58. After that, you can withdraw the EPF money. However, if a subscriber is likely to come back in a few years to India and work, it is better to let the account continue.

will you provide service with regards to withdraw EPF in India?

Hi Prajwala,

No. We do not provide such services.

how can an indian (now NRI) employee withdraw his pf?

Hi Daral,

If you have the UAN linked to your Aadhaar, then you can visit the apply for EPF withdrawal online through the UAN member unified portal.

You can also download the EPFO’s UMANG App, or from the App Store and Play Store, to apply for withdrawal of EPF balance.

In the online application, fill the necessary details and provide the reason for quitting the job as “Abroad Settlement.”

Upload the clearly scanned copies of supporting documents in JPEG or PDF format and submit the form. You will get an OTP for verification, enter it when asked.

If your application and documents check out, usually, the Indian employee provident fund balance is transferred within two weeks from the scrutiny of the completed application.

I am in Germany, I want to withdraw my Pf completely with NRI bank account It is possible?

Hi Vimala Devi

Yes you can.

Hi – I was able to successfully withdraw my entire EPF balance into my NRO account. My question is around repatriation of this money to US. a) Can I repatriate this money to the US fulfilling all the usual formalities b) Will I be subject to taxes on this money since EPF proceeds are tax free.

Appreciate any information you can provide

Hi I left india in 2009 and working abroad and want to withdraw pf. what are the steps and documents needed and how to do it?

Hi Suresh,

You can withdraw the amount online by clicking on below link.

https://www.epfindia.gov.in/site_en/index.php

EPF Withdrawal NRI

Can an NRI withdraw India PF full amount immediately

Hi Rajneesh,

Kindly consult with your CA.

Hi Rajneesh,

Yes you can but there will be 10% tds if you withdraw the amount before 3 years.

Hello Hemant. Thanks for your elaborate article on a very pertinent matter for NRIs (especially those with a relatively long employment record in India and high PF holdings). Considering my case (NRI since start of 2019, with no real intent of returning back), I believe it still makes a lot of sense to retain the account (as I understand the account won’t be inoperative and will continue to earn interest till I am 58 years). Can you confirm?

Hi Vinayak,

Inoperative account will only get the interest for 3 years. after that no interest will be paid.

Linking ADHAR is a problem.

My ex-organization has surrendered my account.

I am not in India since 2016 and do not have active contribution towards my PF account.

How can I withdraw now?

When I try to log in it say – “asks your employer to link Adhar” and problem is I donot have employer any more as I do not work in India.

What is to be done here? Please advise.

Classic case!

As per my knowledge, if your UAN is not linked with your Aadhaar, then you will require endorsement from your employer before submitting the application at the EPFO office.

Hi Rahul

You should try to connect with your ex-employer.

Thanks Amar. I am trying that now.

I have left my job in feb 20and setlled abroad . My total employment was for 4 yrs. Now i want to withdraw my full pf bal.. In the reason for leaving it is mentioned cessation of service(short service). Will tds be deducted

Hi Venkatraman,

There will be 10% TDS if you withdraw the amount before 5 years.

Hi .

I withdraw my Entire PF amount recently . Is there any other financial plans where we can put our money and it will grow for the retirement ?

Hi Shaybu,

Yes, we have plans. Kindly connect with us at [email protected].

Our team will get in touch with you.

I am an NRI and left India in 2016 but i continued as my company’s onsite employee and switched companies in UK. Can you giude me on how you withdrew your full PF?

HI Shaybu, were you able to get entire amount (EPF+pension cont.) without any tds ? thanks

How to withdraw my EPF

Hi Kishor,

Withdrawal can be done through the UAN member portal.

I need help with withdrawing my EPF from india. I am based in the USA now

Hi Rano,

Withdrawal can be done through UAN member portal.

I will currently working for my employer and having last date as 28th Dec 2021.I will be moving to abroad after that immediately. Should I withdraw PF account and leave it.

Hi Sandhya,

Yes you can withdraw your whole PF balance immediately in case you are not taking the next job in India.

Any idea what value should be selected in the dropdown of reason for withdrawal ?

HI Raghav, I have read in comments above that 10% tds will be deducted if you withdraw full amount immediately? Does that mean one has to wait for 3 years (until account become inoperative) for tax free withdrawal? I have moved abroad and took up job in a UK company. Thanks

If I am withdrawing my PF balance in NRO acc with all the supporting doc then will there be any TDS?

Hi Jyoti,

TDS will be deducted @10% on PF balance.

hi,

I am residing in USA since 2013 March and does not have Aadhaar as I do not qualify for that as I have not stayed in India after 2013 for 182 consecutive days. How will I be able to withdraw my EPFO balance? Thanks in advance for the help!

Hi Rinku,

You should connect to the HR of the company.

I’m trying to withdraw from my EPF as I moved to the UK, and working here. I initiated the online claim, filled the form 19, and also attached my resident permit. My claim was rejected with the comment “Claim Rejected SUBMITTED RESIDENCE PERMIT OF UK. CLARIFY WHETHER IS AN INTERNATIONAL WORKER”

Can you pls, tell me what supporting docs I need to provide other than my British resident permit?

Hi,

You should consult with your CA for the same.

Hello,

Need a clarification.

As per rules if EPF is over 5 years, then there is no tax on withdrawal.

However it is said that if the amount is withdrawn to an NRO account then one has to pay tax, as the withdrawn amount would appear as income in NRO and might be taxable.

Can someone clarify this scenario and tell, if EPF after 5 years is withdrawn in a NRO account, does one still have to pay tax?

Hi Deep,

you can withdraw your EPF balance to an NRO account without facing any tax incidence on the completion of 5 years.

Need to withdraw pf with no adhar and foreign passport

Hi Rajat,

As per my knowledge, there would be so many complications to withdraw the fund without these basic documents. Contact your company for better advice.