Many Non-Resident Indians (NRIs) continue to maintain their Indian bank accounts, investments, and properties. It is not always easy and advisable to sell everything and try to establish it in a new country, where you are not even a citizen or a permanent resident.

There are many differences between the treatment of Resident Indians’ and NRIs investments, incomes, and tax liability. These differences may be noticeably clear at most places but may be subtle and lead to confusion.

NRIs are liable to pay taxes on their income and have many NRI tax saving options, just like Resident Indians, and can employ them. You have to remember that NRIs need to pay tax only for their income originated in India and not on their income originating abroad.

Must Read – Simple Process Of Tax Refund for NRI

How Can NRIs Save Tax In India?

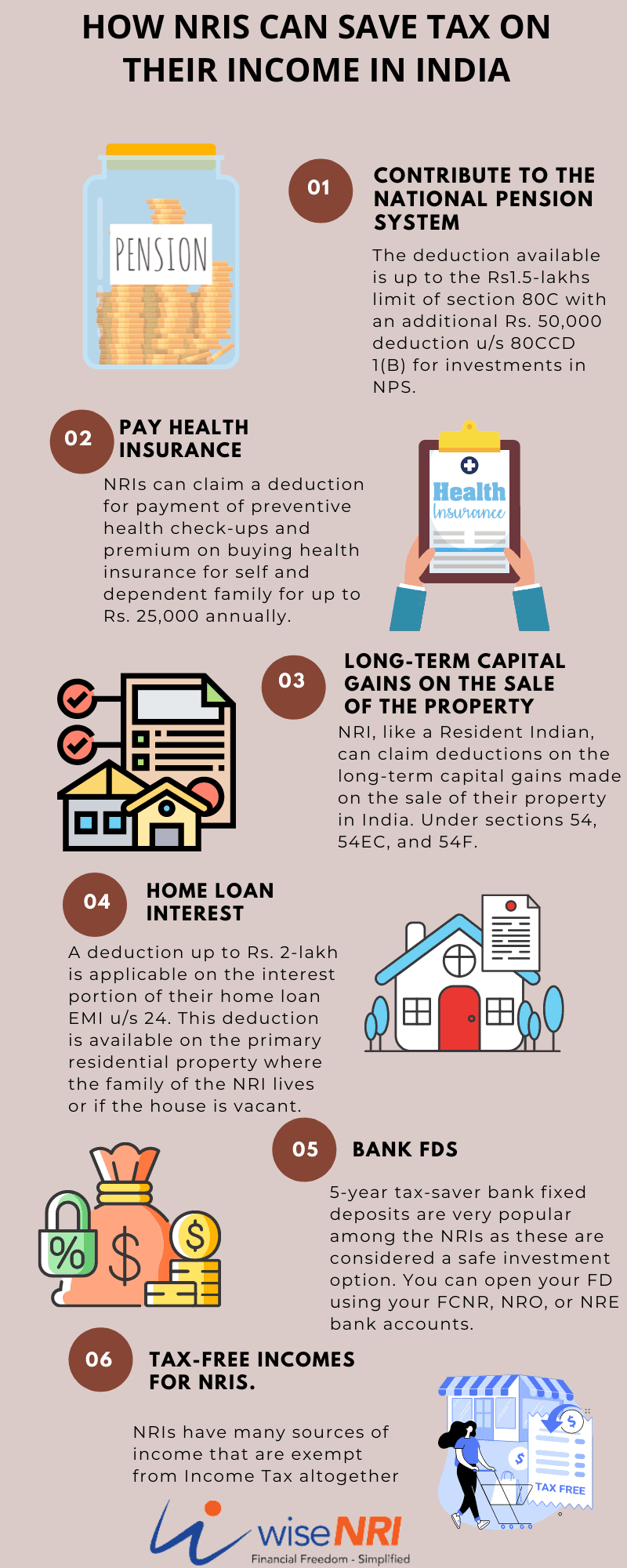

Tax-Free Incomes for NRIs.

NRIs have many sources of income that are exempt from Income Tax altogether. These are:

- Interest earned on Foreign Currency Non-Resident (Bank) [FCNR(B)] Deposits and Non-Resident Non-Repatriable [NRNR].

- Interest on notified bonds and savings certificates issued by the Government of India.

- The interest earned on Non-Resident External [NRE] accounts.

- Interest earned on Non-Resident Ordinary [NRO] savings accounts up to a maximum limit of Rs. 10,000 u/s

- Long-term capital gains up to Rs. 1-lakh from sale/redemption of shares or equity mutual funds.

- Long term capital gains on the sale of house property are reinvested in a new house property (u/s 54), invested in notified bonds of NHAI or REC (u/s 54EC), or on sale of a property other than a house if it is reinvested in a house property (u/s 54F).

Also Check: Tax Strategies for NRIs

House property-related deductions.

Like resident Indians, NRIs can claim deductions on the purchase of house property in India. These deductions are for the property tax paid, interest on the home loan, and towards the principal amount.

Home loan interest

A deduction up to Rs. 2-lakh is applicable on the interest portion of their home loan EMI u/s 24. This deduction is available on the primary residential property where the family of the NRI lives or if the house is vacant. If you have rented out the property, then the entire interest is allowable as a deduction.

Home loan principal repayment.

All homeowners can claim a tax deduction of up to Rs. 1.5-lakhs under the overall limit of section 80C of the IT Act. U/s 80C you can also claim deductions for the stamp duty and registration charges paid, as they are considered to be part of the home acquisition cost. It is better to recuperate them first as they are allowable only in the year they were paid.

First-time homeowners.

Special tax treatment is applicable as the government is pushing for affordable housing. The new exemptions can be availed up to March 31st, 2022 for all affordable housing projects approved after September 1, 2019. These deductions are available u/s 80EE and 80EEA.

- Section 80EE: If the house you bought is your first home, then you get an extra tax benefit of up to Rs. 50,000 on the home loan.

- Section 80EEA: The interest up to Rs. 1.5-lakhs on the home loan for the first house (under affordable housing projects) over and above the Rs. 2-lakhs limit available u/s 24. This makes the total limit of Rs. 3.5-lakhs even if you are not renting out the property.

Must Read – NRI Tax in India on Indian Income 2022-23

Long-term capital gains on the sale of the property.

As discussed earlier, an NRI, like a Resident Indian, can claim deductions on the long-term capital gains made on the sale of their property in India. It is covered u/s 54, 54EC, and 54F.

- Section 54: If the long-term capital gains on the sale of house property are reinvested in the purchase of new house property in a year before the sale or within 2-years from the date of sale of the property. It is 3-year in the case of construction.

- Section 54EC: If the long-term capital gains on the sale of house property are invested in notified bonds of National Highways Authority of India or Rural Electrification Corporation.

- Section 54F: If the long-term capital gains on the sale of property, other than a house, are reinvested in house property in a year before the sale or within 2-years from the date of sale of the property. It is 3-year in the case of construction.

Deductions under section 80C.

Income tax deductions u/s 80C are available to all individual taxpayers with a total cap of Rs. 1.5-lakhs on them.

Life insurance premium payments.

All life insurance payments, for plans in any category – endowment, money back, term, child plan, and ULIPs – are deductible under the overall limit of Rs. 1.5-lakhs.

Also Read: Health Insurance for NRIs in India- 4 factors to be Consider

Public provident fund.

New account opening for PPF accounts for NRIs is now barred, but if you had a PPF account before you became an NRI, then you must continue to invest in that. Investments made to PPF are completely safe as these are direct deposits with the Government of India and have the Exempt-Exempt-Exempt status with the highest interest rate (at the time of writing this piece, it was 7.10%). The PPF investments have, however, a lock-in of a minimum of 15 years.

National Pension Scheme for NRIs

Promoted by the Government of India, the NPS allows NRIs to build their retirement corpus. Any NRI between the ages of 18 and 60 years with an NRE or NRO bank account can open an NPS account. NRIs have the option to choose from equity, corporate bonds, and government debt to invest their funds in. The deduction available is up to the Rs1.5-lakhs limit of section 80C with an additional Rs. 50,000 deduction u/s 80CCD 1(B) for investments in NPS.

Also Check: NPS for NRIs- National Pension Scheme

Bank FDs.

5-year tax-saver bank fixed deposits are very popular among the NRIs as these are considered a safe investment option. You can open your FD using your FCNR, NRO, or NRE bank accounts. There is a lock-in of 5-years and the rate of interest depends on the bank and prevailing rates.

Other deductions u/s 80C.

- Tuition fee for children’s education

- Principal repayment on the home loan (discussed above)

- Investments in Equity-linked savings schemes offered by equity-mutual funds. They have a lock-in period of 3-years.

Health-related deductions u/s 80D.

Medical insurance and preventive health check-ups for self and family.

NRIs can claim a deduction for payment of preventive health check-ups and premium on buying health insurance for self and dependent family for up to Rs. 25,000 annually.

Medical insurance and preventive health check-up of parents

Section 80D also allows you to avail of tax benefits if you buy a health insurance policy or spend on preventive health check-ups of your parents or parents-in-law. The benefit available is dependent on parents’ age as follows:

- Under 60 years: Rs. 25,000 on health insurance + Rs. 5,000 on preventive health check-up = Rs. 30,000

- Between 60 and 80 years: Rs. 50,000 on health insurance + Rs. 5,000 on preventive health check-up = Rs. 55,000

- Over 80 years: Rs. 50,000 on health insurance + Rs. 7,000 on preventive health check-up = Rs. 57,000

Other Deductions

There are many other deductions available to non-resident Indians like deductions for donations made to specified charities (50% or 100% of the donation amount) and to political parties recognized by the Election Commission of India.

Know you have some best ideas about how to NRI Tax Saving options. If you have any questions on Tax-free incomes for NRI – feel free to add them in the comment section.

I am an NRI I would like to purchase property at Mumbai which is more than 50 lakhs. How much Tds I have to deduct and pay them remaining amount

Hey Shankar,

As an NRI purchasing property in Mumbai over 50 lakhs, you’re required to deduct TDS (Tax Deducted at Source) at 20% of the property’s value. You need to pay the remaining amount after deducting this TDS to the seller. Ensure compliance with Indian tax regulations and consider consulting with a tax advisor for precise guidance on TDS deductions and property purchase transactions for NRIs.

Sir, is the TDS for nri on sale consideration or on capital gains on the sale of long term residential property?

Hello Namrata,

The TDS (Tax Deducted at Source) for NRIs (Non-Resident Indians) is applicable on the sale consideration of long-term residential property, not on the capital gains.

I have a flat and want to sell it.Will you provide all taxation services?

Hi Ramesh,

Please consult with CA.

I am an NRI with 4 years of employment abroad and planning to return to India in September. I have NRI savings that I want to remit to India before I return back to India. The NRI savings are already taxed in the foreign country. For the current Fiscal year in the foreign country (Jan to Dec 2022) I am a tax resident in the country. But as I return in September to India I am also a tax resident in India. Can I get DTAA benefit for the current year? Is my previous years NRI savings taxable if I remit now to India?

Hi Aravind,

Yes. You can get the DTAA benefit

HiI gave loan of 16 lacs to some one in india i am USA greencard holder how i can i bring this money to usa without paying tax in india or usa will this amount comes is taxable or should i split payment can i deposit this amount in NRO account in india please advise thanks

Hi Sanjeev,

The repayment of the principal amount and the interest can be done only to the NRO account of the NRI

I am NRI and staying in Qatar since 2015. I had a Insurance policy with LIC and private insurance company both purchased in year 2018. Both are traditional insurance policies. Private insurance company refund GST on premium while LIC denied to refund GST. So my question is what is the rule for GST on traditional insurance policy for NRI. Can I liable to pay GST or not? Pl clarify.

Hi Chirag,

Please consult with your CA regarding this.

I am OCI card holder Non-Indian having NRI/FCNR deposits. I overstayed in India from 20/02/2020 till date. I was NRI since over 15 years. Please advise if the above deposits are taxable as the interest income exceeds 15lakh. Do I file the return? I have never filed the return.

Checking your article on ‘How NRIs can save on their income in India’ , do you have more information on saving interest on notified bonds and savings certificates issued by Govt. of India?

I haven’t converted my savings bank account to NRO account since long time as I am a citizen of another country with PIO status.

Q1. I am an NRI staying in the US. Do I owe tax to the US govt on interest earned on my PPF account in India, even though I am continuing the PPF account and not withdrawing anything?

Q2. Do you have any pros/cons of winding up all accounts in India and repatriating all money to the US?

I am in Denmark, I have NRE and NRO account in India. I am getting some interest on my NRO account and I am paying tax as per the slabs. the question is Do I need to pay the tax for interest earned on an NRO account in Denmark?

If I sell a property at purchase price do l still pay tax and will it be difficult to repatriate money?

Could you please publish an article on guidance for educating NRI investors on the taxation please based on deemed residence status when india income crosses 15 L.This is very important as gain from overseas funds are added to income. I have sizable stake.

I am NRI…I have cumulative interest NCDs bought in secondary…if I hold till maturity what is the tax implication.

Very useful and educative.

Thanks 🙂