Despite the meteoric rise of the equity markets or emergence of Cryptocurrencies as a new “asset class,” real estate remains one of the biggest draws for people with some heft. It may be because of our thousands of years of association with the land as a provider of food, shelter, and security.

Another reason for investing in real estate is the age-old notion, that you would never lose money in real estate. Even if you do not get great returns, you will have a tangible and secure asset as a backup. This notion is cemented with mind-boggling real estate prices and rags-to-riches stories on how someone struck gold with their piece of land.

Must Read – Why Invest in India?

Whatever the reason, Non-resident Indians (NRIs) are also enchanted by the possibilities of investing in real estate. But one trend that is gaining more popularity among Resident Indians as well as NRIs, is their growing inclination to invest in commercial properties rather than residential units, farmhouses, or agricultural land.

In this article let us explore the factors that are fueling this surge, the pitfalls of investing in commercial property in India, and legal and financial considerations an NRI needs to keep in mind.

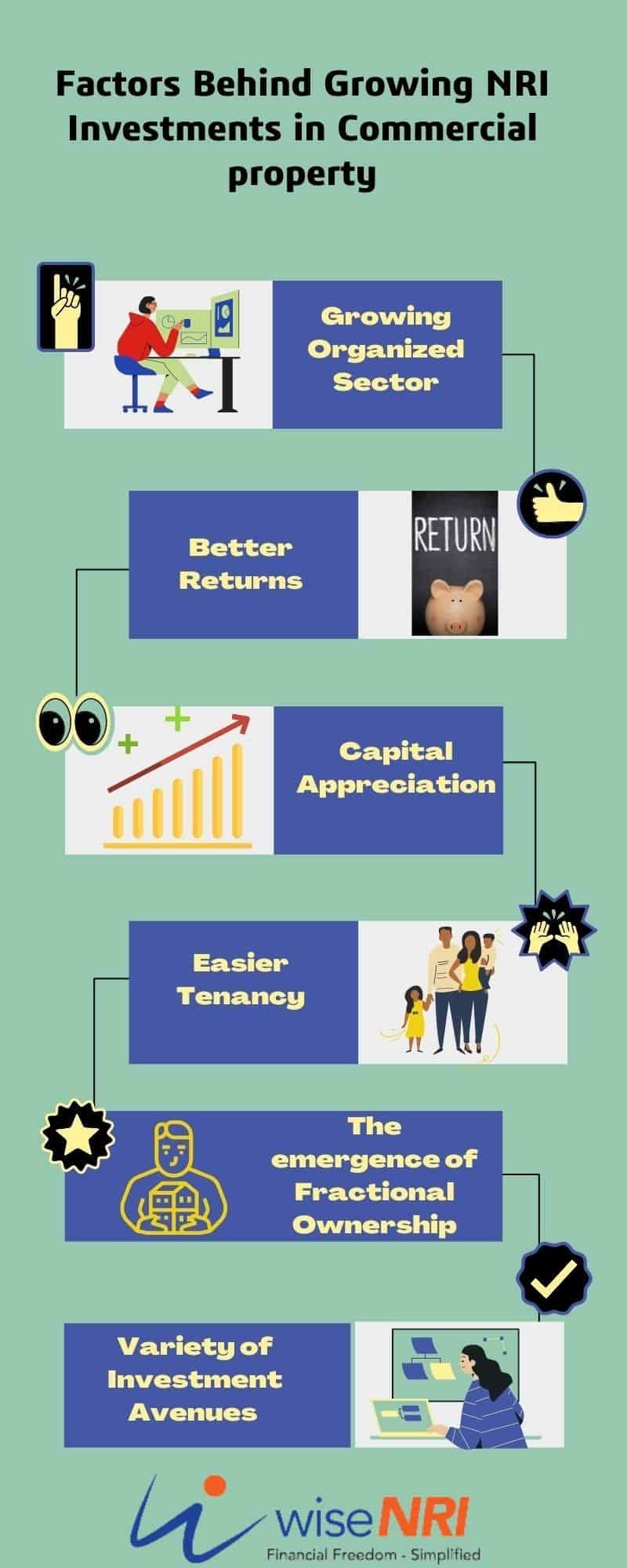

Factors behind Growing NRI Investments in Commercial property

Growing Organized Sector

Investment in prime commercial properties is gaining traction with the growth of organized and corporatized businesses the demand for office space is also growing. The demand for NRI commercial real estate in India is coming from warehouses, training centers, IT back offices, data farms, fulfillment centers, industrial units, and office spaces.

Better Returns

The owners of commercial properties in India, on average, earn 4 to 8 percent more rental income compared to residential units. In fact, except for a few pockets, and except in the aftermath of the COVID-19 restrictions, the rental income of commercial properties automatically increases annually by 5% to 10%.

Must Read – NRI Investment Options in India

Capital Appreciation

Commercial real estate (CRE) is like a dividend-paying growth stock – a hybrid instrument that offers capital appreciation in addition to the monthly rental incomes. Except for a few truly unlucky investments, the value of the underlying property and land continues to appreciate. This is because once a locality becomes popular, everyone would want to have a piece of the prime pie!

Easier Tenancy

The CRE leasing is more formalized and happens through legal channels compared to residential properties. Therefore, it is much easier to get the tenant evicted from a commercial property if the minds do not meet.

The emergence of Fractional Ownership

One other factor that is fueling the growth of such CRE investment by NRIs is the proliferation of fractional ownership platforms. Till a few years back, only the really rich individuals (with net worth upwards of 50 crores) had the purse to invest in the prime commercial properties in metros. For most people, CRE meant buying shops here and there or partnering with some shady developer.

But with the rise of the fractional ownership concept in the CRE market, the doors to the largest and swankiest prime commercial and office are now within reach. Thanks to the startup & tech platforms, properties like Times Square (Andheri, Mumbai), Maker Maxity (BKC, Mumbai), or a Warehouse in Hosur, Tamil Nadu is now open for your investments. They opened the CRE space just like Mutual Funds opened the equity markets for retail investors. Now with as low an investment as Rs. 25 lakhs, you could become a part-owner of these properties and earn from them. If you would like to know more about fractional ownership opportunities available – GET IN TOUCH WITH US.

Variety of Investment Avenues in Commercial real estate in India

Commercial property is not all about swanky office spaces and Grade A buildings with world-class amenities. No doubt that Grade A properties have higher occupancy, better visibility, and impressive tenants. But they also tend to attract more investors spiking their prices and depressing yields.

On the other hand, investments in either Grade B and C properties or Tier II or Tier III cities beyond metros can offer bargain prices and better yields.

Similarly, CRE in the city center would attract more tenants as compared to a warehouse outside the suburbs. But as we all know, all these properties will continue t co-exist and there will be a growing demand for all of them.

Other Factors Favouring NRI investing in commercial property in India

- Depreciating INR against USD and other major currencies gives NRIs an undue advantage.

- Reduction in down payments requirements with easy availability of loans.

- Easing of FEMA regulations, FDI norms, and automatic route investments.

- The increasing contribution of the services sector in the Indian Economy and exports means an insatiable demand for managed CRE.

- A strong regulator in form of RERA (Real Estate Regulatory Authority) to mind the interests of investors in an otherwise lopsided relationship.

- Tax benefits.

Must Check – Investment restrictions for NRIs In India

Major Considerations Of NRI Investing in commercial Real estate in India

Residential vs. Commercial RE

Many steps of the current regime – like demonetization, discouraging cash transactions, the establishment of RERA, and increase vigilance – have created a conducive market for above-board transactions in the real estate market. The residential properties market that was largely driven by cash and black money has now been decimated and is only a shadow of what it was earlier.

This has resulted in a marked shift of interest of NRIs to invest in CRE projects. As most of the tenants are corporates who are audited, all transactions are above board and through proper banking channels.

Regulation

If an NRI wishes to invest in agricultural land, tea or rubber plantations, or farmhouses, then they must seek permission from the RBI. In any other case, NRIs can invest in any property – residential or commercial – directly via the automatic route. There is no cap on the investment in such properties.

Taxation On NRI Investments in Commercial property

Investments in CRE by NRIs are treated at par with RIs. If a property is sold after holding for 2 years or more, then a Long-term Capital Gains (LTCG) tax at 20% is applicable after the indexation benefit. If the property is sold before this period, then a Short-term Capital Gains (STCG) tax is applicable as per your income tax slab. Surcharges and cess, if applicable, are also levied.

If there was a loss on the sale of a commercial property, then it can be carried forward. The loss can be set off against profits from the sale of other properties in the coming financial years.

Must Check – 6 Common Investment Mistakes of NRIs

Repatriation of Proceeds

NRIs can earn two types of proceeds from a commercial property:

- Lease or rental income

- Sale proceeds (at profit/loss)

Repatriation of Lease/Rental Income

Lease payments are only received in the NRO account, and their repatriation will be within the overall limit of USD 1 million per financial year set by the RBI.

Repatriation of Sale Proceeds

Certain restrictions apply to NRIs when they wish to repatriate the sale proceeds of commercial property in India.

- If the property was acquired when they were RIs, or it was inherited, or purchased from the funds in the NRO bank account, then you can repatriate only up to USD 1 million per year.

- If the property was purchased out of the funds in the NRE or the FCNR accounts, then the whole proceeds are repatriable. The amount is only limited to the price paid for acquiring the property, including any major capital expenditure in its renovation, remodeling, or extension.

Note: Sale proceeds of only up to two residential properties can be repatriated in a financial year, even if they were paid from the NRE or FCNR accounts. As this restriction does not apply to commercial properties, it acts as another attraction in their favor.

Check – How can NRIs transfer funds overseas from India?

Things to NRIs Consider Before You Invest in Commercial real estate

Whether you are an RI or an NRI there are many points that you must consider before investing in a CRE. The considerations are far more grave as the ticket size for investment is larger, the investments cannot be liquidated quickly and easily, and the market information or analysis is at best sketchy.

- Legal Title: With a proper legal title, no-dues certificate (bank release), and occupancy certificate from local authorities you can avoid a lot of legal risks. Do not rely only on the information provided by the property owner, brokers, or property platforms in this matter. Always check the legal status independently through a legal counselor.

- Location: The location of the CRE would make all the difference in its rental yields, occupancy, footfalls, accessibility, and price. Many banks may not offer loans on commercial properties at locations with few prospects.

- Amenities and Safety: Parking, common areas, cafeteria, lobby, networking, and lighting are some of the minimum amenities you must look for. Fire and water safety are becoming a must for every CRE and so are drainage and physical security.

Finally

Buying a commercial property is different from residential investments. In the case of the former, there is no emotional value attached. Therefore, you must buy a property only if it fits in your overall investment philosophy, you can take the associated risks, and can block a large part of your investible surplus in an illiquid asset.

Your financial planner can help you in identifying if they fit in your overall plans or at least invest and manage your CRE investments.

If you have any questions regarding real estate – add that in the comment section.

Buying property in India under parent’s name

what is the best way to wrap up a land sale deal?

Good article and thanks for the information

You have stated “If the property is sold before this period (24 Months), then a Short-term Capital Gains (STCG) tax is applicable at the peak tax rate of 30%.”

Seems to be incorrect. Not 30 %, but normal slab rate as applicable to the Assessee.

Thanks – we will check & do the needful.