The market has never been more volatile than they have been in the last few years. Many reasons – from COVID-19 to Supply-chain bottlenecks, and from global geo-political tensions to rising inflation – have contributed to the volatility in the economy.

The economic volatility is reflected in the wild swings of the stock & bond markets. We see the Sensex or the Nifty going down by 5% in a single day or climbing to historic highs in a few sessions.

Must Read – How Can NRI Invest in Mutual Fund in India?

The investors, including the Non-resident Indian (NRI) investors, are left high and dry amid all this volatility and tantrums of Mr. Market.

So, the pressing questions facing an NRI investor are:

- How do I participate in the India growth story, while hedging my risks?

- Is there an investment avenue that benefits from market volatility?

- How do we get all these benefits?

The answer to all these questions is SIP – Mutual Funds’ Systematic Investment Plans for NRIs.

In this article, we will cover :

- What is SIP for NRIs?

- Why SIP Investment important for NRIs?

- How Can NRI Invest in SIP Plans in India?

What is a Systematic Investment Plan for NRIs?

Mutual Funds invest the collective funds of millions of investors in financial securities. The sector is highly transparent and tightly regulated, making investments secure.

Any investment, per se, are not without risks – and so are investments in MF schemes. But the research has shown that there is a gaping hole in investment returns and investor returns. Most investors give in to the twin investing sins of fear and greed.

When the markets are going up in a frenzy, retail investors jump the bandwagon to buy highly-priced securities. And when there is a steep correction, they chicken out and book losses. This goes against the fundamental principle of investing – “Buy low, sell high.”

To take the elements of human emotions out of the investment process, a SIP for NRIs is one of the best ways to invest in any MF scheme of your choice. You can invest in equity, debt, hybrid, gold, arbitrage, or international funds via the SIP route.

A SIP lets you invest small sums regularly in the MF scheme of your choice – in autopilot mode.

Must check – Best Mutual Fund to Invest in India

Equity, Debt, or …?

Depending upon your financial goals, risk tolerance, and investment duration, you can invest in any of the funds. The new SEBI fund categorization has made MF investing a little less complicated for investors. These can be equity funds (with 10 broad categories), debt funds (16), hybrid funds (6), solution-oriented funds (2), and others (2).

One SIP at a Time

Why Not Lump-sum Investments?

To make impressive returns with lump sum investments, your timing of entry and exit must perfectly match the market cycle. But no one can predict the exact point in time when the markets would stop falling or rising. At least most of the time.

For example, you may have felt throughout 2021 that the markets are “overpriced.” If you did not make new investments, then you lost out on the sustained bull run that was visible until November 2021. If you entered the market any time after Sep-2021, you have either not made any money, or worse, are sitting on losses.

Similarly, when the news of the COVID-19 pandemic broke in the middle of January 2020, the world markets started crashing until the fateful weeks of Mark/April 2020. No one knew where, when, and if, the bloodbath will stop. From the peak of Jan-2020, the market crashed close to 50%. Only the most courageous would have dared to invest more in those stormy waters.

Why SIP for NRIs is Important?

Unlike investing in a lump sum, SIP for NRI helps you spread your investments. It simply takes away the need to time the market, and investor emotions, and puts the entire investing process on autopilot.

Below are the benefits of the SIP route of investing.

Discipline

As the SIP amount is automatically deducted from your bank account on a fixed date, you are forced to save/invest before you spend.

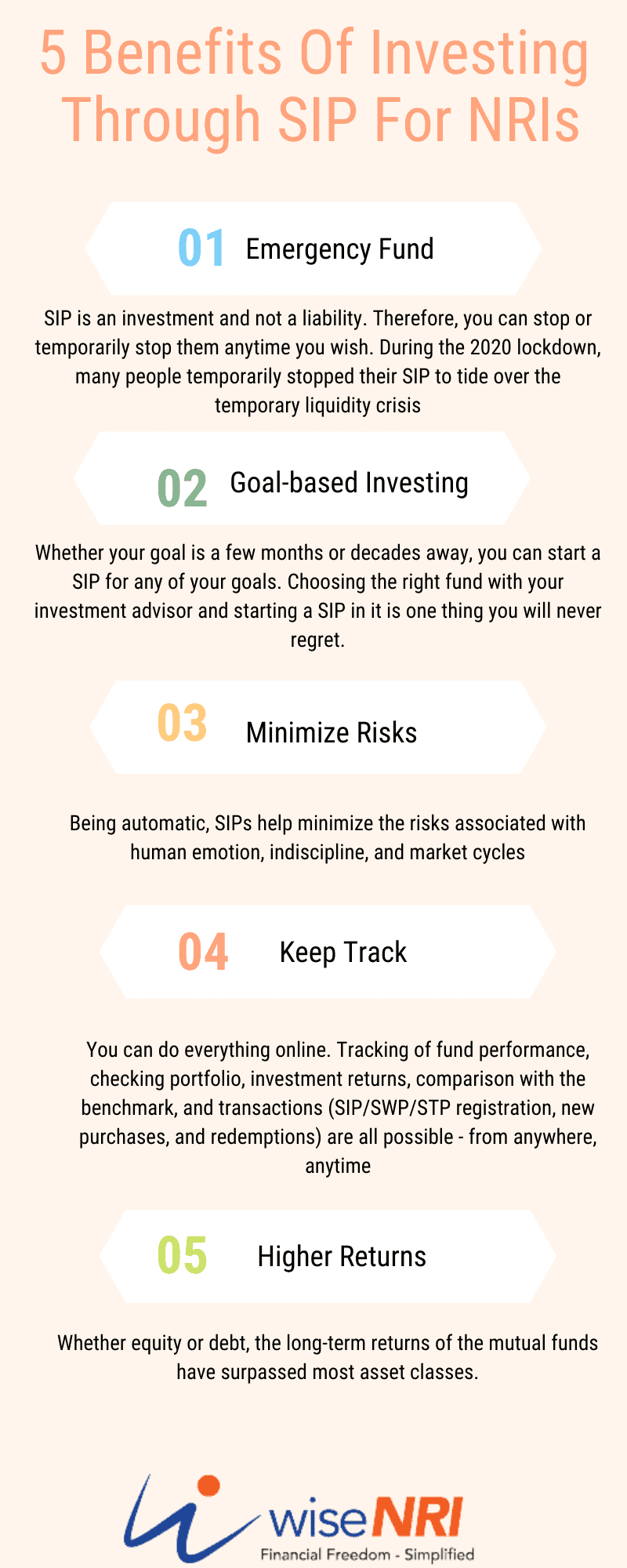

Goal-based Investing

Whether your goal is a few months or decades away, you can start a SIP for any of your goals. Choosing the right fund for your investment in SIP in it is one thing you will never regret.

Minimize Risks

Being automatic, SIPs help minimize the risks associated with human emotion, indiscipline, and market cycles.

Rupee Cost Averaging

The NAV moves in tandem with the prices of underlying securities. As a result, you get fewer units during bull runs and get allocated more units during corrections. You benefit from sustained bull or bear phases of the market as a SIP reduces your average cost of investment.

Keep Track

You can do everything online. Tracking of fund performance, checking portfolio, investment returns, comparison with the benchmark, and transactions (SIP/SWP/STP registration, new purchases, and redemptions) are all possible – from anywhere, anytime.

Flexibility

Of Duration: The SIP duration can match your goals exactly – from a few days (in liquid funds) to decades. Even if there are no new investments, it is not necessary to redeem the units and you can let your investment grow.

Of Fund House: You have the choice to choose from 44 fund houses registered with SEBI.

Of Scheme: The fund houses offer more than 2,500 funds across 36 categories as per the SEBI classification.

Of Investment: You can start investing with a minimum investment of Rs. 500 and a monthly investment of Rs. 100. Though these sums are not going to grow much even in long run, they are the best way to start teaching your children while they are in school/college.

Must Read- NRI Investment Options

Compounding

Investing and staying invested for the long term will help you realize the benefits of compounding. The study that we cited earlier, points to the fact that investors could not realize the benefits because they lacked discipline.

Emergency Fund

SIP is an investment and not a liability. Therefore, you can stop or temporarily stop them anytime you wish. During the 2020 lockdown, many people temporarily stopped their SIP to tide over the temporary liquidity crisis. Also, if you have not invested in a scheme with a defined lock-in period, then you can redeem your investment when in need.

Higher Returns

Whether equity or debt, the long-term returns of the mutual funds have surpassed most asset classes. (but with volatility)

Benefit from Top-up and Flexi SIP

The Top-up SIP and Flexi-SIP are facilities that offer you the benefit of increasing your investment at a predefined interval. You can time them with your annual appraisals or bonus.

| Type of SIP | Investment | Best suited for |

| Regular SIPs | Fixed | Investors with regular income |

| Top-up SIPs | Can be increased | Investors with regular income + regular hikes |

| Flexible SIPs | Can vary | Investors with inconsistent income |

Can NRIs Invest in India?

The good news is yes. You must comply with the Foreign Exchange Management Act (FEMA) rules. On top of this, no approval from RBI or any other body is required to invest in SIPs in India.

As an NRI, you can invest in any of the schemes offered by most MF houses. Though, due to additional FATCA compliance requirements, only 8 fund houses offer MF investments to NRIs from the USA and Canada. These are:

- Aditya Birla Sun Life MF

- DHFL Pramerica MF

- ICICI Prudential MF

- L&T MF

- PPFAS MF

- SBI MF

- Sundaram MF

- UTI MF

NRI investments can be made on either a repatriable basis or a non-repatriable basis.

Repatriable Investments

If you have used your NRE (Non-Resident External) or FCNR (Foreign Currency Non-Resident) account, then any investments and gains thereon are repatriable. It means, you can redeem your investments and transfer the proceeds to your account in your country of residence/citizenship.

Non-Repatriable Investments

If your investments were made from the funds available in the NRO (Non-Resident Ordinary) account, then the investment cannot be transferred to the country of residence. You can, however, transfer all the gains freely. You can transfer the principal only up to specified annual limits.

Check – How NRIs can complete KYC for NRI Mutual Fund

How Can NRI Invest in SIP Plans in India?

Here are simple steps How Can NRI Invest in SIP Plans in India?

1. Account Setup

Open an NRE or FCNR account if you do not already have an NRI bank account. If you have recently become an NRI or are about to become one, then your regular savings account can be converted into an NRO account.

The choice will depend on if you wish to invest your foreign earnings in India (NRE/FCNR) or Indian earnings (NRO) in the MF SIP.

2. Documents for KYC

The Mutual fund KYC procedure will need a handful of basic documents:

- Completed KYC form

- Passport

- PAN card

- Overseas address proof

- Indian address proof

- Recent photographs

- Bank statement

All the documents must be attested by either one of the following:

- Officials of overseas branches of banks registered with RBI

- Judicial or Notary officers of the country of residence

- Officials of the Indian Embassy/Consulates in the country of residence

3. In-Person Verification

In-Person Verification (IPV) is an essential step required by the SEBI. This can be done either by the Fund house, a KYC Registration Agency (KRA), or the AMFI certified distributors.

In recent years, and more so during the pandemic, the IPV is being carried out via live video chat. Aadhaar based one-time password is used for verification and recorded video call is used for authentication.

NOTE: if you are choosing the power-of-attorney route to invest, then first the PoA must be registered. Second, both you and your PoA-holder must fulfill the KYC and IPV requirements.

4. Finally, Invest

Once your KYC status is updated in the fund house records, you can start investing in any of their schemes. Depending on your needs you can either make different folios for multiple investments in the same fund house, or you can club all your investments under a single folio.

The website and mobile apps of all fund houses let you add your bank account and do the initial investment. It may take 2-3 working days to realize the funds and allot units. Once the first investment is done, you can go to the transaction page and set up a SIP Investment according to your needs and goals.

Redemption and Taxation

Like resident Indians, capital gain taxes are applicable on MF investments of NRIs. The fund house credit the redemption value (principal + gains) to your bank account after deducting applicable taxes, if any. Some banks also allow direct deposit of the proceeds to your NRO/NRE/FCNR accounts.

If your country of residence has signed a Double Tax Avoidance Agreement (DTAA) with India, then you can take advantage. You can claim a tax refund when you file ITR in India.

Equity Funds

The holding period of each SIP decides the taxes applicable on the gains from equity funds. Short-term capital gains (for holding up to 12 months) attract 15% tax. While long-term capital gains attract 10% tax on gains exceeding Rs. 1-lakh/annum.

Debt Funds

Short-term capital gains on debt funds are taxed as per your income tax bracket. For long-term capital gains (for a holding period of more than 36 months), a tax rate of 20% with indexation benefit or 10% without indexation benefit is applicable.

If you have any questions on Mutual Funds or SIP for NRIs – add them to the comment section.

Which FUND Houses can accept from NRI in Canada? I have just taken Canadian nationality.

as an NRI is it wise to invest in MF-SIPs through a NRO account or an NRE account

is sip taxable

I would like to the specific fund names in which a NRI can invest in. Among the 8 fund houses there is a host of funds available but only a few are open to NRIs. I want the list of the few

If I invest in SIPs, do I have to pay taxes annually even thought I do not sell

As an NRE, if you invest in SIPs (MFs), do I have to pay taxes on any capital gains annually even if I do not sell. If so, if there are losses can that be offset from gains ?