NRIs may have gone to foreign lands in search of better opportunities, but they come back to India in their twilight years. At a platonic level, is the love for the motherland – people want to spend their last years with familiar faces and surroundings.

Other reasons include:

- Search for a better lifestyle in India, due to PPP (purchasing power parity) arbitrage.

- Retirement corpus may be insufficient for a decent lifestyle in their adopted country.

Whatever the reason they have for returning to India, they deserve to spend a dignified and independent retirement here. Therefore, retirement planning for NRIs is as crucial as for resident Indians. So it’s important to understand all pension plans for NRIs.

In This Article –

- Pension scheme for NRI in India

- Importance of good Retirement Plan for NRIs

- Why does NRI invest in Indian Pension Plan?

- Eligibility for a pension plan for NRI in India

Must Check – 401(k) Retirement Accounts

Importance of good pension plan for NRI

Simply building a retirement corpus to return to India is not sufficient for most of the diaspora seniors. Most of them have been living decent middle-class life, as per the standards applicable there.

When you come back, the corpus amount may seem large initially, but there are certain factors that can toss your calculations out the window.

Why invest in NRI pension schemes or Retirement plans for NRIs?

Pension schemes are designed to make you financially independent by offering a stream of regular cash inflows for daily expenses. A suitable pension or annuity scheme can offer you peace of mind and ensure a regular income out of your life savings.

If you can start early, the power of compounding, which Einstein called the eighth wonder, can help grow your small contributions over time into a sizeable corpus by the time you will retire.

Why Retirement Planning is Important? I think this short Video can explain how a happy story can have a tragic ending so we should better plan for our rainy days.

Must Check – What should NRIs do with their Indian EPF accounts?

Why invest in an Indian pension scheme for NRI?

If you have amassed a large corpus in USD/GBP/AED then you can simply convert it into INR, and the exchange rate arbitrage will put you in good stead.

As the regular income will dry up, you must start thinking about the Best pension plan for NRI in India or the pension Scheme for NRI in India, to help meet your needs.

Pension plans offer multiple benefits:

- lifelong life insurance cover.

- assured returns over a very long period.

- tax benefits.

- the choice to add your spouse of a differently-abled dependent.

- deferred payments to make larger annuities in later years.

- return of principal/corpus to the survivors/nominees.

Read – Retirement Planning for NRIs in India

Retirement Plan for NRIs should cover for:

Your retirement plan must take into consideration the following important factors:

- Life expectancy: As per a World Bank study, the average Indian life expectancy has increased to close to 70 now. Most of you will beat this average by at least 10 to 20 years. You must ensure your corpus won’t run out before that.

- Expenses: Monthly recurring expense of salary, transport, rent, utilities, groceries, regular medical check-ups, and many other things never stop. With a retirement plan, you may wish to pursue hobbies and travel as you’ll have more time.

- Inflation: A developing economy, like India’s, witnesses higher rates of inflation. In India, the CPI ranged between 2.5% and 12% in the past two decades and is expected to remain above 6-7% in near future. The real inflation for food, services, and medicine will be much more!

- Medical expenses: As you will grow older, with your spouse, most of you will need more medical interventions, emergency room visits, medical check-ups, medicines, procedures, and support equipment. Your corpus must be enough for regular health care and for any unforeseen medical emergencies.

- Outstanding loans: Any outstanding debts in the host or home country will require upward adjustment in the retirement corpus. If you don’t do so, then your life after retirement can be severely affected.

- Familial Obligations: Extended family in India will expect your greater presence for family functions. You will be expected to be more generous with gifts and shaguns. Relative may also ask you to extend soft loans in times of need.

Must read –What should (budding ) NRI s do with their Indian EPF accounts?

If you can fit your needs to a suitable NRI retirement plan in India, then you can, not only enjoy higher returns but financial independence for yourself and your spouse.

Check – Mr. NRI – Time Is Money When it Comes to Retirement Planning!

Annuity options available

Immediate Annuity: Immediate pension from the next nearest date from the date of buying the annuity plan.

Deferred Annuity: The annuity starts after some years to let the corpus grow bigger. It is also because near retirement, you may not have an immediate need for a pension.

Annuity Certain: The annuity is paid in-too over a specified period as regular pay-outs. Some options provide for continuity of the annuity after the period.

Life Annuity: Pension is released for your lifetime or to your spouse for their lifetime (if you pass away).

With CoverPension: Insurance cover is included with the annuity component making the dependents entitled to either continued pay-out or a lump sum amount upon death of the annuitant.

National Pension Scheme for NRIs: NRIs can use NPS to build their retirement corpus up to 60 years and extend it by 10 more years. On maturity, you can withdraw up to 60% accumulated amount, and compulsorily use the remaining 40% amount to buy an annuity. You can, however, always use more shares to buy the annuity part.

Read – Why should NRIs save early for Retirement?

What details should you consider?

When you first read about any retirement plan, everything thing seems to fall in place. All you need to do now is to contact the advisor and you are all set.

There are many things that you must understand before you finalize the plan. Finding the right fit is necessary, as once you commit to it, there is no going back.

Eligibility

The entry age for the Best pension plan for NRIs in India is 30 years and the maximum age is 75 years. In cases where the minimum entry age is between 18 and 30 years, there is the requirement of a vesting age set at 45 years. For late entrants, the maximum vesting age is set at 80 years.

Must Read- 5 Financial Planning Moves for NRIs in the 40s

Duration

The pension plan for NRI offered by life insurance companies has a minimum duration of 10 years, subject to the minimum vesting age. The maximum duration can be 30 to 35 years.

Premiums

Usually, there are no maximum premium limits, but the minimum annual premiums are close to Rs. 50,000 in case of pensions schemes. In the case of NPS, the minimum first and subsequent monthly contribution of Rs. 500 is mandated.

Retirement Goal – finding the premium needed for Rs. X pension

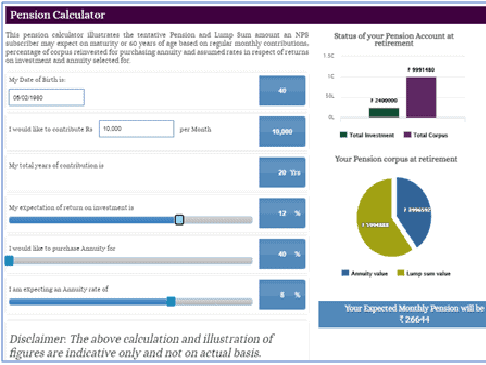

The pension calculator from life insurance companies is a good place to start. Check the pension calculator on the website of the NPS trust.

The screenshot is a grab for a 40-year-old investor. If the investor can contribute about Rs. 10,000 per month towards the NPS contribution, expects a 12% cumulative return over the next 20 years, she can expect a corpus of close to 1-crore rupees.

If she purchases the annuity for the minimum required 60% of the corpus value, then at 6% returns on the annuity she will receive a monthly pension of Rs. 20,000.

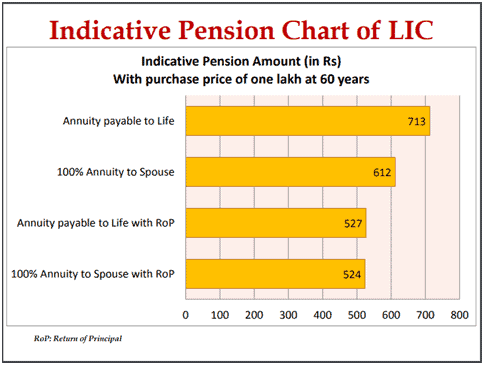

The indicative pension chart available on the NSDL-NPS-CRA website shows a monthly pension per lakh of corpus fund.

Figure 5: Indicative Pension Char from LIC of India (Source)

Documents needed/KYC Process

The KYC verification will require the following documents:

- Valid ID proof – Aadhaar card, PAN card, Voter ID card.

- Age proof – Aadhaar card, birth certificate, passport, driving license, voter ID card, or 10th mark sheet.

- ValidNRI status – valid visa, work permit, or an overseas resident card.

- Local address proof – the electricity bill, telephone bill, voter ID card, or Aadhaar card.

- Bank Account details – certified details of your NRE/NRO/FCNR bank accounts, a cheque for first contribution/premium.

- Optionally some insurance providers may demand the latest medical reports.

Receiving pension

To receive the pension, you can use the same NRO account, open a new NRO account, or convert your regular savings account to NRO status. You will also have to submit a “life certificate” once a year in November to continue the pensions.

Read – NRE Vs NRO Account?

Best Pension Plans for NRI’s in India

For an NRI, whether in their 30s or 40s or close to retirement, there are multiple retirement plans. You can choose the most suitable based on your retirement age, lifestyle goals, current age, and present income & corpus levels.

Top insurance companies, like SBI, LIC, Bajaj Allianz, HDFC Life, and ICICI Prudential, offer various pension plans for NRIs in India with the promise of financial independence in the twilight years. The following table summarizes the best plans according to us.

| Plan Name | Min. Entry Age (years) | Max. Entry Age(years) | Policy Term/Annuity Options | Annuity to Spouse * | Tax Benefits |

| SBI Life – Retire Smart | 30 | 70 | 10 to 35 years/

Single, Regular, Limited (5, 8, 10, 15 years) |

Yes | Yes |

| Aviva Next Innings Pension Plan | 42 | 78 | 13, 16, & 18 years /

Single, 5 & 10 years |

N/A | Yes |

| LIC Jeevan Shanti Plan | 30 | 85 | Lifelong/

Regular, with deferment |

Yes | Yes |

| Bajaj Allianz Life LongLife Goal | 18 | 65 | 99 years age/

99-Age at entry; Premium payment term is between 10 to 25 years |

N/A | Yes |

| National Pension scheme in India for NRIs | 18 | 60 | 60 years of age/

lifelong |

N/A | Yes |

* Annuity to the spouse is not the default option, you will have to buy it.

We plan for 2 months for a 7-10 days vacation but are we planning for the longest vacation of our life – RETIREMENT.

Are you ready to Retire without worry? Talk To Us

If you have any questions related to the Retirement Plan for NRIs – add them in the comment section.

life insurance for senior NRI 66 plus

How can I get register or start contribute for it

pension option

NPS PLAN FOR NRI

I am in an NRI and wish to retire in the next two years. All my assets are as NRE FDS what should I do?

Hello Hemant

thanks for this (and all the other blogs). Very useful and informative.

fyi – the link to the NPStrust calculator does not work. In fact it looks like even the website is not working.

One question i have is this – I am an OCI card holder and i do not have Aadhaar card (and i understand i do not need one). Does this mean i cannot avail of this retirement scheme?

wonderful encouraging program. shall see what it holds in the future.