NRIs moving to a foreign country and establishing a new life there can be difficult, emotionally overwhelming, and tedious at times. Especially if you are approaching retirement – and plan to retire back home – financial inconsistencies should be the last thing on your mind; therefore, your finances must be organized as well.

Approximately, 1.76 million Indians live in the UK alone and form the largest ethnicity after the whites. Among them, close to 43% were born there – close to 3.5 lakhs are NRIs. In the greater European region – including Germany, Mainland France, Italy, Spain, Belgium, Denmark, and Sweden – the number reaches close to 4.08 lakhs.

NRIs often wonder if it would be better to invest in India or their country of residence. As with NRIs around the world, the UK and Europe-based NRIs also seek clarity regarding investment options in India.

Must Check – 10 Best NRI Investment Options in India

Why do UK and Europe Based NRIs Invest In India?

We have discussed many times before why NRIs – residing anywhere in the world – must consider India as a serious destination for their investments.

Whether it is their businesses, startups, or personal investments, India offers the most potential for growth and long-term opportunities among all the major economies in the world.

Here is a quick recap of Why NRIs in Great Britain and Europe Must Plan To Invest in India?, especially in Germany, France, Denmark, Belgium, Italy, and Spain.

1. Falling Rupee Value

A falling rupee allows an NRI investing in India to get greater returns in Pound, Euro, or Dollar terms as compared to INR returns. Good quality assets become more affordable for you in your local currency as you would be able to buy more with the same number of Pounds or Euros.

2. Diversify

We have always been a proponent of diversification as a risk mitigation strategy and one of the key factors of diversification is geographical diversification. By earning in Great Britain, Germany, Denmark, Belgium, Spain, Italy, or France you are already invested in those economies.

You are also required to invest a large part of your earnings in the social security schemes of those countries as mandated by their tax laws. Therefore, India is a natural and attractive alternative for you to invest your surplus funds.

3. Booming Market

In the FY 2021-22 India emerged as the fastest-growing major economy after the pandemic shook the world economies. Despite the raging global inflation, India is still considered to be the best bet for the world’s growth. In the World Banks, latest economic outlook, South Asia, led by India is projected to grow at 6.8% while most of Europe, including England, is expected to shrink by 2.9 percent!

4. Retirement Planning

By investing in India, you will be able to invest adequately to fund the purchase of your retirement home and create a nest egg to help you live comfortably. The returns in India would be more aligned with the requirement in India. Moreover, it would be a hassle-free experience to use Indian investments rather than liquidating your foreign investments. Check – How much Retirement Corpus is enough for NRIs

Must Check – Why Investing In India A Great Option For NRIs

5. Simple Tax and Investment Regime

The tax regime in India has remained conducive to attracting NRI remittances. They enjoy as many benefits as any ordinary resident Indian (RI) when it comes to taxation.

6. Easy Investment Journeys

Tech adoption by the Indian financial services sector have made it among the most advanced ones in the world. The investment journeys of investors have become seamless, and smooth, and can be covered in just a few minutes.

7. Helping Family and Society

When you invest in India, you not only help your immediate family but the extended family of 1.4 billion Indians. Every Pound or Euro that you invest in India is used for the upliftment of the weakest sections of society in a virtuous cycle of demand and growth.

A Quick Guide for UK and Europe-Based NRIs Invest In India

NRIs from UK and Europe must obtain a PAN from the Indian tax authorities and undergo KYC before investing.

The KYC process for different market segments comes under the purview of different regulators – banking is under the RBI, financial securities are under the SEBI, and the National Pension Scheme is regulated by the PFRDA. Therefore, the KYC process, which is almost identical for each of them, would be done separately by their approved KYC agencies.

Luckily, the KYC process for all three sectors is now available online and can be easily done via mobile or desktops using live video streaming.

You must first open an NRI savings bank account – NRO, NRE, or FCNR – to start investing in India. At the time of account opening your banking KYC would be completed. You can then use this account to start investing in the Indian markets – be it stocks or real estate, debt, or pension products.

Must check – 6 Common NRI Investment Mistakes while Investing in India

Different types of NRI bank accounts

1. NRO – Non-Resident Ordinary Account

You can open an NRO bank account after becoming an NRI or just before your status is going to change from RI to that of NRI. If you have a savings bank account with any Indian bank, then that account is designated as an NRO account.

Your NRO account is used to receive any income from your Indian sources – such as profits, dividends, sale proceeds, interest, salary/pension, and gifts. You can also convert your foreign exchange into INR at prevailing rates and deposit them into this account. NRO accounts can be held jointly with other NRIs or with resident Indians (close relatives).

There is one limitation with an NRO account – there is an upper cap on the repatriation of the funds that can be transferred to your foreign account. This limit is set by the RBI and is currently at USD 1 million for the current income from the current financial year. You must also produce a tax-paid certificate from a certified CA.

2. NRE – Non-Resident External Account

As an NRI, you may want to invest and then repatriate your income from a foreign country. For this, an NRE account is the best option. An NRE account can be opened as a savings, current, fixed, or recurring deposit account.

The amount deposited in the NRE account is fully repatriable but the account is maintained in INR. It means whatever amount you deposit in GBP or EUR, will be converted into INR at prevailing rates. You cannot, however, deposit any income originating in India into your NRE accounts.

The account holder may withdraw funds at any time from India without restriction. There is no upper limit on the number of transactions either. Also, the interest earned on NRE accounts is tax-free in India but is r=taxable in your country of residence at marginal rates.

3. FCNR – Foreign Currency Non-Resident Account

If you wish to open a bank account in India but wish to hold it in the foreign currency of your choice, then you need an FCNR account. You can open this account once you have become an NRI. In India, only six foreign currencies are allowed for opening FCNR accounts including USD, CAD, AUD, EUR, YEN, and GBP. It means, that NRIs living in Great Britain and mainland Europe can easily open FCNR accounts.

FCNR accounts can also be opened as fixed or recurring deposit accounts. The interest income on these is not taxable in India but your country of residence. You cannot open a savings or a current account in a foreign currency denomination.

The sum in these accounts is also fully repatriable there is an upper limit on the amount.

Check – Qrops & UK Pension for NRIs

How Can NRIs in Britain and Europe Plan Investments in India?

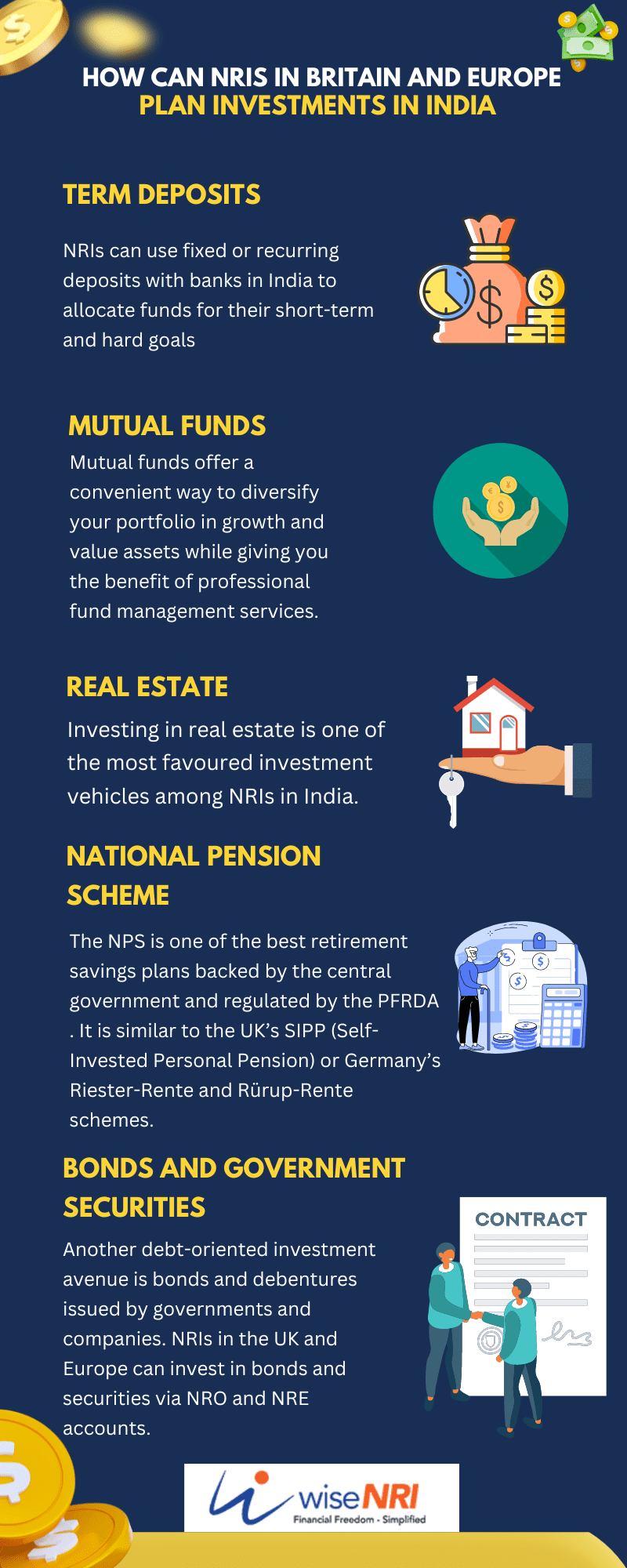

1. Term Deposits

NRIs can use fixed or recurring deposits with banks in India to allocate funds for their short-term and hard goals. These goals generally cannot be compromised at all in terms of amount, duration, and time. NRIs from UK and Europe can make deposits in an NRO, NRE, or FCNR account. The interest on an NRO deposit is taxable in India, while that from NRE and FCNR accounts is not.

2. Mutual Funds

Mutual funds offer a convenient way to diversify your portfolio in growth and value assets while giving you the benefit of professional fund management services. As mutual funds invest in marketable securities – like stocks, gold bonds, sovereign bonds, and corporate NCDs – they are more volatile in returns as compared to fixed deposits.

There are two main categories of mutual funds, and they are taxed differently.

Debt Funds

If a fund’s 35% or more AUM (Assets Under Management) are invested in equity, then they are classified as debt MFs. They are most suited to meet immediate fund parking needs to short-term (under 2 to 4 years) needs of investors and are directly linked to the bonds market of the country.

Depending on the rate cycle, the debt MFs can give returns comparable or superior to bank deposits with indexation gains. If you hold and sell a Debt MF before 36 months, then it is subject to short-term capital gains (STCG) tax, otherwise, the gain is subject to long-term capital gains (LTCG) tax.

Equity Funds

Mutual funds with 65% or more of the AUM invested in stocks are considered equity funds and provide you the booster to grow your wealth. Since 2018, equity and equity MFs also attract LTCG if they are sold after 12 months of holding at 10% for gains over Rs. 1-lakh. If you sell the investment within the first year, you will be taxed at 15% for STCGs.

Must Read – NRE vs NRO Accounts

3. Real Estate

Investing in real estate is one of the most favoured investment vehicles among NRIs in India. With their Pounds and Euros, they invest in residential properties, agricultural land (through their relatives), and increasingly in commercial real estate. At a proper location, it is a good long-term investment giving constant growth. Most NRIs buy property in India for renting out.

4. National Pension Scheme

The NPS is one of the best retirement savings plans backed by the central government and regulated by the PFRDA (Pension Funds Regulatory and Development Authority). It is similar to the UK’s SIPP (Self-Invested Personal Pension) or Germany’s Riester-Rente and Rürup-Rente schemes.

NRIs with Indian citizenship aged 18-60 can invest in NPS through their NRE or NRO accounts. The capital gains are not taxed but payout from the NPS are taxed – pensions at marginal rates, and lumpsum after a limit.

5. Bonds and Government Securities

Another debt-oriented investment avenue is bonds and debentures issued by governments and companies. NRIs in the UK and Europe can invest in bonds and securities via NRO and NRE accounts.

Bonds fall into three main categories:

PSU Bonds

The Public Sector Undertakings issue bonds of a fixed maturity date. With the backing of the central or the state governments, they enjoy the sovereign rating as that of the Government of India or the state government issuing them and are considered one of the safest instruments.

Non-Convertible Debentures (NCD)

Companies looking to raise funds to form the public can do it either by diluting their equity or by asking them to lend money. As the name suggests, these debentures cannot be converted into equity later and are mostly secured by the company’s assets. NCDs from reputed companies are a good source of steady income at a moderate to low risk level.

Perpetual Bonds

Since these bonds are perpetual, there is no maturity date by which they are repaid. The issuing company, however, promises to pay a fixed amount of returns annually to the holder. These bonds are tradable in the bond markets and the investor can get out of them by selling them to others.

Conclusion

Based on the goals, risk appetite, income, and family settings, NRIs living in the United Kingdom or European countries like Denmark, Belgium, Germany, Spain, and France can start investing in India. To understand the lay of the land, and complete all formalities, they can hire a personal financial advisor who can fairly answer these questions as well as offer services.

Financial planning is a personal emotional journey that one needs to cover on their own. As financial planners, we can act as a navigator and a companion, but you are always in the driver’s seat.

I want to know how can i participate in indian stock market from gemany? I am an indian citizen with nri status

If i generated income by mutual fund as long term capital gain . How can i pay tax in uk as capital gain or other income?

Senior citizens/pensioners are exempt from incometax on the interest on their deposits in the banks in India upto Rs.40000 or so in one year but if he is an NRI residing abroad or is not a resident citizen, the exemption on interest income is limited to Rs.10000 or so per year. There are some more additional payments in regard to incometax for NRIs or pensioners. I think the incometax payable should be at the same rate for Indians and NRIs.for their income in India.