Financial planning includes a myriad of things. A banker may not be the best person to entrust your financial plan with as he may not have the experience and knowledge to deal with all the different aspects of financial planning. Complexities in the case of NRIs is even higher…

Must Check – How to Apply For NRI Credit Cards in India & Its Benefit?

NRIs should know that banks mis-sell products or not give the best advice.

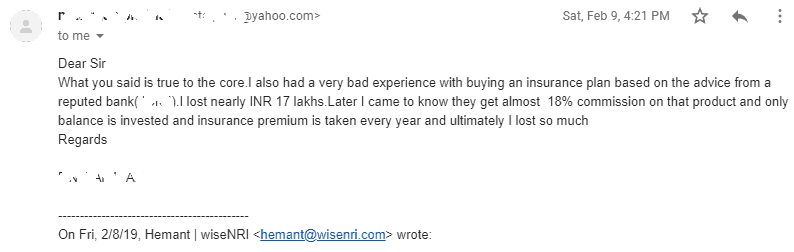

An NRI emailed me…

Every month I get 1 or 2 such emails & I have only one reply…

Sorry to hear that but this is how bankers work 🙁

A simple google search can give you n number of results that how banks mis-sell.

Must Read – Best Bank for NRIs in India

Things NRIs Should know about Financial Planning

Here are some things that should be considered while planning one’s finances –

1. Financial Planning is more than selling investment products

Financial planning for NRIs is a comprehensive exercise which includes the following –

- Assess Current Financial Health

- Guide NRI Tax issues

- Manage estate and will

- Manage investments to meet short term and long term goals

- Provide for financial emergencies

- Advice about compliance related to financial matters

Bankers may be tempted to just look at the investment angle as that is one aspect where they can earn some money for the bank and meet their sales targets. If your banker who is doubling up as your financial adviser is not taking care of the points mentioned above, you might want to look at alternative financial planning options.

2. Criteria for Product suggestions from a financial planner suit the client

When a competent financial planner suggests an investment product, he looks at the following parameters –

- Risk Profile

- Suitability for short term or long term goals

- Tax liability

- Investment portfolio diversification

- Appropriate Asset Allocation and

- Cash Flow

The banker may not be suggesting alternate products or may not present a 360-degree view of the recommended products. If your banker cum financial adviser is not considering the above-mentioned factors, your interests may not be best met with.

NRI Retiring in India should read this…

3. Sales Targets and Financial Advice cannot be merged

Bankers have a job with the bank. They may have sales targets. They will be asked to push the bank’s products as everyone is interested in higher revenues and higher profitability. NRIs are easy targets for bankers…

On the other hand, most financial planners work independently so not target pressures. In most cases, beyond a certain fee, the financial planner also earns commissions but they have to share that information with clients.

So it is in the best interest of both parties – client and financial planner that the best products are suggested and the investment portfolio is at its optimum best.

4. There are many investment products available in the market

Bankers may get an incentive when they sell bank’s products. They may not be aware of all the products in the market. It is easier for him to manage the investments if the products are from the same bank too. So they will recommend their own products.

For example, a banker might tell you to invest in his bank’s FD for low-risk investment and fixed returns. But there are options such as tax-free bonds, taxable bonds, FDs of other banks, etc. (Do you think if NRE FD of x bank is giving more return that his bank – he will inform you that)

“A competent financial planner will consider all products and give you the best advice and you deserve that as a customer.” wiseNRI

5. Financial Planning is a long-term activity

Financial planning is a lifelong activity. Financial planning is important when you get your first job, when you do your first investments, compute your tax liability, set your goals, retire and eventually transfer your estate to your near and dear ones.

Does your banker consider these things while planning your investments? If not, go out there and get a financial adviser who thinks of financial planning more comprehensively.

6. Financial planning does not just mean the recommendation of a few investment products.

Will your banker give you financial planning services, if you close your account in that bank and open a new account with another bank?

A financial adviser will not have any issues here. Some NRI believes banks are more trustworthy and so they will not lose the money.

Check – Best investment for NRI in India

7. Financial Planners are FIDUCIARY

All good Financial Planners are “SEBI Registered Investment Adviser” (RIA) – they are regulated, the advice is in writing & they are required to act in their clients’ best interests. Bankers are not Fiduciary.

A competent financial planner recommends products that are suitable for the client’s financial plan. They do not recommend products suited to their interests. Banks have their own investment products and financial products which bankers are expected to sell. This can lead to a major conflict of interest if recommendations are not suitable for the client. Therefore before you buy any financial product from your banker or product agent, check if it fits in your portfolio.

SEBI Registered Investment Adviser has to share any conflict of interest in the recommendations.

Financial planning includes recommendations on the most suitable products and a review of the same to determine if there have to be any updates on the investments.

Financial planners should give advice that is unbiased and in the best interests of the customer. If your banker’s advice does not follow that, then your financial planning is not optimum.

“You have to choose a financial planner whose advice helps you to create wealth, grow your wealth and utilize your wealth in the best possible way.”

Talk to us about your Financial Plan.

Please share your experience with the bankers in the comment section. If you have any questions regarding financial planning feel free to ask.

You are absolutely right due to this fear some time I avoid to take branch visit also. They are first start selling there product before asking what is my problems. Only we are waiting account protebility what RBI is suggesting few year back like mobile operator. But now same is in cold box.

Thanks for sharing your experience Mr Manoj.

I was NRI and returned to India in Feb end and can i have HUF account ? (I am not resident for the last 2 years)