RNOR (Resident But Not Ordinary Resident) is not very well know even in NRI circles. A few days back when I wrote a post about “status of NRE FD after return to India” – I got a few emails & comments that they have not heard about this.

Surprisingly even bankers don’t provide this information to NRI returning to India after a long stay. This increase the tax liability of NRIs which he would have saved legally.

So I thought to cover this in detail including RNOR India tax & also added a calculator.

Must Read- Singapore CPF

What is RNOR Status?

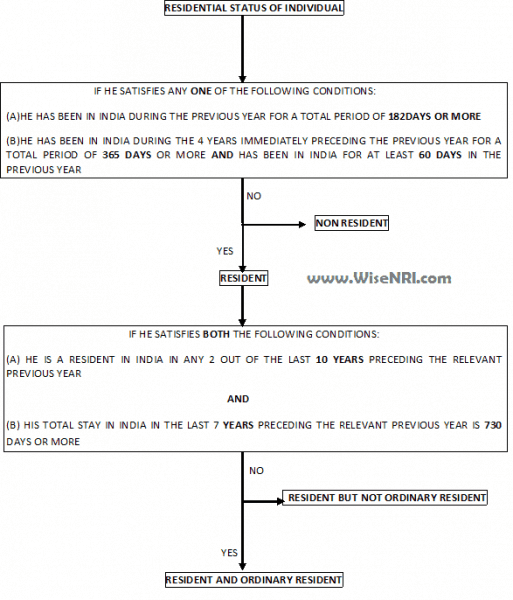

RNOR stands for Resident But Not Ordinary Resident. It is a residential status given to certain people. Here are the conditions of determining whether a person is RNOR or not –

If the person is a resident Indian, he/she will be given the RNOR status if –

A resident Indian can be given an RNOR status if

- He/She has NOT been a resident in at least 2 out of the last 10 years.

OR

- He/She has been in India for a period of 729 days or less during the last 7 financial years

If the person is an NRI who has just returned to India, he/she will be given the RNOR status if –

- If the NRI has been outside of India for 9 out of the last 10 years, he can be an RNOR for 1 year.

- If the NRI has been in India for a period of 729 days or less during the last 7 financial years, he can be an RNOR for 3 years.

Let us make this simple with an example. Ms. Shweta left for the United States in 2001. She returned to India on June 30th, 2017. She will be considered as an RNOR for the financial year April 2017-March 2018.

What about 2018-2019?

She has been in India from June 30th, 2017 to March 31st, 2019. That is a total of 639 days which is less than 729. Therefore she will be treated as an RNOR in the financial year 2018-19.

By March 31st, 2020, she would have been in India for 1005 days and therefore she will be treated as a resident Indian for the financial year 2019-2020.

This flowchart can help you to understand RNOR Status

RNOR Status Calculator

I don’t think after this explanation any calculator is required but if you still want you can download this simple calculator.

Must Read- NRI Home Loan

RNOR Tax Benefits

The government gives certain benefits to returning NRIs by making them residents but not ordinary residents for some time. From a taxation perspective, an RNOR will have a similar status as that of an NRI status.

So the person who is an RNOR will have to pay tax only on income received or accrued in India. The income earned abroad will not be taxed. So not ordinarily resident Indian income tax can be substantially lower

Read – NRI returning to India

Why do NRIs get the RNOR Status ( resident but not ordinary resident)?

This helps the NRIs to bring back their financial gains abroad without tax liability. The person with RNOR status does not have to pay tax on –

- Interest on FCNR deposits and NRE deposits if you convert that to RFC.

- Withdrawals from offshore retirement accounts

- Rent received abroad

- Capital gains made abroad

- Interest or dividend received from investments in deposits and securities abroad

Once the NRI becomes a Resident Indian from an RNOR, all income whether earned in India or abroad is taxable unless concessions and exemptions are granted under the Double Taxation Avoidance Agreement, if any, between India and the previously residing country, are applicable.

Check your residency status every year so that you are aware of it and pay tax and file returns appropriately

If your status gets converted to Resident Indian, inform the bank so that your bank accounts (NRE and NRO) are designated as resident bank accounts. Your investment accounts should also be converted to resident accounts. The deposit accounts in NRE (but should be converted to resident) and FCNR accounts can be continued till maturity, transferred to Resident Foreign currency accounts, or closed down.

Any income received overseas becomes taxable based on Once your status changes to Resident, all your overseas income becomes taxable. wiseNRI

Also, you have to intimate your bank about the changed residency status and convert the existing NRI-specific accounts to resident rupee accounts.

How change in residential status impact investments

What is an RFC account?

An RFC account or Resident Foreign Currency account can be opened by a person who has the status – RNOR. Foreign funds can be brought to India in any currency you wish to and can be deposited in this account. NRE/NRO/FCNR savings accounts and fixed deposits can be converted to RFC accounts and RFC fixed deposits. Any interest that you earn in the RFC account while you have the RNOR status is tax-free in India.

It is useful as you need not to bear the effort and cost of currency conversion. It is easy to transfer these funds abroad if you move to a foreign location again.

I know RNOR is a complex topic – I have tried my best to simplify this. If you still have any questions on Resident but nonordinary resident Indian status – please add them in the comment section. Please also share your experiences.

Do a RNOR has to follow specific procedures to repatriate or outward remittance to purchase a property abroad.? Do they have to fill any forms whatsoever to avoid the TCS charges for an outward remittance the is around 250,000 USD?

I am an NRI and retiring in Dec 24, can I claim RNON Status as I have been an NRI for more than 20 years

Hey Tom,

Yes since you’ve been an NRI for over 20 years, you can qualify as an Resident but Not Ordinarily Resident after retiring in December 2024. This status is available for up to three years offering tax benefits on foreign income in India.

I HAVE BEEN IN UAE LAST 19 YEARS, IF I GO BACK TO INDIA IN DECEMBER 2024, WHETHER 2026-27 I WILL BE IN RNOR STATUS?

Hey Joydev,

If you return to India in December 2024, you can qualify as RNOR for the financial years 2024-25 and 2025-26. However, for 2026-27, your RNOR status depends on your residency conditions under Indian tax laws.

I returned to India in 2021, i have NRi FDs. i am filing ITR since 5 years. need to check my tax liabilities

Hi Shrinath,

Since you returned to India in 2021 your NRI FDs are taxable once your RNOR status ends usually after 2-3 years also check if you are now a Resident for tax purposes. Interest on NRI FDs will then be taxable as per your slab.

I am NRI relocating to India shortly. I have investments in USD outside India. Can I maintain these outside India after becoming resident ? What rules apply ? Pl let me know. Thanks

Hello Raja,

As an NRI relocating to India, you can maintain your investments in USD outside India after becoming a resident. However, you should inform your bank about the change in residency status. The rules applicable include adherence to FEMA guidelines, and you may need to convert your NRE/FCNR accounts to Resident Foreign Currency (RFC) accounts.

Rental income of property in India is deposited into a persons account, living abroad ,since 2017 October. The person has visited India on Two visits- 2018 and 2022( one month each visit). How is the income treated for Tax purposes?

I understand for RNOR status FCNR Deposits are tax free. Please advise if the NRE INR deposit are also tax free. if yes under which IT act section

What happens if you dont bring your assets back to India in RNOR status, and 1) rather bring when you become Resident OR 2) keep invested abroad?

I want to bring partial assets back and keep some assets abroad for my kids that will go to studies abroad.

Hello V J ,

1.If you don’t bring your assets back to India during your RNOR (Resident but Not Ordinarily Resident) status and instead bring them back when you become a full Resident, any income or gains accrued during your RNOR status might become taxable in India.

2. Keeping investments abroad while being an RNOR might have certain tax advantages, as income earned from those assets might not be taxable in India during that period.

Useful article. I’d like to know what happens if your FCNR matures when you are an RNOR. Can that be renewed?

I have been an NRI for the past 30 years, I plan to return to India in the first week of January 2024 however for the FY 2023 to 2024 I would have stayed in India for less than 120 days, do I qualify to be an RNOR and if so till which financial year, thanks

I reached in India on 28 Jun 2020,I was a NRE ,until which date my rnor status remains

Hi Sujith,

It depends on the total number of days you were outside India.

I returned from Saudi finally on 13th March,2022 having spent 15 yrs In Last 4-5 before I returned finally I visited India for total of aprx 115 days only because bof Covid.My question is what about my RNOR status- how many yrs n which year–and, how can I get it for 3 next financial yrs,and what can I do for that, can I visit my daughter in US for those many required months

Is the RNOR status still applicable for NRIs or the laws have changed now?

Hi Shravani,

It is still applicable.

I want to check my rnor status

I am returned nri …returned to india in sep-2020……,till which date do i qualify for rnor status

Hi Ravi,

If you have been outside of India for 9 out of the last 10 years, you can be an RNOR for 1 year.

During the financial year 21-22 i was in india for 179 days and abroad for 186 days am i NRI STATUS

Hey Jai,

since you were present India for 179 days and abroad for 186 days in the financial year 2022-2023, which is less than 186 days so you are consider as NRI.

I am a US citizen living in India since last 7 years, retired, NRe FDs acrew interest on 3 family members account but does not add more then 2.5 lacks per person. Do I have to file income tax return?

How much interest is tax free for rnor

Hey Rakesh,

the treatment of tax depend on which country you lived and which type of interest you are collecting .

What is the procedure to get RNOR status? Which authority to apply?

Hey Sabina,

you have to check that you are fulfill RNOR status criteria in your country . and the tax authority responsible for granting RNOR status.

Is the Insurance maturity proceeds accrued abroad and remitted to India by an RNOR taxable?

Hey Sridhar,

It clearly depends on tax laws of both country. since law can change between countries so you should consult a tax professional, as for my knowledge factors like , residential status, source of income.

My RFC accout mature in may 2024 but my RNOR status expires in FY 23/24Interest is credited to my account monthly but i will receive on maturity.Will i have to pay tax on the maturity amount

if am RNOR status if i work in dubai for 3 months and get the salary in dubai account . will that amount be taxable in india

I am in merchant Navy…I hv maintained my NRE status for 9 years out of the last 10 years on the basis of sailing more than 182 days in given financial year .But this year ie 2021-2022 I was not able to do so as couldn’t sign on on time due to COVID protocols so the NRE status is lost ..

Am I eligible for RNOR in this financial year??Please guide??

my NRE account have some FD running and getting renewed as per maturity date. I return to india last year after 12 years of stay outside india. do I have to pay tax on interest earned on my FD?

Hey Satyendra,

if you collect you RNOR status ,or you have RNOR status than you do not have to pay tax.

Hi Mr. Hemant,

It was indeed a informative article. Can you please guide, what happens to the amount in foreign bank once an RNOR becomes resident in India? Will he be able to transfer the money freely to the Indian account? If not, whether it is advisable to transfer it to RFC account?

Very Nice article. One comment/question on the following RNOR example

”

What about 2018-2019?

She has been in India from June 30th, 2017 to March 31st, 2019. That is a total of 639 days which is less than 729. Therefore she will be treated as an RNOR in the financial year 2018-19″

For FY2018-2019, Only the previous 7 financial years has to be considered right. In that case, the number of days will be from june 30, 2017 to mar31, 2018 ie. only 274 days but she will be RNOR in 18-19. Can the author/readers please clarify this.

Which section exemption for rnor

Hey Arindam,

under section6(6) of income tax act in India .

I am NRI for the last 20 years and retiring next year. I have an investment in foreign funds and bonds from Citibank Singapore. In order to get max benefit from RNOR status, I think I have to return to India after Oct month?

I want to transfer money from my NRE account to my account in UK. how can i easily do it

Hi Samyant,

You can do it online.

can oci still open and have fcnr account ,and if i have fcnr in euro currency and i transfer money to canadian euro currency bank account, do i need to pay any additional charges.?

Hi Monica,

As far as i concern yes you have to pay.

I want to verify if my residential status is RNOR

Hi Pandurang,

You can check the conditions given by FEMA and Income Tax Act for the same.

I was working in Saudi Arabia from 24th October 2014 and returned for good on 27th July 2020. All these years, i was in India only for 30 days per year. For the present financial year, am i a Resident or RNOR? Interest earned from my FD’s from money transferred from Saudi is taxable for Financial year 2020 &21?

good article

How much TDS needs to be deducted by the buyer of a Property when the seller has RNOR status? What documents should the buyer demand from the seller/seller’s CA to safeguard any future tax implications?

Hii Mr. Neeraj

It will be most suitable to take advice from your tax consultant

I am holding a RNOR status for FY 2020-21… I work on ships..I meet the criteria of being NRI for 9 out of 10 precedingof FY 2020-21..I want to know the the interest earned on theterm deposits I hold in NRE accounts , will be taxable in FY 2020-21…

Hi Naresh,

As per my knowledge no it will not be taxable.

Hi Rushi, As per my knowledge what I have come through I have an understanding that the NRE account (FC deposited but maintained in INR in India) FD’s will attract Income tax for the year you are having RNOR status. Only foreign income for the time you were outside (not completed NRI time) &FC was deposited will not attract income tax… Please clear for me as I file my income tax regularly…

Is deduction under 80TTB allowed for a person with RNOR status

Hi Amod,

As per my knowledge deductions are not available for RNOR.

Is rebate under 87a allowed for RNOR status

As per my knowledge,

No.

I am holding an NRE account for almost 20 years and whish to return back home in a years time. What is the process of transferring the interest on NRE FDs to RFC account

Hi Elsa,

You just need to change the account status from NRE to RFC.

I hold post office Rd, fd and PPF now I relocated from India to abroad and status would change to NRI can I continue them or I need to close them.

Hi Dr. Sandhya,

If it is from the Post office you can not but if it is from a bank you can.

I landed in india on 4th june 21 do I have to file returns for FY 2020/21

Hi Francis,

NO.

Hi,

I have been outside India from Feb 2010 to June 2021. I have stayed in India for less than 150 days so far on vacation. Will I qualify as RNOR?

Secondly, will the salary earned from my company outside India exempted from taxation or just the capital gains?

Thanks for your response

Just before expiry of my RNOR status, can i make fixed deposit for say 10 years period from balance in my RFC a/c to get income tax exemption on interest earned for 10 year fixed deposit?

Dear Damodar,

If you are talking about NRE or normal FD that won’t be possible.

I was a non-resident Indian (NRI) from 1998 to 2020. Now, I have returned to India. All my savings are in non-resident external (NRE) fixed deposits (FDs). Since my present status is RNOR, so will the interest from FDs for the financial year 2020~2021 is taxable?

Hi Jayita

Yes, they will be taxable but you can hold them till maturity.

I have been in overseas for the past 8 years. Do i get a tax exemption in India for the next 2 years?

Hi Pravin

Yes it may be but to define it correctly, you can contact a good CA.

while estimating the RNOR status, will they consider the time/days spent in India, when people come for visiting their family/friends etc while they are resident and working overseas?

for eg : Let us say that I am working in overseas for the last 10 years and plan to return to India in 1 May 2021. As per the RNOR calculator, i will be on RNOR status for the fin year 21-22, 22-23 and only from fin year 23-24 I will be not having the RNOR status.

but say if I have visited India while overseas in 2017-18 for 30 days, 18-19 for 30 days and 19-20 for 60 days for the purpose of visiting family and friends ( I was still employed overseas during this period, but only came to India for the visit), do I need to add these 120 days also for calculation of RNOR, in this case will i lose my RNOR status in the fin year 22-23 itself or the visit days before my permanent return to India, I need not calculate ?

I will really appreciate this clarity.

Hi Kumar

I think you can contact a CA as a proper calculation need to be done for this and days staying outside India for any purpose need to consider in the calculation.

IS 87 A applicable to RNOR ?

Hi Rahul

No, it is not applicable.

I do not think the RNOR calculation is right here. The 729 rule is for the previous 7 financial years not to count the relevant financial year stay.

if NRI returns to India his NRE FDs are maturing say 2 or 3 years later whether under RNOR status his interest component will be taxable as per income slab? or it is tax free till he has RNOR status

Hi Aradhahna

Yes it will be taxable but you can hold it till maturity.

Hi Hemant ji need your help to address query under a tricky situation of my forced RNOR for FY20-21 as i could not return to my working country because of covid 19-Pandemic. I am qualified for RNOR based on stay less than 729days clause, for preceding 7 years.

But i realised this at the end of FY 20-21. Till then my NRE NRO accounts are operating. Will that affect on my tax laiablity as like they will not exempt saving and FD interest in NRE account because i have not converted my existing NRE NRO accounts to ordinary ?

I am trying to confirming this with bank but honestly they are very slow and seems not confident to give me appropriate next steps i need to follow. If you could advise me i will be grateful to you. Thanks.

Hi Shikandar

As per the law, you need to immediately convert the Accounts to the ordinary account.

While filing tax return you are required to enclosed the 26AS certificate that will reflect all the Tax already been deducted during the year.

I suggest you to take the help of a good CA for this.

Thank you so much Mukul for your kind feedback. Sorry for my weak understanding. Do you mean if I ask bank they will redesignate my nre and NRO both accounts to ordinary from financial year 20-21 and income as well as interest component for that will be taxed even when I am RNOR ?

Kindly explain. It will be appreciated.

Thanks. Yes

Thank you Hemant ji. Really appreciated the way in which ypu have explained the RNOR status concept in short and simple way. Great!

I have come down in March last year and could not go back for my job abroad. I will be filing my returns as a resident. I want to know what to do about my NRE FDs. Can I keep it till maturity or I need to convert them to ordinary FDs?

Hi Venitius

Yes you can keep them till maturity.

RNOR – Will be taxed on the salary received abroad while physically present in India.

Hi Vijay

As per my knowledge it will not be taxed.

I am completing my RNOR status on 31.03.2021. I have invested in certain foreign shares with foreign brokerages. Is it advisable to sell my holdings before 31-03-2021 so as to lock in my capital gains and save any tax there on, which otherwise I have to pay if sell the shares after 01.04-2021?

Hi Sankaran,

If you are in need of the money then sell those else just for saving tax it not advisable.

I am a merchant navy officer and this year I could not complete my NRI days. But I am maintaining my NRI status since 2005. Shall I eligible to qualify for RNOR status under clause 9 out of 10 years.

Hi Shyam

It depends upon your total days and previous days.

Kindly get in touch with you CA as he will be helpful for you.

Are the days I visited my family in the last 7 years are accounted for during 729 days calculation?

Hi Hemant

Yes, the days you are in India will be counted irrespective of the work you are for.

What rate of TDS will be applicable on rent payment to RNOR?

Hi Bijal

It is 5% and your tenent need to deposit that.

Whether a person in RNOR status can work in India as an employee and deposit his salary into his bank account?

Hi Ramniklal

Yes the person can work.

Sir Namakar jee.I am green card holder in usa. Due to Covid I could not come to India in year 2020-2021.I fulfil condition of previous 4 years stay in India.Now I like to know that what will be present tax status .

Thank you sir.

Surinder pal

Namaskar Surinder Ji

If you have not stayed in India for atleast 60 days on 2020-21 then you are not fulfulling the condition.

I was out of India for the last 11 1/2 years and returned to India on 6th Dec 20. Any my earning has been kept in my NRE account in INR currencies as FDR. on my return just issued a letter to bank to change my address to Local address instead of overseas address. pl, let me know my status.

Very good articles, demystified the RNOR in a very simple way, Thank you

Thanks Julius

On this page, on what’s RNOR you have identified two cases. 1st case is “A resident Indian can be given RNOR status if”. In this phrase wondering what it means by “resident Indian”. Does it mean indian citizens?

In particular, if a Person of Indian Origin and non Indian citizen comes to India lives there for 5 years then goes out for 2 years. Then comes back to India and lives one year. For this latest year in India does he become RNOR?

As per the above clause he can be classified as RNOR for 1 year. But for the flow chart he will be Tax Resident. Please clarify. Thanks.

I stayed in UAE for 38 years continuously. I returned to India in 1/11/2019 for good. is the interest on my NRE FD will come under the tax bracket for year 1/4/2020 t0 31/3/2021?

Hi Gajanan,

If you covert your NRE account into RFC account then it will be tax free.

Please note more than 25 years I have been in the middle east and came back for good. Hope my status is RNOR, am I eligible for tax-free for another 3 years for my NRE Rupee FD Accounts?

Hi Jiji,

You should convert your NRE account to RFC account to get exemption from tax.

I want to know whether if I am a Rnor for tax purpose.

Hi Sagar

Kindly check whether you fulfill the RNOR criteria or consult a Tax expert.

Hemant ji,

Thank you for this piece of information that even banks are confused about. I have a few questions in this regard

(1) Is this relevant even now (for FY 2020-21) or have any changes been made from this post?

(2) Is there any confirmed document from RBI to this effect that we could refer and share with the banks?

(3) Based on the article, I could continue as Resident but with RNOR account for 1, 2, or 3 years as per the RNOR calculator and conditions mentioned above?

RNOR is tax exempted for NRE FD in Rs?

Hi Bhupesh

If you convert it in RFC then it will not be taxable.

I’m a British citizen and I have OCI as well. I am coming to India permanently. I want to know what will by status for tax purposes.

Hi Sanjay

You will be RNOR for 2 years and later become resident.

I am an NRI returning to India after 30 years outside. During my RNOR status I can renew my NRE FDs (in Rupees) similar to NRE conditions ? (Int rates and no taxes ) or they are to be in FCNR only ?

Hi Bhupesh,

You can not renew your NRE FD similar to NRE conditions.

I am a seafarer (Sailor – Merchant Navy. Of the last 10 years, I have spent over 185 days of sailing abroad each year. This year 2020-21 I have spent only 150 days sailing because of a pandemic. Am I an NRI or NOR this year? Will my salary earned abroad be taxed in India if I file a return next year?

NRI leaving an IRA account in USA to avoid penalty(I am 36 years old. the USA charges a penalty if I withdraw before 59.5 years of age). If I stay in India for the next 20 years and then withdraw money IRA, what are the tax implications? I also have Roth IRA account. If I do same with Roth IRA, what are the tax implications?

Hi Venkata

As of the recent informations It will be taxed for an Resident Indian as per the tax slabs. To save taxes on that you can withdraw the amount in small tranches.

I am purchasing a property from RNOR which is above 50 lacs. How much TDS should I deduct before final payment?

Hi Sudha

There will be 20% + Cess which you need to deduct on the Long Term Capital Gain and 30% + Cess on Short Term.

How do I intimate to Bank to change my NRE INR FD Account status to RNOR Status?

Hi Sundeep

You can’t Change your NRE FD to RNOR. You can hold your FD till maturity and later convert it into Savings account by visiting your branch.

Dear Sir,

In 2020 oct, I came to India and couldn’t return to Spore.

I may exceed 120 days. So I’ll become RNOR.

I do work from home.

Will I need to pay Tax for salary income earned in Singapore.

(Though Sg and India has double tax avoidance, will I be calculated to pay as per 30% slab and deduct Sg tax and pay rest in India?)

BR,

Siva

Hi Siva

Assuming that you have been an NRI from Many Years.

For RNOR, it will not be taxable and as per the DTAA you are required to consult your Tax expert on this.

Is there any limit of tax-free NRE FD interest for RNOR?

Hi Vivek,

Yes there is a 2 year limit for this.

I am not refering to time limit. I want to know the amount limit. As per new finance bill it requires some limit of 15 lacs of indian income ( presuming in my case only interest from NRE -INR deposits -as indian income). So please explain tax treatment of NRE interest income of more than 15 lacs during period of my status as RNOR.

I am an NRI for the last 7 years. But in this FY I might have to stay in India for more than 183 days, because of lockdown. What will be my status in FY 20-21?

Hi Ramesh,

Your resident status will be RNOR.

Do NRIs have to pay income tax on the sale of shares or only capital gains tax?

Dear A,

NRI has to pay only capital gain tax.

How can prove my RNOR status, What documents I have to submit for that? Whether I have to get any document from the foreign country where I was residing.

Hi Prasanthan,

You should consult with your Bank for this.

I will be returning to India after living in the US for 5 years. Will I be in RNOR status when I return to India?

Hi Varun,

Yes you will be considered RNOR

Nice article Hemant, has the calculator been updated based on the changes presented in the recent budget

i spent 277 days in f.y 18-19 and in f.y 12-13 ,202 days.then what is my status in f.Y 19-20?

i reached USA in 20th Sept 2014 , was in India for a month in May 2015 and returned to USA. I came to India again in May 2016 and returned in June 1st week 2016. I am back now to India on 25th Oct 2020. Do I need to convert my NRE account immediately to resident savings? How to get tax savings on NRE account? Do I hold RNOR status?

Hi, if a returning NRI gets into RNOR status & works remotely for say 2-3 years after return for the same foreign employer & the income is received in a US bank account, then does he need to pay taxes in India for that period of 2-3 years?

Hi Vishwa,

He doesn’t need to pay tax in India.

I was working in India till May 2019. Quit my job and was travelling abroad and doing my own consultancy. Took up a job in Russia in October 2019 and am living in Russia since then. How will my consultancy income be treated when I was abroad. I have been out of India for more than 182 days in financial year 2019-20. Am I an NRI or RNOR?

Hi Rashi,

As you have been out more than 182 days in a financial year so your residential status is now NRI.

Is the RNOR status just Valid for 1 year after returning to India?

Hi Raju,

As per my Knowledge, RNOR status is valid for atleast 2 FY years.

I want to know whether I’m eligible for RNOR status?

Hi Deepak,

If you satisfy one of the two conditions for a Resident (He/She is in India for 182 days or more during the financial year.

OR

If he/she is in India for at least 365 days during the 4 years preceding that year AND at least 60 days in that year.)

AND

If you have been an NRI in 9 out of 10 financial years preceding the year.

OR

You have during the 7 financial years preceding the year been in India for a period of 729 days or less.

If a person has Nre deposits and on return wishes to convert RFC as prescribed whether the Nre deposits has to get prepaid or can be continued with same ROI?

Hi Sudhakar,

As far as I know, NRE deposits can be converted into RFC only after its maturity.

During RNOR status they are eligible to invest in RBI/Govt Bonds like resident right?

Hi Bhupesh,

RNOR can invest in RBI/Govt Bonds.

I left for the US on 1.11.2011. Since the FY 2012-13 I have come to India for a total of 139 days. I returned to India on 22.08.2020. I am a US passport holder and an OCI card holder too. I am working remotely from home in India for a US software company. If I stay till 31.03.2021 it will be 222 days in India. I have no income in India and file returns in the US and pay taxes there. Would I be liable to pay tax taxes in India too ?

Hi Hemant

Thank you for a very informative site.

Would you also know…. which ITR form should be filled by RNORs please.

Many thanks

Hi Daniel,

You should consult with your CA for this.

Which ITR form to fill up for merchant navy officer working in foreign going ships for FY19-20?

Hi Onkar,

As per my knowledge, if a Merchant navy officer is a resident individual then he needs to do the same procedure for filing ITR as same as other residents.

I want to know if I qualify as an RNOR?

An NRI returns to India for good after staying abroad for over 15 years. He maintained NRI status without break. On return, he is entitled to RNOR status. if he returned ib February 2017 for which period he can enjoy RNOR status for income tax purpose?

Hi Mahendra,

RNOR status is valid for 2 financial year.

my nre deposits will become resident deposits during RNOR status.I want to know whether the existing NRE deposits will be cancelled and new deposits will be made and put in resident account?

Hi Anuj,

It will not be canceled, only the status of that particular FD will change.

Can RNOR avail rebate u/s 87A for the F.Y. 2019-20?

As per my knowledge, yes you can.

Why resident Indian has to pay tax on income earned from foriegn?

FY 20-21 I will be 133 days only outside India, I am Crew member of Foreign Ship.

I have been NRI for 30 years, returned to India in Jan 2020 but unable to travel due to flight restrictions. I have my NRE deposit on which I get monthly interest credit in my NRE account. Do I have to pay tax on my interest earnings on NRE deposits?

Hi David,

Once your status changes to residents, interest earned from them are taxable.

Since last 35 years i stayed in gulf and this month i am going to India for good. I stayed in India abt. 30 to 45 days every year. After returning to india this month, can i entitle to RNOR status. If yes how nany years. I opened some NRE FDs last month for a period of 3 to 5 years. What abt. the tax on these NRE FDs?

Hi Kalasagara,

As per my knowledge you are entitled to the status. And interest earned on FD’s will be taxable once your status is residence.

If I completed 182 days FY 2019-2020, Am I eligible for RNOR?

Hi Raghesh,

As per my knowledge yes, you are eligible.

Thanks. So when my RnoR status will expire if I plan to continue to remain in India

I am an OCI and RNOR for another two more years and my wife is an OCI holder and NRI as well….so till such time, can I retain my joint NRE account with my NRI wife?

I am presently an NRI and have got NRE FD with me. Planning to come down to India soon and was wondering if I could be considered as RNOR and if tax could be exempted on interest earned on FD for the next two years?

Hi Kennedy,

The interest earned on FD will be taxable.

I came to India march 18 2020, due to current pandemic not went back us but still receive us salary. My family is in India cannot travel yet because their visa appointments scheduled april got cancelled. I need to stay more than 182 days to take the family along with me. I stayed abroad about 545 days in last 7 years that is between april 2013 to march 2020. So do i come under rnor status for the fy 2020-2021 and if so will my salary i receive will be tax exempted under rnor status.

RNOR should be away from India continuously for 9 years out of the previous FYs ? or He/She could have visited for short period India?

I am holding NRE FD during my RNOR status whether, interest earned is taxable?

Hi Jagadish,

No, interest earned is not taxable.

1.Please clarify whether Resident demat account can be opened by a person with RNOR status.

2. NRE-FD’s interest is taxable after converting to RFC?

Hi, I am an NRI and will be settling in India. I have Insurance taken outside and the proceeds will be reaching me only after I became resident indian (after 2 years of RNOR in my case). If I get around USD 100K what will be the taxability for this maturity proceeds?

Can you give any citations for this article? I did not get any of these details on the official income tax website

In RNOR status, is there tax applicable on interest earned on FDs maintained in INR?

On your NRO deposits, yes. I don’t know about NRE deposits.

Whether a US citizen with OCI card staying in India for last 8 years need to declare his 401k retirement account details in ITR2?

Hi Suresh,

As per my knowledge you are required to do so.

Thanks!., to be on the safer side I decided to report my 401k, although there is no withdrawal or any income generated.

Indian Citizen working outside india , however lost job due to corona , lost job but could not travel to india due to corona , 1- do i need to close my NRe Account as i do not have a residential status as i lost my job 2- i transferred money to my nre account hope that is fine , i am outside india in my job location as i cant travel to india due to corona and hence i have not closed my nre account.

Hi Shreya,

You will need to close this account when you will be back in India. If you have any NRE FD you can continue it till the maturity.

I am an indian seafarer who has met the NRE requirements (185 days outside india on foreign flag ships) for last 9 years.can i get RNOR status for 10th year?

Thanks Mr. Hemant. The article is quite informative. I am NRI since last 13 years. This year I am planning to permanently return to India in Oct. or Nov 2020. This FY till now I did not visit India due to COVID19. So, after returning my status would be NRI or RNOR? I am confused between 181 days and 60 days condition for being NRI.

I am a long-term nri. Arrived in India on 10th may 2018. Left India on 12 may .arrived in India on 11 august. I would like to know if I qualify for rnor status in india

I am a merchant navy officer since 1998. Last 7 years I have NRI status now returning to India on 25the July, now quit my job and starting my business, how I liable to tax?

We moved from India to Qatar in July 2012 and have now returned to India on 29th July. Can we avail RNOR status for this and next 2 years. We have fixed deposits under NRE account, and so will that be exempted in that case?

I have been a seafarer for last 15 years and maintained my NRI status. This year will not be able to maintain my NRI status. But I am working from India doing audits of ships remotely all over the world. I am paid in USD from my company situated in London. Will I have to pay tax on my earning in financial year 20-21. Thanks for your reply.

Hey Moolayil,

If you are not paying tax in London, you have to pay tax in India.

Should RNOR show the details of the bank accounts of the foreign country in ITR filing in India

Hey Prasad,

As per my knowledge no need to show the foreign account details

How are seafarers going to be taxed I need India from this year onwards?

Hi Harry

As per my understanding, your question is that ‘You will be in India from this year and wanted to know the Tax effects on this?’

If my understanding is right than it will be depend upon your previous stays in India.

Kindly contact your Tax advisor for this.

I am an NRI moving back to India in Oct 2020. I lived abroad for 4 years. Will my salary earned from my job in Dubai in Apr-Sep 2020 (before I move back to India) be taxable in India?

Hi Nishant

It will depend upon your Tax Residential status as per the IT law.

If your status is ROR then it will be taxable else not.

If one is having 178 days in India and 178 days in each year before that particular year, will he be an NRI? he is on employment in Dubai.

Hi Husain

As per the provided information, I think the person will be Resident Indian.

I am an NRI from 1989 and planning to settle in India permanently from 2022 end onwards . Can I be given an RNOR status? For how many years? Each year the max I wld have spent is not more than 3 weeks in a year. For how many yrs I can get tax exemption ?

Hi Jaya

As per my knowledge, You will be RNOR for 2 years.

Hello Mr Hemant, Thanks for the clarity. I have a question relating to a specific situation. I am Indian citizen and living in UAE continuously from 2004 and now returning to India in October 2020. According to new rules ( 120 days), I understand that I will be a resident for FY 2020-21 while still be a RNOR. I want to know if for FY 2020-21. I have to pay tax on the salary earned in UAE?

How can I avoid paying tax on the income earned in UAE . Do I need to postpone coming back?

Thanks

Vipa

Hi Vipa

If your Indian and Abroad Income exceeds the limit of 15 lakh, then it would be advisable to postpone this a little forward.

Explain the additional condition of 2 years out of 10 immediate previous years?

Hi Kavya

This means that you should be a resident for atleast 2 years in the last 10yrs preceding the current Financial Year.

For example – We are in the FY 2020-21 then preceding 10 yrs would be from FY 2010 to 2019

First Time I went In Dubai on 19-03-2018 and return in India on 20-03-2020. In my opinion my residential status for F. Y. 2018-2019 and 2019-2020 is NRI. I worked in Dubai on salary Basis in Dubai Sheikh owner Company. Received 2500/- Dirham P.M.. I transfered Rs. 374000/ in 2018-19 and 425600 in 2019-20. I want to show this trf. money as exempted income . I want to know where I have to show in the ITR. I have business income in India Rs. 190000/- in 2018-19 & 2019-20.

HI Jagmer

Kindly consult your Tax adviser for the same.

Sorry i meant RNOR and not NROR,kindly read above comments accordingly

HiHemant,

Many thanks for sharing detailed information, however I heard there has been some recent changes in the laws post march 2020.

My question :I am NRI since 2020 Jan and both criteria’s are fulfilled for NROR (plan to return before end of sep2020)

NOW MY QUESTION :after reading your article its seems I don’t have to pay tax for my income (april2020-sep2020) till the time I hold NROR status (I believe it could be till 2022).Kindly confirm,

Hi Mohit

As per my knowledge and the Latest Amendments, you will be ROR, rest will depend upon other factors too.

Is TDS applicable for an RNOR while he receiving INR FD Interest..?

Hi Josmy,

Yes, TDS will be applicable if it crosses the prescribed limit.

I am NRI since April 2018, am I an RNOR?

Hi Pramod,

RNOR status will also depend on your residential status or stay in India before April 2018.

As per my understanding, you will consider as RNOR

I have just returned to India and I am in RNOR status. I have some IRA accounts in the US which I want to transfer to India. However, I will not be able to complete transferring all IRA balances in these 2 years. What happens after my RNOR status is over? Are my overseas balances in IRA accounts taxable?

Hi Sundar,

As per my knowledge, when your status will become resident then any income from around the world will be taxed.

I am US Citizen, with OCI card. I am planning to move to India for a long time and I may work remotely from India for a US Company. Do I have to pay taxes in India?

Hi Rajesh,

As per my knowledge, you need to pay taxes as the income will be accrued in India

Hi Ketan, thanks for your response. If a returning NRI gets into RNOR status & income is received in a US bank account even then need to pay taxes in India for that period of 2 years?

I am working in Kuwait for more than 10 years. Since the NRE FD is of low interest can I do FD in some co-operative banks?

Hi Prethiumnan,

Yes, you can open FD with Co-operative. These FDs involve very high credit risk.

Based on the above on RNOR, which month or part of the year is best for someone to return to India for good if they need to maintain NRI/RNOR status to the maximum. Lets base this if someone is planning to return in 2020 remaining part or early 2021

Hi GP,

One should come after September – assuming you are taking care of 180 days criteria. (But still, I will suggest you have a call with CA because now there’s an additional criterion of 15 lakh income)

Thank you.The word RNOR is first time for me,

Thanks for appreciating 🙂

Is the amount earned abroad will come under income tax in India?

Hi Kamal

It will depend upon your residential status. If you are an Resident Indian, then it will be taxable in India.

Can I hold NRE FD in the status of RNOR?

Hi Janak

You cannot hold NRE FD, you need to convert it into Residential FD. It doesn’t mean that you need to premature close your NRE FD and start a new only. Just contact with your bank and tell them to convert it in Residential FD.

sir. I am working in saudi for the past 26 years continously . i will resign job and come to india in august 2020 . howlong my nri atstus will continue and should i pay income tax for the Fy 2020-2020 .

Hi Ramesh

Yes, you have to file the Income Tax return for the income earned in India & you taxability will depend on how much you have earned in FY 2020. The NRI status will continue for will depend on when you return back and what was the status of your previous visits to India.

Generally a person can enjoy RNOR status for 2 to 3 years.

Sir, thank you ever so much for highlighting critical aspects of the NRE to NROR transition.

Just one query: My bankers are saying that once I get the NROR status,they will continue to charge the Tax amount as TDS, on the interest earned on my FCNR deposits.

It is upto me to submit my annual IT filing and get the additional tax paid as a refund.

Is it correct? What I am given to understand is that once you are eligible for a RNOR status and you have been assigned the same, then NO TDS is done on the FCNR interest accrued during the financial year

Thank you so much for your advise.

Hi Dinesh

As per my knowledge, FCNR is Tax-free for RNOR so there will be no TDS deduct on that.

For how long my NRE fixed deposit is free from tax once I permanently reside in India?

Hi Dany

As per my research, NRE FD is tax free till the time you are RNOR.

Please inform, for RNOR, NRE FD and FCNR FD interest are tax-free or become taxable in India?

Hi Prakash

Interest earned on FCNR FD is Tax-free whereas for NRE FD, it is taxable for RNOR

Can RNOR open a bank account and make FD?

Hi Ankur

Yes, you can open RFC account and create FD as RNOR.

I want to know regarding the interest on FD after NRI status.

Hi Rao

Interest earned on a NRE FD are tax free whereas on a NRO FD, it will be taxable.

I change my status from NRE to Resident on July 19, after spending 12 years in UAE. What happens to NRE FDs will the interest be taxable during FY 2019-20?

As per my knowledge, It will be exempt from tax until you are RNOR i.e. Resident but Non – Ordinary Resident.

I have been out of India for employment for more than 35 years. Still keeping NRI status. In case if I return and settle in India from July 2020 onwards, What I have to do with NRE Account FCNR(B) etc.

Hi Saleem,

You have to convert them into RFC account.

question on RNOR status. for the calculation of the 730 days condition, is the current financial year included? or is this 7 years preceding the current financial year?

Hi Shobha

It is 7yrs preceding the current financial year.

Hello Sir, My question is related to RNOR status. I came back to India in Aug 2019 after spending 10 years abroad. Also, I have stayed for less than 730days in the last 7 years in India.1. My understanding is that I can hold RNOR status for 3 years. 2. I am still holding my savings in the NRE account but don’t have any FD or any other investment abroad. Can I still convert my savings into NFCR or FCR account as I am already back in India? If not then please advise me what is the best possible way to save my savings from tax. 3. If I convert my NRE account into a normal account then how will I prove that my income is not taxable as I have RNOR status. 4. Do I need to pay tax on the interest earned in my NRE account as I have already canceled my residence status and I have moved to India in Sept 2019?

Hi Ramesh

1) Yes, you can hold it for 3 yrs.

2) It is advisable to convert it in residential a/c if you are not planning to move out again.

3) I think you will get a certificate or document from your bank which will help you to prove your income else you can take help of a tax advisor.

4) No, Interest earned on NRE is tax free

I have to work in UAE form 30.12.2012 and have returned to India on 05.03.2019 and settled in India to carry out my UAE company branch in India. My question can I be treated as RNOR for the 1st year, if yes do I need to pay taxes as my income comes from my UAE company.

Hi Ashok

Yes you will be considered as RNOR and the income which you received from your UAE company will be taxable.

Hi Mithun,

I have seen somewhere stating RNOR will be treated as equal to NRI for 1 or 3 years. Also i saw it stating the income earned in INDIA is only taxable during this period. Kindly advise

I came to India in 2016 December. I was out of India for almost 15 years with very short visits. Am I RNOR or ROR for F.Y. 2019-20?

Hi Ashok

You will not be considered as RNOR

I am planning to return to India from Abu Dhabi sometime in 2nd half of this year. What will happen to my Income Tax status once I reach India (especially related to my Fixed Deposit as an NRE account in Banks?

Hi Rakesh

It will all depend upon your residential status at the time.

Will my income be taxable in India if I am a resident but not an ordinary resident and getting salary in nre account maintained in India. I am a crew member of a foreign ship.

Hi Sharique

As per my opinion it is tax free

Pl advise whether I can save on Indian taxation if I convert equity mutual fund from dividend payout option to dividend reinvestment option.

Yes, that can be a better option if you have some income in India. Bw going forward I don’t think Mutual Funds will be interested in paying dividends.

I have stayed in the US from October 2nd, 2013 to December 14, 2018. During these 5 years, I was in India for 55 days. Please let me know if I qualify for RNOR status for this financial year 2019-2020 tax filing. My NRE FD’s matures last month and I have transferred 80% of the amount to my wife’s resident account and still have 20% in my NRE account. Do I have to pay taxes on those amounts If I’m gaining RNOR status? Or it can be avoided by opening the RFC account at this stage? Please help!

Hi Ramesh

As per FEMA, you need to update your bank regarding your change in status of resident, if not not yet you need to do that asap and you will not be qualify for RNOR as you are fulfilling all the conditions of an ROR.

In this case all your income will be taxed.

In the recent Budget announced on 1st Feb 2020, the definition of RNOR has been changed. Can you help update?

Hi Parikshit,

As per the budget, the new changes that have been proposed is that the condition of 730 days in last 7 yrs have been removed but the other condition of being in India for 2 yrs in last 10 yrs has been updated to 4yrs in last 10yrs.

I work on a rotational job (i.e. I work for 5 weeks and get days-off for 5 weeks) in Saudi Arabia as an oil field professional. What category do I come under like RI, NRI or RNOR? And will be my income earned in Saudi Arabia will be taxable in India?

I have returned Jan 2020 to India after worked for about 18 years in Malaysia. How many years I am eligible for RNOR status?

Hi Ponnambalam

You will be eligible upto 3yrs, if you are moving India permanently

From 12-sept-2012 to 10-June-2019, I was staying out of India. Can I get RNOR status?

Hi Mishra,

Yes, you can get RNOR status.

Dear Sir, I have returned to India on 11 Oct 2019. Till which year I can claim RNOR status. Do I need to convert the NRE deposit to FCNR?

Hi Sumit,

You can have RNOR status till 2022-2023. You can keep your NRE deposit till you are RNOR.

Hello Hemant, thanks for your webpage. For tax planning purposes, what date in the year should an NRI return for getting maximum period under RNOR status?

Hi Ajay

You can avail your RNOR status only for 3yrs. It will all depend when you leave and come in India.

Dear Singh,

With the recent changes in the income tax law, I understand that if you are a NRI for 10 years, then upon arrival in India, you can hold the RNOR status for 4 years.

Regards,

Ajay

I am an Australian Citizen of Indian Origin and OCI holder. I have been an RNOR between late 2012 and early 2015. Then returned back to Australia. I am planning to be in India in late 2025 for 2-3 years. Can I avail RNOR again from 2025.

Hi Lakshmi

Yes, you can avail.

Thanks.

thanks. how to claim tax deducted from NRE FD INR interest after becoming RNOR status.

Dear Chandran,

RNOR will not make any difference in the case of NRE FD – interest will be taxable. So depending on your taxable interest in India actual amount of tax will be decided.

As per the definition of resident status if any person staying in India 365 in the preceding 4 years. I am Canadian passport holder and OCI will this apply to me as I have not stayed more than 181 days in India but have stayed more than 365 days in the last 4 years .how my tax will impact

Hi Mahesh

Yes it will be applicable to you and your tax will be based on your residential status.

Hi sir, thanks for your article, my question is same as Dilip. Capital gains tax on foreign stock investments after becoming resident Indian. Capital gains meter will start post becoming resident I would suppose ?

would that be correct ?

And how does double taxation treaty help here ?

Hi MS

You have to pay tax on the capital gains which you earned from foreign investments, as far as double taxation is considered it will differ from country to country as different agreements are there between them.

I moved abroad to uae on 03/09/2012 and i am returning to india on 15/01/2020. I have few questions

1.) i have money in my Nre FD maturing in next 2 years. What happens to my FDs after i return back to India?

2.) The money in my Nre account is earned from abroad and i do not wish to pay tax until i find a suitable way to invest the money. What are my options?

3.) I have mutual funds SIP registered with NRE account, what happens to them

Dear Kunwar,

Let me try to answer all your points & this may also help other readers:

1. NRE FD – you can continue your NRE FD but interest will be taxable from the day you will arrive in India – so in your case 15-1-2020

2. Money in NRE Account – if you don’t want to pay tax either you can invest in FCNR before coming to India or transfer that to the RFC account.

3. Mutual Fund SIP – you can change the status in KYC, change bank details with AMCs & continue to hold your investments.

Dear Mr. Hemant,

My query related to the second point responded to Kunwar:

Can the NRE FDs be converted to FCNR or RFC after returning to India?

Thanks,

Ponnambalam

Sir, please advise:

My son, a US citizen, returned to India in June 2017. He has business in US that he handles online from India and also by going there frequently. Till 31 March 2020 he would have stayed in India for less than 729 days. Can he claim to be a RNOR for the F Y 19-20 and claim his US business income as tax free? He has no India income. Please advise. Thanks.

Hi Mehta,

As per my knowledge, he can claim RNOR status and his income will not be taxed in India.

hello. i am OCI holder and settled in india since 8 months. i am now dealing with banks etc and i have RNOR status but i am not sure what to do about my bank accounts. can i keep my NRE / NRO savings accounts? or do i need to convert them to resident accounts?

Hi Shyam

As per my knowledge, you can keep these accounts as you are an OCI holder.

How to check my resident status ?

Hi Hajat,

It will depends upon the number of days or years you lived in India, So refer google for exact days and analysis according to that or you can tell your duration over here for more clear answer.

I stayed abroad for 32 years and came back in Oct 2016. once again I went in Jan 2019 and came back in Nov. What will be my present status as an NRI. I have deposited and want to invest as a safe deposit.

Hi Konanur,

You will be considered as RNOR because you stayed in India between Oct 2016 to Jan 2019, which helped you to claim RNOR status.

Can a retired OCI living in India for more than six months be liable for taxation if his only source of income is FDs in Indian Banks in India?

Hi Himadri,

Any Income earned in India is taxed in India

Hi Hemant,

My status is rnor for fy2019-20. I will become resident for fy2020-21. I have long term Nre fd. As per my CA, I should start paying income tax and file return in fy2021. Is this correct?

Also I have one nre pis trading account managed by a broker. This is one year old investment and in fy2018-19 the loss is 3Lac. Is it mandatory for me to file return for it? If yes, under which provision?

Hi Kumar,

As you become a resident, you are obliged to file a return. As far as your loss is concerned please refer to your CA for better advise.

Dear Sir/Madam,

My duration of stay abroad was from 25 July 2011 till 06 December 2019 which comes to 8 years and 130 days or a total of 3050 days.The number of days I stayed in India during this period was 311 days. I wanted to know regarding my RNOR status.

Hi. Parmindar

Your RNOR status will decide as per your stay in India in FY 2019-2020. If you satisfy either one of the condition i.e. being in India for more than days 181 days or 60 days with 365 days in last 4 year, then you can be considered as an RNOR. This status comes with some other condition as well.

RFC currency deposits attract INR valuation gains taxation?

Hi Dinesh

As per my knowledge it is Taxable.

I am a US citizen, living in India for more than 182 days for FY. The only reason for me to stay in India is to take care of my Dad. I do not have any income sources in India, would I need to declare my US income and file Indian income tax?

Hi Gujji

The taxation will depend on your residence status.

regarding RNOR condition. it says that one is RNOR if he is NRI IN 9 out 10 previous years preceding that year, my question is what it means by preceding that year, which 10 years I have to consider?

Hi Sathya

Last 10 yrs from your current year. Suppose right now we are in 2020-2021, so 10 yrs before this period.

Sir my querry is regarding conditions to satisfy RNOR status

section 6 states that

(a) an individual who has been a non-resident in India in nine out of the ten previous years preceding that year,

in the above statement it is not clear to me what it means by “ten previous years preceding that year”

so if i am NRI for the year 2019 to 2020 and return to India permanently on 1 january 2020 ,

1 it is clear to me that i am NRI for the financial year 2019-2020

2) i am RNOR for the financial year 2020-2021

3) i am not clear about about my RNOR status in 2021- 2022

3 a ) if i understand preceeding years means 2013 to 2022 then i am Resident for 2 out 10 years( 2021 and 2022) , so i become ordinary resident

3 b ) if i understand preceding years means 2012 to 2021 then i was NRI for 9 out 10 years , so i will retain RNOR status

So please let me know what it means by ten previous years preceding that year.”

thanks

sathyamurthi

Hi. Sathyamurthi

10 previous preceding year means immediate 10yr from your current FY.

I have become RNOR this year but next your I’m planning to be outside India for more than 182 days. Can I repatriate amount from my NRE & NRO accounts or RFC next year.

Hi Rakesh,

As per my knowledge you can repatriate.

Indeed Nice article.

I have following 4 questions as planning to settle back in India after stayed in GCC county for 11 years.

Question-1. Which of the Government body has authority to ensure, confirm and give the status as RNOR? is it FEMA or Incometax department or RBI or Bank or CA or else?

Question-2. Till RNOR status one can continue NRE account or not? and if bank say not then what to do?

Question-3 What happens to the MF investment made under NRE kyc, during RNOR stage and after resident stage. When and how to re-designate the kyc under RNOR and resident stage?

Question-4 If the investment is made in MF in international market during NRE stage and will continue to invest for more 5 years even after returning to India. After achieving the resident state in India if those MF redeemed and brought in India, do whole redeemed amount is liable for tax or only the capital gain? since the investment was made during NRE stage only.

Looking forward for your response.

Hi Dilip,

Ans 1 : Its Income Tax Department as the guidelines are set by them.

Ans 2 : As an RNOR, You can continue with RFC account as you have to transfer your money into RFC account but after you become ROR, you have to convert into savings account.

Hi, Dilip

Ans 3: As per my knowledge, as you turn into a ROR, You have to re-designate your KYC as a Resident.

Ans 4: For taxation purpose its better to consult with a CA and what will be the laws after 5 yrs , it will depend on that.

I want to know my NRI status. I joined a ship on 25th may 2019 and will land in India on 26th Nov 2019

Hi. Roy

As per my knowledge you will be consider as RNOR

Does RNOR have to pay tax on interest earned on rupee NRE deposits?

Hi Ronald,

Yes, it is taxable.

I was an NRI for more than 20 years.I came back to India finally in Feb. 2019. What will be my status regarding money in NRE accounts?

Hi Hafiz

As you become a RNOR status person, you have to transfer your money into RFC account and then into savings account when you become a Resident.

I was in Gulf from Sep 2001 to April 2017. How many years I can be considered as NRI assessed. 2 or 3 years

Hy NB,

As long as you stay for more than 182 days in India in a Financial year, you will be considered as a resident but further classification will be depend on how long will you stay here

Hello Hemant,

Thanks a lot for the explanation.

I have a question, during the financial year for which i claim RNOR status , can i move funds from abroad (Tax refund and Final settlement of salary) to a resident account without those counting as income in India or does it necessarily have to be moved to a RFC account, please let me know

Regards Ajith

Hi Ajith,

As per my wisdom , Its better to transfer into a RFC account and during your RNOR status, your earning outside India will not be taxed in India. Rest you can consult a CA for better Tax suggestions.

as an RNOR do i pay tax on my NRE fd’s.

Hi Praveen,

You cannot maintain your NRE account and NRE FDs when you are an RNOR. You need to convert your NRE account to the resident account immediately upon returning to India.

hi i am an oci holder with british passport. Have been living abroad for 17 years and we are planning to move to India permanently. Do we need to pay tax on selling property abroad?

Hi Aniket,

When the status is changed to SB, then it is taxable.

tax liability in nre fd after status from nre to sb

Hi Aniket

It is exempt from Tax

I went to Bahrain on 29 September 20212. Iplan to return t India for good 15 July 2020. Now tell me am I eligible for RNOR status?

Hi Anthony

You will be considered as RNOR as per my knowledge

Working on ships overseas company with irregular nre status,, salary in fcnr and nre account with bank in india. what is tax liability and for how many years

Hi David.

Consult with your CA.

If i take RNOR status for 2019-2020 and next 1 year i.e 2020-2020 i am again out of india for 185 days then am i counted as NRI

Hi Priya

Your status will be decide as per different conditions. So, refer those for best answer.

I am working in ksa from 6.6.1988 to 4/06/2019 and than 1/09/2019 to 31/10/2019 is my last date for retirement Before going to india i will going to send my end of service benifit to my NRE account. considering this financial year based on above-mentioned dates I was going to stay in india 610days only in the period of 7 years and up to 2018 – 2019 i am NRI.the money going to send India principle is taxable ?.

Hi, Syed

As per my knowledge, After you become a RNOR you have to transfer your money into RFC account and as you have earned this money being an NRI, It will not be taxed in India.

I Am an NRIs I want to buy a plot in my country. Do we exempt tax on gst?

Hi Harikrishna,

Please consult a CA

I want to have clarity on rnor status & tax on interest eatned on NRI FD AFTER becoming resident.

Hi Mahesh,

RNOR status doesn’t provide any benefit in the case of NRE FD – interest will be taxed.

Hi Hemantji,

When I return to India after being an NRI for more than 10 years and do not plan to stay for a continuous period in India for coming years, can I claim RNOR status for more than 3 years? As long as I satisfy the criteria for RNOR in Section6? Is there any section restricting the RNOR status availment for more than 3 years even when the I am complying with the RNOR criteria?

Appreciate your inputs on this question.

Thanks

Mugdha

Hi Mugdha,

Please consult a CA.

How does returning NRI inform the banks and when he has to inform about the change in status?

Hi Barun,

Consult with your Bank.

As i am in the merchant navy, For the year 2018 1st april -2019 31st march i was out side india for 158 days only but the requirement is 182 days. Do i have to file tax for the 2018-2019 ?FYI – but from January 2018- 31st Dec 2018 i was outside india for mlre than 182 days.

Hi Rajesh

As you are into merchant navy, some rules will be different for you. So, its better to consult a Tax Advisor for this.

I returned in India on 10 September 2018 after staying abroad for more than 14 years. How long my RNOR status will continue ?

Hi Baman,

For the year 2018-19, You will be considered as an RNOR, and for the next two year your status will be RNOR.

NRI for the last 12 years come back to India in June 2016 what is my residential status for FY 2018-19.

Hi RIchaa

I think you would be Resident- Ordinary Resident.

A PERSON RETURN IN INDIA ON 25.11.18 AFTER STAYING 10 YEARS IN ABROAD. WHAT WILL BE STATUS IN FY 18-19

Hi Barun

That person will be considered as NRI because he is not fulfilling the basic criteria.

Hi Hemant,

This was a v good article which will be useful for all NRI planning to return to india.

I am an NRI more than 10 years now & thinking of coming back for good, will i lose the NRE FD tax benefits immediately on maturity & what to do with existing NRE account ?

Thanks and regards

Thanks Krishna.

Existing NRE Accounts should be closed & FD should be assigned as a resident – interest will be taxed from the day you will arrive in India.

Can I convert all my existing NRE rupees fixed deposits money to RFC fixed deposit immediately after final return to India after staying 33yrs in Saudi Arabia and avail tax relief as RNOR

Hi Dr Masoodsa

Yes, you can avail tax relief.

You have written that interest on NRE deposit is not taxable till NROR status if NRE deposit is converted in to RFC deposit in foreign currency. Now please inform after how much time I can convert FC in RFC deposit in rupees to earn regular income by investment in india. Thanks.

Hi Narendra,

As soon as your status turn into ROR, you have to convert RFC into Normal savings account.

I am an NRI for last 29 years working in Indonesia.want to go back to India for good.when should I go in a financial year so that I can avail RNOR status for maximum number of years. Thanks

Hi Lokaish

As per my knowledge you can avail it for maximum 3 yr , you come to India before October in any year and stay here only.

what the Residential status of a Student going abroad for studies in august 2017 and another going in Aug 16

Hi, Rajinder

They will be consider as either RNOR or NRI as per their previous staying in India.

SIR I HAVE GONE TO UAE FOR BUSINESS PURPOSE SHOW TO AVOID TAX IF I SEND INCOME INDIA EVERY FY

I worked for 35 years outside Bharat and came back to Bharat on 27.04.2019. How I will get RNOR status and for how long I will be exempted from Income tax. Now all my NRe / NRO accounts became Resident accounts and I do not have any FCNR account

Hello – this is regarding RNOR status. I left India in Feb, 2008 and got back in Jan, 2017. I lived in Middle East (ME), Africa and US during this period. I have some deferred benefits with the company both for period in ME and Africa (Pension, Profit Sharing, etc.) as well as in US (401K). I returned back to India in Jan, 2017 with the same company and am leaving the company next month (Aug, 2019). Am I eligible for RNOR status?

Hi Abhishek

You will be RNOR for Fy 2019-20 and from then you will be a resident if you stay in India only,

For Ronr if it’s said less than 729 in the last 7 financial year. Can you give an example?

Hy Ms

Say you are in Fy 2019-20. So, Last 7 Fy would be from Fy 2012-13. During this period you have to stay for 730 days.

No matter how many stretch you take to complete this.

I AM A SEAFARER HAVING COMPLETED THE OBLIGATION OF SAILING ONBOARD FOREIGN GOING SHIPS FOR MORE THAN 182 DAYS IN THIS FINANCIAL YEAR. WHAT IS MY RESIDENTIAL STATUS . (I COULDN’T COMPLETE MY NRI TIME LAST YEAR AND ENDED UP PAYING INCOME TAX FOR THE LAST FINANCIAL YEAR)

Dear Sir,

I have been an NRI since Sept 1982 and returned to India on October 2016. During these years I have come to India for an average duration of 45 days per year. From October 2017 onwards I went abroad and will be working there until October 2019, when I plan to setttle in India Permanently. Kindly advise what will be the status of my existing NRE FDs and NRE SB account after October 2019. Can I claim RNOR status? Can I keep the NRE FDs until the maturity period ? How can I save on taxes after October 2019. Thanks for an urgent reply.

Hi Ajith,

I will suggest you get in touch with a CA.

I could not complete my NRI days, in last financial year. I have been NRI since 2003. Kindly advise, what is RNOR?

I was out of India for more than 20 years and came back permanently in January 2019.when I need to file my return and does my NRE F D will come in perview of RNOR. Status. When I need to inform the bank for redgine my nro and nre account. Please clarify

Hi Janak,

According to FEMA one becomes resident as soon as he returns but for tax purpose, you were NRI in 2018-19 – you can inform your bankers now.

I am a seaman, working on foreign ships.My stay in India has always been less than 182 days. However if the previous 4 years is counted, my stay in India is more than 365 days.

Hi Kevin,

What’s your question?

I am finally returning India after 33yrs continuous stay in Saudi Arabia in sept 3019…Does my NRE Fixed deposits and its interest in Indian rupees are free from any income tax in india till my status is RNOR..pls clarify in detail

Dear Dr Masood,

You can convert those FDs to RFC or tax will be applied.

Thanks for writing about RNOR. Something new that not many people are aware of.

Thanks Rajesh 🙂

My bank told me that they don’t have RNOR. Only resident account. I spend 20 years abroad. Please help.

A person who was nri for more than 10 years happens to be in india for approx 250 days. So his status changes in that fy to rnor .right? Now if he goes out of the country again for job for more than 185 days .will he become nri again? How is tax treated?

I am confused about my Residency status for tax purposes. I moved to Australia on 25 Aug 2018 and found a job there. This means I have stayed for less that 182 days in India and can claim India tax return for FY 2018-19. Is my calculation correct ? I have always stayed in India before moving to Australia in Aug 2018. Would I be correct in assuming that the 60 day rule(+365 days in previous 4 years) does not apply in my case ?

Hi. Cyril,

Yes, You are correct.

Hello Mr. Beniwal,

Thanks for sharing such useful information, it really helps. I would like to ask my query. I have been out of India from SEP 2007 to may 2018. I returned in may 2018 with another offer in hand, however by the time visa & other formalities were completed, it was Feb. 2019. So I am currently out of India. I don’t know what would be my status for financial year 2018-19? Also, since I was supposed to go back out of India, I did not inform bank as there was no plan to return. However, now I am planning to return in August 2019 permanently. Please let me know what should I consider while filing return for year 2018-19? Also, in this case when does my RNOR status starts & ends?

Hi. Mahesh,

As you have stayed less than 182 days in FY 2018-19 that means you have to file ITR as Resident Indian.

For RNOR status please refer Example in the above Article.

How to convert domestic deposit to nre deposit?

Hi. Mahendran,

You cannot convert domestic/saving deposits into NRE Deposits but you can convert it into NRO deposits.

For this, you need to consult with your banker or you need to intimate them regarding your NRI status.

Kindly clarify me.

If a Nri deposit opened on 01 7.17 for 10yrs and he became resident on 01.4.2019 what will be deposit status? Whether it can be continued till ten yrs. If can be continued means what about the ineterst. Is it taxable?

Hi. Mahe,

You must check.

https://www.wisenri.com/nre-fd-after-return-to-india/#comments

i have been an nri for 20 years till jan 2017.. wil i be rnor this FY.?

Hi. Prakash,

No, you will not be eligible for RNOR for FY 2018-19 because you have stayed in India for 800 days approx > 729 days till March 31st, 2019.

Good Morning.,

Can you reconfirm that for a person on RNOR status the NRE deposits interest income is not taxable until maturity?

I am on RNOR status for AY 2019-2020 and preparing my IT Returns now. My auditor is now saying NRE Deposit interest is taxable during RNOR status.

But I find logic in your assessment, the Banks too, have not deducted TDS on NRE Interests. In addition for practical purposes, NRE Deposit and FCNR Deposits are the same.

Is there any case study where the IT Department has accepted or rejected our contention that NRE deposit Interest during RNOR is not taxable?

Thanks a lot.

Hi Sundar,

For this purpose, one needs to determine residential status under FEMA. If a person is NRI under FEMA, only then his interest on NRE account will be exempt from income tax.

In all probabilities, an RNOR will also be a “resident” under FEMA. If this is the fact, his interest will be taxable.

Dear Sundar,

How can I change my status to RNOR from NRE as I worked more than twenty years. What is the procedure for that. Kindly please help me.

Sanil

I have returned to india on 4th april anf my wife on 15th march.. i have nre fd account.. what happens to the interest on them. I have been resoding oitside india for past 13 years

Hi. Jainendra,

You must check.

https://www.wisenri.com/nre-fd-after-return-to-india/

During RNOR period of the person goes away to abroad for say 4 months then how will you calculate number of days leading to 729?

Good information on RNOR. BUT there is disconnect on redesignation in reference to tax free interest earned till maturity

Dear Sir,

I was NRI from 12-10-1981 to 16-5-2017. How many years I can avail RNOR status?

Regards,

Omkar

Hi. Omkara,

You can avail RNOR status only till FY 2018-19.

Dear Akshay,

I was not aware about this , since one year iam in India. How can I change my status to RNOR. When I asked bank they said they have only resident account. My 23 years saving are in NRE account. Kindly please help me.

Sanil

I came in india on 1st March 2019. How to calculate RNOR status

Hi Rohan,

You can find your status with the help of the diagram mentioned above in the article

Where is the rule written that during RNOR status, interest on NRE FD is exempted from tax ? Because even many CA say that only FCNR interest is exmpted and not NRE FD ineterst.

Dear Hemant jee, Brilliant work by you. I returned to India on 4 February 2016 after working overseas for 15 years. I filed IT return for FY 2016-17 and 2017-18 as Resident Indian and claimed exemption under RNOR providions. I worked outside India for about 150 days in total till end of FY 2018-19 since my return to India. Please advise on applicability of RNOR exemption for FY 2018-19 in my case.

Hi Prakash,

Yes, you are RNOR for FY18-19

Dear Hemant,

Thank you for this very useful information. Can you please tell where is the claus/rule that say for RNOR interest on NRE FD is not taxable ? Because some CAs even do not know and say that NRE FD ineterst is taxable for RNOR status.

Appreciate your reply.

Thanking you,

Balkrishna Kapdi

I am RNOR. I have FD in INR in NRE account. Is interest in these FD’s taxable?I also earn consultancy income from one client from abroad and being paid in USD in my NRE account. Do I have tax liability on this income?

Hi Manish,

Whatever your status is any income received in India will be taxed in India so file tax.

How does one get/claim RNOR status ie. what online or paper form should i fill to claim this status and where can i find them?

Hi Ashutosh,

This is a residential status for income tax purpose.You can hold this status only while filing your income tax return

In case of PIO having regular business in USA starts a back office in India and stays for more than 182 days in India, then upto which period he will be R N O R?

Will interest earned on his funds in NRE/FCNR account will become taxable in India? Since he has also set up business in India, his status immediately becomes resident under FEMA?

Hi R.K.,

As a NRI, you are running a back office in india and earning in india from that backoffice. Your income from such office is taxable in india even if you hav RNOR status. You can avail RNOR status upto 3 yrs. Only interest from FCNR deposit is exempt from tax till you are holding RNOR status.

For a returning NRI , with RNOR status, you have mentioned that interest on NRE FD is free of tax till deposit maturity. Is it true as I had been informed through all other sources that interest earned on NRE a FD in Indian Rupees is taxable from the day I return back to India irrespective of RNOR status

Hi Jaweed,

If these FDs are converted to RFC – interest can be tax-free but rates & structure of the product is totally different.