As an NRI, inheriting property in India can be both an exciting and overwhelming experience. While it is a valuable asset, transferring the property titles into your name can be a complex process.

In this article, we will guide you through the steps you need to take to successfully transfer inherited property titles in India, so you can fully claim your ownership of this valuable asset. Whether you are living abroad or planning to return to India, we will provide you with the information you need to make the process as smooth as possible.

NRI Transfering Inherited Property

NRIs are allowed to pass their movable or immovable property to any person (NRI or resident), company, or organization. NRIs can inherit property that is residential or commercial. They are also entitled to inherit agricultural land or a farmhouse even though they are not allowed to purchase such properties.

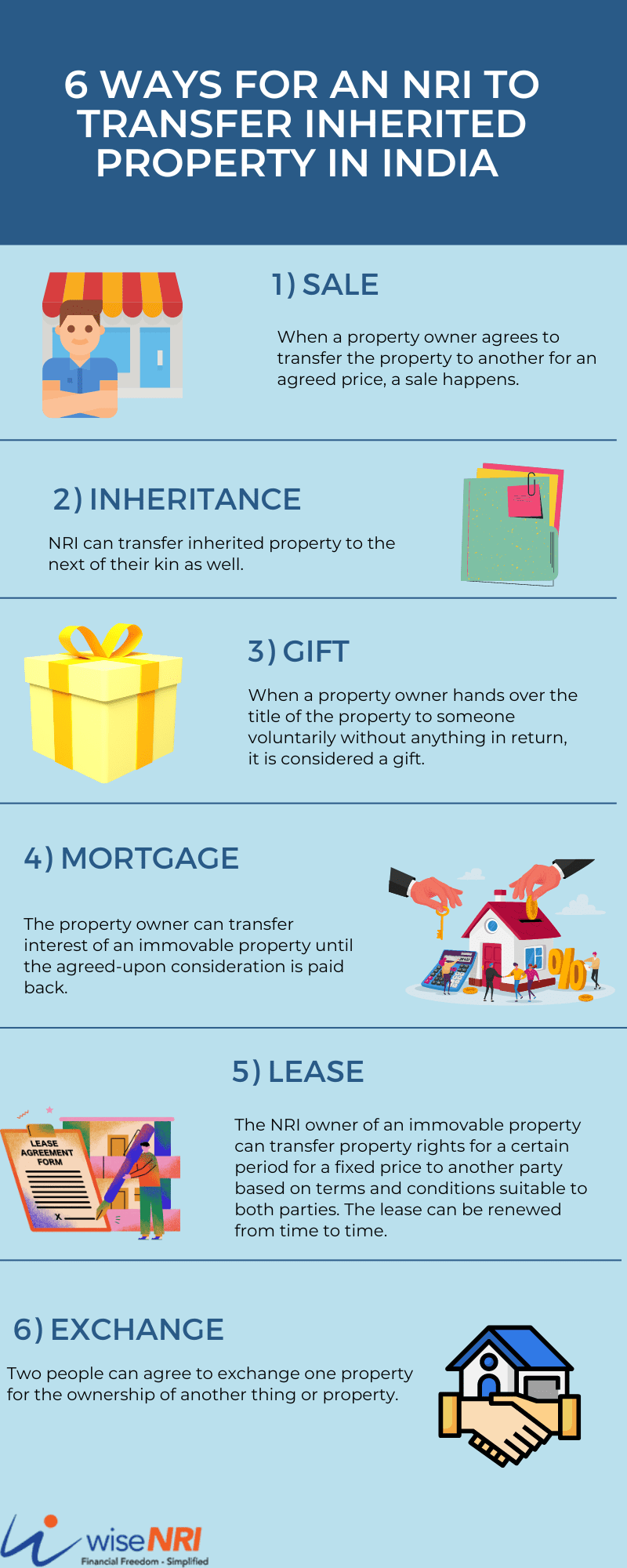

Ways for an NRI to Transfer Inherited Property in India

There are two ways of transfer –

Voluntary Transfer – A voluntary transfer is done when the rightful owner of a property willingly transfers their property in one of the three ways –

- For consideration via sale, mortgage, lease or exchange

- Via a will or inheritance

- By gifting

Involuntary Transfer – An involuntary transfer is done when the court seizes the property of an individual and makes a decision on the transfer irrespective of the original property owner’s consent.

Read – NRI Investments in Commercial Property

How is the transfer done?

In case of an involuntary transfer, the court of law takes precedence. In the case of a voluntary transfer, the process depends on the type of transfer. Let us look at each in detail:

Sale

When a property owner agrees to transfer the property to another for an agreed price, a sale happens.

Inheritance

NRI can transfer inherited property to the next of their kin as well.

Gift

When a property owner hands over the title of the property to someone voluntarily without anything in return, it is considered a gift. All relevant title-related documentation must be transferred so that the transfer remains transparent to all concerned parties. Check – NRI Gift Tax in India

Mortgage

The property owner can transfer interest of an immovable property until the agreed-upon consideration is paid back.

Lease

The NRI owner of an immovable property can transfer property rights for a certain period for a fixed price to another party based on terms and conditions suitable to both parties. The lease can be renewed from time to time.

Exchange

Two people can agree to exchange one property for the ownership of another thing or property.

Documents that are needed to transfer property in India

Various necessary documents are required in order to complete the property transfer in India by an NRI. The key documents are

- Registered Will for NRI (It is not mandatory to have it legally registered)

- Succession Certificate (in case of no will)

- Purchase Deed and Registration Papers

- Encumbrance Certificate (to prove that the property is free from monetary disputes, legal liabilities etc.)

- Khata ( revenue document that is proof of the entry of the person’s property in the records of the Municipality or Corporation and has details of the property)

- If the property is transferred via sale, the additional documents required include passport, PAN card, tax returns, documents indicating approval from the society, sale deed, registration document, etc.

Read – NRI Real Estate investments outside India

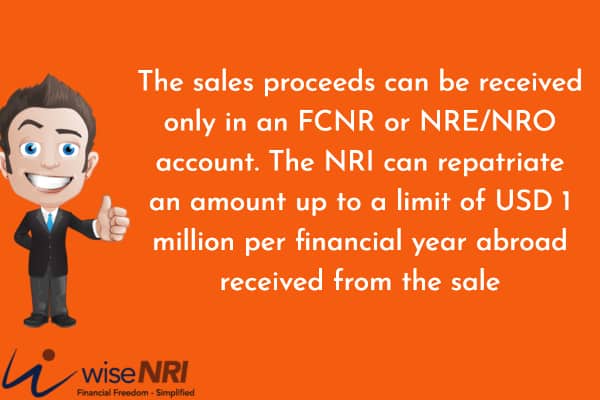

Rules related to sales proceeds and taxation

The sales proceeds can be received only in an FCNR or NRE/NRO account. The NRI can repatriate an amount up to a limit of USD 1 million per financial year abroad received from the sale. For this, the NRI has to obtain two certificates from a Chartered Accountant – Form 15A and Form 15CB that state the amount has been obtained by legal means. To remit a higher amount, permission from the RBI is required.

When an NRI sells a property, the buyer is liable to deduct TDS @ 20% and deposit it with the government. If the property has been sold within 2 years from the date of purchase, a TDS rate of 30% is applicable. A surcharge of 10% for value between ₹ 50,00,000 and ₹ 1,00,00,000 and 20% for values over ₹ 1,00,00,000 and the 4% health and education cess are applicable as well.

If an NRI wants to avoid the refund process, they can apply for a certificate for deducting TDS at a lower rate with the Jurisdictional Assessing Officer of the Income Tax department. The application for this certificate has to be made before executing the sales agreement. NRIs are allowed to claim exemptions under section 54 and Section 54EC on long-term capital gains from the sale of house property in India. If no tax is payable, the NRI can claim the TDS paid as a refund at the time of filing income tax returns.

NRIs can transfer inherited property in a similar manner as residents. The only difference is that there are a few more regulations and documents to be taken care of.

Check – Estate Laws for NRIs

In conclusion as an NRI, transferring inherited property titles in India can seem like a daunting task. However, with proper planning and the help of a qualified lawyer, the process can be made much smoother.

By following the steps outlined in this article and seeking the assistance of a lawyer, you can successfully transfer the titles of your inherited property in India. It is important to gather all necessary documents, register the property in your name, and pay any applicable fees to ensure the smooth transfer of ownership. By taking these steps, you can secure your ownership of the property and protect your assets for the future.

If you have any questions or experience with NRI Transfer Inherited Property – please add in the comment section.

When Resident Indian dies , how his property is transferred to his children who are NRI ?

Hi Naynesh,

When a resident Indian dies and leaves behind property, the transfer of the property to the children who are NRIs will depend on the nature of the property and the provisions of the will, if any.

If the deceased had a valid will that specifies how the property is to be distributed among the heirs, the property will be transferred according to the provisions of the will. The will must be probated, which involves proving the validity of the will and the appointment of an executor to administer the estate.

If the deceased did not have a will, or if the will is not valid, the property will be distributed according to the laws of inheritance that apply in India. These laws vary depending on the religion of the deceased and the nature of the property.