As an NRI, you can invest in mutual fund schemes in India but you have to pay taxes on Mutual Fund.

You have to pay tax on mutual funds in India based on certain criteria, Keep in mind that tax implications are different for NRIs as compared to Resident Indians.

In this post we are talking about the NRI mutual funds tax in India that you have to pay in India – you should remember that you may also have to pay tax in the country where you are staying right now.

Must Read – Mutual Funds in India for NRI

NRI Mutual Fund Tax in India

You Can Check in this post

- NRI Equity Mutual Fund Tax for NRI

- NRI Debt Mutual Fund Taxation

- TDS for NRIs on Mutual Funds in India

- Provisions of Set-Off for NRIs

- Few more important points for NRIs

Let us look at the different types of MF schemes and the tax liability of NRI investors on those –

NRI Equity Mutual Fund Taxation India

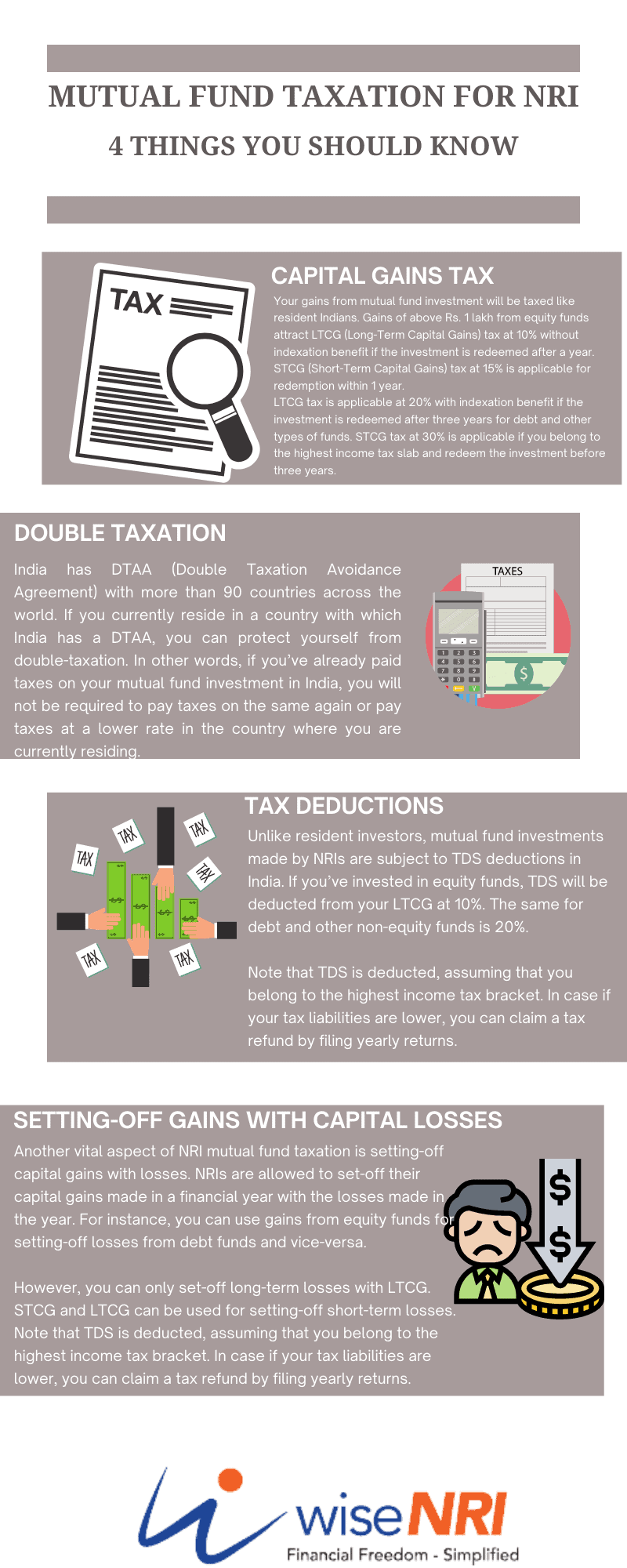

These are funds that have at least 65% invested in equity assets. You can make either short-term gains or long-term gains. If the holding period is more than one year, then the gains you make are long-term gains. If the holding period is less than one year, then gains are considered as short-term gains.

| Taxes on Short-Term Gains | 15% of the gains is payable. |

| Taxes on Long-Term Gains | Gains up to Rs. 1,00,000 per year are exempt from tax. Gains over and above that are subject to 10% tax. (without Indexation) |

Must Check –How NRIs can complete KYC for investing in Mutual Funds in India?

NRI Debt taxation in mutual funds in India

Non-Equity Funds (Debt Funds, Gold Funds, International Funds (including equity), Fund of Funds)

The majority of the portfolio of non-equity funds are invested in assets other than equity-like Government Bonds, deposits, gold, etc. If the holding period is more than three years, then the gains you make are long-term gains. If the holding period is less than three years, then gains are considered as short-term gains.

| Tax on Short-Term Gains | Based on your tax slab (TDS 30%) |

| Tax on Long-Term Gains | Listed Mutual Funds – 20% applicable (with indexation)

Unlisted Mutual Funds – 10% applicable (without indexation) |

NRI – Taxation on Fixed Maturity Plans (FMPs)

FMPs are closed-end debt funds & they are listed on the stock exchange. They have a fixed maturity period – if you want to exit before maturity you have to sell on the stock exchange. They are not available for subscription on a continuous basis.

FMPs typically invest in debt instruments like Corporate Bonds, Certificates of deposits (CDs), money market instruments, and other commercial papers.

The fund manager allocates money in instruments that typically match the duration of the scheme.

| Taxes on Short-Term Gains | If the FMP matures in less than 3 years, tax is applicable as per the income tax slab of the individual. |

| Taxes on Long-Term Gains | 20% with indexation |

Indexation – The purchase cost adjusted for inflation

Must Read –FCNR Deposit with Forward Cover

Other Charges Applicable

Health and Education Cess @ 4% will be applicable on the aggregate of tax.

Securities Transaction Tax of 0.001% is applicable to purchasers and sellers of Equity Mutual Funds.

Read – Tax Rates for NRIs on Indian Income

TDS for NRI in Mutual Fund

TDS is applicable for NRIs on Mutual Fund Redemption. The rate depends on the type of scheme and the holding period.

| TDS On Short-Term Gains | Equity MFs – 15%

Non-Equity MFs – 30% |

| TDS On Long-Term Gains | Equity MFs – 10%

Non-Equity MFs (Listed) – 20% with Indexation Non-Equity MFs (Unlisted) – 10% without Indexation |

The TDS is charged at the highest applicable rate. If the NRI falls in a lower tax slab, he is eligible for a refund when he files his returns.

Check – Portfolio Investment Scheme NRI

NRI Capital Gains Tax On Mutual Fund in India – Example

Let us look at some examples to understand the taxation structure better –

| Transaction Details | Purchase Price | Sale Price | Type of Gain | Capital Gains | Tax Payable |

| Equity Fund was purchased in January 2021 and sold in August 2021 | Rs. 2,00,000 | Rs. 2,07,000 | Short Term

|

Rs. 7,000 | 15.6% of Rs. 7,000 = Rs. 1,092 |

|

Equity Fund was purchased in January 2018 and sold in August 2021 |

Rs. 2,00,000 | Rs. 2,35,000 | Long Term | Zero ( Below Rs 100,000 Capital gains are exempt from Tax) | Rs 0 |

| Debt Fund purchased in January 2021 and sold in August 2021 | Rs. 2,00,000 | Rs. 2,05,000 | Short Term | Rs. 5,000 | 30% of Rs. 5,000 = Rs. 1500

(assuming the investor is in the highest tax bracket) |

| Debt Fund purchased in January 2018 and sold in August 2021

(CII of 2020-21 = 317

|

Rs. 2,00,000 | Rs. 2,50,000 | Long Term | Rs. 20,000

Indexed Gain (250000-233000=17000 |

20% of Rs. 17,000 = Rs. 3400

|

| FMP subscribed to in January 2018 and maturity is in July 2021

(CII of 2017-18 = 272 (CII of 2020-21= 301 |

Rs. 2,00,000 | Rs. 2,25,000 | Long Term | Rs. 25,000

Indexed Gains = 4530 (Rs. 225,000-Rs. 2,20,470) |

20% of Rs. 4530 = Rs. 906

(Savings of Rs. 4094 (5000-906))

|

Check – NRI tax in India New Rule

Provisions of Set-Off for NRIs

- Short-term capital losses can be set off against short-term loss or against the long-term loss

- Long-term losses against only long-term gains to reduce tax liability.

- NRIs can carry forward losses for 8 years but for this, they have to file the tax return.

- Set off of Mutual Fund capital gain against basic tax exemption limit of Rs 2.5 Lakh

- Equity Mutual Funds

- Short-Term – Not Available to NRIs

- Long Term – Only 1 Lakh exemption limit is Available

- Debt Mutual Funds

- Short-Term – PERMITTED to NRIs

- Long-Term – Not Available to NRIs

- Equity Mutual Funds

- Sec 80 C Deduction – Only in the case of Short-term Gains in debt mutual funds – you can also reduce your tax liability by investing in PPF, ELSS, etc.

NRIs income tax liability may not be over by paying tax in India. You may have to pay the additional tax in your country of residence. You may get credit for taxes paid in India based on DTAA. wiseNRI

Important Points to Note for NRIs

- You can get the capital Gains statement from the Mutual Fund or from either Registrar and Transfer (R&T) agents – Karvy or Computer Age Management Services.

- You have to show the short-term and long-term gains in Schedule Capital Gain in the Income Tax Return.

- The units that are purchased first are assumed to be sold first. (FIFO)

Do not be under the impression that you do not have to file returns if you are an NRI. You will be liable for the penalty. File your returns considering your capital gains. Ensure that you get your refund in case you have paid more than required.

Note – Please talk to your CA or Financial Planner before taking any action based on this post. The individual circumstance of NRI can play a big role in the actual taxes that he needs to pay.

If you have any questions on NRI Mutual Fund Tax in India 2022 for NRIs in India or if you would like to share your experience – feel free to add them in the comment section.

Can I Gift MF to my NRI son?

My daughter has long-term capital gains from a debt mutual fund for Rs 60000. However her income is below the thresh hold limit of 2.5 lacs, Will she still pay tax on LTCG ON THE DEBT FUNDS

I need to understand taxation on mutual funds for NRI

I am an NRI who has invested in Nippon Retirement Plan for the last 5 years. What would be the tax liability on redemption?

I am 80, nri, no income in US or India. What form I need to fill out and submit for refund of TDS paid?

I invest in mutual-funds for long term. If i redeemed how much % tax i have to pay. I am NRI

I inevested in mutual funds al growth some are IDCw and equity hybrid all are long term, when i invested i was a resident now i am non resident when i redeeemed

I sold some unis in MF (Equity) with total sales val of 61442.7 and absolute long term cap gain of 13765.07 and tax paid of 1431.61 (I am NRI) – how has the tax been calculated please

If sale and purchase of MF from NRE account what ITR form to be filled

I invested in HDFC Equity Mutual Fund from MAR 2015 till FEB 2018 (INR 5000 per month, i.e. Total INR 1,80,000.–).Do I have to pay Tax if I redamp now After more than 8 years as NRI?

I have sold SBI Corporate Bond Fund – Regular Plan Growth, ISIN : INF200KA1YM5 (Bond)

I am US Ctz. I have PAN but no AADHAR, obviously. My bank, other investments are still NOT in NR Category. Shall I be able to withdraw MF and Bank deposits in September 2023?

Hi Joshi

As per my knowledge yes you can withdraw money from deposits in india and transfer them to an NRE/NRO account as soon as possible.

I redeemed my mutual funds and they deduct capital gain tax. Can I claim for refund?

Hi Karan

Yes, as an NRI who has redeemed mutual funds in India and had capital gains tax deducted, you may be eligible to claim a refund if you meet certain conditions.

If I made mutual fund investment this year Financial year and I move to UAE next financial year and get NRI status.After becoming NRI sold my investment. How capital gain is taxed in this case?

Hi Dhara

If you make a mutual fund investment in India during the current financial year and then become an NRI and sell your investment in the subsequent financial year, the taxation of capital gains will depend on the following factors:

Residential status: Your residential status for tax purposes at the time of selling the mutual funds will determine how the capital gains are taxed. As an NRI, you will be subject to different tax rules compared to a resident Indian.

Capital gains tax for NRIs: As an NRI, the capital gains tax on the sale of mutual funds will depend on the type and duration of the investment. Here are the general rules:

a. Equity-oriented mutual funds: If you sell equity-oriented mutual funds after holding them for more than one year, the gains will be considered long-term capital gains (LTCG), and no tax will be applicable up to March 31, 2022. However, if the sale occurs after April 1, 2022, LTCG on equity-oriented funds will be taxable at 10% without indexation.

b. Non-equity-oriented mutual funds: For non-equity-oriented funds, such as debt funds or balanced funds, if you sell them after holding for more than three years, the gains will be considered long-term capital gains and taxed at 20% with indexation benefit. If you sell them within three years, the gains will be considered short-term capital gains and taxed at the applicable income tax slab rate.

It’s important to note that tax rules and rates may change over time, so it’s recommended to check the current tax laws and consult with a tax advisor or chartered accountant for the most up-to-date and accurate information.

Tax implications in UAE: Apart from the tax implications in India, you should also consider the tax laws in the UAE regarding the taxation of capital gains. It’s advisable to consult with a tax professional in the UAE to understand the tax implications of selling your mutual fund investments as an NRI residing there.

It’s crucial to note that the tax laws and provisions are subject to change, so it’s recommended to consult with a qualified tax professional or chartered accountant who can provide specific advice based on your individual circumstances and the prevailing tax laws in both India and the UAE.

Any options to invest in mutual fund for NRI living in USA

Hi Govind

It is highly recommended for you to consult a Financial Planner as they will advise you how to invest according to your needs.

NRI debt mutual fund tds claim procedures

Hi Vivek

As an NRI, if you have invested in debt mutual funds in India and have tax deducted at source (TDS) on the income earned from those investments, you can claim a refund for any excess TDS deducted by following these procedures:

File an income tax return: As an NRI, you are required to file an income tax return in India if your total income, including income from debt mutual funds, exceeds the specified threshold limit. You will need to include the details of the TDS deducted in your income tax return.

Obtain Form 16A: Request the Form 16A from the mutual fund company or the financial institution from where you have made the investments. Form 16A is a TDS certificate that provides details of the TDS deducted on your income.

Calculate tax liability: Calculate your total tax liability based on the applicable tax rates and deductions for your income, including the income from debt mutual funds. The tax rates for NRI investors may vary depending on the type and duration of the investment.

Claim credit for TDS: While filing your income tax return, you can claim a credit for the TDS deducted on your income. This credit can be claimed based on the information provided in Form 16A.

Refund claim: If the TDS deducted is higher than your actual tax liability, you can claim a refund of the excess TDS paid by filing an income tax return. Make sure to provide accurate information and details of the TDS deducted in the return to support your refund claim.

It is important to note that the specific procedures and requirements for claiming a refund of excess TDS may vary depending on your individual circumstances and the tax laws in force at the time. It is advisable to consult with a qualified tax professional or chartered accountant who can guide you through the refund claim process and provide personalized advice based on your situation.

How do I save taxes on india investments in mutual funds

Hi Parveen,

You have to pay tax if there is any capital Gain.

How the investment done in Mutual fund from NRO account is different from investment done through NRE account?

Hi Amit,

There is a single difference: NRE is a repatriable account and an NRO account is not.

If you have NRI status, it is advisable to invest in a mutual fund from an NRE account.

NRE : Inflow : from Foreign Country

Outflow: Within India, also Repatriable to the

country it came from

NRO : Inflow : from within India

Outflow: within India- MONEY NO GOING TO

FOREIGN COUNTRY

is it better to have 5% return in NRE fixed deposit with no tax or invest that money in Indian mutual funds for long term?

Hi Ajay,

This entirely depends on your goal, if this investment is for the short-term horizon, then you should invest in FD otherwise MF for the long term.

nri account invest in mutual fund dividend payout so tax deducted can get refund from income tax department

Hi Dinesh,

Yes, you can claim TDS when you will file your ITR.

for USA NRI, apart from TDS on realised mutual fund gains , will i to pay tax in USA … funds like tata small cap , sbi contra fund ??

Hi Vijay,

For US taxation, you should consult your CA in US.

Yes, Offset of Tax paid in India available under DTT

Nri mutual funds profit is less than 2.5 lac means total income in India so can I claim refund

No, the MF LT Profit in excess of Rs 100,000 taxable,

Long term capital gain on debt mutual fund sale by nri

Dear Hemant

I sold DEBT mutual fund in India as NRI and I do not know which are LISTED and WHICH are UNLISTED debt mutual fund to claim indexation benefit

HOW Do I know that Nippon India DYNAMIC BOND FUND is a Listed or unlisted? What is the process to ascertain the same?

Can I claim Indexation benefit in long term capital gain for DEBIT Mutual fund sale?

Hello Hemant,

I am Canadian Citizen and I would like to invest in mutual fund. one of my friend suggest some mutual fund. pls. advise is right to invest ? I am thinking to invest 5 year and 1 year investment.

1- Nippon India Balanced Advantage Fund

2- Nippon India Small cap fund

3- Quant Flexi cap fund

4- Quant infrastructure fund

5- Quant midcap fund

6-Sundaram Dividend Yield fund

7-Nippon India Flexi cap Fund

8-Quant small cap fund

9- Quant Infrastructure fund

Is TDS applicable in NRE account for Switch in or switch out in mutual fund

I am a UK citizen of Indian origin living in UK, having tax residency UK. My mutual fund redemptions and switch overs are taxed for TDS by AMC. My broker shows them on capital gains statements. Is this correct process? The investment was done from NRE account and redemption is also done in NRE account.

Hi Dilip,

yes this is the correct process.

Hello Mr.Beniwal.

I am an ardent reader of your responses in this column.I used to be quite delighted to follow your highly valuable clarifications.

I am an NRI(Merchant Navy Engineer) ,having MF investment in India.Recently I have redeemed one of MF investment of Rs.10,000,00/- made in 2016 when the Current value was Rs.15,000,01/-.But my NRE account was credited with Rs.14,54,265/-. after TDS.

This seems to be very high rate.Is it correct?

Please provide your advice at what rate I have to pay Tax and (Computation)how to procced to get refund .I have no other income in India .Am I eligible to invest in Tax Savings to reduce my tax burden.

Thanking you

George Joseph

I have just redeemed DSp mutual fund tax saving from my NRE account. DSP iffice deducted TDS. This is correct or ok

Hi Premkumar,

Yes, when the capital gain is more than Rs. 1 Lac.

And you can claim your TDS while filing ITR.

I have invested in MF when In India but now i am NRI and in USA. So do i need to pay taxes in USA on my Funds with Growth options even though not redeemed means still continuing

Hii Dr. Bhuwan

As far as I know the unrealized gain on mutual fund is not taxable in U.S.

Thanks for your reply. What about PFIC .

i understand there is taxation for us nationals .

pl.clarify.

yes There may not be taxed in India

on unrealised gain but probably in USA under PFIC.

pl.clarify.

No, you pay tax on profit and you make profit only when you sale

I am an NRI residing in Saudi Arabia, recently switched few Mutual funs to direct plan. The AMC fund houses already deducted Long term capital gain as 10%, Am I liable to again pay tax on it or it will be 10 % only as LTCG tax?

Hii Mr. Hemant

As far as I know their will be a LTCG tax of 10% on amount in excess of Rs. 100000 and TDS charges of 10%.

And I suggest to take advice from the tax consultant for most appropriate solution.

NRI, Switching of debt MF to equity MF within 1 Year, how much TDS and STCG applicable. Need to file ITR? No other income from India

Hii Mr. Pradeep

As far as I know you need to file a income tax return and since you redeemed the debt mutual fund within 1 year their will be a TDS of 30% and STCG tax based on your income tax slab.

It is better to take advice from tax consultant.

hi. i am living in new zealand. i did redeem debt mfs and 22000inr deducteed by amc asTDS. my question is that do i get TDS refund with filling ITR. thank you in advance

Hii Mr. Sarabjit

As per my knowledge, if the NRI falls in a lower tax slab, he is eligible for a refund when he files his returns.

It is better to take advice from tax consultant

Hello Mr Beniwal , Thank you for this good informative site. My wife is NRI and have Debt mutual fund LTCG. I have two doubts and request if you could clarify.

1) My wife Mutual fund AMC have already cut the tax on with out indexation basis. Where in ITR 2 i need to show the LTCG fm debt Mutual fund. I checked and found there is a place where only they have given option to fill cost of acquisition with indexation and there is not place for filling cost of acquisition with out indexation.

2) How to know which debt mutual fund is listed and which is not listed. As per rules it is made as listed debt funds we can use Indexation and non listed we can not use indexation. Thanks

Hello Mr. Ramesh

As per my knowledge

1. TDS is applicable for NRIs on Mutual Fund Redemption, this is the tax which as you said AMC deducted. The rate depends on the type of scheme and the holding period. The TDS is charged at the highest applicable rate. If the NRI falls in a lower tax slab, he is eligible for a refund when he files his returns.

2. SEBI registered mutual funds are listed and available for trading in the capital market segment of the Exchange.

Thank you

Hi Siya : Similar problem to me also

I sold DEBT mutual fund in India as NRI and I do not know which are LISTED and WHICH are UNLISTED debt mutual fund to claim indexation benefit

HOW Do I know that Nippon India DYNAMIC BOND FUND is a Listed or unlisted? What is the process to ascertain the same?

Can I claim Indexation benefit in long term capital gain for DEBIT Mutual fund sale?

Can I buy mutual funds while outside India

Hi Sunny,

Yes you can.

If TDS deduct form nri account, so it is mandatory to file itr

Hii Mr. Asif

It is better to consult a tax consultant in this case

I am an NRI and I have rental income of 2.5 Lakhs from India and I had a loss of 2.1 Lakhs from Futures & Options trading (which can be classified as business loss). Can I set-off the loss to the rental income?

Hi Santosh,

No, it can’t be set off from the rental income.

Why? For resident it is very much possible. Is there any rule because of which business loss for NRI can’t be offset with rental/other income?

my banker has been telling me to invest in SIPs with lock up for 5 years to not have to pay tax as a NRI, please advice if there is such a benefit ? also if I invest without 5 year lock up will my LTCG tax be just 10.4% above 1Lac ?

Hi SG,

For 5 year lock-in option is available only in ULIP plans.

It’s not a mutual fund.

Thank you for your reply, for a nri to get access to mutual funds/sip etc would you suggest doing the ULIP or without ULIP ?

Dear Mr. Beniwal,

Some 20 years ago I had invested in the Franklin Templeton Blue Chip India mutual fund with the option of dividend reinvestments. The source of that investment was an NRE account and the mutual fund is still linked to the NRE account. The investment company is deducting TDS of 28.5% from my dividend reinvestments. I have two questions: (1) Is it the law to deduct TDS from NRE investment income in mutual funds? (2) Is the TDS rate of 28.5% correct? Your article states 10%.

Thank you,

Anita

Hi Anita,

1) Yes, as per the Law TDS is deducted.

2) Ya, rates are changed from Jan 2020 in budget.

I am NRI and the TDS dedcution for me for equity mutual fund should be 10% but when i got the statememt 20.8% had een deducted. Can you please tell me why has there been a dedcution of 20.8%?

Hi Pragya,

As per my knowledge, TDS is only Deducted on Debt Fund, not on Equity Fund.

I had asked a question earlier . I have not got the response yet

ITR filling for nri

Hi Jayesh,

You can Consult with a CA.

As an NRI residing in USA, can I invest money in stocks and mutual funds?……. But I will not sell anything and take profits until I return to India in probably 10 years time. (By then I will no longer be an NRI, will my taxation change at that point)?

Hi Murali,

As per my Knowledge, Taxation will depend on Your Residential Status at the time of Selling the Mutual Fund.

When you come back to India you need to Change the Status in MFs.

I moved to usa in 2020 march,i have soem mutual funds in India , so do I need to pay any taxes for them or how to keep on investing in same?

Hi Kirti,

As per my Knowledge, Firstly you need to Change your Status in MF holdings as NRI and if the Changed Status allowed you to Invest, You can Invest Continuously.

i have invested money in mutual fund with my NRI account for long term when i completed some amount is deducted as TDS how can i get my TDS amount

Hi Ankit,

You can get it by Filing the ITR.

i have not filed ITR for previous 10 FYs ..i can claim capital gain losses that i had incurred by filing ITR for FY2020-21

Hi Sachin,

As per my Knowledge, You need to File the ITR with a Late fee for these Respective Years.

TDS ON SALE OF MUTUAL FUND. Do NRIs have the option to claim a refund against the basic exemption limit of ₹2.5 lakh

Hi harish,

As per my knowledge, You can get the TDS refund by Filing the ITR.

Switch out in mutual fund taxability for NRI?

Hi Keyur,

It will be treated as Redemption.

How much tax NRI needs to pay for the existing mutual fund which has been purchased before becoming NRI.

Hi Rakesh,

As per my Knowledge, In case of Selling the Mutual taxation will be same as For Residents.

Is NRI entitled to an Rs1 lac exemption on long-term capital gains on the sale of shares?

Hi Sunil,

As far as I know, It is available.

TDS on Mutual Fund Dividend. I am NRI. Indian income is less than 2.5 L/yr. TDS abt 10K. Can I get a Refund of this by filing Return?

Hi Samuel,

Yes, You can do that.

if nri person can be given for tax or TDS in equity mutual funds for long-term capital gains?

Hi Sajeev,

As per my knowledge, NRI can claim TDS on Debt Mutual Funds if their Indian Income is less than the basic exemption limit.

I am an NRI residing in UAE. invested in mutual funds 6 months back in an equity fund. if I withdraw the money now how much tax will be deducted and am I eligible to get a refund of the deducted tax amount on my profit.

Hi Aju,

As per my understanding, You will be Charged 15% on your equity gains as short-term capital gain tax. No, you can’t get a TDS refund on this gain.

In India what is the taxation process of mutual funds for NRE account?

Hi Ramesh,

As per my knowledge, it will depend on the holding period of your Mutual fund Investments.

Hi, I am an OCI citizen having an investment in mutual funds in India. I had invested in a 3 year Axis Emerging Opportunities fund. I found that after maturity a sum of 3300 INR has been deducted as TDS. Why is this so?

Hi Debashish,

As per my knowledge when you get a Capital Gain on Mutual funds there will be a mandatory TDS deduction.

Thanks, Vinay. Then there will be no point if one pays tax in India as well as well as the country of residence. I think the govt. does not want to make thing transparent as long as they have customers like Nirav Modi and Vijay Mallah. So, sad.

If we redeem equity investments of NRI, why is the full amount not getting credited to the bank account. Why is the deduction?

Hi Vandana

The TDS amount is getting deducted from your gains.

I am an NRI and I sold Equity MF’s in FY 2019-20 that I had purchased before 2017. If the MF company, hasn’t deducted tax before redemption, does it mean that there are no capital gains?

Hi Kvs,

If you sell equity MF before 1 year then MF comapnies deduct 15% TDS. & after 1 year if your gain is more than Rs 1 lakh then you have to pay 10% tax.

Is there a tax if the profit is less than 100000 rs in a year for Equity and Debt mutual funds?

Hi Geesal,

for equity there will be no tax if the gain is less than Rs 1 lakh. for debt funds holding period is 3 year for calculation long term captial gain. If you have STCG in debt funds it will be taxable as per income clab.(30% TDS)

Now investment as NRI but coming days I become resident of India,then taxation will calculate?

Hi Anuj,

taxation will be same for equity funds. and for debt funds short term gain will be added in your income and LTCG will be taxed @ 20%

HI Mate

if taxation is same for Equity for above question , will there be any TDS for NRI who became RI later if claiming after one year after return to India?

how do i know in which tax slab i am?

Hi Aftab,

You can ask this to your CA or you can check that on income tax department website.

is the capital gain on mutual fund taxable being an NRI?

Hi Santosh,

Ye it is taxable.

I am investing mutual fund through NRE account so, What is the TDS % for redemption within one year and after one year for Equity ?

Hi Leihal,

i think its 15% if redeem within 1 year and 10% if redeem after 1 year.

As NRI do I need to have Pan card to invest in Debt Fund?

Hi Rajesh,

PAN Card is a must for investments.

Where to report gains or losses mutual fund transactions in ITR?

Hi Suchit,

As per my Knowledge, You can file it in Capital Gain & Loss Section.

i am nri i have short term capital gain in mutual fund equity fund scheme what is my chargeable section under income tax act?

Hi Mahendhran,

As per my Knowledge, it is under section 48.

I have old MF investments in India when I was resident now I want to redeem those investments. Now I am NRI. Should I get my money back in domestic account or NRO account?

Hi Anurag,

As per my knowledge, it should be credited into NRO account.

Hi,

I recently became an NRI and opened a new NRE and NRO account. Can I convert my existing SIP mutual fund accounts to my NRE account rather than NRO?

1. If I can link my NRE account to MF, will TDS still be applicable during redemption?

2. Given that NRE accounts can’t accept Indian currency, how will the maturity amount in INR be credited to my NRE account?

Hi Aravind,

Really appreciate that you have done these changes – I know lots of NRIs who even after 8-10 years continue with the same SB a/c & Mutual Fund in resident status.

Answer to your questions – 1) TDS will be deducted whether you have linked NRE or NRO account. 2) Don’t worry about that redemptions will reach your NRE account without any issues.

I am a UAE based NRI. I had invested in equity MF in India for more than 2 years. when I redeemed my MF, they had deducted tax from my amount even my capital gain is not even 50,000 Rs

Hi Saravanakumar,

As per the comment, it seems like it is TDS which is been deducted from your amount by AMC.

Hi Anil, When i approached them, they informed me that 20% TDS will be deducted from capital gain for NRI and advised me to file IT returns to get that amount.. Do you have any idea about it?

An NRI wants to invest Rs. 1 lac in Sundaram large-cap bluechip NFO. Wants to stay upto 15 years. Does he comes under tax?

Hi Rama,

As per my knowledge, Yes the standard tax should be applicable to it.

in which country is he NRI.

if an US NRi inherits indian mutual fund shares in INR as nominee, how will he pay taxes on capital gains in India as of sept 2020?

My question in brief then – if an US NRI (Indian passport holder) inherits some Indian mutual fund shares in INR as nominee, how will he pay taxes on capital gains in India as of sept 2020?

Im an US NRI. I want to invest some money in INR accumulated on an old FD account in India. options like GROWW/Zerodah/ICICI/Axis were of no help as Im in US. Most of the fund houses claimed in the internet do not accept US NRI’s for mutual funds anymore.

So, I plan to move this INR amount to a family member in India as gift + stay as nominee and request him/her to invest in X/Y/Z fund. When, in the future, I eventually legally own the money, I know i cannot do SIP or transact online – but will I still have to pay taxes annually in India based on the yearly INR capital gains? What are my options to keep the money then in INR/USD? Even Indian tax consultants cannot answer this question – can you please help?

My son is an NRI. He wants to invest Rs 1 lac in sundaram NFO bluechip mutual fund . Wants to stay there for 15 more years without redeeming. Is he comes under tax paynent

Dear Rama,

In a few countries, it can be an issue including the US & Canada – tax will depend on resident country regulations.

The tax will be applicable only when he sells the fund. the tax will be 10% of the profit if sold after one year. if he sell after return to india then tax wont be deducted at source. but if it is above the tax slab he has to file return.

Which fund (not equity fund) is better for investing over a horizon of 6-9 months?

Hi Prasad.

You can opt for a Ultra Short Duration or Low Duration category of fund.

What is the TDS calculation if I redeem my money from debt scheme in mf?

Hi Simhan

30% TDS will be deducted from gains and rest will be paid to you.

Suppose, A person bought a unit of Debt MF at 100 and within 1 year he sold it at 150. The Mutual Fund company will deduct 30% i.e. 50(150-100)*30%=15 from the redemption value and rest will be paid to you.

I am an NRI having invesment in equities as per new regulations of tax deductions of equity holder account whereas I being NRI residing in UAE having benefit of Double Tax Treaty, understand is available between two countries. what are the document IT need to have to approve on one off basis instead each equity can it be possibe to have on approval on my DEMAT ID?

Hi Kishin,

Kindly consult your Tax Advisor as he or she will be able to guide you better.

I would like to ask about MF long terms capital gain taxes?

Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year. The long-term capital gains tax rate is 0%, 15%, or 20% depending on your taxable income and filing status.

Is TDS different for NRO and NRE?

Interest earned on NRE accounts and FCNR accounts is tax-free in India. Hence, there would be no TDS. However, interest earned on the NRO is taxable and will be subject to a TDS of 30 percent.

For NRI you are saying to become NRI, one has to stay for 245 days or more outside India. But if a person is coming back to india having a resident permit, does he has to follow the above especially in case of Covid 19 situations when the flights are not available.

Hi Rameshwar,

As per my Opinion,

Until and unless the authorities will not give the notice we can’t comment. For the period being, we have to follow the standard rule.

Can NRI purchased MF before 2018 be cost basis on 31-01-2018?

Hi Sarvan,

As per my knowledge yes it would be the basis on the mentioned date.

On my short term capital gain on non equity fund they deducted tds 30%. Now in return i can claim refund of that 30%.

Hi Ankita,

As per my knowledge you can’t.

Hello Hemant –

Thanks for the helpful blog.

I have invested in the same equity mutual fund (same scheme) in 2 different folios (one from NRO account i.e. non-repatriable basis and one from NRE i.e. repatriable).

If I sell some of the units from NRE, then, to compute the capital gains, should I consider first acquisition in the NRE folio only or first acquisition overall?

Thank you in advance

Hi Shailesh,

FIFO (first in first out) will be applied Folio wise so in your case”first acquisition in the NRE folio”.

I am a nre holder i want put some money for mutal fund but this money at any time with in 3 days i want to withdraw, how much interest i can get it?

Hey Paul,

Subject to Stock market performance in that period.

Hey Paul,

For liquidity purposes, you can invest in overnight funds. It will fetch you returns like a saving account.

Is TDS cut for mutual fund gains for NRI?

Hi Vijayan,

Yes.

Hi , I have MFs worth 50 Lacs which i want to redeem. Ican you please advise who can do the tax calcuations and ITR filings.

I tried a guy from cleartax.in, was not very helpful.

Hey Kris,

For this, a mutual fund statement is needed because calculations may differ from category of funds.

Regarding the TDS for MF equity fund, I could see TWO answers in your blog;

1) TDS of 10.4%

2) TDS of 10.4% with 100,000 exemption limit.

Kindly tell me, which one is correct?

Many Thanks,

Hi Shinoop,

TDS will be 10.4% – exemption limit will come in play at the time of tax refund.

Hi Hemanthji,

Greetings to you

I read your articles and they give very valuable information to us.

I have a query on PTI schedule of ITR -2 Ay 2020-21.

I am NRI and live in USA. I made an investment in AIF cat II fund from through my NRE account couple of years back.. Consequent to the provision made in Budget 2019 , these Cat 1 & 2 funds are permitted to

PASS THTOUGH losses made by the Fund to its unit holders and also the cumulative losses made by the fund till 31 March 2019 are deemed to be losses of unit holder and these capital losses ( on sale of shares) can be carried forward and be set off with the capital gain incomes

of the investor from 1 st April 2020 on wards.This is a welcome benefit .I am stuck with on how to claim this benefit in ITR of Fy 2019-20 as

the FUND communicated me capital gain income as Pass through income of Fy 2019-20 and also communicated cumulative short term capital losses as on 31 st march 2019 ( loss pertains to FY 2017-18.)

Now where do I have to show the cumulative losses of earlier years to take benefit of set off with taxable capital gain income of Fy 201-20, in

the ITR as PTI schedule have column to show the losses of current year and not for the previous losses.

I can not now include the earlier losses in CFL schedule as I have not shown these losses in filed ITR of Fy 2017-18.

I can not now revise the ITR of 2017-18 as the PASS THROUGH loss benefit was approved for Fy 2019-20 as the amendment was done in BUDGET 2019 on Sec 115UB and not valid for Fy 2017-18.

Please advise whether any of my assumptions are wrong or ITR for Fy 2019-20 need to be changed suitably for reflecting PASS THROUGH LOSSES OF EARLIER YEARS, in PTI schedule.

How the benefit contemplated by the Government can be availed by me ( any investor of this fund)

Sorry for my long note.

Regards

Ravi Jupudy

Dear Ravi,

Sorry for replying late as I discussed this with a few friends.

Unfortunately, you will not be able to file tax for earlier years to adjust losses. But still, I suggest you consult a good CA or tax consultant.

I wants to understand TDS actually I take sbi life pension plan in 2010 now this plan maturing on 28th July 2020. I ask sbi to surrender my policy and give full amount which is nearly 1565000.00 my investment through my nri account is 999,000.00 . Capital gain against my investment is 566,000.00 . Please let me know how much TDS apply on my capital gain?

Hi Sandeep

Maturity Proceeding from the Life Insurance is exempt under section 10 (10)(D). Therefore no TDS will be deducted.

Is indexation benefit is available for NRI?

Hi Brinda

Yes, Indexation benefits are available for NRIs

Franklin Templeton debt fund deduct thirty percent TDS from the redemption of units. is it right? I think tax is to be deducted from short term/long term gains

Hello Hemant,

Thanks for the fantastic article. I am an NRI with negligible income in India (only interest from savings back accounts). It seems to me that it is financially beneficial to sell my Debt Mutual Funds within Short Term as long as I can keep the gains below the basic tax exemption limit of Rs. 2.5L. I can buy back the same volume immediately and hold it for another block of <3 years. Can you please comment if this is the right approach? It sounds very weird since the government is supposed to encourage longer term investment. What do you think is the economic rationale of not permitting the set off against basic exemption limit for long term gains in debt funds? Even with the indexation benefit, I will pay some taxes in the Long Term while it is possible for me to avoid taxation entirely in the Short Term.

Regards,

Prit

What is the full form of DTAA?

Hi Dhanush

Its Double Taxation Avoidance Agreements.

If I have multiple Mutual Funds from different AMCs (mutual fund houses) to redeem, How TDS will be deducted …. each fund house will deduct 10% straightaway for LTCG or there is a centralized mechanism which will count overall gain losses from different MFs and deduct TDS accordingly along with consideration of Rs 1 Lakh capital gain exemption?

Hi Pranit

Each AMCs will deduct their own TDS.

If I will invest in MF through NRO account then want to know the complete process after redemption of MF units. Will the redemption amount directly get credit into my NRO account and how tax is implied on it?

Hi Tejas

Yes, after the redemption whole amount will credited to your NRO account. As per Tax point it will depend on whether it is short term or long term (Gain/Loss).

I am an NRI and doing investment in the Equity market and STCG is being deducted on profit. My India income is less than Rs. 2.5 lakh and I do file a tax return. Can I claim for a refund for this deducted STCG?

Hi Anuj

As per my knowledge, it should be the TDS that need to deduct instead of STCG. You can tax to your broker or adviser for tax and STCG is not get refunded. It can only be set off against any STCL or LTCL

hi, i am an NRI from Bahrain. I want to invest in mutual fund. I have NRE account and my wife has resident account in India. Which account is better for mutual funds in terms of taxation for long term investment?. please advise.

Hi Suria,

You should consider NRE account so you don’t have any repatriation issues. If your wise is NRI she should not have a resident account. Even if she is Resident Individual, you should not transfer in her account, there are clubbing provisions in Income Tax & in the long term, you may have issues.

Hello Hemant ji,

i am a NRI and doing investment in Equity market and STCG is being deducted on profit. my India income is less than Rs. 2.5 lakh and i do file tax return. can i file this STCG for refund? will STCG be treated same as TDS?

how to register KYC online from the NRE account?

if I invest in mutual funds through NRO account then how much tax needs to be pay I am in UAE.

Tax arise from the mutual funds are depend upon the scheme you hold and the time duration you are holding your investment.

Kindly consult your Tax consultant as he can guide you better.

my daughter is in the US she wants to invest in Axis MF when she will be here on vacation what is the procedure?

Hi Nishikant

The procedure is simple, she can approach any nearby AXIS MF office with her documents such as address proof and pan card, they will guide her about the fund in which she wishes to invest or she can go with any financial advisor for guide and investment.

if NRI from USA (Houston) invests in India in Direct Equity/ Mutual funds / FDR or Corporate Bonds. Is he liable to declare & pay tax in the USA? And at what rate?

Kindly consult with your Tax advisor in USA, as he can better guide you as different country as different tax laws.

I was a US-based NRI about one year back I invested 4000000 in debt mutual fund, about 2 months back I got back to India, and withdraw 1000000 but my TDS 22000 deducted, can I file for TDS return?

Yes Abhishek, you can file your IT return for TDS return.

This 22000 TDS was deducted from your capital gains? in Jan?

There are No TDS on redemption or capital gains since Feb. 2020.

“It is hereby clarified that under the proposed section, a mutual fund shall be required to deduct TDS at 10 per cent only on dividend payment and no tax shall be required to be deducted by the mutual fund on income which is in the nature of capital gains,” it said.

If you have an NRE repatriable account as KYC. Lets say you invest in liquid funds in a lumpsum. As a NRE Savings account,currently its tax free.. But is the liquid fund investment earnings-tax free? Or is it treated as a ST debt?

Hi Chirag,

Liquid fund earnings will be considered short term capital gain (there will TDS at the time of redemption) but if you don’t have any income in India or less than taxable slabs – you can ask for tax refunds.

If an equity mutual fund was purchased in Jan 2015 and sold in Aug 2018, it is required to check grandfathering value as on 31 Jan 2018.

And most of the equity funds have higher NAV than in Jan 2015. Thus capital gain will be much less , possibly it will be capital loss.

Hi Bijan,

You are right about grandfathering but most of the funds other than a few mid & small cap are above 31st Jan 2018 levels. So there can be a tax but on case to case basis.

Hi

My query is regarding reducing tax liability from STCG of debt funds. Which of the below is available to me as an NRI?

1. If STCG TDS is deducted at 30%, can I claim refund for the full TDS amount since my tax slab is at 0%, i.e. I dont have any other income in India, so I am below the 2.5 lacs slab.

2. If STCG is deducted at 30%, can I claim exemption under Sec 80C deduction by investing the same amount in ELSS funds?

Hi Gaurav,

First will work – you can get tax refund.

WHAT IS THE BEST WAY TO PARK EXCESS money for NRI.

Hi Meeankshi,

Purpose or goal should be clear before investing money.

Considering Taxes, does it mean that investing in Debt Fund is not a good option, In case I want to park my excess money.

Hi Meenakshi,

Yes NRE FD is a comparatively better option if funds are not able to generate returns more than that. But debt funds can be used for asset allocation & rebalancing – if you don’t have any taxable income in India, you can also claim a tax refund on Short Term gains. So there can’t be a generalized answer – actually it will depend on your situation.

If NRI invest in mutual funds in India and he has capital gains, is he liable to pay tax in India?

Hi Suresh,

Yes, they have to pay the tax – TDS will be deducted.

TDS on Mutual Funds: I-T Dept clarifies 10% tax at source only on dividends, not on capital gains (Feb. 2020)

“It is hereby clarified that under the proposed section, a mutual fund shall be required to deduct TDS at 10 per cent only on dividend payment and no tax shall be required to be deducted by the mutual fund on income which is in the nature of capital gains,” it said.

if i do sip form my nri account and when i redeem my mutual fund ….on the maturety amount there is any tax deduction on that amount

Hi Ranjith,

Yes TDS will be deducted on gains.

Hello, I am an NRI and have an existing ELSS mutual fund SIP from my NRO account. Will the gains from SIP will be taxable under same rule mentioned in your chart? Also, do we have any benefit if we open the new ELSS from NRE account or shift the existing the NRO linked ELSS to NRE account ELSS? Does NRE account linked ELSS follows the same rules of taxation mentioned in your chart?

Hi Ankit,

NRE or NRO tax rules will be the same for NRIs.

I am an NRI.. I invested in ultra short debt fund.What is the taxation.. Will the indexation applicable for me

Yes, you can avail Indexation.

I’m an NRI, currently in UAE. I’m planning to invest in Mutual funds. My question is that do I have to pay T.D.S in india?

Hi Harish,

Yes, TDS will be deducted.

I am an NRI investing regularly through SIP. Some of them were started when I was a resident. How can I change it to NRI status in the MF records?

Hi. Harsha

First of all, you have to change the status in KYC and then in every folio by submitting required froms and documents to the respective AMCs.

Are gains from all type sbi mutual funds & sbi life tax-free for NRI ??

Hi Amit,

It’s taxable in case of Mutual Funds – please talk to your advisor.

Will the MF investments I made as a resident Indian be taxed differently than the MF investments that I make as an NRI?

Hi. Varun,

No, taxation on both investments will be the same.

Does an NRI have to pay any taxes in India on mutual funds until they are cashed ?

Hi Hari,

Only after redemption, you have to pay the tax.

Hello Hemant, This is the point i am not clear as well. Tax on Gains , i thought every year we need to file the tax return on the income earned right ? ,and TDS would be deducted when you redeem the MF. Please give me some more thoughts on this.

I am filing ITR-2 as NRI, woild like to know if indexation benefits applicable for NRI on LTCG

Hi. Sunil,

Yes, indexation benefits are applicable for NRIs.

Are gains from all type mutual funds tax-free for NRIs?

Hi Amit,

All gains are taxable but in a few cases, you can take tax refund.

Hi,

I am an Indian Resident and receive regular dividend income from Equity Mutual Funds, which is tax free in my hands. I plan to move to the USA. Will this income remain tax free, or will it be taxed in the USA once I become a USA Tax Resident.

Dear Asok,

There are major issues for US NRIs if they invest in Indian MF – I will suggest you speak with a Financial Planner.

I would like to know about DTAA as I want to claim refund for mutual fund capital gains

Rajeshwari, DTAA will depend on country to country.. Kindly consult your Tax advisor.

Dear Mr. Beniwal,

Thank you for your post!

I understand that tax on LTCG on an Equity mutual fund, for a NRI is exempt for the 1st one lakh Rupees. However, I used the online ITR2 Excel Tax preparation utility provided by the Income Tax department and under section 7d of the Schedule CG, “LTCG after threshold limit as per section 112A (7c – Rs 1 lakh)” has been greyed out for me. So, my LTCG of <Rs.3000 is now chargeable income under the head Capital Gains. No benefit of the Rs 1lakh exemption has been allowed. Do you think this is possibly an error from the IT business analyst? Would welcome your response.

Many thanks,

Valerie

Hi Valerie,

One of my friends talked to income tax help desk. They said, lot of assessees are facing this issue. It may not show deduction of 100,000 in CG schedule, but at the end in schedule of computation of tax, it will consider this exemption of 100,000.

He asked to first validate the entire return and then check the tax effect.

Please try & also update us.

Tax on Mutual fund redemption for NRI

my question is that when i uae i invest in india in mutual fund or share but i us short teram capital again it is taxble i know tax that time dissaided when tds cut but tds not cut how to i know it is tx=axble or not it;;s confiused m

can you tall me when uae invesat in india in mutual funds or share when he us short tearm capital again police it is chargeble

Hi Kaniksh

I think you probably asking for tds deduction for short term capital gain, it would be 30% in debt and 15% in equity

Hello Mr. Beniwal,

Really appreciate enlightening the NRIs.

While most things are clear, I still have following questions.

1. I am Tax Resident of Singapore and thus DTAA is applicable. I hear that if I update my Tax Residency in Mutual funds as Singapore Tax Resident using the TRC, then no Tax will be applicable and thus no TDS will be deducted on redemptions. Is this accurate understanding?

2.If I earn some income on my investments e.g. NRO Savings Account Interest, can I choose not to pay Income Tax in India but pay instead in Singapore as per DTAA? Now as Singapore doesn’t tax people on global income so that Indian Account Interest will save tax here too ( Zero Tax). Hence, is it correct to assume that I will not have to pay tax at all on such income?

Request you kind opinion on these queries.

Regards

Pankaj

Dear Pankaj,

I have taken help from an expert to answer your questions.

Reply to specific query raised:

I am a tax resident of Singapore and thus DTAA is applicable. I hear that if I update my Tax Residency in Mutual Funds as Singapore Tax Resident using the TRC, then no tax will be applicable and thus no TDS will be deducted on redemptions. Is this accurate understanding?

Answer:

There are different tax treatments on sale / redemptions of equity oriented mutual funds and debt mutual funds under the Indian Income tax Act. As per Article 13 of the India-Singapore DTAA, any gains from alienation of any property, other than immovable property, business property, ships or aircraft or shares in company, will be taxed only in the country in which the person is a resident (i.e. Singapore in your case) and not in the country where the capital asset is situated (i.e. India, in your case).

Initially, this treaty benefit was available in case of alienation of shares in a company also. However, the India Singapore Treaty has undergone a major amendments where by such benefit is now no more available to shares acquired on or after 1st April, 2017. Further, these amendments are in case of ‘shares’ in a company. Hence, it will be a good case to argue that units of an equity oriented mutual funds are not covered within the term ‘shares’ and thus will be taxed in the country where the person is a resident.

Under the Indian Income tax Act, a person can claim benefit of DTAA if he can obtain Tax Residency Certificate from the country of his residence. Hence, as correctly pointed out by you, there should be no withholding tax implications in India on redemptions of mutual fund unit.

It is advisable to check with your mutual fund house as to how practically they intend to deal with it.

If I earn some income on my investments e.g. NRO Savings Account , can I choose not to pay income tax in India but pay instead in Singapore as per DTAA? Now as Singapore doesn’t tax people on global income so that Indian Account Interest will save tax here too (zero tax). Hence, is it correct to assume that I will not have to pay tax at all on such income?

As per Article 11 of the India-Singapore treaty, interest will be taxed in the country where it arises (i.e. India in this case). Hence, interest on your NRO savings account will be taxed in India. Later while filing your Singapore tax return, you can claim credit of the tax paid in India subject, ofcourse to the provisions of the laws of Singapore regarding the allowance as a credit.

A taxpayer cannot as such ‘choose’ to be taxed in one country and not to be taxed in other country.

If SecurityTransition Tax is deducted, how will it help in taxation?

Hi Piyush

In tax,there is concessional taxation on capital gain arising from STT paid transaction like 15% on STCG and 10% on LTCG on above 100000limit

In case of persons showing trading income as business income,

STT paid is allowed as deduction as business expense

I sold my mutual funds in Dec 2018 purchased in July 2018. There is ling term capital cost of Rs.1,40,000. More over I have income of Rs.2,60,000 of interest and Dividend. Is M F CApital Gain on MF is tax free for NRI? If not how to calculate the tax or how much I can deduct from LTCG

Hi PD,

As specified above in the article, TDS is appicable to NRIs at the time of Redemption and it is deducted with the highest rate and if you fall in lower tax bracket, you can claim it by filing return

Your interest income is taxable and Dividend income from MF is tax free in your hands as DDT is applicable

For proper tax calculation, its better you should hire a good CA

should i file itr if i hv purchased mutual fund this year?

Hi. Ankit,

There is no need to file ITR while investing in MF.

But you have to file ITR when you are selling those MF units because that attracts Capital gains taxes so you get the refund of TDS according to your Income in India.

I am sailor.and not competed my nre neither filed for itr..and i want to invest in mutual funds.is it possible for me to invest in mf

Hi. Sanju,

Yes, you can invest in MF.

If i invest 20 lakhs in mutual fund from my nri account, shall i pay tax on my invested value or only on the gains?

Hi. Bij,

There is no tax on the invested value of MF. You only need to pay tax on the gains from MF

Thanks for great article. I born in India, thus citizen by birth. Currently living on h1b visa for 4 years in USA.I feel investing in MF on my name needs lot of paperwork and less options.

Question is, is it legal (tax free) to transfer USD to my NRE ac and then give that to Mother and invest on her name?

Hi Ankit,

A lot of US NRIs are doing that by transferring (gifting) to their parents & investing in their name. Gifting is fine but transferring just for the purpose of investment may have issues in the long term.

Thanks Hemant. Can you share more details on the “issues in the long term” ?

Legal 🙁

Dear Hemantji

Apperantly there is a mistake below

————————————————————————————————————————

Majority of the portfolio of non-equity funds are invested in assets other than equity – like Government Bonds, deposits, gold etc. If the holding period is more than three years, then the gains you make are long-term gains. If the holding period is less than three years, then gains are considered as short-term gains.

Tax on Short-Term Gains 30% of the gains is payable.

_________________________________________________________________________

Fact is

For debt funds sold within 3 years the gain shall be added to other income (if any ) and short term tax is charged at rate etc applicable to such income and not at flat 30% to all NRI

Please comment

Suresh

Dear Suresh Ji,

Thanks for bringing that to my notice – that was a typo, I have corrected that.

TDS is 30% but tax is based on the tax slab – which I mentioned in the set-off part in the article.

Dear Hemantji

So far as I know NRI need not file IT return if his income consists of only investment income and TDS is deducted by payee of such investment income

Please see the section 115G reproduced below from Income tax site

———————————————————————————————————–

Return of income not to be filed in certain cases.

115G. It shall not be necessary for a non-resident Indian to furnish under sub-section (1) of section 139 a return of his income if—

(a) his total income in respect of which he is assessable under this Act during the previous year consisted only of investment income or income by way of long-term capital gains or both; and

(b) the tax deductible at source under the provisions of Chapter XVII-B has been deducted from such income.

——————————————————————————————————————

Please comment

Suresh

Yes, you are partially right at your point, But TDS deducted more than your slab rate can only be refunded if you file IT return.

Dear Hemant Ji,

I was told that Set off of Mutual Fund capital gain against basic tax exemption limit is also available on short term equity gains & long term debt gains.Please guide?

Hi Shyam,

Thanks for asking.

That benefit is available to resident Indian but not to NRIs.

Hello! Does this means that investing in Debt fund is not a good option for NRI considering tax involved. In between…. I really like your all articles.

Thanks for appreciating – I have already answered your query.