What do you dream of when you think of your retirement? Basking on an exotic beach or living in a palatial home? Or do you want to be back to your roots and run the social venture you have wanted to do for some time now?

While each person’s dream could be different, a common factor is to prepare yourself financially for retirement. It is more so in the case of NRIs. Apart from the usual steps to be taken and factors to be considered, you have to account for currency fluctuations, taxation on retirement savings in multiple countries, investments allowed, etc.

While money may not be the most critical factor for everyone to have a fulfilling life, it is essential to build a retirement corpus so that you can fund the lifestyle that you wish to have.

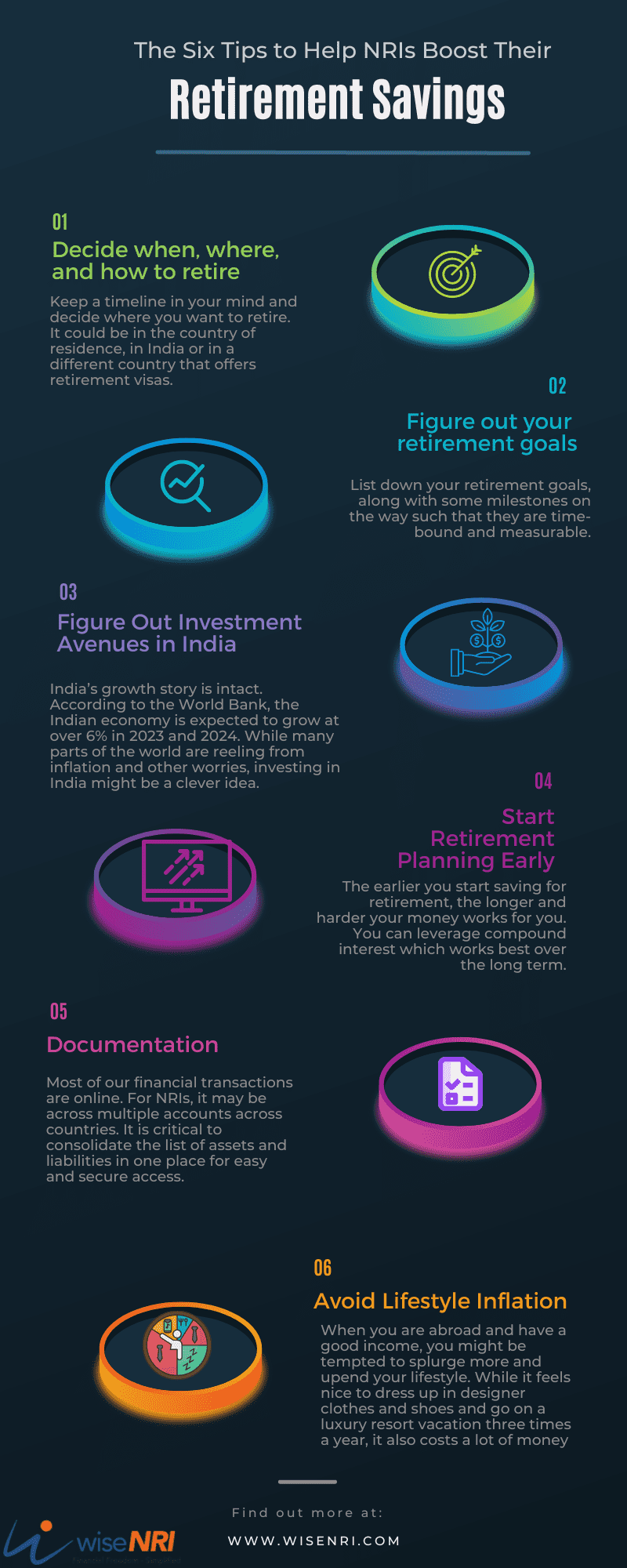

We share some tips on how NRIs can boost their retirement savings.

Decide When, Where, and How to Retire –

When living in a foreign country, your residency may depend on factors not always in your control. It is critical to prepare for your retirement rather than make a last-minute decision or be forced to make a less optimal decision. Keep a timeline in your mind and decide where you want to retire. It could be in the country of residence, in India, or in a different country that offers retirement visas. These decisions will help you estimate your retirement corpus better. Check – Best places to retire in India

Figure Out Your Retirement Goals

List down your retirement goals, along with some milestones on the way such that they are time-bound and measurable. For example – The retirement goal could be living in your own two-story house in your hometown by 2035. Some benchmarks could be accumulating 50% of the amount for the purchase of land by 2026 and the rest by 2030. You will better understand why you are saving and investing and feel a sense of satisfaction when you attain the milestones. It will also help make realistic changes to your plan if required.

Must Read – How much retirement corpus is enough for retirement

Avoid Lifestyle Inflation

When you are abroad and have a good income, you might be tempted to splurge more and upend your lifestyle or lifestyle inflation. While it feels nice to dress up in designer clothes and shoes and go on a luxury resort vacation three times a year, it also costs a lot of money. So, when you get a raise, celebrate by adding to your investment or paying off some of the car loans. In this manner, you will be taking care of your future self.

Figure Out Investment Avenues in India –

India’s growth story is intact. According to the World Bank, the Indian economy is expected to grow at over 6% in 2023 and 2024. While many parts of the world are reeling from inflation and other worries, investing in India might be a clever idea. There are various investment avenues in India (link to NRI investment options), and you can create an investment portfolio based on your financial capacity and risk profile.

Start Retirement Planning Early

In your 20s, you might feel retirement is a long way ahead. But with inflation, increasing responsibilities, and unexpected events (e.g., COVID-19, business downturn), it is not prudent to put off retirement planning for later. The earlier you start saving for retirement, the longer and harder your money works for you. You can leverage compound interest which works best over the long term. Check – FIRE strategy for NRIs

Documentation

Most of our financial transactions are online. For NRIs, it may be across multiple accounts across countries. It is critical to consolidate the list of assets and liabilities in one place for easy and secure access. It has to be updated regularly as well. Tax documentation should also be saved such that it can be easily referenced. Ensure that a loved one has access or can get access to the relevant information in case of unfortunate events like disability or death.

Bonus – Use apps and tools to help track expenses and plan for retirement

Using apps and tools to track expenses and plan for retirement can be a great way for Non-Resident Indians (NRIs) to stay on top of their finances. These tools can help NRIs gain a better understanding of their spending habits, identify areas where they can cut back, and create a budget that allows them to save more for retirement.

One popular app for tracking expenses is a budgeting app, which allows users to connect all of their bank and credit card accounts, and then categorizes their spending into different categories such as housing, transportation, and entertainment. This can help NRIs see exactly where their money is going and identify areas where they can cut back.

Must Check – Top 7 Financial Tools that NRIs must use

Retirement planning for NRIs may be a little more complex than for residents, but it is manageable. If you are short of time or skeptical of creating your own plan, we can help you.

You have to plan carefully to maintain a well-balanced investment portfolio that can fund the post-retirement life you desire. You have the opportunity to have a higher quality of life if you ensure that your money works harder for you over the long term.

I am returning to India and would like to know what to do with End of Service Benefitsv money.. I am leaving on 2nd Aug