Moving abroad is a pretty common phenomenon for Indians. But an NRI should ensure that their financial plan is in place and can take care of their short-term, mid-term, and long-term goals. Asking yourself relevant questions is a good way to keep a check on your financial life.

Must Read – NRI Frequently Asked Questions And Answers

It will help you avoid making money mistakes or getting on the wrong side of the law with your money. Asking questions will also help you decide if you want the services of a professional financial planner. If you feel you do not have time or are not confident enough to handle your money matters, you might want to take the help of a financial planner who has expertise and experience in handling finances for NRIs.

Here are some questions that you should ask yourself if you have not asked them already –

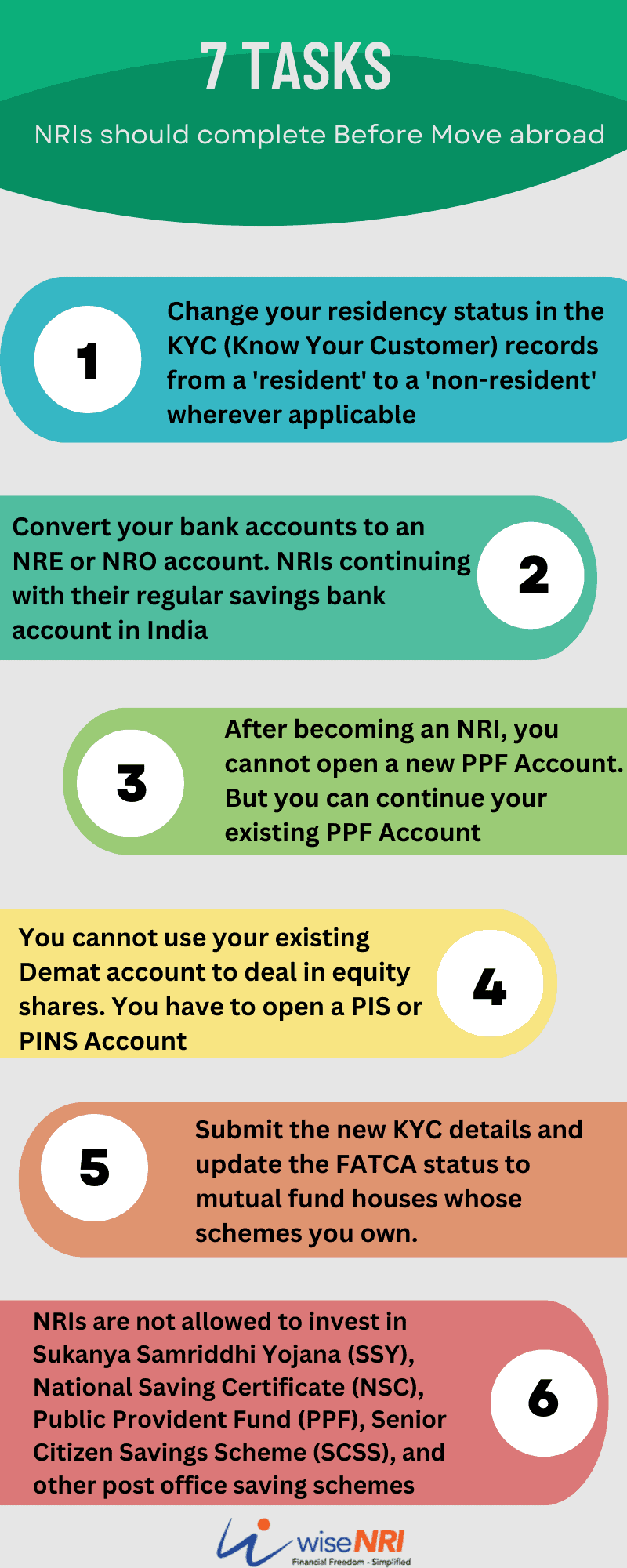

1. Have I Taken Care of The Mandatory Changes to be done from a Financial Perspective when I become an NRI?

When you move abroad, there are some tasks that you should complete to ensure you have clean financial records. We have listed the most important ones here –

- Change your residency status in the KYC (Know Your Customer) records from a ‘resident’ to a ‘non-resident’ wherever applicable.

- Convert your bank accounts to an NRE or NRO account. NRIs continuing with their regular savings bank account in India even after becoming an NRI violate the law under the Foreign Exchange and Management Act (FEMA).

- After becoming an NRI, you cannot open a new PPF Account. But you can continue your existing PPF Account opened as an Indian Resident and contribute to it through NRE/NRO Account.

- You cannot use your existing Demat account to deal in equity shares. You have to open a PIS or PINS Account and transfer your holdings into the PIS Account to use for transactions. If you do not own a Demat account, as an NRI, you have to open a new PIS account to deal in equity shares.

- Submit the new KYC details and update the FATCA status to mutual fund houses whose schemes you own. Your new residential status will get updated in the mutual fund folios. Link your NRO Account to each of the folios so that recurring transactions like- SIPs, and STPs continue without any issues.

- NRIs are not allowed to invest in Sukanya Samriddhi Yojana (SSY), National Saving Certificate (NSC), Public Provident Fund (PPF), Senior Citizen Savings Scheme (SCSS), and other post office saving schemes.

Must Check – Checklist – Things to do before you become NRI

2. Do I have to Pay Tax on Income Earned in India?

An NRI whose income in India exceeds Rs 2,50,000 must file an income tax return in India.

NRIs have to file tax returns in India in many cases –

- Suppose you are an NRI and you have received salary in India directly into an Indian Account, or you have received income for services rendered in India. In that case, you have to pay tax on the same as per the tax slab applicable to you.

- If you sell capital assets such as shares or securities and earn capital gains, the capital gain is taxable.

- If you sell a house property, then a TDS of 20 percent is applicable on long-term capital gains, and a TDS of 30 percent is applicable on short-term capital gains. (but you can take TDS refund)

- Interest on NRO fixed deposits and savings accounts are taxable.

- Rental income is taxable. The tenant who pays rent to an NRI owner must deduct TDS at 30% while paying rent.

- If your Indian income is above 15 lakh – things become even more confusing. Read – Who is NRI

Must Read – Early Retirement Guide for NRIs

3. Will I be able to maintain my lifestyle when I return to India?

Many NRIs have this question as they usually have a better lifestyle abroad. With higher disposable income, many are able to carve out a comfortable lifestyle abroad. When they return to India, they may not have the same income level, and it could be challenging to maintain the same lifestyle. Check – Lifestyle Inflation

If you are an NRI who plans to retire early and return to India, you will have to start your retirement planning today if you have not started it yet! Identify what kind of lifestyle you want in India, check the feasibility of the same and create and execute a plan to achieve it. Others may come back for better job opportunities or to be close to family. It is important to plan the return based on your financial situation and long-term goals so that you have a sustainable lifestyle and do not regret any decisions.

Meanwhile, remember these tips –

- Change the residency status of all your bank accounts in India

- Make use of the RNOR status for up to 3 years after your return for tax management

- Ensure that you have health insurance that is valid in India and if applicable life insurance as well.

Plan your return to India well and execute the plan well so that you do not leave your finances to chance and your decisions are well-informed.

I will love to see how you rate yourself on these 3 questions – please add in the comment section.

I am a foreign National (NRI) and Like to see a video on how to fill out ITR-2 to get some refund on my Capital Gains I received on my Mutual Funds and also TDS on NRO interest earned? I do not wish to go thru CA for this.

If the NRI friend is transfer money to Indian friend.. Can Indian friend pay charges to agent before the received money in bank account?

I am an NRI with NRE and NRO accounts both. Do I have to pay Income Tax in India? I am a foreign national.

Very good questions and suggestions

Thanks Ravi 🙂