Like all developed economies, Singapore also has a central retirement fund called the Central Provident Fund of Singapore (CPF) managed by the CPF Board. The central provident funds are a mandatory employment-based savings scheme with defined contributions from the employees and their employers. Both contribute a pre-defined percentage of the employee’s compensation to the CPF funds.

The primary objective of the Central Provident Fund singapore is to help the working populace, Singapore citizens as well as Singapore Permanent Residents (SPRs), fund their healthcare, retirement, and housing needs.

In this article :

- What is CPF?

- Types of accounts in Singapore Central provident fund

- Conditions of Withdrawal CPF Funds

- What do NRIs do with Singapore CPF when moving back to India?

- How can NRIs Withdrawal Singapore Central Provident Fund?

- How does the CPF system work?

Types of Accounts In Singapore CPF

Under the Central Provident Fund Act, employees and employers must make regular monthly contributions to the employee’s.

Central Provident Fund accounts. There are three types of accounts to which the contributions are allocated.

Must Read- 10 Best NRI Investment Options

Ordinary Account (OA)

This account helps build the corpus for housing, insurance, investment, and educational needs of the investee.

Special Account (SA)

The special account is built for old age investments and it is invested in retirement-related financial products.

Medisave Account (MA)

To take care of the payment for approved medical insurance and hospitalization needs of the employees, the Medisave account contributions are used.

Retirement Account (RA)

This is not a separate account, but when you turn 55, the OA and SA are combined into the Retirement Account (RA). The RA is used to make monthly payouts in the form of annuities to meet basic needs post your retirement.

Must Check – Mr. NRI – How Much Retirement Corpus Is Enough

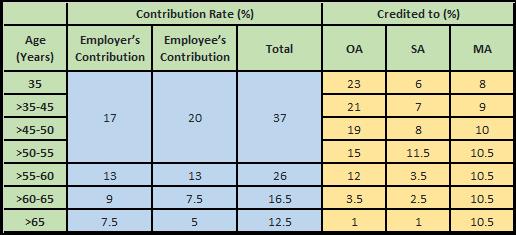

CPF Contributions and Allocations

As per Singapore laws, contribution and allocation rates change with your age group. This helps ensure the employability of workers as well as meeting their financial needs later in life.

The Central Provident Fund seeks more contributions from younger workers and their employers than from older employees. As you contribute more, early in your career, even small contributions compound for a longer period. As one grows older, the contribution decreases to allow for more take-home salary.

The following table shows the ratio of contributions and allocations for a person earning SGD 750/month.

Must Check –401k Plan Before Moving Back To India

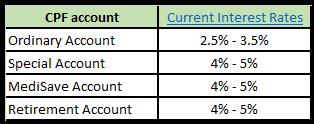

Earnings on CPF

Not only contributions and allocations are well-defined, but the earnings on each of The Central Provident Fund account are defined from time to time depending on the current standard of living, inflation rate, and monetary policy prevailing in Singapore. CPF in Singapore savings earn at least 2.5% interest on OA balance, and at least 4% for SA, MA, and RA.

What are your options?

Contribution to the central provident fund is not an option for anyone working in Singapore as all Citizens and SPRs must make monthly CPF contribution Singapore. This applies to all workers in Singapore on a contract, or in a permanent, part-time, or casual capacity.

For self-employed and business persons, only MA contributions are mandatory. They can, however, voluntarily contribute to all three CPF accounts. The voluntary contributions will be credited to the OA, SA, and MA as per the usual Central provident fund allocation rates.

Check – NPS for NRI

Investment options

However, all CPF members can invest in specified securities and avenues their OA and SA balances under the CPF Investment Schemes CPFIS-OA and CPFIS-SA, for their OA and SA accounts, respectively. You can make these investments only if you have a balance in excess of SGD 20,000 in OA, and SGD 40,000 in SA, w.e.f. July 1, 2020.

Specified assets include:

- Insurance

- Unit Trusts

- ETFs

- Fixed Deposits

- Government Bonds & Treasury Bills

- Shares on the Singapore Exchange

- Property Funds

- Gold

What to do when moving back to India?

If you wish to surrender your SPR status and return back to India, you must first settle all your tax liabilities. Your employer must notify the Singapore IRAS for tax clearance and ensure all your taxes are fully paid before your employment comes to an end.

Once you have tax clearance, you can apply for the complete withdrawal of your Central Provident Fund balances from all three accounts in full.

Conditions of Withdrawal CPF Funds

NRIs (or their legal representatives) can withdraw CPF savings on the following grounds:

- If one has renounced their SPR status and leaving Singapore and West Malaysia permanently.

- If one has become certifiably permanently unfit for work due to physical or mental incapacity.

- Upon their death:

- Upon the death, in Singapore, the relevant public agency will notify the CPF Board, and it will distribute the CPF balance accordingly.

- If the NRI with SPR was residing overseas at the time of death, then you must inform the CPF Board in writing along with all the relevant documents like the local death certificate and SPR status documents.

Must check – Gift by NRI to Resident Indian

Process of Withdrawal Central Provident Fund (CPF)

- Download and fill the CPF withdrawal form from here. You can find more details here.

- If you have already left Singapore, then all non-original documents will require certification by officials at Singapore Missions. For attestation of your signature on the CPF Withdrawal form, schedule an appointment at the Consulate/Mission and bring the following documents:

- Central Provident Fund Withdrawal form

- Original passport for ID and signature verification

- Photocopy of passport for office records.

- Processing Fee

- Forward the CPF Withdrawal Form directly to the CPF Board.

- Once the application is approved and you have any income tax liabilities, the Inland Revenue Authority of Singapore (IRAS) will use your CPF funds to settle them. Mostly, you will get all your CPF balances in OA, SA, and MA accounts.

- The CPF Board will inform the agent bank about the closure of your CPF Investment Scheme – Ordinary Account. Once you receive notification from the Board, approach the bank to get you transferred to your own name. You may liquidate them and get paid directly of the sale proceeds.

- Similarly, for the CPF Investment Scheme – Special Account, the Product Provider will get notification from the Board to transfer your investments in your name. You can liquidate and have the sale proceeds.

The DTAA and Indian Tax Provisions

The DTAA between Singapore and India prevents double taxation of income earned and taxed in Singapore from being taxed in India again. Therefore, there is no tax liability on you for transferring CPF money to your NRE account.

However, as the money in the NRE account earns interest or is invested and income accrues on it, you will be liable to pay tax on that income earned in India.

If you receive annuity payments or pensions from former employers in Singapore, even after returning to India, then those are taxable as per your tax slab under the head ‘Income from Salary or Pension.’ This is again subject to the applicability of DTAA and is tax is already deducted by the employer in Singapore.

Check our

Retirement Planning Service For NRIs

Hope this gives you a good idea about Singapore CPF or CPF in Singapore- if you have any questions add them to the comment sections.

I moved from Singapore to the US. Now I want to close my CPF in Singapore and withdraw the funds. Is it better to transfer it to my account in the US or to an NRE account in India?

I worked in Singapore till 2020. Then I returned to India. At present, my CPF account earns interest on 31st December. The interest is added in the CPF account. My status in India for AY 2023-24 is Resident in India. So what should be tax treatment for the CPF interest earned in Singapore? How should I handle it in ITR2 form of income tax filing in India?

Hey Mansukh,

the CPF interest earned in Singapore would be taxable in India. You should report the CPF interest as foreign income in your Income Tax Return (ITR2) under the head “Income from other sources.” While filing the ITR2 form, you will need to provide the necessary details of the foreign income earned, including the amount of CPF interest and the country where it was earned (Singapore).

Hi Sunil, the CPF account in Singapore is like EPF account in India, where Employer and Employee contribute every month. As per rules for EPF contribution in India, the opening balance and interest on the opening balance are not taxed. Only the interest on the contributions in the previous year is taxed as per my understanding. As I retired and moved to India before 3 years, there is no contribution in my account in my CPF account and as the previous opening balance and interest on that balance are not charged in India, should I not claim benefits under exemption income?

Is there any kind of Tax Exemption available u/s income tax of India on such Singapore CPF interest income?

Is there any kind of Tax Exemption available u/s income tax of India on such Singapore CPF interest income?

After becoming resident Indian, i receive my CPF money in Singapore and transfer to India. How will this monies be taxed in India?

Hey Sunil,

The money will be subject to taxation in India. The transfer will be considered as foreign remittance, and any income component within the CPF amount will be taxable as per Indian tax laws. The taxation will depend on the nature of the income, such as interest or capital gains, and should be reported in your Income Tax Return (ITR) accordingly.

Is CPF earned in singapore taxable in India when one returns to india

Hello Poornima

Central Provident Fund (CPF) contributions made by an individual while working in Singapore are not taxable in India, as CPF contributions are made by the employee and the employer in Singapore to provide retirement and other benefits to the employee.

is the cpF earned in SIngapore taxable in india

Hello Jaydev

Central Provident Fund (CPF) contributions made by an individual while working in Singapore are not taxable in India, as CPF contributions are made by the employee and the employer in Singapore to provide retirement and other benefits to the employee.

Singapore CPF withdrwal is deposited to singapore bank account. Now if transfer to india resident savings account , is it taxable in india ?

Hi Abhishek,

As per my knowledge if you have paid tax in Singapore you don’t need to pay tax in India

Hi,

I am in India since 2013 and my pr expired in 2015. I have withdrawan cpf in 2022. If I transfer in my resident account in India, will it be taxable by India. I don’t hold any nre account

Hi Sunny,

Kindly consult with your CA.

Once an NRI returns to India permanently from Singapore and becomes resident, he cannot hold an NRE account and has to convert their NRE account to Resident account after a specified period of time. So, if the Singapore CPF amounts are fully withdrawn upon surrender of SPR, does it become taxable in India?

This is subject to the applicability of DTAA and is tax is already deducted by the employer in Singapore.

There is no tax liability on you for transferring CPF money to your NRE account.

However, as the money in the NRE account earns interest or is invested and income accrues on it, you will be liable to pay tax on that income earned in India.

For an OCI from Singapore, and resident in India, are CPF Retirement Account payouts taxable in India. Thank you

Hi Prathap,

As per my knowledge, the payouts are not taxable in India.

Gday Reet

Thanks yours..

Appreciate if you would please advise if it is specifically addressed under India Income Tax code.

Thank you

Prathap

My SG PR expired in 2020, have been in India since 2011, If I withdraw my CPF now, will I be charged income tax on withdrawal.

Hii Meghana Ji

The DTAA between Singapore and India prevents double taxation of income earned and taxed in Singapore from being taxed in India again. Therefore, there is no tax liability on you for transferring CPF money to your NRE account.

Transferring CPF money to resident india savings account is taxable ?

Hi Meghana,

I’m in a similar situation, not sure if I transfer from the CPF account to Resident Account in India is it taxable?

(I’m not NRI now and do not hold any NRE Account)

Please advise if you have figured it out.

Hi Shivakumar, I’m also in a similar situation. Did you find out? Please share. Thank you.

What will be transfer charges from cpf account to NRE ACCOUNT

Hii Mr. Ajay

As per my knowledge if you transfer it in foreign currency(SGD) their might be no charges but if you have converted it in INR then their may be foreign exchange charges

The article is well compiled. Thanks Hemant.

Thanks Yugan

Is there Tax Exemption available on accrued (Singapore) CPF interest to be reported in Indian ITR, by an Indian individual ?? (now Ordinary Resident of India, who was former Singapore PR)