NRIs Joint Indian account with resident Indian was not possible till 2011. But now Non-Resident Indians can also operate a resident savings bank account in India on an ‘either-or ‘survivor’ basis with a resident – resident can also be a joint holder in an NRO account.

For example, a son who works abroad can open a joint bank account with his mother who is a resident. This bank account would be a residential savings bank or NRO account.

But still, it’s illegal for an NRI to hold a resident savings account as a single holder – there’s a penalty.

Must Check – FCNR with Forward Cover

Can NRI open Joint Account with resident Indian?

Key conditions :

- The joint account can be between a Non-Resident Indian and his/her resident relative. The relative includes – parents, siblings, siblings’ spouses, own spouse, children, spouses of children, grandparents, grandchildren, spouses of grandchildren.

- The accounts will be subjected to all rules and regulations applicable to a resident bank account.

- The bank should keep the relevant documentation in place, record the need for the account and also get a signed declaration from the non-resident account holder indicating that the Non-Resident Indian will not use the cash in violation of FEMA and is responsible for any repercussions in case there is a violation of FEMA.

- The NRI cannot deposit any money in the form of cash, cheque, direct credit, or remittances received in this account.

- Money cannot be transferred outside India, nor can be given as a gift. The funds cannot be transferred to NRE/NRO accounts.

- The resident Indian will be the primary/first account holder in the joint account. The NRI will be the second holder.

- It can be used to facilitate payments in India by the resident holder.

Must Read – What is Australia Superannuation Plan for NRI

NRI can be a joint holder in more than one savings account but only with close relatives. If due to any circumstance, the NRI holder becomes the survivor that savings account shall be categorised as NRO. wiseNRI

NRIs can open other types of accounts in India for transaction purposes. These include NRE, NRO, or FCNR accounts. NRE and NRO accounts can either be savings, or fixed deposit accounts. The FCNR is only a term deposit account.

Here are answers to some commonly asked questions –

How to open an NRI joint Indian account with resident Indian?

Savings, Current, and Fixed Deposit accounts opened by resident individuals can have an NRI who is a close relative as a joint account holder. The account holders should file a declaration of the status of the NRI and submit the necessary documentation as per the bank’s requirements.

NRO Joint account with Resident Indian- is it possible?

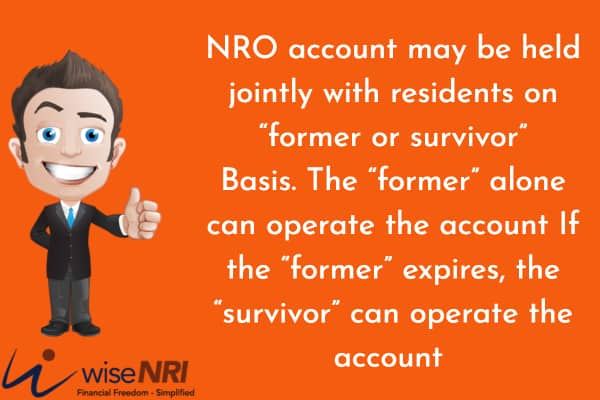

Yes, the NRO account can be jointly held with resident Indians – but this account can’t be “either or survivor” – it should compulsorily be “former or survivor”.

Must Check – NRI Save For Early Retirement

Can an NRI open a resident savings account?

NRIs cannot open resident accounts. After their status changes to ‘NRI, they have to close the resident accounts. They can open and operate any of the following accounts –

- Non-Resident Rupee (NRE )

- Foreign Currency Non-resident (FCNR )

- Non-Resident Ordinary Rupee Scheme (NRO ) and

- Special Non-resident Rupee (SNRR) (for business)

- NRIs can operate resident bank accounts on an “either-or survivor” basis with a resident Indian.

Read – Change in Residential Status

How to convert resident Indian account to NRI account?

A resident savings bank account can be converted to an NRO account. The steps are as follows –

- Inform the bank that your residency status will be changed.

- Get and complete form for conversion of resident account to NRO account.

- Get documentation required such as KYC, Visa permit, passport, etc in place

- Submit all relevant documentation.

- Bank will verify the details and if approved will redesignate the status of the resident account to an NRO account

How to convert NRI account to resident account?

The NRI has to file a declaration stating that he is returning back to India and would be a resident Indian. The declaration should ask for re-designation of the NRO account to the Resident Savings account and be submitted to the local branch of the bank.

If you have any questions or if you would like to share your experience with other readers – please add them in the comment section.

Can my friend local and i as a foreigner can open a joint account under probate?

I have joint FD with my grand daughter who is us citizen She is primary holder I either or survivorNow I want to withdraw FD , how can I do it she is unable to come to India due to her medical study

Hi Komal,

You should be able to withdraw the FD without her physical presence. However, you will need to follow the bank’s specific procedures for such withdrawals. and you should have the written consent of your granddaughter regarding this.

Can one convert jointly held Indian resident savings account to NRO account with same joint holder name.

Hi Ambrish,

Yes, it is generally possible to convert a jointly held Indian resident savings account to an NRO account with the same joint holders’ names when one or more of the account holders become NRIs.

We are returned from Gulf after 40 years, can we operate NRE account with our son who is working in Gulf (UAE) still.

Hii Victor Pereira,

If you have returned to India after spending 40 years abroad, you might no longer be classified as an NRI, and thus, you might not be eligible to operate an NRE account. NRIs are generally those who have spent less than 182 days in India in a financial year.

Hi Victor Pereira,

Yes, you can operate an NRE account jointly with your son who is working in the UAE. Joint NRE accounts can be held with close relatives. However, ensure to follow the bank’s guidelines for joint account holders and provide necessary documentation.

Whether Resident SB Account jointly held by husband and wife could be continued even if one amoung them becoming aNRI as a Resident account

Hi Nageswaran,

When one of the account holders becomes an NRI, the joint savings bank account will be converted into an NRO account and certain banking operations and transactions that were allowed in a resident account may be restricted or subject to specific rules applicable to NRO accounts.

Hi Nageswaran,

When one account holder becomes an NRI, the joint account may need to be converted to an NRO account or another appropriate type of account based on the bank’s policies.

Can a nri become joint account holder with resident mother as secondary holder to operate her account

Hi John,

No, NRIs are not permitted to be joint account holders with resident individuals for any type of bank account, including savings accounts, current accounts, fixed deposits, etc..

Hi John,

Yes, an NRI can become a joint account holder with a resident mother as the secondary holder to operate her account. Many banks and financial institutions allow such arrangements.

Can NRI open fixed deposit with Indian Citizen

Hi Kushal,

NRIs are not allowed to open fixed deposits jointly with Indian citizens.

Hi Kushal,

Yes, you might be able to open a joint FD account where one account holder is an NRI and the other is an Indian citizen.

My sister is currently residing in luxembourg and we arr selling property in bangalore.. Can she get her dd to indian savings account?

Hi Manjunatha

As per my knowledge your sister, being an NRI residing in Luxembourg, should be able to repatriate the proceeds from the sale of property in Bangalore to her Indian savings account.

Im an OCI Card Holder, stayed here for more than 180 days…I dont have a PAN/AADHAR Card…Can I Open a Bank Account

Hi Kisor,

Overseas Citizen of India (OCI) cardholders who have stayed in India for more than 180 days in the preceding financial year are generally eligible to open a bank account in India. However, the specific requirements and documentation needed may vary between banks and their internal policies.

While a PAN (Permanent Account Number) card and Aadhaar card are commonly requested for account opening in India, it’s important to note that they are not mandatory for OCI cardholders. As an alternative, other identification documents such as the OCI card itself, a valid foreign passport, and proof of address may be accepted by banks for opening an account.

To obtain the most accurate and up-to-date information regarding the specific requirements and documentation needed to open a bank account as an OCI cardholder in India, it is recommended to contact the bank directly or visit their official website. They will be able to provide you with the specific details and guide you through the account opening process based on their policies and procedures.

can nri account be opened without a 2nd holder?

Hi Abhishek

Kindly elaborate your question?

Can I join in my demat account in third name who is NRI

Hi Karan

kindly Elaborate your question?

I am having a joint account with my son,who is us citizen.Can I transfer money from this account to my us citizen son?

Hi Mithilesh

It is recommended to consult with your bank and a qualified financial advisor who can guide you through the process and provide you with the most up-to-date information based on the current regulations and requirements.

I am an NRI for last 16 years. but will be resident from 1 ap 2023 onwardsI have many Fixed Deposts in my Name which will mautre in Sept 2025.Will the interest accrued from Ap 2023 to sept 2025 be tax free in india till the maturity

Hi R C Chawla

As an NRI returning to India and becoming a resident from April 1, 2023 onwards, your tax liability in India will change. As a resident, you will be subject to tax on your global income, including the interest earned on your fixed deposits in India.

Typically, interest income from fixed deposits is taxable in India, regardless of the residential status of the individual. Therefore, the interest accrued on your fixed deposits from April 2023 to September 2025 will be taxable in India.

How can a nri joint account holder do kyc

Hi Rubynomics,

As an NRI joint account holder, you can complete the Know Your Customer (KYC) requirements by following these general steps:

Contact your bank: Reach out to your bank where you hold the joint account and inform them about your NRI status. They will provide you with the specific KYC requirements and procedures applicable to NRI joint account holders.

Gather necessary documents: Typically, the required documents for NRI KYC verification include:

Passport: Submit a copy of your valid passport containing the relevant pages with personal details and visa/immigration stamps.

Proof of NRI status: Provide supporting documents that establish your NRI status, such as your employment visa, work permit, OCI/PIO card, or any other relevant document.

Proof of address: Submit a document that verifies your current overseas residential address, such as a utility bill, bank statement, or government-issued ID containing your address.

Submit the documents: Provide the required documents to the bank for verification. Depending on the bank’s procedures, you may need to visit a branch in person or submit the documents online through their designated channels.

In-person verification: In some cases, the bank may require an in-person verification process. This could involve visiting a branch or arranging for a representative from the bank to verify your identity and documents.

Can my daughter open a bank account in kolkata

Hi Diptisri,

Kindly elaborate your question?

Can i join my wife in my NRO account

Hi Arvind,

Yes, it is generally possible for a spouse to join an NRE joint account. NRE (Non-Resident External) accounts are specifically designed for Non-Resident Indians (NRIs) to hold and manage their foreign income in India. These accounts can be opened by NRIs in their own name or jointly with another NRI.

What mandate can be in nre joint account

I am resident Indian.My minor grandson is us citizen.I want open a saving bank account jointly in our names

Hi ,

Yes, you can open a joint savings bank account with your minor grandson who is a US citizen

can a NRI (Husband and wife) open a joint account in India in canara bank ?

Hii ,

Viswanathan

Yes, a joint account can be opened with a Resident Indian who is a close relative.

Can an OCI hold an account with a resident Indian as a second holder? The primary or main account holder is a Resident Indian National.

Can I open my NRI account with my friend?

Hi Mohan,

No, you can’t open an NRI account with your friend

I would prefer an email reply

I am a resident of India. I have a savings account in Indian bank. My husband is a sailor and has NRE account. Can my husband be a joint holder in my savings account.

Hi Shailla,

Yes, he can be a join holder in your saving account.

Hi Shailla,

Yes, he can be joint holder.

Question regarding nre account

Can i open a joint account here in india with my friend who’s from usa?

Hi Adella,

Yes you can.

I am an OCI card holder and have Canadian passport. I have joint savings account with my parents as a secondary account holder. They operate those accounts, my name is only there. I dont do any transactions. When they opened those accounts, i was an indian citizen. My kyc still have indian information. Can I still keep my name on those accounts ? Will it be a problem if i update my kyc with Canadian documents?

Hi Sheena,

You should change your kyc status from resident to NRI. you can keep those account as you are second holder. But for the investment you should change your kyc status.

Thanks Bobby for your reply. What did you mean by ‘For the investment’? I don’t have any personal investment or savings accounts in india. These are all my parents accounts .only my name is there as a joint account holder.

Have a joint a/c with my son who will now move abroad. He is the primary a/c holder

Can NRI person have joint account with his Indian cousins or uncle/aunts?

Hi Prasad,

Yes he can.

I am a non resident Indian holding a saving account with my 2 brothers. I am not the primary account holder do i have to update the kyc or only the primary account holder requires kyc update?

Hi Sam

All account holders need to update KYC.

If husband is in abroad can a wife open joint account with him

Hi Sonam

Yes you can

I am a Us citizen with an OCI card. My four siblings are also in US. My mom passed away 4.5 years ago and my dad passed away 3 months ago. They have many bank accounts….how do I start the process of consolidating the bank accounts and getting them to closure?

Hi Nazeer,

You will have to get in touch with bank regarding that.

Which form I need to fill for withdraw entire pf if I am going to abroad

Hi Sarbjeet,

You need to fill the form 31 UAN to withdraw entire PF amount.

My son was an employee in a software company for 2 years. He resigned. For his higher studies, he had been to abroad. After 6 months of resignation, he wants to withdraw the epf accumulations.

Hi T S Rao,

Yes your son can withdraw the full amount from EPF

I have returned back after being NRI for more than 20 years continuously and qualify for RNOR status. What will be my tax status in the coming years?

Hi Santosh,

You can keep your RNOR status for upto 3 years after your return. Any income earned in India would be taxable and that earned abroad, will not be taxable.

I am an oci and my mother is having a resident account in India she wants me to be added to his resident account as a secondry is it possible ? if possible what are all the documents required?

Hi Murlii,

Yes it is possible.

How to convert joint SBI SB ac to Joint NRO account

Hi Rao,

You can consult with your bank.

I am resident Indian. My daughter is NRI. Recently we opened NRO account In India where I am a second holder. is it ok?

Hi Grish,

Yes, you can be a second holder.

NRI account jointly held with the resident. Now nri is no more. First account holder is NRI second is resident. Now NRI IS NO MORE. Whether the second account holder can operate this account

I learn that I living in India can open saving account and have my daughter who lives abroad be ajoint acct holder. If yes what is the tax liability

Ya, she can be a joint holder, and tax liability is based on slab rate.

Nri selling property jointly owned by resident indian along with relative nri

Hii Janthkar

As per my knowledge NRI and resident Indian can sell the property jointly.

I m Australian citizen my partner from india but we are not married i want open joint account India

Hii Mr. Sunny

As per my knowledge, savings, current, and fixed deposit account opened by resident individuals can have an NRI who is a close relative as a joint account holder.

we have a joint account in bank of baroda with NRE deosite account and NRE deposit both are NRE and account wich either or survival. now Bank of Baroda Rajkot branch is not giving satisfaction. what is a right way if i get signed of my brother who has joint account with me. he is in abroad and i am here on visa and bank is not supporting satisfactory support. what is right thing

I am NRI and my mother is Indian resident. We have couple of joint FDRs will there be a problem if something happens to her?

Hi Sakshi,

There will be no problem, the amount will easily transfer to your NRO account.

I am in aid on a student visa I want to open my joint account with my husband he is in India now

Hi Anchal,

Yes, you can open a joint account.

I am on green card in USA. I have S. B. a/c in India. I want to open NRO a/c in India. Can I open more than one NRO a/c in different banks in India ?

Hi Amarsingh,

Yes, you can.

Whether a NRI can open a NRE FD account jointly with his wife who is a resident?

Hi Kalyanasundaram,

As per my Knowledge, Yes you can.

I have joint saving resident accounts with my father in India. But my father died recently. What should I do now?

My wife and me are holders of joint d mat account my died my only son is us passport holder can we open a new account me and him as holders

Hi Baldev,

Yes, You can Open it.

Can an oci have savings account with a brother in india

Hi Ajay,

As per my knowledge, Yes You can.

I want to open joint account with my wife she is nri and i am from India.

Hi Sukh,

As per my Knowledge, Yes You can Open a Joint account.

i am an NRI for last 15 years. I have SB joint account with my wife (wife is not NRE) for around 8years. the SB joint account is either or survivor type. we have FD in this account and the interest is credited to the joint account. The interest is used for the family maintenance expenses. Either me or my wife take the interest credited in the joint account. My Pan card and Wife’s Pan card are provided for this joint account.

Even though the bank know that I am an NRI, it is not recorded in the bank that i am an NRI. Bank did not mention about the FEMA violation too.

My wife has Demat account too for mutual funds.

Now I plan to open and FD account with my NRE account. To open an FD in my NRE bank account, they ask PAN card. If I open and FD in my NRE account, would that make any problem as the PAN CARD is already provide in the SB either or survivor joint account? is it a FEMA violation? If there is any problem to hold the SB joint account , how can I close that account by making only my wife is the only account holder? Thank you.

My Mom is holding shares in her resident Demat account of which I am the only nominee and would like to know would I be able to obtain her shares in case of her unfortunate demise.

Hi Chris,

As per my knowledge, You need to consult your depository for the process.

I want to know if I as a foreigner can open a joint account with my Indian husband In India?

Hi Ferina,

Yes, you can.

Which bank I will be open a joint account with my NRI wife?

I have a joint NRI savings/passbook account with my brother. My brother has signed a letter agreeing the entirety of the money is mine. I want to unlock the account and I want to transfer the money into an NRE account. How do I do this?

I have a joint account in a Kolkata bank with my son. My son went to Sweden in 2007 and now has citizenship there and an OCI card also. Can we continue the account?

Hi Ranendra,

As per my Knowledge, You just need to Inform the Bank Regarding the Status Change.

Who can deposit money in this account?

the bank opened a joint account NRE with an Indian resident in 2001. was this in violation of FEMA if yes who is at fault bank or NRE. What are the consequences under FEMA?

Hi Ashwani,

As per my knowledge, NRI can open a Joint account with a Resident who is a close Relative.

Can I continue to hold a joint resident account with my spouse after becoming non-resident?

Hi Suresh,

You need to inform the Bank about your Status Change.

What’s the best way to collect rent money overseas from India?

Hi Balwinder,

As per my knowledge, You can take the Rental Income on Your NRO Account.

I bought equity shares jointly with my one friend long back. Now I want to open a Demat account but my friend is now settled outside the country. He doesn’t have a pan card and adhar an Indian Passport. Then how can I open a Demat account jointly with my friend

Hi Prashant,

As per my Knowledge, PAN Card is mandatory for making any Investments in India.

I am just reading up this blog that says an NRI can hold a joint account with a resident. I have been an account holder with my father at an Indian bank since I was on a student visa in the USA (from the late 2000s) in 2016 Dec, I became a perm. a resident of the USA, and still have the same joint account.. did not make any modifications… is it all okay?

Hi Souro,

As per my knowledge, You need to inform your bank regarding the same.

My mama (mother’s brother)is Indian resident expired he has a joint account with her wife, now his only son is a USA citizen, how inherent with this bank account and a DEMAT account

Hi Mukesh,

As per my knowledge, You need to submit the Death Certificate to the bank.

Hello,

If I am an NRI and open a joint account with my grandmother who lives in India where she deposits money, upon her death, will I be able to automatically operate the account and transfer the money to the EU? Is there a limit on how much I can transfer?

The purpose is to avoid a higher gift tax in the EU while the donor is alive, where as an inheritance is taxed lower.

Thank you

can I make a joint account online?

Documents needed for a joint account for NRI with Indian resident mother.

Hi Balabasqer,

You should consult with your bank for the documents.

If I hold an account in India am moving out of the country should I change the account?

Hi Sanjay,

After being an NRI its illegal to have resident saving account. so you should open NRO or NRE account.

Can we open an NRO account only?

Hi George,

Yes you can.

If I am RNOR having joint account with my wife in foreign bank with my income alone . My wife is resident , will she be taxes on income generated?

Hi Vikrant,

No she doesn’t need to pay tax.

Thanks and how can I get to speak you for advisory services

I am a US citizen, and my wife lives in India. Can she open up the joint saving account with me in India without my presence? What are the documentation needed from my side?

Yes, she can open a saving account without your presence. she can consult with the bank officer for required documents.

I am US citizen can I join the saving bank account of my brother? And become a joint holder on my brothers account?

Hi Kamlesh,

Yes you can.

Thank you. Will I be having NRE or NRO account?

Can I be a joint holder of my husband’s salary account in Australia, I am working and taxable in India. Please confirm.

Hi,

As per my knowledge, Yes you can be a joint holder of your husband’s salary account.

My daughter, after graduating in USA has joined for employment in Houston now. What type of account can be opened in India. My purpose is that she should be able to remit money into this account for repayment of her educational loan. I should be able to operate the account for her at India.

Hi Abhay,

As per my knowledge, you can open an NRO account jointly with your Daughter in that way you will be able to operate it as well, and the money can be used to pay the education loan.

Me and my husband have a joint account in Indian bank shall we do online transaction ?

Hi, Sharmila

Yes, you can do online transactions if online banking is active for the respective account.

Hi,pls guide on the following:

My wife has become an NRI for this FY and I am resident indian.

1. We have a joint home loan account. The EMI’s are being jointly paid.

2. My wife has tax saving FD (05 yr locking)maturing 2023.

Now, how to convert her accounts onto NRO ?

Pls advice

Thanks you

Hey Shitiz,

Bank prescribes the specific form for changing the account. It can be obtained from the bank website.

My wife is foreigner and not citizen of India and I am Indian resident and we both are living in Delhi… I have to open a joint account for Australian visa purpose… How to open joint account with foreigner wife?

Hi Ali,

As per my knowledge, you can easily open the Joint account(Nre) via online or offline mode through the bank.

I have a joint account in icici under me and my husband’s name but we living in Newzealand. How can we close our account or run?

Hi Sapna,

As per my knowledge, If you want to continue the account you can ask the bank to convert it into the NRO account.

Hi, I’m a Singapore citizen staying in Singapore. My girlfriend is staying in India. She is born there. Can I open a bank joint account with her?

Hi Sundaram,

As per my knowledge, you can only open a joint account with a close relative.

I have not converted my resident account yet, i have few fixed deposites in it. If i open a joint saving account , can i have fd’s on my name in that account?

Hi Reshu,

As per my knowledge, yes it is possible if you would open a Joint NRO account with a resident.

hi, I have joint savings account with my mother since 2012, in the year 2016 I became NRI working for cruise ships sailing outside India. normally my assignment is around 8 months outside India. is it legal to send my salary in that account? as I don’t have any other NRE/NRO account. also if it is legal to make an investment from my savings in the above mentioned joint account like fixed deposits or government-backed investment schemes.

Hi Prasoon,

As per my knowledge, it is advisable to have an NRO/NRE for the purpose of investment if you are an NRI.

I am NRI, I have a joint resident account with my mother who is resident and the first holder of the account, can I use this account for PPF?

Hi Sanjay,

As per my Knowledge, An NRI cannot open a PPF account, However, you can open the PPF account on your Mother’s name.

I am NRI and my child is now 18 yrs and will be in India for higher studies. Do I need to open a savings resident account or nro joint account with the resident?

Hi Sanjay,

As per my knowledge, It’s better to open an NRO account for the same.

can I open a joint account with my father in India through online?

Hi Sony,

Yes, You can open a joint account by applying online.

What is the procedure for opening an NRE joint account with my wife?

Hi Naveen,

As per my knowledge, You have to apply in the respective bank through online or offline mode with the required documents.

I am having a resident savings account. Can I add my NRI son as a joint account holder?

Hi Mithilesh,

As per my knowledge, An NRI can be a joint holder with a resident Indian but only on a former or survivor basis.

I am an NRI but my wife is not… we have a joint NRO account. The bank says my wife cannot operate the same since she is not an NRI. is this true?

Hi Debasish,

As per my knowledge, Your wife cannot Operate the joint account as it is on “former or survivor” basis.

I have normal joint saving acct with my son who is NRI in canada . Can he deposite money in this acct from his NRO acct. Can this money be then gifted fo him & transfered to his bank in canada

Hi Baldev,

As per my knowledge, you can transfer the amount from the NRO account to saving account. The transfer of the Amount should be done accordingly as mentioned in gift taxation rule.

If resident go to foreign country & have saving bank as resident. But did not come to india after 2 to 3 years. Then what position of the saving bank a/c also not in position to inform bank.

Hi Vipan,

As per my knowledge, it is mandatory to inform the bank in case of resident status changed otherwise the account will be penalized.

my friend’s son goes to Europe in the study. his son have joint saving a/c with their parent & has FDs whose interest is below rs 50000.

my friends filling return of his son as resident status, but income is only interest on fixed deposit is below Rs.50 thousand, advise me to say what to do for the year 2020 as their son’s income from only interest income is below Rs.50.000/- is it necessary to file ITR for the year 2020 as basic limit is for NRI is Rs.2,50,000/- by changing in ITR profile as NRI. he should not file ITR for the year 2020. Is not filling is penality for NRI.

Hi Somya,

As per my knowledge, there is no penalty for the same but it is advisable to file the return.

Can I open a joint account without another person?

Hi Rose,

As per my knowledge, no you can’t.

my question is that I do have one NRI account and I am planning to close it and apply it to some other bank?

Hi Mujeebuddin,

Yes, You can.

I am working in abroad and I don’t have an account in India I want open NRI account what to do presently I am in India.

Hi Syed,

You can visit any bank nearby in which you want to open an account or directly call the customer support of the bank. You need to give certain documents and your account will be open.

Hi I want joint account open in India with my wife is this possible or not because am in abroad

Hi Manpreet

As per my knowledge it would be quite difficult as you both are not present. Its better to talk to customer support of the bank in which you want to open.

Hi Raj,

Yes, it is chargeable to tax. And For avoid tax liability , consult with CA

I have been NRI for the past 20 years. in this period, my father and wife also were with me in Foreign. They both had their individual earning here. However, for the sake of convivence, we had one bank account in my name and all such balances were transferred to India and most of them maintained as FDR. Now when I come back to India for good, will interest of deposits fully charged to me? will I able to avoid tax liability?

Kya mai joint ac kholsakta noon kya document chahiye galf ka aur India ka

Hi Sayad,

Consult with your Bank.

How I can join my kotak mahendra bank nri

Hi Ladup,

Consult with Kotak Bank

Can I get refund LTCG

Hi Chandni,

No, It cannot be refunded but it will be exempted through different investment options.

Can an NRI and Resident Individual be joint holders in demat account.

Hi Jignesh,

Yes, NRIs and resident individual can be joint holders in Demat account

Hi, your post is very knowlegable. is their any RBI circulars or FEMA circular which u can provide as reference. Kindly provide guidelines for resident savings account of NRI with a resident Indian.

Thanks Karan for appreciating 🙂

You can search circular on RBI site.

I’m an NRI with having rent income which is being transferred to the wife’s savings account. What will be a tax liability?

Hi Leo,

Consult with your CA

Can an NRI open joint savings account with his spouse?

Hi Leo,

Yes, you can.

Can we remove one of the account holder if there is joint account and i am the primary account holder

Hi Saurav,

Some banks allow the primary account holder to make changes autonomously, but most require the consent of both parties.

More details about KYC COMPLIANCE!!!

Can an NRI son have a single joint resident savings account with his father and mother?

Hi Jitendra,

Yes, he can.

an my mother open bank account as primary holder with me(as NRI). and if yes then i can open PPF in name of my mother. where i will contribute.

Hi Avishek,

The resident Indian will be the primary holder in the joint account. The NRI will be the second holder.

Can NRI primary account holder be removed and account to be continued with secondary account holder alone?

Hi Pradeep,

Usually, the joint account is on a “former or survivor” basis. In this case, the “former” alone can operate the account. If the “former” expires, the “survivor” can operate the account.

I am NRI and hold OCI. I have a NRE/NRO account. My mother is very old. Can I open a joint account with my mother. She is an Indian resident. Her money will be in that account. I just want to operate it to transfer money in Indian payments when she is sick

Hi Urmila,

Yes, you can open a joint account with your mother.

I have come to usa for my son medical visa and my question is can i open a joint account in india without my presence and the other person currently residing in india open the joint account for us

Hi Aadil,

As per my knowledge, your presence will not important.

If i have saving account & NRE account in india in different banks & i investing in mutual funds already by saving account ??i have any problem in future..??but saving account all money i transfer by NRE account.Please advise me.

can i open a NRE account jointly with a resident indian?

Hi Alok,

Yes, you can.

I am resident in Australia and I have a joint NRO account with my brother who also lives in Australia. Can I add as another joint holder my other brother who is resident in India on this NRO account?

Hi John,

Yes, you can

Can three members share a single NRI account? My and my husband is in abroad.can me, my husband and my mother in law can share a single NRI account?

Hi Kirti,

Yes, you all three can share a single NRI account.

Can I open a joint account with my fiance who is a resident in India. I am a permanent resident of NZ? We are not married yet. Thanks

Hi. Gerald,

As you are a permanent resident, you need to consult to your banker regarding this.

I am an NRI and also my husband. I have an NRE Account in a Bank and wants to add my husband to make it a joint account

Hi. Maria,

You can’t add your husband in the existing account.

But you can open a new bank account as a joint status.

My father and my son held a savings account. My son is now an NRI. My father is dead and my son is only survivor for that account. There is only 500 rs in it. Bank goes on deleting 15 rs quarterly as sms charges. What will happen when the balance is zero and still account is not closed??

Hi Hitendra,

They will keep adding the charges so if possible you can close this account.

I am an nri, and transferring my salary to indian resident account of mine. what will be the repercussions?

Hi Raj,

Whether salary directly received in an Indian bank account by an NRI for receives rendered outside India has been a matter of frequent litigation. In these cases, usually, the view has been that such salary is not taxable in India since the services have not been rendered in India, and funds have been merely remitted to an Indian bank account. However, in some cases, such income is taxed in India based upon the fact that it was first received in India. It is recommended that you receive the salary locally where you are employed and then remit it as required by you. Otherwise, you may have to report it in tax returns in both the countries and take credit of taxes paid in the country where you are resident for tax paid outside based upon double tax avoidance agreement between the two countries.

And for further knowledge, consult with your financial planner.

My dad is an nri and wants to open an nri account and wants me to be joint account holder with him. But I am not an nri. So can he open the account

Hi PS,

Yes, he can open NRI joint account with you.

Mujhe account kholna hai

I moved to NRI status and I have rental income in Kerala. Can I deposit it to my joint account with my mother or to my NRO account only?

Hi Subin,

Rental income in Kerala can be deposited only in NRO Accounts.

Hi .i am living in Dubai and working there as cabin crew .but now am in India and I want to open an joint nri account .what documents the bank may ask ?

Hi Pravinder,

For documents, it’s better you should check bank website

How about opening joint DEMAT account where first owner is NRI and second owner is RI and vice versa? This is just to convert pre-existing paper based shares into DEMAT form and eventually sell them off.

Dear Sougata,

My understanding is even joint holder in demat should be an NRI – I will suggest you to check with your broker.

I have a house at Ernakulam and wanted to rent it to a Govt Staff, whose rent is paid by Govt via DD in my name. Can I deposit that DD in to my joint account with my mother?

Hi Subin,

Yes, you can deposit DD in your joint account.

Can I convert my joint account to nri account as my spouse is working aboard? What are the KYC I need to submit?

Hi Sumit,

Yes, you can redesignate your joint saving account to NRO account if your wife status is NRI as NRO account allows joint holding with a resident relative. Regarding KYC its better you should check bank website.

I am an NRI and my Wife was NRI when account was opened…now she is resident Indian, is it legal

Hi Savio,

As per law, NRE account cannot be held jointly by NRI and resident relative.You have to intimate your bank regarding your wife status

My son is a NRI and we parents are NRI too, but we parents will be returning to India. Wanted to know if we three can be a joint NRE account holder even after we parents return to India. Son will continue to work abroad

Hi john,

Only 2 NRIs can become joint holders of NRE Account. You three cant be joint holders of NRE account

When my NRI son inherits our house, and he disposes off by Will, how can he take this funds to USA? He accepts cheque as payments which he needs to take home.Can he use services like Western Money to take money home?

Hi Hirendra,

Definitely online money transfers such as western money transfers are faster and cheaper mode of transferring money abroad.As per RBI guideline, there is a per person per year limit of $250000 or its equivalent in indian rupees on transfers.