We Indians have an affinity towards real estate investments. NRIs and resident Indians keep a lookout for real estate deals abroad. Indians are quite active in the property market in Singapore, Dubai, Australia, the US, UK, Canada, etc.

Read – NRI Investments in Commercial Property

NRI Real Estate Investments Outside India

I received a message from a wiseNRI reader & decided to write this post

“I am living in Europe for the last 6 years and plan to do so for at least the next 5 to 10 years. As there is a 100% loan available and no need for a down payment, I thought it would be a good opportunity for a house. However, I need to chip money for the legal and property fees of up to 10,000 euros. With low interest and, paying the same amount as I pay now as rent for my current room but for an entire house, I see it as not only a good investment but also as a mark of personal freedom. It’s not just me, many in Europe, many among the NRI group that I am in have the same question. An expert opinion would be helpful.”

It is not difficult for to NRI buy property abroad as long as you comply with the relevant rules. These rules relate to laws regarding the type of property to be acquired, visa requirements, transfer of money overseas, residency status, and tax implications. Before you buy a property abroad, be sure to research diligently on these aspects. Let us look at the requirements of NRI buying property overseas –

Singapore

If you want to buy landed property such as bungalows or terraced houses, you need approval from the Singapore government. On the other hand, if you want to buy condo units or apartments, no such approval is required. But do remember, you cannot buy flats in subsidized housing complexes unless you are a permanent resident. The price of real estate in Singapore is very high compared to other Southeast Asian countries but the system is entirely transparent. You can also get a loan to buy a property.

Check – Child’s Higher Education – Things NRIs Should Consider

US and UK

In the US, as long as you have an Individual Taxpayer Identification Number or a Social Security Number, you can buy a property. The mortgage rates are also very attractive. But the US is a vast country and so it is important to choose the right location.

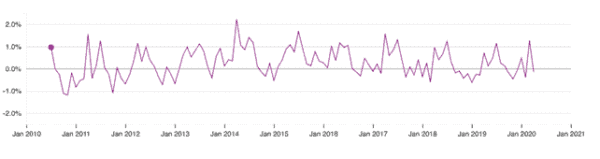

In the UK, the process of buying a property is pretty straightforward both for Indians and NRIs. It is easier to buy in a cash deal. The mortgage application process is more stringent for a foreigner in terms of documentation, higher interest rates, etc. Here is a graph on the movement in property price in the UK for the last 10 years. The price now is down considering Brexit and the COVID-19 situation.

Contrary Side – Is it a good time to buy property in India for NRIs?

Source: Land Registry UK

From a financial perspective, resident Indians can remit up to $250,000 per financial year overseas under the LRS scheme for investment in house property. NRIs can remit amounts abroad from NRO, NRE and FCNR accounts subject to rules and requisite documentation –

- NRIs can remit up to US$ 10,00,000 from an NRO account

- There are no restrictions on remittance from an NRE or FCNR account

Benefits of investing in property abroad

- Indians who have enough wealth and liquidity like to invest in overseas markets as it provides a hedge against the domestic economy and market risk.

- INR has depreciated against the US dollar. Investors benefit from the depreciation when they are selling capital investments and converting the money to INR.

- Real estate deals in India are not always transparent. But in countries like Singapore and the US, regulations are highly evolved. They are transparent. You can de-risk yourself from issues typical to the Indian real estate market such as –

- Changing rules and regulations

- Lack of accurate information related to the market

- Old and unresolved property related issues

- Macroeconomic risks

- Stronghold of real estate developers

- Usually, real estate transactions are timely in developed countries. Costs are fixed.

- Rental yields in most developed countries are higher than in India and provide a significant positive difference over the mortgage rate.

- Many countries offer citizenship, allow a longer stay to immigrants, or offer special schemes to foreigners who invest or buy properties there. These can be advantageous for NRIs who want to settle abroad or want their future generations to stay abroad. Some people have their children studying abroad, family members living abroad, and want to have a home for them in that country.

- In some cases, people can get tax breaks on investments made in a foreign country that can be used as an advantage.

Check – can NRIs buy agricultural land in India?

Drawbacks of Investing in Real Estate Abroad

- It is not easy for foreigners to obtain mortgages. Banks are reluctant to offer loans to people who are on work visas. For example, in the Philippines, many banks refuse to offer loans to foreigners.

- The paperwork and loan process is more extensive and stringent as compared to the same for locals.

- There are income tax implications on the returns and investments made in the global market. You will have to abide by the taxation rules in the country of the real estate transaction and India. This can result in higher tax outgo and documentation.

- If you are not living in the same country where you invest in real estate, maintenance and management can become difficult. You may not be able to address issues immediately. Traveling quickly to manage housing and mortgage issues will not always be a feasible option. You may have to enlist the services of a property manager which increases your cost.

- Interest rates across the globe are almost the lowest in the last 100 years – what will happen when interest rates will start moving upwards?

Buying property abroad could be a good idea if you or your family plan to settle in that country or you want to diversify your portfolio. Remember to conduct thorough research on the various aspects of the real estate market and the transaction before you buy a house.

If you are an NRI – please share your experience of Real Estate Investment Outside India that will help other readers.

How can i as a foreigner purchase a commercial property or open business

Can I take advise from you My son is in London If he invests in real estate , residential/ commercial in India by taking loan in india through bank and money transfer from UK to his accounts in India and paying for the property Then when he sells his property in India , there is capital gain , he is liable for I tax on capital gain After this he repatriates it to UK the principal as well as capital appreciation Does he is liable to pay tax on income / capital transferred back to UK , is it allowed by Indian Govt Pl advise

If an NRI holds the property in India as NRI & if he sells that property? What about the proceeds? Can he deposit it in the NRE account & send back the money abroad?

Be cautious about buying in markets like UAE.

90% of the population are expats whose connection to the land is only weakly emotional – based on years spent and relationships cultivated. The link to the country being directly employment related it does signficantly affect the ability to exit the market without signficant losses during a severe economic downturn.

Normal rent vs buy calculations assume that property never depreciates. This assumption has prooven to be severaly flawed when valuations have dropped by 50% from the peak purchase price.

Buying during a severe downturn is a safeguard against losses as and when one exits whether voluntarily or otherwise. Assuming NIL appreciation would be a cautious approach when crunching the buy vs rent numbers. The safe multiple to buy is in the range of 10x to 12x the annual rent.

Remember if you buy in the UAE you will pay a minimum of AED 15 per sq ft annually towards maintenance and property “fees” (property taxes are called “fees”) and another AED 6 per sq ft approx towards annual chilled water fixed charges (excluding consumption). This annual maintenance and chiller fee is around 2.5% of the purchase price per sq ft. It should be comparable to the costs in other premium destinations.

One also needs to bear in mind that past promises of residence visas linked to property have been reneged upon. Having a visa linked to active or passive income rather than property may be a wiser option than having it linked to property purchase.

Thanks Mr Rao for sharing this 🙂