If you are a Non-Resident Indian (NRI) and you’ve invested in Indian mutual funds, here’s an important update you should know.

A recent ruling by the Income Tax Appellate Tribunal (ITAT), Mumbai has clarified that NRIs living in countries like Singapore may not have to pay capital gains tax in India on the sale of mutual fund units — thanks to the tax treaty between India and Singapore. And good part is this is not limited to only Singapore…

This is great news, especially for NRIs who may not be fully aware of how tax treaties work and how they can help reduce tax liability.

Check – Best Investment options for NRIs

What Did the ITAT Say?

The ruling came in the case of a taxpayer named A. Shah, who is a tax resident of Singapore. She sold mutual fund units in India during the financial year 2021–22 and earned capital gains of over ₹1.35 crore (₹88.75 lakh from debt mutual funds and ₹46.91 lakh from equity mutual funds).

In her income tax return, she claimed that this income should not be taxed in India, as per the India-Singapore tax treaty. According to Article 13 of the treaty, capital gains from assets like mutual fund units are taxable only in the country of residence — in this case, Singapore.

Read – Check Double Taxation Avoidance Agreement (DTAA)

Why Was There a Dispute?

The Indian Income Tax Officer disagreed. They argued that since the mutual funds are based in India and get their value from Indian assets, the gains should be taxed in India.

This disagreement led to a legal case, and eventually, the matter was taken to the ITAT.

✅ What Was the Final Decision?

The ITAT ruled in favor of the taxpayer (Shah). It made a very important distinction:

- Mutual fund units are not the same as shares of a company.

- They are issued by trusts, not companies.

- So, they fall under a specific category in the treaty known as the “residual clause.”

According to this clause, capital gains from such assets are only taxed in the country where the person lives, not in India.

Therefore, Shah was not required to pay capital gains tax in India.

Does This Apply Only to Singapore?

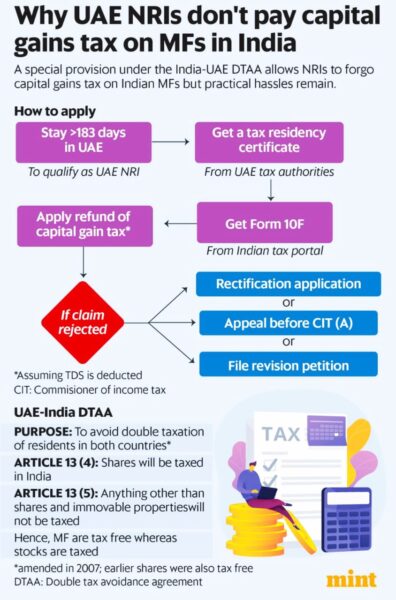

No. India has similar tax treaties with several countries, such as:

- UAE

- Mauritius

- Netherlands

- Spain

- Portugal

In all these cases, if the tax treaty has a similar “residual clause,” NRIs from those countries may also avoid paying capital gains tax in India on the sale of mutual fund units.

Source: Mint

Why This Matters for NRIs

This ruling is a reminder for NRIs to:

- Understand the tax treaty between India and their country of residence

- Plan their investments and redemptions wisely

- Consult a qualified Chartered Accountant or investment advisor

Many NRIs are not aware that these treaty benefits exist. As a result, they may end up paying tax in India unnecessarily.

Must Read – NRI Mutual Fund Taxation

What Should You Do Now?

- Check if your country has a tax treaty with India that includes similar capital gains provisions

- Review your mutual fund investments

- Speak to your CA or advisor to understand if this benefit applies to you

- Plan ahead to reduce your tax burden and increase your returns

Final Thought

Tax rules can be complex, especially when they involve two countries. But with the right guidance and awareness, you can make informed decisions and avoid paying more tax than necessary.

If you’re an NRI with mutual fund investments in India, this is a good time to check if you’re eligible for this exemption — and start a conversation with your tax advisor today.

Hope you found this post helpful. If you have any questions or would like to share your experience, feel free to drop a comment below.