Not all Non-resident Indians (NRIs) are wealthy with plush jobs and booming businesses. While many NRIs make it big – especially when they return to India – it is not a sure-shot guarantee of a continued life of comfort. Many factors affect the incomes and savings of a person when they are working abroad.

In fact, estimates show that a majority of NRIs are doing slightly better than their Indian counterparts – especially the ones in blue-collar jobs, or jobs requiring lesser cognitive abilities. No doubt, that the median income for NRIs is higher than that of Resident Indians (RIs), but the cost of living needs to be factored in while seeing their overall situation.

Must Check – NPS For NRI

Many NRIs who return to India – forcefully or voluntarily – need regular income support if they do not have sufficient funds for retirement. Therefore, there was a long-standing demand from the ex-pats returning that there should be some social security on their return. They argued that when they were working abroad, their remittances resulted in a boom for the local economy of their villages and towns, boosted India’s foreign exchange reserves, and India’s clout internationally.

The Initiative of Kerala Pravasi Pension Scheme

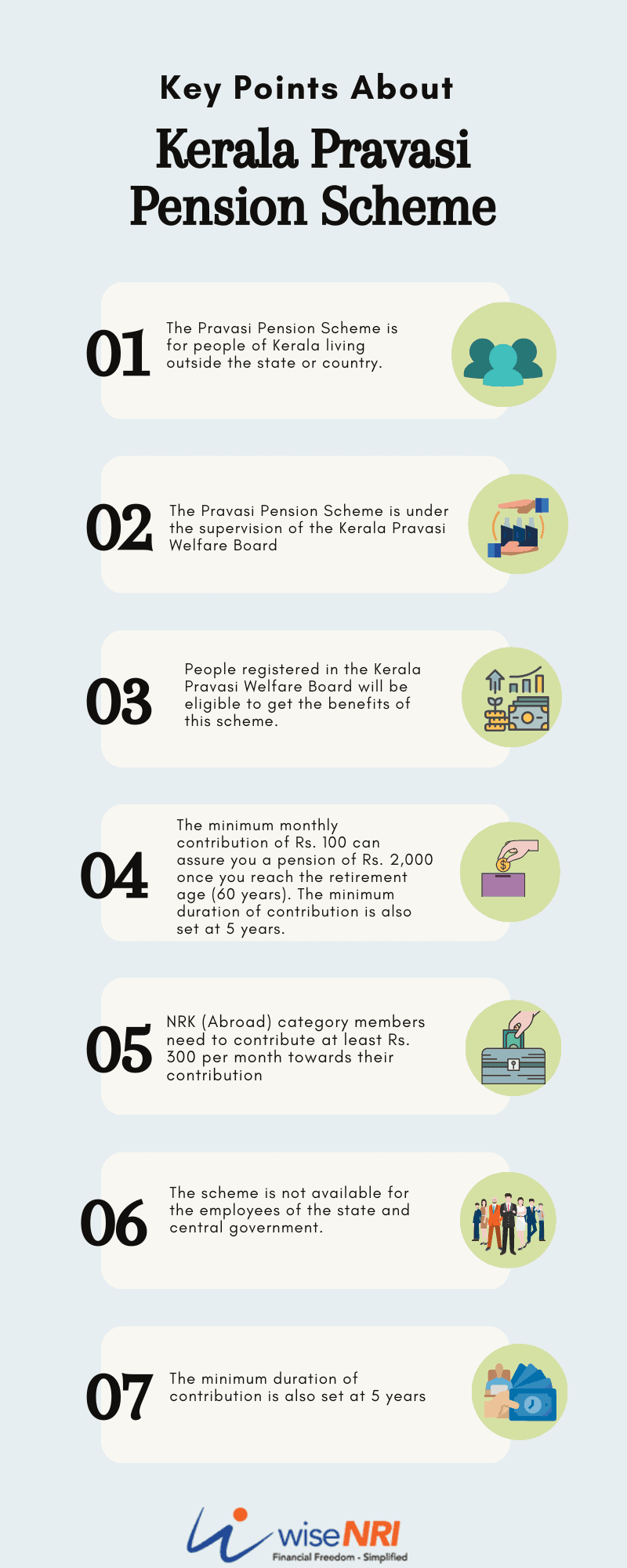

The Kerala Government, in April 2018 initiated and introduced the Pravasi Pension Scheme to address the issue. Kerala is one of the major states sending ex-pats to many countries, especially to the Middle East and South-East Asia, and has benefitted from their contributions.

To help the Non-resident Keralites (NRKs) who were engaged in low-paying jobs while abroad, the Pravasi Pension Scheme is a step in the right direction. The first of its kind in the country, the Non-Resident Keralites’ Welfare Fund, managed by the Kerala Non-Resident Keralites’ Welfare Board (the board) to provide income and emergency funds support for NRKs. It has provisions to support NRKs still living abroad, returned to Kerala, and returned to India.

Pravasi Welfare Fund

The Non-Resident Keralites’ Welfare Act, 2008 (the Welfare act or the Act) was passed in 2009 and established the Kerala Non-Resident Keralites’ Welfare Board under the Government of Kerala. The Board would manage the Non-Resident Keralites’ Welfare Fund (or popularly the Pravasi Pension Fund) to provide various welfare schemes to NRKs.

The Welfare act provides for many social services and welfare schemes for NRKs including pension schemes, a pension scheme for disabled and differently-abled persons, family pension scheme, emergency medical aid, and financial assistance for dependents of a deceased member.

Must Read – Pension Plan For NRI in India

The Kerala Pravasi Pension Scheme for NRIs

Keralites (who are Indian citizens) who are living abroad or who were once an NRI (for at least two financial years) and have returned since are eligible to become members of the Pravasi pension scheme. One must register themselves with the Kerala Non-Resident Keralites’ Welfare Board to take benefits under its different schemes.

The minimum monthly contribution of Rs. 100 can assure you a pension of Rs. 2,000 once you reach the retirement age (60 years). The minimum duration of contribution is also set at 5 years. If you fail to contribute for 12 months continuously, then you cease to exist as a member of the scheme. If you consistently contribute for 5 years without a break, the fund will add a 3% incentive to your corpus at the end of the five-year term.

Must Read – QROPS & UK Pension for Non-Resident Indians

The Kerala Pravasi Pension Scheme for NRIs divides NRKs into three categories:

- NRK (Abroad) – Non-resident Keralites who are still living abroad.

- NRK (Kerala) – Non-resident Keralites who have returned to Kerala for permanent settlement after at least two years of employment as an NRI.

- NRK (India) – Non-resident Keralites who have returned to other parts of India for permanent settlement after at least two years of employment as an NRI.

The contribution for each of the categories is different for NRKs.

- NRK (Abroad) category members need to contribute at least Rs. 300 per month towards their contribution.

- NRK (Kerala) and NRK (India) category members can start their contribution at Rs. 100 per month.

The scheme is available only for private members and not for the employees of the Government of India, the Government of Kerala, or their undertakings.

How to Become a Member Pravasi Pension Scheme for NRIs

Any Non-Resident Keralite between 18 and 60 years can become a member of the Pravasi Welfare Fund. As mentioned earlier, the members are divided into three categories – NRK (Abroad), NRK (Kerala), and NRK (India).

Offline Registration Process

Eligible NRKs can apply for becoming a member using the following forms as per their category:

Complete the relevant form, attach self-attested documents, and visit the local common service center in Kerala to pay a Rs. 200 service fee and deposit the documents.

Online Registration Process

The registration process should comprise of the following procedures:

- Visit the official Pravasi Kerala website and go to the Services section.

- The self-service portal allows registration using a mobile number or email ID.

- Login to the self-service portal and fill in details – category, demographic, persona, local and overseas address, passport, NRI work, and nomination.

- Keep your relevant documents ready – A photo ID card, passport, photo, work permit, and tax returns.

- Make a payment for a one-time registration fee of Rs. 200.

- Once your application is processed you can enter your bank account details – NRE/NRO account for NRKs still working abroad, and savings account for NRKs who have returned.

- After the successful mapping of your bank account with your profile, you can start making deposits.

Must Check – NRI Foreign Pension Fund Issues

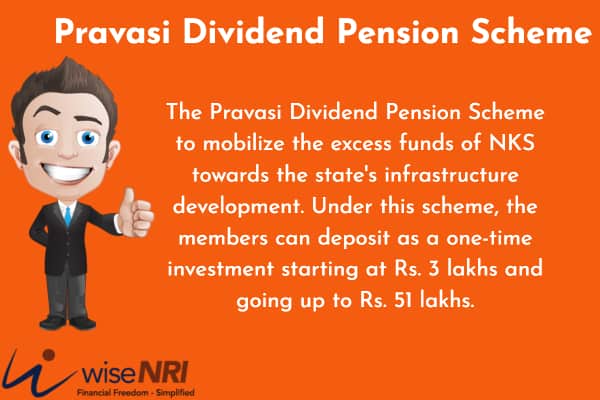

The Pravasi Dividend Pension Scheme

Another innovative scheme launched and managed by the Kerala Government is the Pravasi Dividend Pension Scheme to mobilize the excess funds of NKS towards the state’s infrastructure development. Under this scheme, the members can deposit as a one-time investment starting at Rs. 3 lakhs and going up to Rs. 51 lakhs.

The deposits will be utilized by the Kerala Infrastructure Investment Fund Board to finance infrastructure developmental projects by government agencies. The Pravasi Dividend Pension Scheme envisages a monthly dividend at a 10% annualized rate starting from the fourth year. The dividends of the first three years would be added to the investment corpus of the depositor.

In case of the demise of the depositor, the dependent wife would be eligible to get the dividends for her remaining life. After the death of the dependent wife, the initial deposit with three years’ accrued dividend would be returned to the nominee(s).

The Pravasi Family Pension Scheme

The Pravasi Pension Scheme provides pension support to a member of NRK. If a member passes away, while they were eligible for the pension, their dependent family members (including spouse, children under 21 years, unmarried daughters, and dependent parents) become eligible to receive the family pension. The family pension is capped at 50% of the monthly pension to the now-deceased member.

If an NRK (Abroad) member dies of an illness or an accident, then only one of their dependents (spouse, minor children, unmarried/widowed daughters, dependent parents, dependent sisters & brothers) would get one-time financial assistance of up to Rs. 50,000. For NRK (Kerala) members the one-time financial assistance is capped at Rs. 30,000.

Emergency Financial Assistance for Medical Treatment

The Pravasi Pension Scheme addresses a common pain point of NRKs – emergency financial assistance during a medical emergency. If an NRK member of the scheme suffers from a critical illness, then they can claim one-time financial assistance of up to Rs. 50,000. This assistance can be availed only one time during the membership of the NRK. An NRK who has received financial assistance for the same ailment from the Central or State government, or its agencies, cannot claim this financial assistance.

Assistance for Marriage

NRK members who have been contributing regularly for at least three years can take financial assistance of Rs. 10,000 for the marriage of up to two daughters. If there are more than one NRKs in a family who are member of the scheme, then only one member can avail of this benefit. It means for this specific assistance, the family (as defined by the Income Tax Act, 1961) is taken as a unit.

Please share in the comment section – some products that you came across that are available for NRIs.

Pavasi dividend scheme contact number for the regional manager?

House wife Visa working office assistant. Is eligible for pension

Procedure to join pravasi dividend scheme

Can we do two or three instalment in pravasi divident fund

The monthly dividend is taxable

How can I register my name and where ?

I want to deposit in pravasi dividend scheme 5 lakhs for 3 years how to do and how much monthly pension I will get after 3 years

Pravsasi pension scheme is applicable for all state NRIs ?

I registered for pravasi pension. how long will take for the next step

Last 7 years i am paying pravasi pension scheme amount(300 Rs each)my date of birth 01/03/1962,stil i am working in UAE, i can apply for pension now

How prvasi pension online register?

In the scenario I am mortgaging my property in India and sending the borrowed money to my UK bank account, is there any tax payable in India?

I am Tamil Nadu state person now I working in Oman I am eligible this scheme

In pravasi dividend scheme can I invest two times

How to check my pension aproove

Rite now Am in uae.. 15 years i worked as a teacher.. Now one year am a home maker.. Is it possible to apply for pravasi Penson scheme

Can i change nomonee or dependent wife for dividend scheme

I joined in pravasi welfare fund from the age of 40 years… I have to pay coming 20 years.. So after 60 years how much will be the pension

I am five year finished my date of Barth 29.01.1963. How I can cat pension

Heard there is new employment exchange for nris who lost their jobs. Can you tell me how to register for it

If I deposite 4 lakh in pravasi dividend scheme, what will be my monthly return?

I am already age 60thHow can I getmy pravasi Pension

I am already age 60thHow can I get my pravasi Pension

for initial investment of 3,00,000what is the Dividend recd per month after 3 years

Can i pay my contribution towards pension scheme with backlogs and fine?

How much is the tax rate for pravasi dividend for residents

Recently i took pravasi member ship card for KPWB .. when i can get pension ?

how can i start NRI divident scheme

I am completed pravasi subscripristion ,how can i applay for pesion

How to join pravasi divident scheme

Pension schemes by government

I have nre account in Gujarat and paying tax to uk on interest income. How to avoid paying taxes i am British citizen but spend more time in India