The moment your residential status change to NRI, there are many rules & regulations in personal finance which get applicable to you or simply get changed. Right from your bank accounts to the properties, you may hold, all of them have a different status. Most people tend to ignore some of them; unaware that these are illegal in law and will attract penalties.

The most basic of these is the NRI resident savings bank accounts which is the starting point and attractive investments like PPF. I keep getting multiple questions on this – like:

- Can NRI open savings account in India?

- Is there any penalty for not converting to NRO accounts?

- Can NRI open a PPF account in India?

- Can NRI transfer money to savings account in India?

This post will answer all these questions.

Must Read – Wealth Planning Checklist for NRIs

Here’s what the laws say and what you should do when you attain the NRI status.

Can NRI have savings account in India?

Most individuals make the mistake of continuing a resident savings account even after becoming an NRI but the law does not allow it. Or in simple words, it’s ILLEGAL to hold resident savings bank account for NRIs. As per FEMA regulation, when your status changes to NRI the resident savings account have to be converted to an NRO account.

An NRO account, also known as a Non-Resident Ordinary account, is a rupee-denominated account that can be opened by Non-Resident Indians to manage their income earned in India. This account can also be used to deposit funds that come from India or are in Indian rupees. The interest earned on this account is taxable in India. An NRO account can be in the form of savings, RD, or FD.

All income that is receivable in India such as rentals from the property, investments, pension, etc has to be deposited in this account and any payment towards insurance premiums or EMIs on loans which you availed while in India also has to be mandated from the NRO accounts. For this, you need to inform your bank of status change within a reasonable time period. (This period is not defined but you can consider a maximum of 3 months)

The bank then will designate your existing resident account to the NRO accounts and your payment will continue as it is. Alternatively, you have the option to close the existing resident savings account and open a new NRO account in case you choose to change your bank.

Do remember that if you continue the NRI savings account and it comes to the notice you will be penalized for the same. Funds from the NRO account are now repatriable up to $1 million now but with a condition that you have obtained a certificate from a Chartered Accountant for payment of taxes as applicable on your income in India.

Must Read – Power of Attorney In India For NRI

For depositing funds from abroad one will need an NRE account where there is no limit on repatriating funds back to the resident country.

All your investments and payments are linked to bank accounts. If your existing resident bank account is changed to NRO then only the status is changed. In such a case you may have to inform the respective institution. In case if you open a new account then you will have to give the fresh cheques or if it is being done through ECS/ACH then the ECS/ACH mandate will have to be changed to the new NRO account. The same process will be applicable for any payout with regard to investments.

“You don’t have to be present in India to convert Resident Savings Account to NRO & can be simply done by informing the bank through a letter or in few banks even an email will work.” wiseNRI

Check – Best Investment Plan For NRI

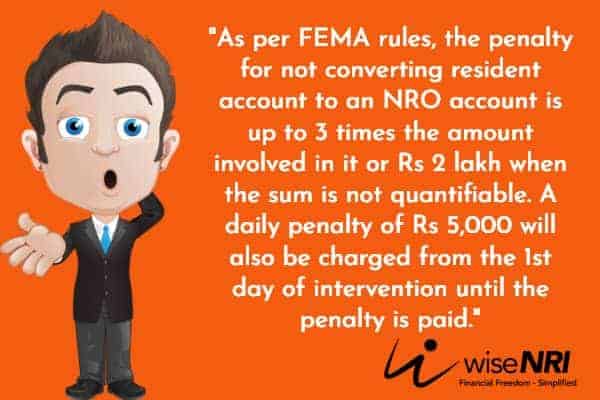

Penalty for not converting to NRO account

I have heard from our NRI clients that few bankers suggest maintaining the status quo on a resident savings account but if any liability arises they will not be there to help you. Few bankers are not genuinely unaware & others think if the status will be changed – these accounts may be mapped to NRI cell & they will lose on the incentives.

Check – Impact of Change in Residential Status

To be frank I have not come across any NRI who is penalized for having savings account in India. But why do you want to take chance – follow the rules & have peace of mind.

Similarly in the case of PPF one of our clients clearly asked the manager of the Public Sector bank that he is an NRI so can he open the PPF account – the manager said YES. He opened that account but now I have suggested him to discontinue that.

Can NRI transfer money to savings account in India?

No, if you are still talking about NRIs’ illegal savings accounts. Yes, if it’s your friends or family members’ accounts. However, they must ensure that you comply with the regulations set by the Reserve Bank of India (RBI) for such transactions.

Can NRI open a PPF account in India?

PPF is a very effective savings tool for long-term planning which you would have availed as a resident Indian. But NRIs are not eligible to open a PPF account. However, the most unclear rules are for existing accounts. From 2003 onwards, if you have opened a PPF account while you are a resident Indian and then your status changes to NRI, you are allowed to continue with your PPF. You can make contributions from NRE or NRO accounts.

On maturity, the funds will have to be withdrawn as they are not allowed for extension and the proceeds will be deposited in the NRO accounts.

Although in India the interest is tax-free and one can also claim 80C benefit from the investment if there is taxable income here, but the maturity or accrued interest may be taxable in the respective country where you are residing as NRI. You must check DTAA or talk to a tax consultant.

Read – NRE Vs NRO Account

What you should do when you become NRI

If you have recently obtained an NRI status then these should be the first step for you:

1. Inform your bank that your status has changed. Approach your branch which will help you with the necessary paperwork for your new accounts.

2. Redo your KYC in your investments and update your accounts.

3. Reissue the cheques from a new account in all your investments and liabilities. If it is an auto-debit then change the bank mandate to NRO or NRE accounts.

In conclusion, NRIs cannot continue with their resident savings account in India and must convert it into an NRO account. Failure to comply with the regulations and not converting to an NRO account may result in penalties and legal consequences, so it is important for NRIs to take the necessary steps to avoid any complications. Therefore, to answer the initial question, no, an NRI cannot hold a resident savings account in India.

If you are an NRI please share your practical experience with Resident Saving Bank Account or if you know someone how is penalized for the same. If you have any questions feel free to add them in the comments section.

My sister paid NRI tax this year still her bank accounts and Dmat accounts or residence account she is planning to close her accounts she doesn’t want to switch NRO can she do it”

My sister is American citizen she did not change her residence to NRO status she didn’t listen!! she doesn’t want to change, Indian government is no strict she doesn’t want to change her status!

My aunt has 15 acres of land and 4 portions house in India she came to the USA a long time back she is collecting money from her house she knows if she get money in her bank she has to pay government she is green card holder.

I went to USA long time back o changed residence to NRI what are my penalties.

I have converted resident ac to nro, living in Canada. I have submitted forms and attested documents to the sbi branch. Now over 3 months they have not removed my deceased husband name and replaced with my son name. Also sent forms to update content details. No response from branch manager. What do i do

1986 left from India my father put on my name shares, money and farm didn’t know paying residence tax I’m living in USA family gave me 2019 didn’t know I have to change NRI status didn’t submit taxes in USA found out changed my status this year I’m worrying about the penalties?

When is the cutoff date to convert the resident account to NRO?

LAST 20 YEARS I AM WORKING IN uae.in India, I have an NRE account , also NRO Account, both 1 scheduled bank and an old SB account also handle one district cooperative bank

I am a housewife of an NRI and we both are residing in saudi arabia. I have an indian resident bank account. Can i continue it or do i need to convert it to nre/nro. I am not working.

Nri passport renewal in India documents required

I am currently in france in family visa iam not working or earning can i continue using my resident account or i need to convert to nro nri at any possible way iam not sending money from france to india

can an nri have a normal saving account in india

I NRI and i have saving account in india and NRE account also so is it okay ?

Hi Shankar,

As an NRI, it is perfectly acceptable and common to have both a savings account and an NRE account in India.

I am a NRI and use my savings account for my agricultural income deposit and paying my bills. Is it ok?

Hi Gursimrandeep,

Actually, this is illegal to have a resident savings account after being NRI. You will have to convert your resident savings account into an NRO account.

What is the best option if I got delayed in converting savings account to nro account. Should I close savings account or convert it to nro account

Hi Adite,

You should wait to convert a savings account to an NRO account. Because if you open a new NRO account, it will take the same time.

Due to illness if i stay 18 months abroad, any effect to my running FD or Running bank account in India

Hi Amiya,

You may be classified as an NRI for income tax and banking purposes. So the interest rates on Fixed Deposits for NRIs may differ from those for residents. Interest income from FDs can be subject to different tax rules for NRIs.

Can a nri dependent with payslips get a home loan in India?

Hi Snehavani,

Yes, An NRI can apply for home loans in India. However, the NRI applying for the home loan must be eligible as per the criteria set by the lending institution.

I have Savings account in India in ICICI Bank, can i open the NRI account in Axis bank and maintained both account normal savings and NRI accounts.

Hi Mohammed Younus Sangram,

Yes, as an NRI, you can maintain both a regular savings account and an NRI account in different banks in India. There are no restrictions on holding multiple accounts with different banks.

When TDS on the rent received by NRI is around 31%, which is paid to Government by the Tenant, can the NRI owner claim back this TDS as per the prevailing income tax %?

Hi Chetan,

Yes, an NRI owner can potentially claim a refund of the excess TDS deducted on rental income if the actual tax liability is lower than the TDS deducted.

What happen to tax saving fd in resident account when you become nri

Hi Ankur,

As an NRI, you lose the tax benefit under Section 80C on these Tax-saving FDs. You cannot claim this deduction once you become an NRI. The interest income from these FDs may also be subject to tax.

My daughter and son holding nominal dmat and trading account in India . Few years back Becomes NRI with British passport but no funds have come from abroad and no sale/ purchase of indian shares for past 3 to 4 years now Bank has suspended said dmat account even though shares with less than INR one lac are held in the dmat account what if the remedy. Daughter is holding British passport since 2020.

Hi Devinder,

First of all, you have to contact the bank or the Depository Participant through which the Demat account is held. Inquire about the reasons for the account suspension. They will be able to provide specific information regarding the status of the account.

If the account has been suspended due to inactivity, you may be able to reactivate it by providing the necessary documents and information. The bank or DP will inform you about the documents required for reactivation.

After returning permanently to India on the 17.11.2022 do i continue with my savings account which i have not used till now

Hi Karan,

Yes, you can continue to use your existing savings account, even if you have not used it while residing abroad.

I have working in other country for the past 10 months , till now I have been sending money to my residential account. So I need to convert residential account to NRI OR NRO account.Is there any penalty applicable or is it possible to change residence account to NRI account

Hi Monish,

it’s advisable to convert your residential savings account to either an NRI or NRO account. Generally, there should not be any penalties for converting your residential account into an NRI or NRO account. However, you should check with your bank regarding their specific policies and procedures for converting the account.

Recently i came to kuwait on work visa. Can i send money to my sbi saving account in india

Hi Sherkhan,

Yes, as an Indian resident working in Kuwait, you can send money to your SBI savings account in India.

I have just opened a business in Dubai, now should I wait for 180 days in current financial yr to open Nro account or open it asap?

Hi Rajat,

You can open an NRO account at any time, regardless of the number of days you have spent in India during the current financial year. There is no specific requirement to wait for 180 days to open an NRO account.

If I am nri, can I open demat account with my Indian bank account?Or I need to open demat account through nri bank?

Hi Thomas,

As an NRI, you are generally allowed to open a Demat account with your Indian bank account. You do not necessarily need to open a separate NRI bank account to open a Demat account. Many Indian banks and financial institutions offer the option for NRIs to open Demat accounts with their regular savings or NRO/NRE accounts.

I am an NRI now, shall i continue my saving account in my country

Hey Sanjay,

No, you need to convert your resident savings account into NRO account.

I am a NRI. Still i do not have NRE Account . i am sending money to other persons account. he still in india. is it any tax will appear in that other persons account

Hi Jay,

If you are gifting money to someone in India, it’s important to understand the gift tax implications. In India, gifts from non-relatives can be subject to tax if the total value of gifts received in a year exceeds a certain threshold. If the person receiving the money earns interest or other income on the funds you’ve sent, they might be liable for income tax on that income. The tax liability depends on their total income and applicable tax slab.

I have PPF account in SB account. I continued to keep SB account after NRI status. Also I opened PPF account in SB after NRI. Now I am opting to change SB to NRO. I m wondering what will happen to PPF fund.

Hi Herald,

According to the rules set by the Reserve Bank of India (RBI), NRIs are not eligible to open a new PPF account. However, if you already had a PPF account before your NRI status, you are allowed to continue contributing to it until maturity (15 years from the year of opening). This means that your existing PPF account can be maintained even after you become an NRI.

NRO Savings Account and PPF Account: When you change your savings account to an NRO account, the linked PPF account’s status might also need to be updated to reflect the change.

I have a NRE account in SBI and a savings account in PNB from which I have taken a loan . should i convert my pnb account to nro account?

Hi Abhishek,

If you have taken a loan from PNB and are repaying it through your savings account, converting it to an NRO account might impact the loan repayment process. NRO accounts are meant for managing income earned in India and might not be the most suitable account for loan repayment. It’s important to discuss this with PNB and understand how the conversion could affect your loan obligations.

Penalty for maintaining savings bank account

Hi Dilip,

The penalties for maintaining a savings bank account can be with specific actions or situations related to the account like, Minimum Balance Requirement, Overdrawn Account, ATM Usage exceeding a certain number of free ATM transactions, Cash Deposit Withdrawal, Non-Maintenance of Account, etc..

I am an NRI have fixed deposit in cooperative bank this is illegal

Hi Umesh,

The RBI has guidelines that define the types of accounts NRIs are allowed to open and maintain in India. Cooperative banks are subject to these regulations, and they might not be authorized to offer NRI accounts or fixed deposits.

I have already an NRE account but is it possible to open normal savings account in india to separate my money into that account

Hi Sadham,

Yes, it’s generally possible for NRIs to open a regular savings account in India in addition to their NRE account. However, funds from your NRE account cannot be transferred back after being transferred to a resident account and interest earned on resident savings accounts might be subject to taxation.

Can nri have saving account in india and can withdraw money by ATM in foreign

Hi AK Jain,

Yes, NRIs can have NRO savings accounts. When you use an NRO account’s debit card for foreign ATM withdrawals, the transaction would typically involve currency conversion and potentially higher fees compared to using an NRE account. This might lead to conversion charges and foreign exchange rate differences. Additionally, the bank might levy ATM withdrawal fees.

Can a nri hold savings account after residing in India?

Hii Jay,

If as an NRI you return to India and becomes a resident again, you typically need to convert NRE or NRO accounts into regular resident savings accounts as per the guidelines of the respective bank and the Reserve Bank of India (RBI).

Hi Jay

Yes, an NRI can hold a savings account even after returning to India and becoming a resident again.

I am NRI, have saving ac in INDIA ,and cant Convert saving to NRO UNTILL end of feb 2024. Can I be Fined ?

why cant you convert? when did you leave india?

I am an NRI and i hv a saving account and not NRO account. I invest in mutual funds through that

I am residing in the united kingdom since April and I am holding a indian federal bank normal account, I have a home loan in that account, therefore I need to send money to the account every month for the loan emi. So do I need to convert the account to nro or do i get any penalty for holding the account like this?

Hi Neethu,

As an NRI, your residential status changes, and you become eligible for NRO account for managing your Indian income and transactions. Holding an NRO account might have tax implications, such as TDS on certain transactions.

I dont have nre and nro account , iam an nri for 2 years. Iam continues my regular savings account in india. If i change that into nro , is there any fine

Hi Vysak

There is no penalty you just need to change your regular savings account into NRO account as soon as possible.

what happen to PF account? can i transfer amount to PPF from my indian saving account even after being out of india for an year?

How NRI for example can claim FDR account payee demand draft with no account in india.He open FDR when he was 11 from parents account. But now bank made draft at Adult age in indian Rupees. Please help

Hi Gulwinder

As per my knowledge you should refer to the respective bank for the process regarding the same.

I am a widower and only relative of my daughter who is an NRI. I am resident with her and have a resident visa. I do not have any income abroad and no bank accounts. Do I have to change my savings accounts back home to NRO?

Hi G M Bhat,

As per my knowledge, If you are a widower residing with your NRI daughter and holding a resident visa, and you do not have any income abroad, it is not necessary for you to convert your savings accounts back home to NRO (Non-Residential Ordinary) accounts.

NRO accounts are typically opened by NRIs to manage their income earned in India or income that is deemed to be Indian-sourced. Since you are a resident in India and do not have any income abroad, your savings accounts can continue to be resident accounts.

Resident accounts are designed for individuals who are residents of India and can be used to hold and manage income earned in India. As a resident, you are entitled to the benefits and facilities provided to resident account holders, such as higher transaction limits, access to certain investment options, and potentially more favorable tax treatment.

NRI by fema definition due staying over one year but resident permit pending and what happens to resident savings account

Hi Jay,

As per the definition under the Foreign Exchange Management Act (FEMA), an individual is considered an NRI (Non-Resident Indian) if they have stayed outside India for more than 182 days in a financial year. However, it’s important to note that the definition of an NRI for FEMA purposes may differ from the definition used for residency permits or visas.

If you meet the FEMA definition of an NRI but are still awaiting a resident permit or visa, you would be classified as an NRI for banking and financial purposes. In this case, you can continue to hold and operate your existing resident savings account until your residential status is officially changed or updated.

However, once you obtain your resident permit or visa, it is advisable to notify your bank and convert your resident savings account into a resident account. This is important because the regulations and benefits associated with resident accounts may differ from those of NRI accounts.

Converting your account to a resident account will ensure compliance with the applicable banking regulations and allow you to avail of the benefits and facilities provided to resident account holders, such as higher transaction limits, access to certain investment options, and potentially more favorable tax treatment.

I moved to foreign it is going to be 3 months. I hold a savings account in India. I want to know if my husband can transfer his salaries earned in India to my account. Then, transfer the money to his foreign account.

Hi Karan,

As per my knowledge As an NRI who has moved abroad, you can maintain your existing savings account in India. However, there are certain regulations and restrictions to consider when transferring funds from India to a foreign account.

Transfer from your husband’s Indian salary account to your Indian account: Your husband can transfer his salaries earned in India to your savings account in India. This is generally allowed as long as the funds are sourced from legitimate income earned in India.

Transfer from your Indian account to your husband’s foreign account: Transferring money from your Indian account to your husband’s foreign account may require compliance with the Reserve Bank of India’s (RBI) guidelines and regulations.

a. Liberalized Remittance Scheme (LRS): Under the LRS, an individual is allowed to transfer a certain amount of funds per financial year from India to a foreign account. As of my knowledge cutoff in September 2021, the limit was set at $250,000 per financial year.

b. Reporting requirements: When making such a transfer, you may need to comply with reporting requirements such as submitting Form 15CA and 15CB, which provide information about the nature and purpose of the transfer.

Recently my status changed to nri i would like to close my indian bank savings account in india what should i do

HiJay,

Kindly contact your respective bank account for the same.

I am about to convert my ICICI SB account to NRO. I also have ICICI Direct account. What would be the best way forward for my shares. I dont plan to invest anymore in Indian share market after conversion to NRI.

Hi Sachin,

It is highly recommended for you to contact a financial planner for the same.

Conversion of savings inte nro is mandatory, is there any time limit is there ?

Hi Ganesh,

There is no such specific time limit however, a period of 3 months is recommended.

I have moved to Germany last month and my status will not an NRI right for 6 months. Can I send money earned in germany to savings account and invest in mutual funds?

Hey Vamshi,

you can send money which you earned in Germany to your saving account in India, regarding mutual funds investment you also can invest mutual funds both in domestic and international mutual funds, however you should consider rules and regulations given by RBI .

If you don’t know the RBI rules and regulations, why are you replying?

Can nri keep the local saving account in Indian bank

Hey Nishant,

You can maintain your local saving account in Indian bank, while you are NRI

I am an NRI and living in Canada. I had applied to my bank for converting my residential account into NRO more than 3 years back. Bank instead of converting my residential account into NRO account asking me to open a new NRI account which is against the law as I cannot have two status resident and non resident. They are insisting on wrong footing and don.t listen. This is causing me worry. Please guideHR Singh Brampton

Hi Harwant,

I would suggest you to write to the bank stating that you had applied for converting your residential account into an NRO account, and that the bank is obligated to follow the RBI guidelines for NRI accounts. The RBI allows the conversion of a resident account to an NRO account upon an NRI’s return to their country of origin.

If the bank still insists on opening a new NRI account, you can approach the Banking Ombudsman in Canada or India to resolve the issue. The Banking Ombudsman is an authority appointed by the RBI to address grievances related to banking services, and they have the power to direct the bank to comply with the RBI guidelines.

NRI can not continue saving bank account in India , does this NRI means NRI as per section 6 of Income tax act or NRI after acquiring citizenship of abroad country?

I m NRI but now I do not want to go back to foreign countries so can I use my NRE account as saving account

Us citizen / OCI card holder/ NRO account holder,how to transfer money to USA

Your article says nri cannot have Indian savings account, it must b converted to NRO. Why u say nri cannot have Indian savings account? Can nri have Indian current account?

I have nro /nre account.when I came to India during pandemic I had opened a savings account now when I am back to uk Iam struggling to convert my savings to nro .Will it be a problem considering I won’t be able to return to India anytime soon

I am unable to transfer funds from my NRO savings account to an FD as I was previously doing… why is that?

I am NRI but my minor son is a resident. I have an account in his name since before my status changed. For the purpose of the resident savings account in his name, I am the legal guardian/parent and my PAN is attached to this account. Do I do anything about this account like change it to NRO?

If NRI wants to live in India for a long time I mean he does not want to go to his country citizen ship then he can operate his savings account without converting it in NRO account

If i change my citizenship how can i maintain indian bank accounts

Can I continue with my HUF account after becoming Canadian citizen

What are the rules of rbi wrt to getting funds from a relative from abroad . In this case my sibling is transferring to me for expenses of parents

I went to uk on 14 th Feb 2022 and started job there . Came to india on holiday in November 2022 for 20 days .since when will I be classified as an NRI

I have a post office savings scheme for 15 years, that was opened when I was indian citizen. Now I am OCI card holder. Can i still continue to invest in that savings scheme?

Hi,

I have now changed my status to NRI. However, my fixed deposit and PPF matures next year. What happens if I do not withdrawn the amount upon maturity? Will it get transferred to my NRO account automatically?

What is penalty if i dont convert nri account to local account

my mother recently became an NRI and she receives pension in India at SBI bank. Can she convert her bank account to SBI branch in Chicago?

Hi Manjit,

She can convert her resident account into an NRO account.

When an NRI in US convert savings account to NRO, is it necessary to give his Social Security No in the application? NRO conversion forms of SBI and HDFC found online asking for Tax residency and Tax Information No. Is it same as Social Security No?

As father how much money l can send as gift to my son in Belgium

Hi,

You can send up to USD 250,000 per financial year as a gift.

I have resident account in india since long. there is not more money only 3 lacs and I never use it but my father in law was just updating it. Now he has died in 2020. should i convert that account to NRE?

Hi Parth,

Your resident account can only be converted into an NRO account.

I am a citizen of US. I have SB account in india can that be done to NRO.

Hi Shambhu,

As a US citizen, you can convert your SB (savings bank) account in India to an NRO (Non-Resident Ordinary) account. An NRO account is a bank account designated for non-resident Indians (NRIs) and persons of Indian origin (PIOs) to enable them to manage their income earned in India, such as rent, dividends, and pension.

To convert your SB account to an NRO account, you will need to visit the bank where you have the account and submit the necessary documents. The documents you will need to provide may vary depending on the bank, but typically include proof of your identity, such as a passport, and proof of your address, such as a utility bill or bank statement.

It is advisable to check with the bank for the specific documents and requirements for converting your SB account to an NRO account. The bank will also be able to assist you with the conversion process.

I already have nre and nro account, can I open saving bank account also

Hi Karan,

As per FEMA rule, for NRI it is illegal to open a saving account.

If there is an FD in a resident account and I convert it to an Nro account, will I lose 30% in USC straight away? The money in FD was from salary with tax deducted at source

I have a 4 years Work permit for Australia. After which I will return to India. Do I need to change my Icici bank savings account to NRO Account, as all my home loans, LIC premiums etc are from that account. Secondly, I have a joint account with my wife, where she is the primary holder and she is staying in India only, what needs to be done in that case?

Hi Bhaskar,

As you are a non-resident Indian and you have a savings account in India, you will need to change the account to a Non-Resident Ordinary (NRO) account. The NRO account is a rupee-denominated account that allows NRIs to save their income earned in India and abroad in Indian Rupees.

As for your joint account with your wife, as she is the primary holder and she is staying in India, she can continue to hold and operate the account as a resident Indian. It is a good idea to consult with a financial advisor or professional.

Hi, Good read, thanks for detailed info. I have a few queries:

I am a Canadian PR and haven’t moved to Canada yet. I just landed, took my PR Card in 2021, returned and continued to live and work in India. Now I am planning to move to Canada in a few months (Let’s say March 2023).

1. I believe it’s OK to convert the Savings A/c to NRO A/c within around an year of actually moving to Canada ? (Say April – May 2024).

2. My FDs close in April 2024. If I have not converted to NRO, and file ITR in 2024 to claim TDS, I’ll fill as NRI and my Account would be Resident Savings A/c. Any issues in this case? Let’s assume, I have plans to close deposits then and convert the Account to NRO sometime in 2024.

3. Any issues with continuing to Invest in Mutual Funds (ELSS and other Equity and Debt MFs) until mid-2024 when I convert SB A/c to NRO A/c.

4. I intend to continue making some transfers from my SB A/c to Canadian A/c (already doing since last year). Any issues there.

Source of Income is Salary and Interest only, Tax Paid, ITRs filled as required for all years.

Thanks in advance.

I have taken citizenship of USA and got OCI too recently and have my savings account in India and properly can I continue using and staying in India as long as I want

Hi,

During the conversion process from resident savings account to NRO account, will I be able to receive money normally in my account? Will I have to give any different detail to people sending me money in India?

Had an account in India, moved to Canada, became Canadian citizen, now account is dormant. What shall I do ?

If I am an NRI because my son has applied for it and I am senior citizen and not working in usa. Do I need to convert my account to nro?

Can I close my NRE FD and put the balance in my NRE saving account without visiting India

If one goes abroad for short term assignment/employment of 6-8months and comes back to india. What he should do to send his remittances and Indian SB account?

Can i have nri and saving account in icici bank

Whom should we report to if we know someone who maintains resident account for many years after becoming nri

what should be done for the savings bank account?

Hi Thirumoolasangu,

You can convert your resident saving account into NRO account.

regarding my nri status when i am student

I write this from USA. My spouse and I became NRIs by virtue of geeting our green cards as a result of a petition filed by our daughter. We are in the US since June 2019.my spouse got green card in April 2020and I, in Jan 2021.We have joint residential bank accounts in India where we live. I have not been able to inform my banks about change in our status.Can I do it now and how I should go about it? We are returning to India in last week of July ’22

Hi Nikunj,

Yes you can do it now. You need to visit bank for this

I am NRI and want to transfer money to abroad from India , was options available?

Hi Deepali,

You can transfer money from your NRE account to an abroad account.

If an NRI continues a resident account, does he face a chance of just monetary penalty or could be jail term too?

Hi Shashank,

He will face only Monetary penalty.

Whether NRI account open without closing resident account

Hi Surjeet,

Yes you can open a new NRE Account without closing resident account. But it’s illegal to have a resident account after being an NRI. So I will suggest you to convert your resident account into NRO Account.

Rules are clear that NRI, PIOs and OCIs cannot keep resident accounts in banks in India and penalties are specified if you maintain such accounts. But there is no enforcement mechanism built into the rules. Banks do not take any action to inform NRI to convert their resident account to NRO account. It is entirely NRI’s responsibility to convert his account to NRO account. Only a plain paper application to bank is enough to convert to NRO account.

Person having multiple bank resident account what to do after becoming NRI to this account

Hi Krishna,

You have to convert your resident saving bank account into NRO Account as soon as possible.

from NRI A/C I can’t use gpay or any UPI payment.?

Hi Suresh,

Yes, if you have the bank account linked to Google Pay already then all you have to do is to use a VPN that will connect to Indian IP.

I have resident bank account and a resident demat account which is a joint account with my sister. My name is first in both accounts and I am now NRI. Can I keep it as it is, as they are a joint account with my sister and she is resident?

Hi Chetan,

You can continue both accounts.

Definitions of NRI as per FEMA and as per Income Tax Act are different. While for bank accounts FEMA provisions seem to apply, what is the position in respect of other liquid assets like shares,bonds, demat accounts etc. as per IT act if one is resident in India in the concerned financial year and for at least 365 days in the preceding 4 years, then he is treated as resident, while he might have been a non-resident for the post years as per FEMA .

can a NRI open a resident savings account in India? if NO then under which law will that be unlawful.? Please guide

Hi Tarun,

As per RBI Regulations, a Non-Resident Indian (NRI) cannot open and operate a regular resident Savings Account and further, any account should be converted into NRI Account by the bank before one gets NRI status.

Thanks for reply.

Still I need a clarification on the issue of penal action if any by any law if the account is maintained as resident even if person is NRI.

PL guide

Nre with normal sb acct, not converted to nro yet, want to withdraw 25 lakhs in cash

Hi Vijay,

Before withdrawing money, you need to convert your Savings Bank Account into NRO A/c.

I moved to Canada last year, Haven’t converted my Account, I’ll be doing that soon. Need to ask one question though.

I have an account in ICICI bank and a home loan EMI (from HDFC LTD) is connected with it. IF i convert that icici bank account to NRO account then what will happen to EMI, will it stop? or what do i have to do for that in order to continue paying EMIs uninterrupted.?

Hi Ravi,

EMI will not get impacted.

I have not converted my sb acct till date

Hi Harish,

It is illegal to have a resident account when you become an NRI . You have to change the bank accounts as soon as possible.

After becoming NRI if I have not informed my Bank to change my resident accounts to NRO what is the fine Goverment can impose

Hi Rajan,

If you do not convert your resident account then, a penalty of up to 3 times the amount involved in it or Rs. 2 lakh (if the sum is not quantifiable) will be charged. Moreover, the account holder will be liable to pay a penalty of Rs. 5,000 every day from the first day of violation until the penalty is paid.

I had NRI account since 2013 to 2018 then i cancelled my account but still living outside India, so now i decided to reopen again. What is the issue if i dont have one

Hi Lakshmi,

It is Illegal to have Resident Accounts when you are NRI. YOu must convert your bank accounts as soon as possible.

When I open a NRE account in India just before travelling overseas, does my status change immediately to NRI or does that still change after 183 days – at what point in time do i then need to inform my bank to change my Resident Bank A/C to NRO ?

Hi Anirban,

As per Income tax rules, if you stay more than 182 days in abroad then you will be considered NRI.

And as per FEMA rules, if you have left the country for employment then you will become NRI immediately.

I wish to give my cash assets as inheritance to specific rel Iatives before my death. I have no real estate, How can IAchieve it ?

Hi Rajeev,

You will have to write a Will.

I wish to give my cash assets as inheritance to specific rel Iatives before my death. I have no real estate, How can I Achieve it ?

can an NRI have anordinary SB aor FD account in indian banks

Hi Bosewell

NRI cannot open ordinary SB account in Indian banks and you can open FD account via NRE or NRO account

i have nri account and saving account also can i open new nro account.

Hi Anand

Yes

Hello, We realised only now that we cant hold savings account being an NRI and planning to close and open NRE/NRO accounts. We had been doing mutual funds from our savings and would like to how to proceed with continuing the mutual fund investments. Do we need to withdraw and invest again or we can just change account to NRO and continue doing so. Thank you

Hi Dhanalakshmi,

You have to update your KYC from residential status from resident to NRI. Also you need to convert your resident saving account to NRO account. You don’t need to withdraw the amount from your mutual funds. you have to change the status in your MF as well. for that I will suggest you to consult with a financial advisor.

Hi Hemant,

I am going to be an NRI in the coming months. I have an SBI home loan currently. Do i need to change anything related to that ? If i change my ECS savings bank account to NRO, will that affect my monthly EMI payments ?

Hi Anand

I think you need to inform your bank regarding your upcoming change of status.

How much penalty for maintaining local account in india for NRI account holders?

Hi Vijay,

There is no fixed penalty specified. But you should convert your resident account into NRO/NRE asap.

I am N NRI but doesn’t have NRI account only savings account in ICICI Bank .can I take NRI personal loan from this bank

Hi Shankar,

No you can’t take that. you should open a NRE or NRO account.

if I change my account to NRO, will my Mutual fund SIPS and LIC policieis ECS continue as before

Hi Neha,

Yes, But you will have to update KYC status.

If a person is having multiple saving account/bank accounts in India. Is that enough to convert only one bank account to NRO or all accounts to be converted to NRO?

Hi Moi,

You will need to convert all your saving accounts.

What is PPF account

Hi Elayat,

PPF is Public Provident Fund that is used for long-term investment.

i am from UK, my wife is also from UK, but dad has an Indian passport. Can my wife have an Indian bank account

Hi Lucas,

No.

can a Nri be joint account holder for a Resident account. or Can NRI join Either Or Survivor Resident account of his family member

Hi Rajen,

Yes.

Thanks. Can I open a new NRO account and then transfer all my money from my resident savings account to NRO for closing the savings account? Will I be charged on the transfer or will tax be applied ? The resident savings account is in my name currently.

Hi Omar,

You will not be penalized. But you will have to convert your account within the predefined time limit.

I have local Indian account.Can I transfer from overseas to my local account?

Hi Chetan,

No.

I am in Australia and have SBI saving account in India? Can I continue that? Or do I need to change it?

Hi, Kuldeep

No, you can not hold savings account in india. You need to change it.

Mr. Sharma is an Indian national he has approached you for opening an account jointly with his wife who is an American national. Can you open a normal saving account for the both or not?

Hi Sonia,

The account can be opened but the primary holder will be Mr. Sharma.

Can I transfer fund from Nre account HDFC to PNB normal saving account through cheque?

Hi Indranil,

Yes.

You cannot keep normal saving bank account if you have NRE account,and question of transfer does not exist

Can I change my existing Saving bank account to NRO account after being an NRI since last 2 years? Will i he penalized for it? I just came to know through your blog that it is illegal to carry normal resident SB account after having status changed to NRI

Hi Piyush,

Yes, you will be penalized.

Who will penalize? how will they know?

I am having saving accounts in India , now i am moving to abroad , do i need convert my saving accounts to NRIs? or I can continue my saving accounts as it is?

Hi Abhi,

You need to convert your savings account as soon as possible.

How one can manage If someone forgot to convert his/her SB account to NRO account, as required, after becoming NRI.

Hi Madan,

You should consult with your bank immediately and convert your saving bank account to NRO account.

My near relatives who is NRI generally resides in India but maintained saving bank account as Indian what he should do now

Hi Skaurdhir,

He must have convert his saving account to NRO account.

I need some help in circle rate matching with stamp duty rate, possible for someone to call back.

should i Change all my savings to NRI account ?

Hi,

you can convert all your regular savings accounts held in the country to NRO accounts. Once this is done, you can deposit all your earnings in NRO account.

A married nri daughter can gift property to his father in india?

Hi Sunil,

Yes it is allowed for a married NRI daughter to gift immovable property to his father in India.

I live in uk and want gift Rs 900000. my question is Regarding tax.

Its is regarding gifts from NRI to relatives: What if I do 2 tranfer of 45,000 rupees each will that amount be tax free for my relatives?

Hi Sameet,

If you are transferring money to some relatives included in your blood relations, total amount will be exempted from tax. Otherwise amount in excess of 50000 rupees in total will be charged for tax.

Can I make a gift from NRO account to an NRE account which belongs to my sibling?

Yes

After turning to NRI how much time do they have to convert their savings account into NRI bank account

Hi Vijay,

The reasonable time can be assumed as 3 months.

I am an Nri but i never changed my account to an nre account as my bank told me it is not mandatory. so i continued with my checking account in india. But im paying in india for the money im sending from usa to india which iam already paying in usa . What can i do.

Hi Swetha,

NRI needs to convert his resident saving account to NRO.

Either he should open a NRE account for transaction.

It is not allowed legally for an NRI to continue saving account.

A student before going abroad was maintaing Resident savings account with his father jointly and having some money and FD. 2 years (generally the student was supposed to be in India for 4 + 1 Months in a year as per academic callender) he could not come to India for Covid. Now He becomes NRI (as it is more than 6 months). My query is, can he continue with the same savings account or it is to be converted to NRO account.

Hii

An NRI can continue to have a resident saving account with close relative.

You have not said anything about the Properties held in India by NRIs. Many must be owning apartments before becoming NRI. What is to be done about it and What happens when the apartment is sold??????

I am working in Dubai for 5 years. I have a savings account in India to which I deposit money every month. Only recently I came to know about changing it to NRE account. Is it necessary? And If I go to the bank branch to convert to NRE will there be a penalty?

As per law NRI need open either NRE or NRO account.

Holding saving account is not legal.

Can NRE deposit money in its savings account

Hi Zeeshan,

Holding Resident Saving account for NRE is illegal.

What is resident saving account Can a NRI continue resident saving account

Hi Jerald,

As per my Knowledge, a Resident account means a Bank account opened by an Indian Resident. NRI Cannot Continue their Resident Saving Account.

When I try to validate my bank account with Income tax dept. It show verification at Bank fails. What are the reasons

Will bank convert existing savings accounts to nro with just letter or email request? Will my old cheque books accepted for transactions

Hi Abhi,

As per my knowledge, You can write an email to the bank for Changing account status with respective Documents.

You need to have a new Cheque with Updated Status.

Can an NRI open an NRO HUF account in India

Dear sir is it possible to transfer funds from abroad to Indian savings account of 3rd party or close relatives

Hi Rayakar,

As per my understanding, Yes you can but better to Consult with a CA.

Is it legal to send money through wise to my nre account

Hi Kapil,

As per my knowledge, Yes it is legal.

I am redesignating my savings account to NRO savings. Will existing debit card and credit cards workable

Hi Manoj,

As per my knowledge, You will have to ask the bank to re-issue the international debit cards and the credit card.

I have SB account which is linked to my Dmat account . Now I want to change the status of my SB account to NRO so will it affect the dmat account status

Hi Jaideep,

As per my knowledge, your Demat account will not be affected, But as per laws you will have to update the status in your Demat account as well and that is a different process.

Can my resident saving account be converted to NRO without changing any of account particulars such as account number etc

Hii George

As far as I know, their is no change in account number

A person who is having a saving account in icici bank and he shifted to usa about 12 years back what will be the status of his account as on date

Hii Rajeev

One should change his bank account status from resident to NRI as it is illegal for NRI to have a resident saving account in India

Can I change my saving bank account into NRI account in Dubai

Hii Farooq Ji

After becoming NRI you must close your resident saving account and open NRE or NRO account in India

I have become NRI in Jan 2021 applied for NRO account updation to Bank for my SB account but delayed what should I do?

Hii Pawan

It would be suitable to contact your bank branch to know the reason of delay and take the required action to get the updation done asap.

Can NRI open NRE account with a Basic savings NRO account in India? We are US citizens

Hii Zain

As per my knowledge an NRI can have both NRO and NRE account

Indian national holding OCI….wat document required to open normal savings account in India

Normally OCI is issued to indians who have foreign passports. NRI rules will apply

One of my relatives left India but he has a saving account in India is it legal.

Hii Mr. Sanjay

As per my knowledge if your friend has become an NRI it is illegal to have a resident saving account

Is it mandatory to show the interest earned from NRE FDs in ITR, If so where to show

Hii Mr. Santosh

The interest on NRE FD (Fixed Deposit) and/ or NRE savings account is not taxable

As per my knowledge you don’t need to mention it in ITR

What is the intention of such a provision in FEMA?

Hi, I am NRI from 2015 but didn’t changed my account to NRI and all my earnings are in Resident Account. I checked the forms to convert my account to NRE but they are asking for the effective date. If I put the effective date as 2015, will it create any problem. FYI, I have filed all my taxes as NRI and paid all required taxes without fail in all these years. Only thing was that I am not aware that account to be converted as NRI. Can any one please suggest if you have any experience on this? My accounts are with ICICI and SBI. Thanks.

I came Canada on PR in 2019 and want to go back in India within 6 month but due to COVID I miss till now but My saving account in bank in India are running same saving account. Now how can I convert my saving account in NRO Account

Can I buy shares in secondary market from NRO account?

Hii Shashi

As far as I know NRI need to open a Portfolio Investment Scheme account to make direct investment in Indian equities and through NRE accounts.

I am working in germany and transfer money to india using transferwise to my saving account. Is there any legal issue if I do not have nri or nre account.

Hii Mr. Vipin

It is not legally allowed to a NRI to have his saving account in India.

He need to have a NRE or NRO account.

Very nice and useful information

Supposing if nri is holding resident account for number of years without fema knowledge what are the consequences

Hi Raveendra,

As per my knowledge, If you hold the Resident Account after becoming the NRI then there might be chances that you will get a heavy Penality or the Account can be Freezed.

can an nri have a resident savings account for trading

Hi Sunny,

No, It is not Legal.

Have bank account in India.. want to bring money abroad.. I am aware of TCS 5% Rule.. the question is do I need to convert my savings account to NRO/NRE for doing INR to CAD? The TransferWise app asks for the declaration: “You are a Indian tax resident” that confuses me.

Hii Mr. Vinay

As per FEMA regulation, when your status changes to NRI the resident savings account have to be converted to an NRO account.

very useful post sir. just one query, is it acceptable if I hold resident savings accounts in India but they do not have any balance and no transactions in them? Or is it still in contravention to the norms? Thanks in advance.

Can i open local account while having already nre account?

Hii Mr Sanjay

As per the Foreign Exchange Management Act (FEMA) guidelines, an NRI cannot have a savings account in his or her name in India. You must convert all your savings (money earned abroad) to a Non-Resident External Account (NRE) or Non-Resident Ordinary (NRO) account.

Hi I am an NRI. MY account conversion to NRO is in progress but i have a loan running from a bank and i have to pay last emi for that but i don’t have sufficient funds in my savings account . My question is that can i transfer amount to my cuurent savings account in india?

I changed my sbi nri account to normal account, now can i continue to use my check book?

Hi Stainjelly,

You must have received the New Cheque Book as Resident account. You can use that.

I’m a sea farer I don’t have a nre account is there a problem for that?

Hi Deepesh,

As per my Knowledge, You need to open it if you are eligible as NRI in terms of the number of days you will be abroad.

Hi sir my self sheik Mohammed Imran i have canara bank nre account iam exit forighn contry now iam settled in India so my question is my nre account changed to sb account?

Hi Sheik,

As per my Knowledge, Yes You need to Change that into the Saving Account.

How can I convert my NRI Ac to savings ac

Hi Abhi,

Kindly contact your Bank, They can assist you.

Because I Of covid I have been unable to go to India can I file nre tax?

Hi Prashanth,

As per my knowledge, That’s Depend on How many Days you have been in Foreign.

Thank you I stayed in foreign for all 365 days but my fds in India are not converted to nre so can I file nre

Can i continue to contribute to PPF once my savings account has been converted to NRO account? My bank manager at HDFC told me that I cannot invest anymore into the PPF account after its status changes from Savings to NRO.

Hi Shubham,

As per my Knowledge, You can Continue to Contribute to PPF as an NRI if you have opened it as a resident.

What do I need to do to convert my account to savings account?

Hi Shyla,

As per my opinion, you need to Consult with the respective bank.

trading in India through saving account while being an NRI

Hi Ankit,

As per my knowledge, it is Illegal to hold a Saving account as NRI. You can open a PIS account for Shares.

I hold a Indian passport and moved to India for two years. I hold a resident card in another country. Whether I can open a NRE account in India if I have to transfer my savings from the other country? For my domestic earnings in India, I have been holding resident savings account here and paying my tax returns. Also I would like to know whether I can continue to hold the resident savings account or Whether I need to change the resident saving account to NRO?

Can NRI keep the local account as 2nd name..holder

Hi Shiv,

As per my knowledge, The Reserve Bank of India (RBI) has allowed non-resident Indians (NRIs) to operate resident bank accounts on an “either or survivor” basis

I have become NRI in F.Y.2021. I have a Long term capital gain around 71000/- . while filing the return in ITR 2 it imposes capital gain tax and my understanding is that it is exempted up to 1 lac so how to avail that benefit

Hi Kanhiya,

As per my Knowledge, Its better to Consult with a CA.

As a resident account holder, how can I carry out the online transfer of funds overseas?

Is any additional tax for NRI while redemption of Mutual funds?

Hi Suny,

As per my Understanding, TDS is deducted on Short Term Gain on Debt Mutual Funds while Redemption.

Hello, I am NRI and family also staying with me in abroad. But my wife is not working in abroad. So she is maintaining her savings account in India. I have few questions. Is it mandatory that savings account has to be converted as NRO account? Can she invest in mutual funds from her savings account? Thank you!

Hi,

No she can’t invest in mutual fund from resident account.

As her status is NRI, so you should convert her saving account into NRO account.

As per Fema nri cannot have indian savings bank account….so the Nri status mentioned here,is it as per FEMA or as per Income tax act as both have different definitions for Nri

Hi Delina,

As per Income tax rules, if you stay more than 182 days in abroad then you will be considered NRI.

And as per FEMA rules, if you have left the country for employment then you will become NRI immediately.

Will Income Tax Refund continue to be deposited in the redesignated NRO account?

Hi,

Yes, it is deposited in the NRO account.

I am from India And Ia m having saving account in some bank

Hi Amar,

As per FEMA rules, it is illegal to hold the resident saving account for NRI.

If i convert my nre account to a residentialmaccoun

Hi Ashish,

Ya you can do that.

As NRO returned back to India within how many days we have to convert the NRO and NRE accounts

Hi Syed,

As soon as possible you have to convert your account.

Dear Hemant sir,

Thank you for the informative article. It was really good & helped to understand the laws wrt NRIs.

I have 3 queries :

1. As per my knowledge, the status of an individual changes to NRI when a person lives outside India for a consecutive period of more than 6 months. If it’s true, is it ok if I change my resident saving accounts to NRO after 6 months from the day I travel outside India?

2. I have 3 saving accounts in 3 different banks in India. Is there a way I can change all these accounts in one go to NRO online or by submitting a single form to any one bank (may be the bank which holds my NRE account) or I have to visit all these banks to submit the forms separately?

3. Is there any impact on my existing home loan terms & conditions (specially on it’s interest rate) after changing my status to NRI?

I have nri account but now I want to convert to residents account

Hi,

Consult with your bank.

Hello, Thanks for the blog . Could someone advice please ? , Have been an NRI for a few years but still hold a savings Account. Is it advisable to close that account and initiate a new bank account or better to convert the existing one to NRI ? Though I have had my savings account for a while, I haven’t had any income or any FD etc.. Its kind of been idle.. what’s better for avoid fine and other processes. Also, how to approach this fairly ? Thank you!

Hi Keph,

As per FEMA rules, it is illegal to hold the resident saving account. If your bank service is good than you can convert the saving account into NRO account or close the saving account and open new account.

Is it possible to open a NRE account in one bank & NRO in other bank ?

Hi Abhishek,

Yes you can.

I am working abroad but I do not have nri account…. but I still hold a saving account in SBI so every month I transfer money for saving can I continue with my saving account and what are limit of deposits in financial year

Hi Cavin,

As per FEMA rules, NRI cannot continue the resident saving account

You should convert your saving account into NRO.

Ok I will do later when it will be available to come to India… as of now cannot travel… is that ok right

I shifted out of India in March 2021, when exactly I will become NRI and whom I am supposed to tell this? bank of IT Deptt?

Hi Shrey,

As per Income tax rules, If you stay more than 182 days in abroad then you will be considered NRI.

And as per FEMA Rules , if you have left the country for employment, then you will become NRI immediately.

You have to inform to your bank.

1. Does bank ask to update visa status in order to update KYC in case of NRO account ?

2. Is it also possible to have a NRE account in one bank & NRO account in another bank .

As I am keep moving from one to another countries so visa status keep changing .

Thank you for replying

Hi Rajyabhisek,

1. As per my view, it is not necessary to update visa status. But your status should be NRI, not resident in all case.

2.Yes it is possible to open NRE and NRO account from different bank.

I am working abroad i have an Indian bank saving account is it illegal?

Hi Christopher,

Yes it is illegal as per FEMA rules.

When I become an NRI (after being out of India for more than 182 days) do I change my bank account to NRI/NRO on day 183 or before?

Hi Jatin,

Yes, you should change your resident bank account into NRO on day one when your status is NRI.

I have sbi savings account and how to open an NRI account. I have net banking.

Hi Peddinti,

Consult with your bank.

I have saving bank account and I am NRI from and I am transferring money to my that account for investing I was not aware of rules now what I can do ?

Hi Aman,

First you should change your KYC status in investment from resident to NRI. And also inform to bank regarding NRI status.

Then you have to start your investment from NRE/NRO account.

Hello Gitika

Thanks for your reply and really appriciate the time you spent on me to give your advice and guidance but I have one question if I convert my account from resident to NRO how I can sell my shares as I bought those shares in my resident account as NRI.

I mean I was NRI when I bought shares in my resident account.

Please advice me I will be really thankful to you

Hi Aman,

You have to open new NRE Demat account i.e PIS .And then transfer your existing shares into new account.

whether I can open a normal saving account from abroad?

Hi Shuhaib,

You can open a abroad saving account not resident saving account.

Hello sir

I am in merchant navy, country of residence and taxation is india only. FY in which i complete 183 days outside india, I am considered NRI but sometimes we miss 183 days and in those FY, we are resident individual and also paying due tax to government.

My question-

1.) As my residential status varies every FY- if i can keep Savings account and NRE/NRO account?

2.) In what category, we are in general -NRI or resident.

Please reply

Hi Rishi,

1)As per my point of view, you can keep either NRI account or resident account.

You cannot keep both account at same time.

2) In generally you are in NRI category.

Can NRI continue with a savings account in India or has to convert it into NRO.

Hi Rahul,

You should change your resident account into NRO.

As per FEMA rules, it is illegal to hold resident saving account when your status is NRI.

My son is in the USA. He has a savings bank account in India,he is the first holder the parents are joint holders, Whether the account to be changed to NRO.

Hi Biswanath,

Yes, Your son have to change the resident account to NRO account.

I have two saving account in two banks. If Convert saving account to nro account will it cover both banks or open seperately in each bank?

Hi Janak,

You have to imform both Banks for converting the resident account to NRO account.

I am Indian citizen working in Israel last 10 years ..I have no NRI bank account. only resident savings account..I can transfer from Israel post my account to my personal bank account ..? I never send money to bank account either mine or others..can I transfer fund? if I sent a bulk amount is it taxable?

Hi Prachi,

As per FEMA act, you cannot transfer funds from Israel to your resident account.

As an NRI, you cannot hold resident savings account.

Can a family Visa holder open an NRO Account?

Hi Shreya,

As per my opinion, family visa holder can open an NRO account.

Does dependant NRI need to convert bank account to NRI?

Hi Kirupa,

If the dependant status is NRI, so they also need to convert resident bank account to NRI.

I an Indian resident have my son – an NRI- name 2nd in my savings account. I had added his name when he was not NRI. What needs to be done?

Hi Perin,

First you should inform to Bank about his NRI status.

NRI can also hold jointly bank account with a resident relative on ‘former or survivor’ basis.

I have an NRO account with sbi now blocked now how to activate it on the internet.

Hi Dharm,

You have to consult with bank only.

Hi Hemant

Thanks for the article.I am US Citizen and I have some questions. Is it possible to communicate with you via email.

I made the swift transfer to my saving account in India but now Indian bank want me to get a nro bank account and I am not there so can call my bank here to get that money back if it’s possible.

Hi Naishal,

You can open a NRO account online to get your money back.

What are the criteria to be called NRI? Is there any simpler version for layman’s point of view?

Hi Rajesh,

You can get your answer by reading below article.

https://www.wisenri.com/who-is-nri/

A resident who became an NRI 20 years back advised the bank to change the sb acct to NRO but the bank did not take any action. The Sb acct details were furnished to US tax authorities regularly. what is to be done now?pls, clarify.

Hi Raman,

You can open online NRO Account. you can contact with HDFC, ICICI & Kotak bank for this. Also you should consult with your CA for tax purpose.

Can I only change my savings account to NRO account from outside India?

Hi Pradip,

yes you can open NRO Account online. you can contact ICICI, HDFC & Kotak bank for this.

I will be traveling to Poland and will stay for 2 years. My questions are1. when I am supposed to change my status? after staying more than 180 days abroad in FY? or immediately while leaving India? 2. similarly, when I am supposed to open NRE/NRO account? immediately while leaving India or after staying more than 180 days abroad in FY? 3. so far am not an NRI and even after leaving India, I am not. then when is the best time to open NRE or convert Resident bank accounts to NRO?

Do NRI who is on dependent visa, have to convert her SB account into NRO account?

Hi Shazia,

Its illegal to have a SB account after being an NRI so

every NRI should convert SB account into NRO/NRE account.

Can I transfer funds from NRO to NRE?

Hi Praveen,

Yes you can transfer the funds from NRO to NRE account upto $1 million per financial year.

I would like to know NRI can open a saving account in small finance banks that are not regulated by RBI.

Hi Sankar,

It is illegal to open a resident saving account after being an NRI. So you should avoid this as it can attract penalty in future.

can you pl provide reference re: rules or regulations which specify the illegality /penalty details etc?tks

What problem would I face, if I transfer money directly from abroad to normal savings account in India instead of opening an NRE or NRO.

Hi Cnu,

As per my knowledge it can attract penalty in future.

Is the ppf amount on maturity taxable in case I have an NRO account.

Hi Diwanshu,

PPF amount on maturity is tax free.

I had went to Canada in march 2018 for job and came back in oct 2019 but i didnt change my saving account to nro/nre account. Upon my return in oct 2019, i closed my canada bank accounts and transferred all money to indian bank accounts. will this attract any penality since i didnt convert my bank account to nre/nro account. and what can be done now?

Hi Devesh,

As per my knowledge there will be no penalty.And if you have become resident now so you can continue with this account.

Hi Hemant,

can you please share official link where it is mentioned if NRO account is not opened, it will be penalized 3 times the money involved. I have read several other forums, I could not find, it mentions about property outside India will be penalized where property can be defined in several ways.

Hemant – Thanks for this blog. May I ask your opinion on a couple of items,

(1) What is the implication on a joint savings account if the second holder becomes NRI but first holder remains Resident?

(2) What is the taxation (on savings interest) on a joint savings account if the second holder becomes NRI but first holder remains Resident?

Rgds – Suman

As an OCI cardholder and staying in India for more than 6 months do I need to convert my NRI account to a resident account in banks?

Hi Avinash,

Yes you need to convert that.

Hi, I m working in the UK my bank account in India so how many deposits to myself without taxes?

Hi Abhishek,

There is no limit for this.But the interest on NRO account will be taxable.

I want to know if three months deadline to open or convert savings to nre/nro after completing the 6 months outside of India? For Ex, let’s say I came out of India on 25 September 2020 and my 6 months would complete in the last of march 2021. In this case, I will be NRI officially in March 2021 then what should be the timeline for changing the account status.

Hi Abhinaw,

There is no fixed time line to convert saving account to NRE/NRO.

My question is till when we can change the status from residence to NRI

Hi ram,

If you live or visit less than 182 days in india in a FY. then your status will become NRI.

Can NRI hold normal savings account in India?

Not as per the rules

What is the difference in interest and tax if an account is changed from resident to NRO?

It’s same. NRE doesn’t attract taxes but NRO does similar to a Residential savings bank account

I am a seafarer any my NRI status changes every year, sometimes I am resident sometime I am NRI, So what should I do whether to close my saving account or not.

Hi, if lets say i have NRE account in ICIC bank and saving account in SBI bank. do i still need to close my saving account in SBI

Hi rajesh,

You can convert your SBI saving account into NRE/NRO Account

I have emi which is cutting from the SB account. I want to convert it into an NRI account. Which account I should open NRI or NRO?

Hi Abidali,

You can open any account for your EMI.

What is it mandatory to convert saving account into NRO account on residential status change?

Hi Shriya,

Its illegal to have a resident saving account after being an NRI. It attracts penalty if you don’t change your residential status.

I have a NRE a/c and saving a/c of SBI can i maintain both..? NRE for money transfer and saving a/c for local transfer and local receive money

Me and My frined both H1 Visa holder, are working at IT in USA . My frined he wants to purchase house at USA. He is asking me to transfer 25k USD to his us bank account and equivalent amount INR 18lakhs he want to transfer in my NRO account in India. But my frined doesn’t have NRE/NRO account. He is still maintaing as normal India saving account. We both are paying proper tax at USA and India. My questions are following

1. What is the Tax implication?

2. Who need to pay the tax?

3. Is ther any other way we can show the transaction and get rid of any future issue ?

Hi Tina,

As per my knowledge, if you transfer the amount without any consideration then it will be taxed in the hands of the recipient and added to his income and taxed according to the slab.

Can I as a NRI (USA citizen) transfer my NRO rupees to NRE existing account maintained at SBI New Delhi and what is the process?

Hi Raj

Yes, you can but a certain limit of 1 million USD is there per Financial Year and after paying proper taxes on that.

Hi Raj,

I think You can transfer funds from NRO to NRE accounts provided you submit the necessary forms, 15CA, and 15CB.

Dear Mr. Beniwal,

Thank you for the helpful compilation.

I just need clarification on one point. You have mentioned that a PPF account opened after 2003 can be continued till maturity even if the holder becomes an NRI. However, on maturity it cannot be extended for further blocks.

1. Is this rule still current?

2. If yes, can the NRI continue to deposit money in the PPF account till maturity?

Would appreciate some clarity on this.

Thank you

Ram

Dear Ram,

Yes, this rule is still applicable & you can contribute to PPF till maturity. 2-3 years back the government came with a change which meant compulsory withdrawal from PPF for NRIs but that was dropped later.

Dear Mr. Beniwal,

Thank you very much for the clarification. It has set my mind at rest.

Best Regards,

Ram

Does this also apply to students who have left India on a F1 Visa and may return back to India after completing their studies?What happens if the Resident Savings Account in India is in the Joint name of the NRI and a parent who is a resident in India?

PPF Account can be maintained by the NRI if it was opened by the NRI before he became a NRI, till maturity.So you mean that a NRI cannot seek the optional 5 year Extensions of his PPF account?

My logical next question will be Can A NRI gift his father all the sums in his ordinary savings account and PPF on Maturity, and then close the Savings account as he has no income in India?

Hi Sanjay

1) Yes it applies to students as well and the status of the first holder will depend if it is needed to change the savings account or not.

2) Yes, NRI’s do not have such options.

3) Yes, NRI can gift to their relatives (as mentioned in Income Tax Act).

most of these rules cant be applied.. people are from IT projects finish and we keep moving countries and back to India.. no one can keep redesignating accounts .. its totally impossible .. ! and same from NRE one cant keep moving NRE FD to RFC etc which means in middle of ur FD u break loose money and then buy foreign currency pay commssion to the bank ?

Hi RL,

I think These rules imply to people who want to permanently change their residency status.

I cannot go till Covid-19 situation gets back to normal and travel becomes as before

I have account in some banks in India who are asking to personally come and do the conversion formalities. it is not possible for me to go as I am above 70yrs old and have medical conditions. Only one private bank is having procedure for online conversion but not by just sending letter or email. Many documents have to be uploaded, which can be done with some effort. But what about who don’t do conversion ONLINE or through email or letter as you have said.

Can father of NRI can open fixed deposit in his sons name from his retirement fund to distribute his share with other family members to avoid dispute latter on.

Hi Kanchan

In such situation, it is advisable to prepare a Will to avoid any dispute.

Hi Kanchan

As per my knowledge, an NRI cannot hold resident FD, the FD can be created either through the Son’s NRE account or NRO account.

Dear Hemant,

Very good info. But let me share that i am a person who is frequently changing residency. Like few project I am doing in Gulf. Some in India. It is very difficult every time to follow this type of change specialy it links many things like demat, MF, PPF, NPS, FD, Corporet FD.

Dear Manoj,

I can understand your concern but I can only share the rules 🙂