NRIs are looking for the Best NRI investment options in India but the problem is that NRIs tend to succumb to marketing gimmicks by sellers (mostly bankers) and end up buying products that they don’t need.

It’s important that NRIs first should look at their goal & risk profile – then only hit search for NRI investment in India.

We have divided this article into 3 Parts:

- High Return Investments for NRIs

- Low-risk investment for NRIs

- 5 investments for High Networth NRIs

Must Raed – Investment restrictions for NRIs In India

Best NRI Investment Options in India 2024

The population of Non-Resident Indians (NRIs) is huge. It is estimated that there are 16 million Indians living outside India as per a UN survey.

But as an NRI, you cannot participate in all investments to diversify. But there is some Best Investment Plan for NRIs Where should NRIs Invest in 2024? Let us look at these –

High Return -NRI Investment In India

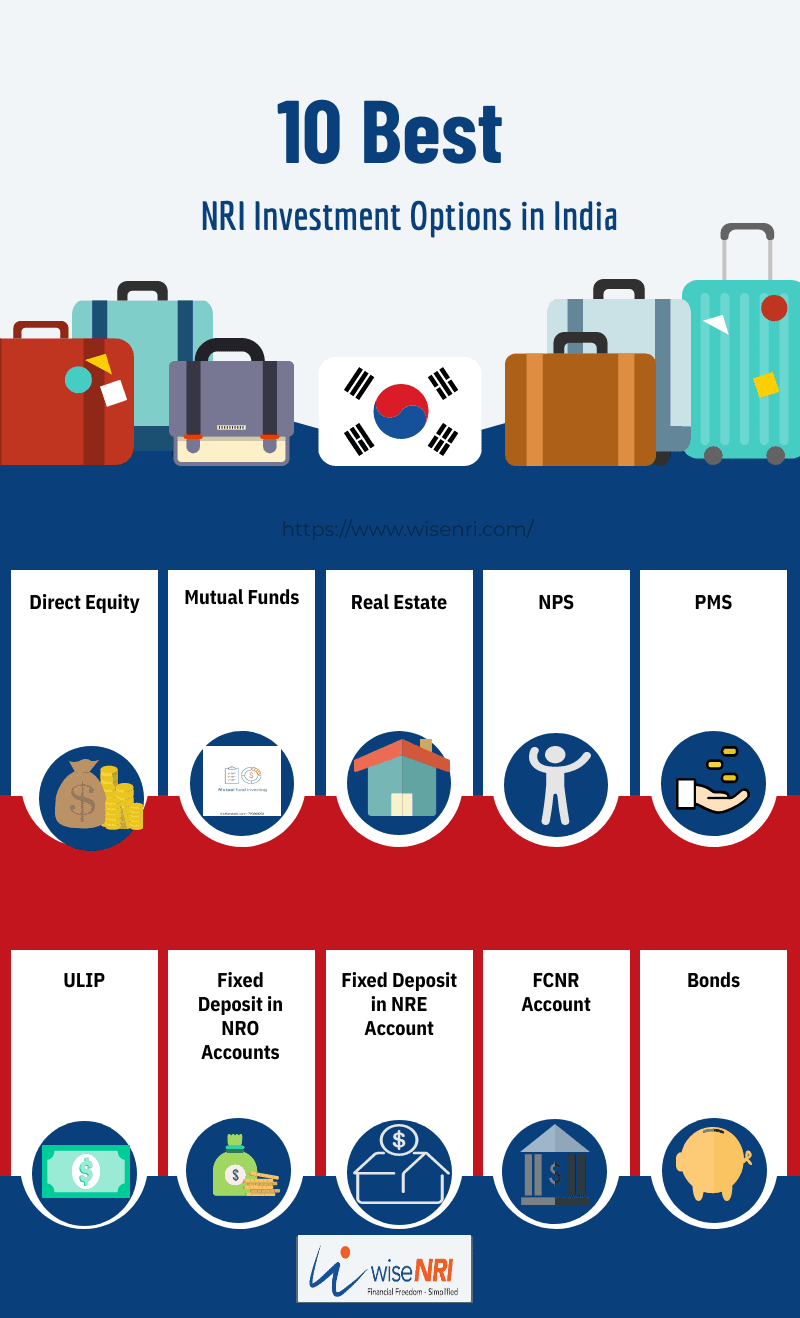

Direct Equity

An NRI can invest in the Indian stock market. To do this, he needs to open a Portfolio Investment Scheme – commonly known as a PIS Account. This can be linked to a Demat account which can be opened with any registered stockbroker in India.

Returns in the Indian stock market are high over the long term but not without volatility. Equity investments have the ability to beat inflation and make your wealth grow.

Risk is also higher compared to FDs and PPFs in any stock market-related instrument. You should only make informed decisions.

If the investment is sold within 1 year of purchase, the tax is 15%. If the investment is sold after a year, there is a 10% tax.

NRIs can open a trading account but they can’t do day trading in stocks – they can only sell the stocks that are already delivered to them.

Read More – How Can NRI Invest in the Indian Stock Market

Mutual Funds

NRIs except for the USA and Canada can invest in Indian Mutual Funds. NRIs from the US and Canada have certain restrictions and can buy only a select few Mutual Fund schemes. (even other fund houses request for additional information at the time of purchase & in a few cases even at the time of redemption)

Depending on risk profile, an NRI can invest in equity funds, balanced funds, debt funds, liquid funds, and MIPs.

The gains on the sale of non-equity funds within 3 years of holding will be considered as short-term capital gains. It will be taxed at 30%.

Gains on the sale of non-equity funds after 3 years are long-term gains. They will be taxed at 20% after indexation.

Taxation of Mutual Fund for NRIs is more or less the same as Resident Indian but for NRIs Tax is Deducted at source (TDS) by Mutual Fund Companies. Check Detailed Post on TDS for NRI & how to get a refund

Good Indian mutual funds give returns that can beat inflation in long term. They are managed by professionals so they are less risky in comparison to direct stocks.

There are various options for investing in Mutual Funds. You can use SIPs for regular investments and SWPs for regular withdrawals.

Equity-linked savings schemes or ELSS have become one of the most favored tax saving instruments for all including NRIs if they have some income in India.

Must Check – Mutual fund KYC Process for NRIs

Real Estate

NRIs can invest in residential real estate and commercial real estate. They can avail of loans in India to buy property. NRIs are not allowed to invest in farms, agricultural land, and plantations.

If you invest carefully in reputed properties, it can appreciate quite a bit.

But it might be tough to stay updated from far away and it is difficult to manage if there are some documentation or any processes to be done

The sale of house property after 2 years of purchase is considered a long-term capital gain, and a TDS of 20% is applicable.

The sale of house property within 2 years of purchase is considered as short-term gain and a TDS of 30% is applicable. buyer shall deduct TDS at 20%.

You are allowed to claim capital gains exemption by investing in house property in India as per Section 54 or investing in Capital Gains Bonds as per Section 54EC.

You can also deposit your gains in a PSU bank or other banks as per the Capital Gains Account Scheme, 1988. Claim this as an exemption while filing returns and you will get a refund.

Till a few years back property was one of the favorite Best NRI Investment India but now they have seriously started considering financial investments like Mutual Funds.

Note – Real estate investment had not seen much appreciation in the last decade but 2024 looked better. End users have started taking interest in buying bigger and better houses – this means some price appreciation.

Must-Read – Investment in Commercial Real estate in India

NPS

NRIs can open National Pension Scheme accounts. Now there is an option of opening an NPS account as well if you have a PAN card or Aadhaar card. NRE or NRO accounts can be used.

If you are an NRI between the ages of 18 and 60 years, you are allowed to open an NPS account with a bank in India called the Point of Presence. You can choose the asset classes in which your funds should be distributed. If you do not choose, automatic distribution across asset classes as per age will be done.

For an investor below the age of 60 –

- A minimum of 80% of the total investment will have to be annuitized and withdrawal is limited to a maximum of 20%

- If the total corpus is less than Rs. 1,00,000, the entire sum can be withdrawn

The annuities and the maturity account are taxable.

For an investor who is 60 years or above-

- A minimum of 40% of the total investment will have to be annuitized and withdrawal is limited to a maximum of 60%

- If the total corpus is less than Rs. 2,00,000, the entire sum can be withdrawn

The pension/annuity will be paid in INR. It is best to open an NPS account with the same bank where the NRE/NRO account it.

It may not be the best bet considering the withdrawal rules, illiquidity and taxation if there are better alternatives. A small amount can be invested in it is required only if the NRI is sure to settle in India post-retirement.

You can read our detailed post on- NPS For NRIs

ULIP

ULIPs or other insurance products are sold to NRIs by bankers to maximize their earnings in the short term as these products have heavy upfront commissions. We normally do not suggest mixing insurance & investments but even if you are offered such products – do detailed research before signing dotted lines.

Must Read – NRI’s Investment Planning Mistakes

Low Risk – Best Investment options in India for NRI

Bank Account

I don’t want to count the bank account as an investment but as you need an account for the rest of the investments I am adding it here. There are two types of popular accounts that NRIs use:

- NRE (Non-Resident External Account) – this is preferred by most of the NRIs as repatriation of money is easy. They transfer their foreign currency to India and use this account for investments. Interest is tax-free.

- NRO (Non-Resident Ordinary Account) – for your income in India like rental this is a good option. Repatriation of money is also possible but with additional documentation & process. Interest is taxable.

Note – it’s illegal for an NRI to hold a Resident Indian Savings bank account – if you have one, you should immediately convert that to an NRO account.

Check – Best Bank for NRIs

Fixed Deposit in NRO Accounts

NRIs can invest in Indian currency FDs in NRO.

The interest rate is good. The risk is low.

Interest on the NRO account is taxable and the tax is computed at 30% of the interest earned. It is deducted at the source.

It might be subject to tax in the country you live in depending on certain conditions. If there is tax to be paid, a beneficial tax rate or a refund can be claimed depending on conditions of the Double Taxation Avoidance Agreement (DTAA).

Fixed Deposit in NRE Account

As an NRI, you can have a Fixed Deposit in an NRE account.

Interest is tax-free but you have to understand that it can be taxed in your resident country. Example: If you are resident in a no income tax country like UAE, Saudi Arabia, Oman, Qatar, Kuwait, etc. – there is no tax that you have to pay in India or these middle east countries. But what about if you are a resident of Singapore, the UK, or the USA – you may have to pay tax in those countries depending on DTAA.

The risk is low. The interest rate ranges from 6% – 7.75%.

FCNR Account

FDs can be opened for a period of 1 to 5 years.

It can be in any foreign currency.

Interest is exempt from tax until the person is an NRI or a Resident but Not Ordinarily Resident (RNOR). Another benefit is that you will not have any impact from foreign exchange fluctuations.

You can check our detailed post – FCNR Deposit

NSC

If you had invested in NSC when you had the status ‘Resident’ – you should withdraw that amount or you will get returns equal to Saving Bank.

PPF is a 15-year scheme, which can be extended indefinitely in blocks of 5 years. However, for a resident turned NRI, the extension is not allowed. wiseNRI

Public Provident Fund

If you opened your Public Provident Fund account when you were a resident Indian – you can contribute & continue that. If you are an NRI – you can’t open a new PPF account.

NCDs or Corporate FDs

NRIs can invest in Non-Convertable Debentures or Company Fixed Deposits if the issuer is allowing them to participate. These will be taxable so one should consider is tax liability or compare their return with NRE FDs which are tax-free.

Government Securities

Indian Government has now allowed NRI to invest in government securities and T-bills on a repatriable or non-repatriable basis.

Bonds

NRIs can also invest in various bonds if the issuer allows the same be it PSU bonds or perpetual bonds. A few years back government also issued tax-free bonds to NRIs.

HNI NRIs investment in India

HNIs keep asking in India where to invest. So we have added a separate section in this article.

PMS

PMS or Portfolio Management Services are complex and risky. For 90% of the investors, Mutual Fund is a good way to participate in equity markets. But US-based NRIs due to tax issues when they invest in Mutual Funds can consider PMS as one of the Best NRI investments in India (but after doing due diligence). Don’t only look at the returns – also check the risk & cost involved. Minimum Investment INR 50 Lakh

Startups

Investing in Indian startups has become increasingly popular among NRIs in recent years. With the rise of online investment platforms like IPV, LetsVenture, AngelList India etc, NRIs now have easier access to the Indian startup ecosystem. These platforms provide a streamlined process for NRIs to discover and invest in promising startups. Additionally, these platforms offer tools for due diligence, allowing NRIs to evaluate potential investments and mitigate risks. No minimum investment but for diversification considers a minimum 20-30 lakh commitment over a period of time.

AIFs

Indian AIFs (Alternative Investment Funds) have emerged as a popular investment option among high Netwrth NRIs seeking exposure to alternative asset classes such as private equity, real estate, and hedge funds. These funds are regulated by the Securities and Exchange Board of India (SEBI) and provide NRIs with access to high-quality investment opportunities that were previously available only to institutional investors. AIFs offer diversification, higher returns, and the potential for capital appreciation, making them an attractive option for NRIs seeking to build a well-rounded investment portfolio. Minimum investment INR 1 CR.

Fractional ownership of CRE

NRIs are increasingly investing in commercial real estate (CRE) in India, which provides diversification and potential for higher returns than traditional investment options. Fractional ownership of CRE is also becoming popular among NRIs, as it allows them to invest in high-value properties that would otherwise be unaffordable. Fractional ownership provides access to a portion of the property’s rental income and appreciation in value, making it an attractive investment option for NRIs seeking passive income. Platforms have made investing in CRE and fractional ownership more accessible to NRIs, providing a seamless and transparent investment process. As the Indian real estate market continues to grow, investing in CRE and fractional ownership can provide NRIs with diversification and long-term value. Minimum investment R 25-30 Lakh.

INVITs

NRIs are increasingly investing in INVITs (Infrastructure Investment Trusts) in India as a means of accessing investment opportunities in infrastructure projects such as roads, power plants, and airports. INVITs are regulated by SEBI and provide NRIs with a cost-effective way to invest in infrastructure projects with low minimum investments. The trusts provide regular income to investors in the form of dividends and offer potential for capital appreciation.

Why Investing In India A Great Option For NRIs?

If you are practical, read on to find out why it makes sense to invest in India –

One Of The Fastest Growing And Stable Economy

When investing, it is important to consider a country’s economic stability. India is one of the most rapidly growing and stable economies in the world, which reduces the risk of investment even during market volatility.

Demographics

More than 65% of the population in India is below the age of 35. This segment has consumerist aspirations and a higher propensity to spend. They have a higher disposable income which they will use to improve their lifestyle. This will lead to increased revenues for companies.

Moreover, they are aware of investing, and therefore there is a high inflow of retail investments in financial products especially mutual funds.

This means our markets have the potential to do well. There will be more steps to streamline markets and financial products.

Must Check – How Can NRI Investment in Indian Stock Market?

Big-spending by corporates

Big brands like IKEA and H&M have started operations in India. Netflix is spending massive amounts on marketing in India. They must have done some research and analysis and seen some potential in India before committing huge funds in the country.

NRIs can follow their suit to create wealth for themselves.

Underdeveloped markets

The consumer base in India is growing by leaps and bounds. India is expected to be the third-largest consumer market by 2025.

Per capita income is on a rising trend which means expenditure on health, education, communication, transport, food, and entertainment will increase for the next few years. The consumption of goods in rural India is also rising. The Indian middle class which is increasing in numbers loves to buy which means companies can target these different segments aggressively.

“NRIs should not miss this growth story and invest in India such that they reap benefits too.” wiseNRI

Performance of Key Indicators

All the economic indicators have been showing the right signals. Inflation has come down. The interest rates on FDs have gone up. The equity markets and mutual funds in India have performed better than most countries in the last few years.

Although past performance cannot guarantee future performance, there are no events that have altered the fundamentals in India, so one can reasonably expect things to go on as they have been going on.

So India is a good destination for investment and NRIs should take advantage of the same.

Conclusion

In conclusion, NRIs have a variety of investment options available to them in India. However, it is important to understand the conditions and restrictions imposed by the RBI before making any investments. NRIs should also consult with a financial advisor to determine the most suitable investment options based on their financial goals and risk tolerance. With careful planning and research, NRIs can make sound investments in India and enjoy the benefits of long-term wealth creation.

Please share if you have come across any other best NRI investments in India.

Is hdfc life immediate income scheme is ULIP? Product is hdfc life sanchay par advantage policy for NRI age 35.

Hi Satish,

The HDFC Life Immediate Income Plan is not a ULIP. It is a traditional insurance plan.

Can i invest through nro account in child investment in Rs

Hi Vishnu,

Yes, you can invest in a child’s name through an NRO account in India.

I am 54 years NRE. What ist the best investment for retirement in 12 years

Hi Gopi

The best investment can vary from person to person based on their approach toward their finances.

I want to open a stat up in india .what is the process to get a non refundable amount scheme by Modi ji for NRI

Hi Suruchi,

Please contact a financial planner for the same.

This is inaccurate. NRIs are allowed to invest in farms, agricultural land, and plantations… as long as they are Indian citizens i.e. Indian passport holders!

Hi CS

Non-Resident Indians (NRIs) are generally not allowed to invest in agricultural land, farms, and plantations in India, irrespective of whether they hold an Indian passport or not. The acquisition and ownership of agricultural land in India are regulated by various state laws, and these laws typically restrict or prohibit NRIs from owning agricultural land.

However, there are some exceptions and variations in the regulations across different states in India. In some states, NRIs might be allowed to inherit agricultural land or acquire it through gifts or bequests. Additionally, NRIs are generally permitted to invest in agricultural activities through other means such as contract farming, agricultural infrastructure, or agro-processing industries.

Investing in India can be a great way to contribute to the country’s development and growth while also earning a return on your investment. It’s a win-win situation for both NRIs and India as a whole.

Hi Krishna

You have said it rightly.

I am in usa for the last 10 years on H!B visa. prior to leaving for USA in 2010 I invested in some MFs which are still alive. what should I do

Hi Pd Singh

It is recommended to contact a financial planner to advise you for the same.

How can I grow 1 crore in to 15 crores in india

What is the maximum contribution NRI can make in enps?

Hi Sarathi,

There is no maximum limit for NPS contribution.

How can i transfer money from Japan to India with minimal transaction/brokerage charges

Post you become an NRI, The EPF Account already in the EPF account continues to earn the same rate of interest. Is is advisable to continue to park that money in EPF account or withdraw.

NRI sold inherited property acquired and paid capital gain tax in India he is also liable to pay tax in USA?

Tata digital direct growth fund is it good for a nri customer?

I wanted to know about Insurance for NRI Person

Best pension plan

I am reading your article, have pis account. But how could I open DEMAT account sitting in USA?

Hello Madhvi,

After becoming NRI, You can not able be to open a Demat Account because it will be against rules.

As NRI which bond can we invest

Hii

Jay

Thanks for Msg.

there is some point.

1. Public Sector Units (PSU) and Capital Bonds

2. Secure Corporate Bonds and Non-Convertible Debentures (NCDs)

3. Bharat Bond ETF & FOF

4. Debt mutual funds

If NRI over 69 yrs of age, how they invest LIC INDIA?

Very fresh informative for NRI,

Thanks,

I want to gift 70000 Canadian dollar to my wife’s brother staying in Canada. He is a Canadian citizen of Indian origin.Is it permissible under Fema and Income Tax Act

HI Vikash,

Yes, you can transfer the amount but it will be taxable.

What is the interest rate if I invest from usa?

Hi Rishbha,

Every bank has different interest rate. Currently it is near to 5.5%

NRI can get loan from bank to buy a house

Hi Savi,

Yes they can.

Can an NRI earn from stock delivery trade n take back the profits to canada

Hi Rajat,

Yes he can. for that he should have a NRE account.

at present I am resident Indian and have SCSS account(senior citizens saving scheme)Once I get NRI status, can I continue with SCSS account ?

Hi Divesh,

Yes you can continue with that.

My friend wants to send me 100 dollor, so which purpose code should we put/ use?

As an NRI,what are the good investment option here,in the USA.

Hi Rama,

Your investment should be according to your goals.You should consult with a local investment advisor in USA.

How to open nri bank account with demate and trading under one roof ?

Hi Karan,

ICICIdirect NRI 3-in-1 Account offers you a combination of the bank – Demat – trading accounts all linked together for a seamless and paperless investment experience.

Visit: https://www.icicidirect.com/open-nri-account

Hi Hemant,

I understand that interest earned on NRE-FD is not taxable, as long as you hold NRE or RONR status.

But if a NRE-FD matures after the RONR period (which I believe is 3 years after returning to India) still will the interest earned on such NRE-FDs be tax free ? Kindly cIarify.

Dear Kumar,

I will suggest you check this https://www.wisenri.com/nre-fd-after-return-to-india/

NRI people try to avoid putting money in NRO accounts, each money earned they deduct cess, tax etc…. always try to convert NRO money into NRI SB.

When NRI file I T return in INdia

Hi Ketan,

NRI Income tax return must be filed on or before 31st July.

small investment ideas

NRI investment

Hi Sunny,

Yes, we provide investment advice for NRIs. Please drop your mail id or contact no. We will connect with you.

Please provide investment advice for NRIs

Total Tax on NRE account for capital gain

Hi Karan

For NRIs, LTCG on equity and equity-oriented investments is taxable at 10 per cent exceeding Rs.1 lakh exemption. Short-term capital gains from equity and equity-oriented investments are taxable at a flat 15 per cent.

Can i withdraw investment

Hi Harsh

Yes

Is it good to invest in NPS if we plan to settle in india?

Hi Karthik

Yes but there are other investment avenues also available that you can consider to get diversification benefits.

I have a friend who has returned to india for good after spending some years in USA. He has NRE fixed deposit opened when he was abroad. what is the taxability of interest from April 2022 onwards on his NRE FD

Hi S. Rajagopalan

Interest earned on NRE Fixed Deposit is exempt from tax in India.

I am an American living in India. Can you provide advice for investments in India?

Hi Sam,

Yes. Please drop your mail here so that we can contact you.

As nri if amount is transferred to family members in India and they invest real estate including agriculture land is it permissible ?

Hi Athar,

Yes, they can purchase land on their name.

What is the best mutual fund investment in India for Indian in Canada

I want to trade stocks in India on Zerodha platform. Can I do that?

Hi Rupsi,

yes, you can trade.

I do have a commercial land arround 45 acres I want to sell it to NRI Customer…

Hi Sudipto,

Yes, you can sell it.

which is the best repatriable long term recurring investment for NRI

Hi Abhishek,

Please consult with your advisor

In NRE Account is there any cap on tax-free income?

Hii Dwarika Ji

As per my knowledge the income earned on NRE account is tax free

Like to know about top high return NRI investment plan

Hii Mr. Abhijeet

The investment plan are suggested after reviewing your risk tolerance level.

And also a investment plan are subject to market risk.

So, it is suitable to take advice of a financial planner

whether investments by OCI or NRI are taxed in the same manner or different?

Hii Mr. Amit

Regarding taxation it is suitable to consult a tax consultant

Which investment plans gives highest return ?

Hii Mr. Rajat

It depends on your risk profile which investment plan would be most appropriate for you.

A plan which might give highest return may not be suitable for your risk profile.

Invest in Usdcoin cryptocurrency

What is this course all about?

I need 1 lack per month. What is the investment plan

I’m a seafarer, is it required to pay tax in India prior starting investment in India

Hi Ezhilan,

If you are earning Indian income, then you need to pay tax.

Can NRI invest in Perpetual Bonds from NRO accounts?

Hi Rakesh,

As per my Knowledge, Yes You can.

How to open nri demat account

Hi Ranjn,

You can approach any Depository Participant for opening the Account.

Best investment for NRI?

Hi Myush,

It depends on the Time horizon of the Investment.

Some Investments NRIs can prefer:

NRE Deposits

Mutual Funds

NPS

Bonds

As an NRI which are the safest investments in india?

Hi Sameer,

As per my knowledge, NRE fds, NPS and Mutual Funds can be a option.

If an NRI had property in his name when he 2nd minor and Indian resident how to deal? Can he keep it ad it is and it is a must to inform authority?

What is the best investment option for NRIs in India?

Hi Gurramkonda,

As per my knowledge, Mutual Fund can be an option.

I am an American PIO what Government Bond can I invest in?

Can I invest as I am from South Africa?

Hi Kamy,

If you have NRE/NRO account, you can Invest.

How much interest NRI can get from fixed deposits kept in US$?

Hi Shantha,

As per my knowledge, You can get around 1.5-2.00%.

I am NRI invested through the NRE account. however Wrongly it stated as RES and sb what should I do?

Hi Vandana,

As per my knowledge, You need to Consult with your Investment Advisor. They can rectify the Mistake.

Best monthly interest payout bond in India?

Hi Hemant

You have stated in your article that ‘NRIs are not allowed to invest in farms, agricultural land and plantations’. What would be the situation if an NRI gets agricultural land as inheritance?

Can the NRI keep it or has to sell it, or only that the NRI cannot invest?

Hi Chetan,

NRI can receive that as an inheritance – no need to sell.

which saving account to be open to transferring money from Ireland to India?

Hi Subodh,

You need to open an NRE account.

Hi Hemant, great article and you are the first financial planner in india i have come across who mentioned the tax treatment of nre savings abroad as i am having to pay tax here in the uk.

What are your thoughts on more recent ulip type products offered over shorter terms (5-7 ) years ? Would you recommend these?

Best

Feroz

I’ve an NRO account with significant cash. My bank is pushing me to invest in ULIP without saying what exactly it is. They’re promising 8% with recurring deposit of Rs. 5L every year for 5 years. Is it good to invest in this? Please advise.

Dear Krish,

I promised my wife moons & stars – she is still waiting for that day for 15 years 😉

No one can promise even 1% in ULIP – it’s a market-linked product. (from this budget they are taxable)

Can an NRI invest in an NPS scheme using NRE money?

Hi Anish,

As per my knowledge, Yes NRI can invest in NPS.

Hi Hemant

How NRI can do option trading in India? Is there any special requirement?

Hi Frank,

As per my knowledge, Yes, NRIs are allowed to invest in the futures & options segment of the exchange out of Rupee funds held in India on a non-repatriation basis, subject to the limits prescribed by SEBI.

I am an NRI and my daughter ( 2yrs old born and living in INDIA) she is expected to join me in my country of work shortly. How can I invest some amount in her name in India, considering I am a non-resident and soon she will also be a non-resident?

Hi Vamshi,

You can invest in India by opening a bank account in Child’s Name. Some Documents will be required like a Birth Certificate and PAN Card.

Which is best highest interest rate of NRI non senoiro citizens investment.

Dear Mr. Beniwal, when an Indian citizen relinquishes his green card and returns to India permanently, what are the taxation obligations in India and the USA if this person had a long standing IRA (retirement account) when he resided in USA, and is now subject to mandatory annual distributions from the account upon reaching age 72?

As I am an NRI citizen can I open PPF account?

Hi Sandeep,

As per my knowledge, NRI cannot open a PPF account.

if Canadian citizen OCI invests in India is there going to be restrictions for investment options or it applies only if some live abroad and invests in India.

Hi Mahi,

As per my knowledge, the same rule applies to OCI and NRIs. But there are Some Restrictions for US and Canadian NRIs in Mutual Fund Investments.

I am an NRI based out of Africa and my wife, a homemaker is also a resident in Africa. Both my parents (retired with no income) are Indian residents. If I gift 50 lakhs to my parents and another 50 lakhs to my wife and they invest it in regular bank FDs or mutual funds and earn income on that. Will the income generated from these investments be clubbed with my income or will it become their income and they pay taxes on it.

It will be taxable in the hands of your parents and your wife respectively

Best investment?

Hi Saigal,

It will depend on your Investment Horizon and Purpose.

What is the tax implication if an NRI returns to India and when his NRE A/C status changes and when he is taxable?

Hi Varghese,

As per my knowledge, After returning NRI can hold RNOR status for some time and then he will be treated as resident for taxation purposes.

I already asked you my question a few days back. It’s about remitting money to her in her US a/c. From which a/c I should remit, so that new 5% TCS rule is not applicable. I can remit through 2 different accounts. 1) My normal Resident Indian a /c. 2) Through her NRO A/C. here in the same bank, in which I am a mandate holder.

Is NRE FDs interest tax free for RNOR? If yes , then is there any limit on tax free interest – NRE and FCNR FDs ?

Hi Vivek,

Yes it is tax free for RNOR & there is no limit for this.

Sir, NRI can be a working partner in India?

Hi Shabbir,

Yes he can be. but he has to pay tax on income accrued or receive in India.

What is the best NRI investment plan with a high return? I am NRI based in Oman Muscat.

Hi Santosh,

There is no best in life and finance.Investment plan should be according to your financial goals.

i am earning around INR 30 lakh interest yearly from FD. I want to come back in india. What will the taxable income for me after coming back?

Hi Kamlesh,

As per my Knowledge, you entire income in India would be taxable.

How many years it takes to double RD account deposits

Hi Sa,

It depends on the ROUI you are getting, for Example if you are getting 7% then the amount will double in 9 years as per the rule of 72, For better clearity you can refer to the rule of 72 as well, divide the ROI that you are getting by 72.

Is there any tax for Nri, if investment in mutual funds?

Hi Abhishek,

Yes, There are taxes for NRIs investing in mutual funds.

Which is the safest investment scheme under the Indian Govt for NRIs?

Hi Anuj,

As per my knowledge, If the PPF account is already opened as a resident then an NRI can continue contributing into it. Other than that there is NPS but risk is there in it.

Hello, I am an Indian Entrepreneur willing to Register a Startup(most probably an LLP)towards establishing a Tourism & Hospitality Sector Project. How could I get an Investing Co-founder for my dream Project ?

I am an NRI, I want to invest in India in the stock market.

Hi Peter,

NRIs can invest through PIS in the stock market.

best NRI investment in monthly payout?

I m an individual having NRI status I have received a dividend of Rs 1500 in FY 19-20 I want to know the taxability of income?

Hi Ayush,

I think The dividend income is taxed as per the income tax slab.

Your article on NRI investments is very well written and covers almost all investment avenues for NRIs to invest in India. Thank you for the information.

Thanks, Archana Ji for appreciating our effort 🙂

I am citizen of usa. Thinking about opening saving account in india.

Hi Parambir,

Yes, you can open an NRE/NRO account.

I want to know about the high rates of interest given lic?

Hi Beltton,

The interest rate in LIC depends on different policies.

What is the best investment option for NRI?

Hi Manoj,

It depends on the Time Horizon for which you want to make an investment.i.e for Long Term Debt you can go for Bonds, NPS, and for short term Debt Mutual Funds is there and you can opt. for equity Mutual Funds for Long Term Equity Investment

Can i know which rbi or sbi bonds allow to invest by nri?

Hi Mr. Chopra,

As far as I know, you can find out the list on RBI’s website.

Can NRI invest in Bonds and Govt. Securities?

Hi Praveen,

Yes, NRI can invest in Govt. Securities and Bonds.

Want to know tax implications if i sell my flat?

Hi, there are lot of speculations that NRI can’t have/invest in “Bonds” and “Government Securities”. Is it possible now?

Hi Praveen,

Now NRI can invest in Government Securities and Bonds.

Looking for child education fixed return investment in India , where can be best to invest ? Having long term perspective

Tax saving investment options?

Hi Rishi,

You can opt for ELSS, PPF, NPS instruments.

I want to know about investment in post office. i am a oci holder .Can i invest in post office?

I am a british national , relocated from india 18 years ago to england – i do not have a pan card or oci – i used to visit india on an evisa which is now expired. I have recently opened nre accounts with form 60 and my nre statements were used for kyc in absence of oci – can you advise if I can still invest with same set of documents as i used for nre accounts ?

As of date, which Indian bank offers best interest rate for NRE and Resident fund investments?

Hi Shelly,

As per my knowledge, there are no fixed criteria for the best return, its depend on the tenure of the Fd and the type of bank you select.

Whst are the fixed income options for NRE?

Hi Sunny,

NRI can go for Nre Fds, Bonds, or Government Securities.

I opened the PPF account before 18 years in India, and operate 3 years, from the last 15 years I did not operate, I worked in UAE from last 15 years. can I continue that account?

Hi Vimal,

You have to close that now. You can open a new account once you return to India.

Hi,

Can you please advice how can I join NPS

Hi,

You can contact to NSDL to open the account via. online or offline mode.

My sister in law and her father has saving account in Allahabad bank..now her father is no more. she wants to make her mother joint account holder. can she make her frm outside india? because Allahabad bank is in canada too.

Hi Imran,

It’s better to consult with the bank regarding this matter.

Can I have an investment in USD other than FCNR?

Hi Lalit,

As per my knowledge, you can hold the investment in 8 currency other than USD.

Investment options for NRI?

Hi Dharmesh,

As per my knowledge, you can opt. for Mutual Funds, PPF, NPS, NRE/FCNR FDs, Stocks, Debentures, Bonds based on your investment objective.

what is the retirement scheme for NRIs?

Hi Rao,

As per my knowledge, if you wanna retire in India. You could go for some post office schemes like Senior Citizen Saving Scheme or Insurance Pension Plan.

Maximum how many NRIs can be joint holder in NRE NRO or FCNR account?

Hi Anoop,

As per my viewpoint, max. three NRIs can be a joint holder in NRE, NRO, FCNR accounts.

Hi sir looking for buying any property in Bangalore

I am moving to Taiwan from USA, can I invest in India from Taiwan as well?

Hi Rishabh,

Yes, you can.

which is the best investment option for NRI ?

Hi Angel,

Best investment options for NRI –

NPS, NRE FD, Mutual fund & Stocks

I reside in usa on work basis and want to open an NRI account. Can you suggest me which bank will be good?

Hi Collin,

In my opinion

ICICI, Axis, HDFC, SBI are best.

Best NRI investment options?

Hi Amit,

As per my knowledge, the good option for NRI investment is

1. NPS

2. Mutual Fund & Stocks

3. NRE FD

Hi, what is the best and safe MIS for NRE account holders specially in nationalised banks like SBI or Canara banks

Hi Sudhir,

In my opinion, these are few safe MIS options for NRI.

For a very long time, the NRE RD of Indian banks has been preferred by NRIs for their safety and the higher rate of interest offered.

PPF (If you have existing PPF account) and NPS for the post-retirement annuity.

My son stays and earnS in us and he wants to invest in fed in Bajaj finance service. Guide me

Hi Sandesh,

In my opinion, its a good option.

i am a regular follower of your newsletter.it is very useful.i have some more specific questions,like what should i have to do for the insurance policies /PLI which was opened when i was in India before becoming green card holder and about the HUF account, still i have not converted it to NRO.(now all the members are NRI)

Hi Amit,

Thanks for appreciating… you can inform insurers about change in status (if you have sufficient insurance in USA – you can consider surrendering).. Talk to your banker regarding accounts…

how money can nri to his parents in a year without tax

Hi PVR,

In most of the countries there’s no limit but if you are US-based NRI – it’s approx $14000

How much Insurance covered in Bank FD for NRE?

Hi Harshad,

Insurance covered in Bank FD for NRE is same upto Rs. 5 Lac

Thanks

Hi. A very informative site indeed! Highly appreciable!

A couple of quick questions which I seek clarity on..

1. Can an NRI parent contribute into his ‘Resident Indian’ minor children’s PPF A/c and get exemption benefit u/s 80C on his own Indian income ?? (Note: The said accounts were started 10 years ago.)

2. Can an NRI continue to hold his PPF A/c post-maturity, without further contribution/investment therein ??

Regards & Thanks in advance!

Hi,

1. In my view point, you will get exemption.

2.In case, post maturity you leave the account unattended, it will be considered as “extended without contribution”.

How much Insurance covered in NRE FD.

Like in India for Indian citizen their bank deposit covered up to 5Lacs.

Hi Harshad,

Same case with the NRE FD , insurance covered upto 5Lac

I m searching for a book that will give me knowledge about investment and NRI /NRO can make and tax liability against the same in India.

Hi Nikunj,

For investment knowledge, you can refer – “The Intelligent Investor”

and for NRI/ NRO & TAX liability updates- you can refer google.

I am NRI having an NRE account and Demet account I want to invest in share with the short term, which is the best?

Hi Rashid,

Better to consult with the Financial Planner.

The best option for NRI to invest to get maximum return?

Hi Sanu,

Better to consult with your financial planner.

Like to know if as an OCI holder can I invest in ELSS and mutual funds and I do have NRE and NRO already

Hi Dheeraj,

Yes you can invest.

Hi,

Any reason why ULIP and ELSS are not mentioned here in the article?

Hi Venkat,

We don’t recommend mixing insurance & investments So ULIP is missing – but as you mentioned so I will add with my views. ELSS is part of Mutual Funds.

Best investment option for NRI ?

Very Informative blog. So many questions answered and nicely written. Bookmarking this page.

I have a small question.

Iam residing in Denmark for last 2-3 years and hold both NRE and NRO accounts. Recently all the interest earned in these accounts are shown in my Tax calculations in Denmark. Small question on this.

I have an NRO Deposit account and the Interest earned is TDS @30% in India.

1. Can I claim the TDS by filing Income tax returns ?

2. In Denmark the Tax free Interest limit is Rs 20,000.

So if I earn more than that they can tax as well and thier rate is 45%

(Higher than India’s).

So do I need pay the differences of the rates (45-30%) in Denmark ?

3. Will the Income tax returns also get notified or since it is Indian

Govt’s perogative to give money back they would not be notified.

4. Just want to extend second point on Mutual funds as well. If the

tax rate is higher then should the difference be paid ?

How to convert Gold jewellery to cash. Can this be done through banks

I am nri and want to invest sip in India to get better returns

Hi Manoj,

NRIs except from US and Canada can invest in mutual funds in india.NRIs from US and Canada have restrictions and can buy selected mutual funds

is TDS deducted on NRO account refundable if i have just interest income in india and its below 2 lakhs?

Hi gunvin,

Yes you can claim TDS deducted by filing income tax return

What is the investment plan explan me

Hi Hemant.

I enjoy NRI status since 2014 and have a NRE/NRO Account. I changed my job in June last year. Although living abroad, currently my salary is being deposited in India and am paying taxes in India. Can I invest in Post Office or other schemes from which NRI’s are normally not allowed to invest.

Regards

Dear TS Bhullar,

As your status is NRI – you can’t invest in those schemes irrespective of where you receive the salary.

I want loan of rs 3 crore

Dear Manish,

Talk to your bank.

I want to know about best saving plans for nri.

Hi Nikhil,

That will depend on your risk profile & goals. Please consult an advisor.

I am a Australian citizen, having an Overseas citizen of India card. Can I invest in FDs ? What will be the interest I can get ?

Hi Sri,

They can invest in FD through NRE or NRO – interest rate will be similar to other NRIs.

Hello Hemant,

Very clear and helpful information. Can a NRI have more than one NRO accounts in different banks? Thanks

Hi Soli,

There’s no such limit.. based on your requirement.. you can have multiple accounts.

what is the best investment plan for NRI

That depends on your requirement & risk profile.

Which is the best option for a NRI to INVEST in INDIA

Hi Anish,

That depends on your requirement & risk profile.

Hi Hemant,

This article is really good, appreciate your effort.

But you missed, what if already shares/MF/Bonds before becoming NRI.

How it will be treated?

Thanks Saravana – you should check this https://www.wisenri.com/nri-change-residential-status/

Hi Hemant,

I wanted to check if an Investment is made in PMS of a a person who is currently Resident Indian but Status will change in 2 months time to NRI.

He has moved abroad, but his status has not changed yet.

How would the withdrawal be impacted with status changes say after 3 years – Is there a TDS?

What are the tax implications and exit options.

Would be grateful if you can throw some light on this.

Hi Rahul,

NRI cannot invest directly in PMS. They have to route through PIS accounts. That’s the biggest change.

Legally – he cannot receive funds in resident account if he declares as nri.. Either NRO or nre

Since we already know the status change is going to happen, it’s not a good idea open in the Resident Indian. You are not allowed to buy certain stocks as NRI so the client could end up with compliance issues.

Better to wait for status change and then invest.

Check our post on the impact of residential status change https://www.wisenri.com/nri-change-residential-status/

If I’m getting inheritance… the builders want to cut tds on source … my ca is saying I can avoid taxation if I buy property in India and sell it in a year .. is that true

Dear Mahdiya,

There is no Inheritance Tax in India. Thus, when one receive property as “Inheritance”, no TDS will be deducted. On selling of ” Inheritance Property”, there are tax implications and also available option to avoid taxation.

Your CA will be a better person to answer.

Thank you for the periodic informative articles and updates. I believe there is a temporary relief for existing NRI PPF account holders. I presume they can now hold on till Maturity.

Ya Deepak – now NRIs can continue there existing PPF.

1. You have not mentioned about PMS services…..,most relevant.

2. The implications of 10% LTCG tax on equity, and eq. MF may be briefly mentioned.

3. House property sale: The need for the purchaser to deduct tax and deposit with IT – is important to mention, although you have commented on refund.

4. Good advice included: advice on -ve associated with real estate investment.

5. Add a separate section in web-site on taxation in India (and wherever possible, in foreign country of resistance, mainly USA and Canada).

Thanks for your suggestions Mr Seetharama.

Will add PMS. This was just an intro kind of article – will try to write detailed posts on these investments in coming days.

Bw tax section is already in pipeline 🙂

Update section on PPF. NRIs can NOW continue PPF.

Thanks will update.

can NRI from USA invest in Bonds, ETFs, Tax Free Bonds, Corporate FDs ? which MF can they invest and how?

Dear Sanjay,

Thanks for your comment – I am planning to write a detailed post on this will share soon.