Are you an NRI looking for effective tax planning strategies? Are you unsure about your tax obligations in India? We’ve got you covered! In this post, we will share five simple yet powerful tax planning tips specifically tailored for NRIs.

Whether you are wondering about NRI taxes in India, tax planning for NRIs, or whether you should pay tax in India as an NRI, this guide will provide you with valuable insights and practical advice. Let’s dive in and explore the world of NRI taxation and tax planning together!

NRI tax planning

As a Non-Resident Indian (NRI), you are subject to taxation laws applicable in India.

There are a few advantages and many disadvantages of the taxes policy for NRIs. But you can make the best use of these tax strategies for NRIs

Advantages of Tax Planning for NRIs

- Interest earned in NRE savings accounts and FCNR accounts is taxes-free.

- Taxes on capital gains earned from the sale of house property is exempt if the gains are invested in a house property or capital gains bonds within a certain timeframe.

- NRIs are taxed only 20% on income received on certain investments such as shares in an Indian company, deposits in banks and public companies, and central government assets and securities. If this is the only income earned, the NRI is not required to file IT returns.

Disadvantages Tax Planning for NRIs

- As a senior citizen NRI, you will not get the higher exemption limit enjoyed by senior citizens who are residents. If your income in India exceeds Rs. 2,50,000, you have to pay taxes.

- Rental income is subject to 30% TDS.

- Long-term capital gains on the selling of house property attract 20% TDS.

It is important to strategize our financial planning and tax planning for NRI so that we pay the right amount of tax.

Must Read – NRI TDS in India

Detailed Post – NRI Mutual Fund Taxation

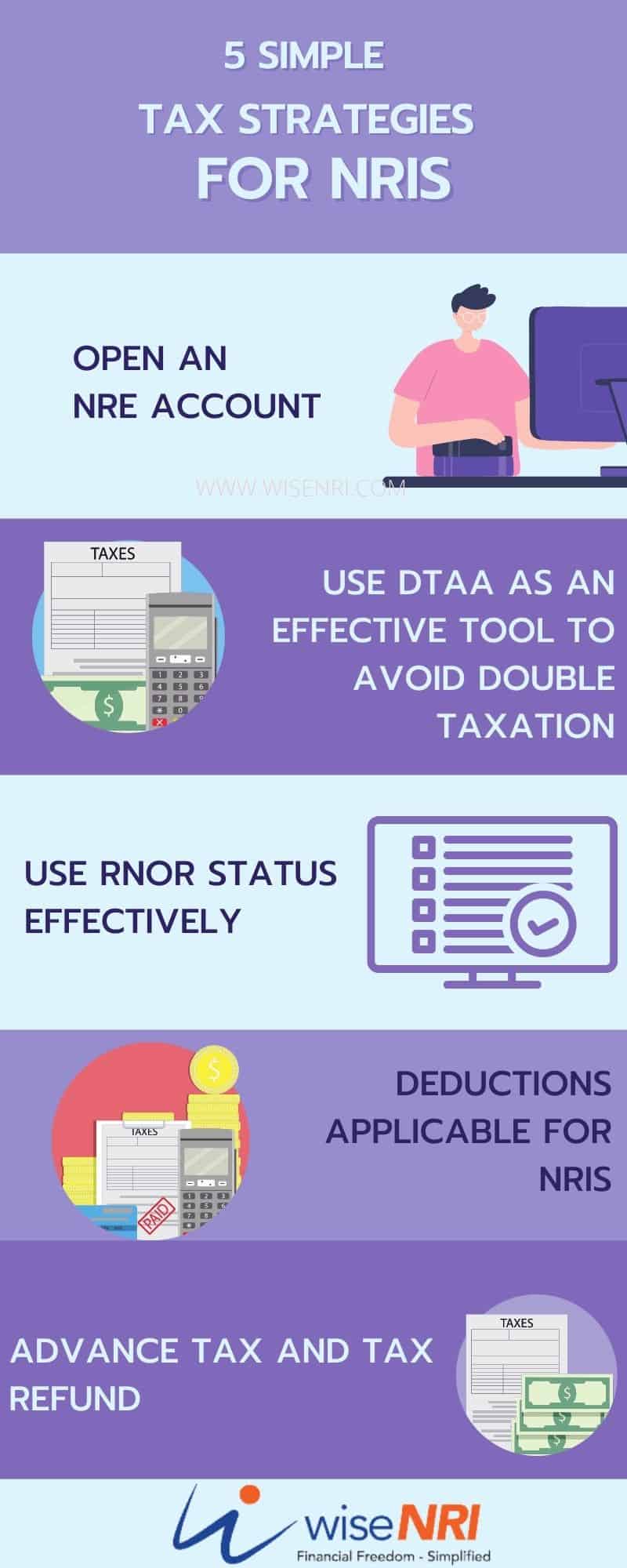

5 Tax Strategies NRIs Should consider

1) Open an NRE Account

An NRE account can be saving, fixed, or recurring deposit account. The principal and interest amounts are exempt from tax in India.

You can also repatriate principal and interest components from India to your country of residence without any tax liability. All popular banks in India offer NRE account services.

Must Read – How can NRI save tax in India

2) Use DTAA as an effective tool to avoid double taxation

Nobody likes to pay taxes twice on one income source. Therefore India has signed a treaty called the Double Tax Avoidance Agreement (DTAA) with many countries. Individuals can use the provisions of this agreement to avoid double taxation. You can claim relief from double taxation in three ways –

- The exemption method follows the TDS method. You are taxed in one country and exempted from taxes in the other.

- The deduction method ensures that taxes are paid in the country where income is earned and is subtracted from the total global income. Then tax in the other country is calculated on the difference between income earned and tax already paid in one country.

- The tax credit method provides relief up to the extent of taxes paid in one country.

“DTAA Application Form – Form 10F should be obtained from the income tax department and verified by the government of the country where you reside.” wiseNRI

Also, Check – What is TRC? (Tax Residency Certificate)

3) Use RNOR status effectively

If you have just returned to India, you can make use of the Resident but Not Ordinarily Resident (RNOR) status.

A person with the ‘RNOR’ status will have to pay tax only on income received or accrued in India. Income earned abroad will not be taxed in India. Withdrawals from accounts abroad, rent received abroad and capital gains earned abroad will be tax-free in India. The RNOR status can be used to your advantage for three financial years from the date you returned to India.

4) Deductions applicable for NRIs

Most deductions allowed for residents are allowed for NRIs with respect to taxes calculation. So you can get the deduction for the following –

- Interest paid on home loan for home and loan in India.

- Premium paid for health insurance of self, spouse, children, and parents

- Interest paid on education loans

- Donations under Section 80G

- Interest income on NRO savings bank accounts up to a maximum of Rs. 10,000

Use these deductions wisely to optimize your taxes paid.

For example, if you know you are going to return to India and want to own and live in your own house, you should consider buying one using a home loan. If you have dependent parents in India, you should buy health insurance for them.

Check – All about FCNR Deposit for NRI

5) Advance Tax and Tax Refund

As an NRI, you are also liable to pay advance taxes. If your tax liability in a financial year exceeds Rs 10,000, you have to pay advance taxes. If you have missed paying it, you will have to pay interest. Advance tax can be paid on or before 15th June, 15th Sept, 15th Dec, and 15th March.

Similarly, you are entitled to a refund in case you have paid excess tax. The excess tax is automatically refunded to you provided you have filed your IT return and verified your IT return within the given deadlines for the financial year.

Check – NRI Gift Tax

You have to be careful while managing your taxes. As an NRI, you have to manage taxes in more than one country. This takes effort, time, and knowledge of tax regulations.

You may take the help of a financial planner or tax advisor if you are not comfortable managing it on your own. Once you are confident, you may even opt to do it yourself.

Please add your tax strategies for NRI which can be useful for other NRIs. Also, feel free to add your questions in the comment section.

Do you help with US tax filing for NRI on visa?

Hey Damini,

No, We don’t.

If i have 3 savings accounts in India, do i need to convert each of them to nre or nro account?

Hey Jaysingh,

If you have multiple savings accounts in India, you don’t necessarily need to convert each one to an NRE (Non-Resident External) or NRO (Non-Resident Ordinary) account if you’re an NRI. You can maintain the existing savings accounts but should consider consolidating or converting them to NRO accounts to comply with RBI regulations and avoid any non-compliance issues while staying abroad.

NRI returned to India this year. Need tax based advice on assets.

I want help to file taxes in india and then open nro and nee account to transfer money to canada

Hello Sumit ,

Determine your tax residency status in India based on the number of days you have stayed in the country during the financial year. Obtain the necessary tax forms, such as Form ITR-2, from the Income Tax Department’s official website. Once taxes are filed, open an NRO (Non-Resident Ordinary) and NRE (Non-Resident External) bank account in India. These accounts allow you to transfer money to Canada and hold Indian and foreign currency respectively. Contact an Indian bank to initiate the account opening process and provide the necessary documentation.

Are endowment policies payouts taxable in NRE account?

Hello Vishnu

Endowment policies payouts received by an NRI in their NRE account are generally not taxable in India. This is because an NRE account is a tax-free account, and any income earned or received in an NRE account, including endowment policy payouts, is exempt from tax in India.

Tynan you Hemraj. But this has changed for any new policies issued after March 31, 2023. Hence the question.

I have been living in UAE for last 44 years and have been holding NRI status since then. I have now retired and planning to live with my children in Canada on Canadian visit visa. If I live more than 182 days in Canada and balance number of days in India during a financial year, can I hold my NRI status. Thanks

Hi Saranjit,

Yes, you can the NRI Status.

Are you a auditing /tax firm based in Chennai Tamil nadu ?

Hi Kanika,

No.

Hi Team,

I found your site very useful. It has answered most of my queries. However, I have few queries as below:

1. As an NRI from UK, if I invest in indian share market ( equity) through NRE/NRO demat account, then which country is it that I need to pay tax? India, UK or Both?

2. Which will be best broker for me to open demat account? Zerodha or Angel?

3. Which demat account will be best for investing in Indian Share market (equity)? NRE or NRO?

4. Can NRI open 2 demat account? Is it possible? If yes, then should the broker( zerodha or Angel) be same or different?

Thanks in advance.

Eagerly waiting for your reply

Hi Dipika,

You are liable to pay tax in India.

You can have as many as Demat accounts as you want.

An NRI needs a PIS account from a Bank, and a trading account with a broker. The NRI can have a trading account for the NRE account as well as for the NRO account. As of April 2023, IndusInd Bank offers zero charges on trades made through their PIS account, and ProStocks offers zero charges on trades made through on their trading account. Both IndusInd and ProStocks do however charge a small annual fees. The NRI can open multiple such accounts, if wished. Source: my research as an NRI in April 2023, as I am also looking into opening such accounts.

As an NRI from uk, if I invest in Indian share market equity and mutual funds through my NRE /NRO account, then where should I need to show and pay the tax? UK, India or both. Also which account is best for investment purpose NRE or NRO? How much will b taxable amount?

I am NRI from Uk. If I invest in Indian Share market equity and mutual funds, then where is it that I need to show and pay tax? Uk, India or both? Also what will b the taxable amount?

Hi Dipika,

If you invest in Indian equities and mutual funds, you have to show the income generated from this in your annual tax filing.

Hi Aditi, Thanks for your reply. Need clarification will it be India or Uk?

I am NRI from USA. My parents want to send me 50K USD as gift from India. What are the applicable taxes for my parents in India and also for me here in the USA?

Hi Sreekanth,

There will be no tax liability for your parents and for you, you can consult a tax advisor in the US.

Hi Hemant,

Quite a useful site that clarifies many issues.

How are NRE FDs dealt for Returning Indians, when the return happens before the maturity of an FD (NRE)? In your article on “Status of NRE FD after return to India” it was stated “They can be continued in the same state till maturity whether you return to India or not during the FD tenure.”.

If I understood it right, this means that when the individual returns say after three years of opening the 5 year FD (NRE), the FD will continue to with interest rates as applicable to the FD (NRE) and no tax will apply (on principal as well as interest) till its maturity (i.e for another 2 years in this example). Upon maturity, if the individual continues to be a Resident Indian, then he will be taxed as per IT rules applicable to Resident Indians.

Please confirm my understanding. Thank you in advance.

Thanks Venkatram for appreciating our efforts 🙂

NRE FD can be continued but interest will be taxed from the day you arrive in India. Check https://www.wisenri.com/nre-fd-after-return-to-india/

Thank you Hemant. That’s helpful.

As a NRI can I transfer money to my wife’s NRE or NRO account when is a housewife and can she use those funds to buy a flat in India? Any tax implications?

Hi Jyoti,

Yes you can transfer the money.

Hi

If an NRI having interest income on NRO Fixed deposits exceeds 250000 in a year, He is required to file ITR. Which ITR Form he should use and is it compulsory to show his NRE income also in ITR?

Hi Suresh,

He has to file ITR & he doesn’t need to show his NRE incomein ITR. for ITR form he should consult with CA.

If a parmanent resident card holder frequentlly resided in India and in

foreign countries, some time 180days in a financial year some time less than 180days. And more than 360days in India in last 4 yers.

1.How will be treated his residential status.

2. He is reuired to change status of his bank accounts every now and than he resides in India and abroad.

I want to know about the tax implications after returning back to INDIA from the USA. Like, what happens to my investments in the USA. Will I have to pay double tax in both INDIA and USA. Is there any way, that I can withdraw my money from the USA into India over a period of certain years without having to pay double tax?

Hi Kireet,

You don’t need to pay tax in india for your investments in USA. To avoid double taxation on your investments you should consult with your CA.

If i am going to recieve income in November, do i still need to pay advance tax for that income in June and September?

Hi Pranav,

Sorry I am not able to understand your question.

I am an NRI holding some shares. Who is required to deduct TDS on sale of my shares?

Hi Shay,

No one will TDS on share sale – you can calculate & pay tax while filing ITR.

I didn’t file ITR this time as I have become an NRI and my net earnings from sources in India doesn’t cross the taxable threshold but now I regularly receive mails from IT office that “we have missed you this time. you have been the regular tax payer, etc. “. Do i need to file NIL ITR still ? Also, I think NRI need to fill ITR-2 form which has only “upload xml” option in IT website which is complex to me. Need advice. Thank you.

Hi Nimesh,

These look general emails from the tax department so you can ignore them.

I am not sure about the second part.

I have RNOR status and I have NRE FDR . do I need to to show the interest accrued in FDR account for payment of advance tax.

Hi Janak,

Even in the case of RNOR you have to pay tax on (NRE) FD interest.