What NRIs Should Consider when Moving from one Foreign Country to Another?

Moving to yet another foreign country? Whether you’re moving to a country other than your current country of residence for a new job, business, or retirement, it is important to get your financial life sorted. While you may have fewer tasks related to investments, bank accounts, and liabilities in India, you need to tie in all the loose ends in your financial life in your current country of residence. Keep the financial situation in the current country of residence in check before you embark on your life journey in the following country of residence.

Check – Financial Planning for NRIs

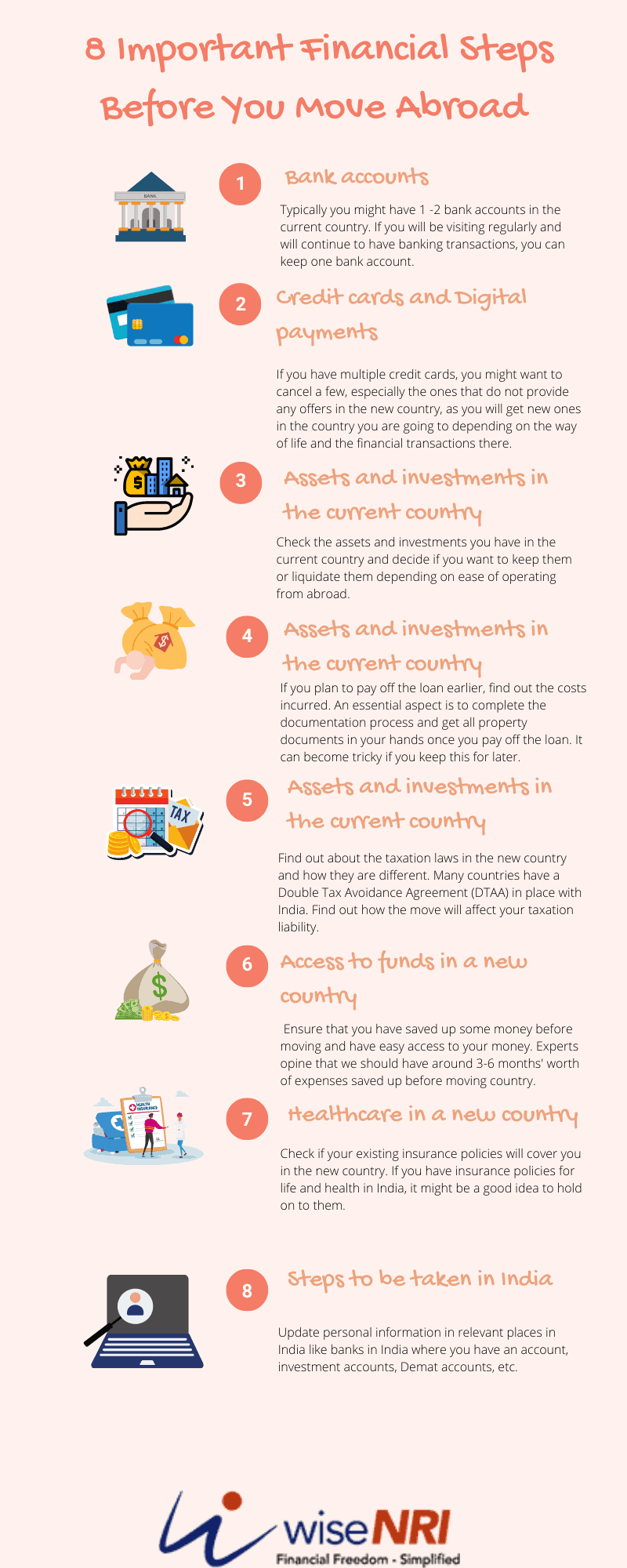

Here are 8 Important Financial Steps Before You Move Abroad

1. Bank accounts in the current country

Typically you might have 1 -2 bank accounts in the current country. If you will be visiting regularly and will continue to have banking transactions, you can keep one bank account. It is better to close other accounts. If you do not plan to come back, transfer/withdraw your money and close all bank accounts. One of the most Important Financial Steps Before You Move Abroad.

2. Credit cards and Digital payments

Notify your credit card company of your plan so that purchases in the new country are authorized. When I moved to a country that did not have a robust banking system or credit card system in place about ten years back, none of my cards from India worked, and I did land into a couple of uncomfortable situations. If you have multiple credit cards, you might want to cancel a few, especially the ones that do not provide any offers in the new country, as you will get new ones in the country you are going to depending on the way of life and the financial transactions there. It is advisable to close down all your local digital payment apps in the current country. Else, your money can get stuck.

Must read- What kind of Issues NRIs Face With Their Banks in India?

3. Assets and investments in the current country

Check the assets and investments you have in the current country and decide if you want to keep them or liquidate them depending on ease of operating from abroad. For example, if you have invested in bonds, check how easy it is to get the proceeds post maturity or the conditions around early redemption.

If you have real estate, you will have to remotely manage maintenance bills, utilities, property tax, and equated monthly installments remotely. The property will require upkeep. You can enlist the services of a property management firm or ask friends/relatives to manage the property. If you are giving it on rent or believe there is a lot of appreciation value, it may be a good idea to hold on to the asset. If you want to avoid hassles and close financial ties with the current country, it may be a good idea to sell it and move on. If you plan to sell, understand the processes and taxation rules around it. There are always different rules and additional steps that non-citizens have to undertake.

4. Liabilities in the current country

How do you plan to service loans if any in the current country? Are you allowed to move from the country when you have loans? Are the loans tied to your visa validity? Find out the answers to these questions. If you plan to pay off the loan earlier, find out the costs incurred. An essential aspect is to complete the documentation process and get all property documents in your hands once you pay off the loan. It can become tricky if you keep this for later.

Must read – NRI Checklist

5. Taxation in the new country

Find out about the taxation laws in the new country and how they are different. Many countries have a Double Tax Avoidance Agreement (DTAA) in place with India. Find out how the move will affect your taxation liability. If you will earn returns in the current country even after you move out, and they are liable for taxation, ensure you know how to pay the tax and manage the documentation when you are not in the country.

6. Access to funds in a new country

When you move to a new country, you will be engulfed in a myriad of emotions – excitement, anxiety, etc. New expenses, moving-in expenses, unexpected expenses, and indulgences can occur. Moreover, the prices of items will not necessarily be on par. Slowly, but surely understand the price structure. Ensure that you have saved up some money before moving and have easy access to your money. Experts opine that we should have around 3-6 months’ worth of expenses saved up before moving country.

Check if the banks with which you have branches or affiliations in the new country. Check if you can use online banking for expenses in the new country. Open a bank account in the new country as soon as possible.

7. Healthcare in a new country

Check if your existing insurance policies will cover you in the new country. If you have insurance policies for life and health in India, it might be a good idea to hold on to them. They will be useful when you move back, and most health insurance policies have waiting periods. . You must also have a health cover for you and your family either provided by the government, your new employer or purchased by you.

8. Steps to be taken in India

When you move to the new country and get proof related to identification and address there, update your KYC in India else, financial matters in India can get stuck. It is also crucial to update personal information in relevant places in India like banks in India where you have an account, investment accounts, Demat accounts, etc.

Moving to a new country is a life-changing event, and it is important to plan it well and tie up all loose ends so that it turns out to be a smooth process. If you have any questions regarding important financial steps before you move abroad add them to the comments section.

I am o.c.i holder,I have moved to india.Want to know what to do regarding my n.r.e. accounts and fcnr deposit?

If I become Resident Indian for one year and then the following year go abroad and become nri

Regarding RNOR status