As digital finance continues to grow, being informed will empower NRIs to navigate Indian banking with confidence and ease. UPI is India’s gift to the world, a remarkable innovation that’s reshaping global financial transactions and showcasing India’s fintech power. People worldwide are recognizing and appreciating India’s fintech growth.

Though it may have come a bit late, UPI for NRIs is now fully functional, making life easier and more convenient for NRIs by enabling seamless, instant payments and enhancing their connection to India.

Check – Best Bank Account for NRIs

UPI for NRIs

The Unified Payments Interface (UPI) is an instant payment system developed by National Payments Corporation of India (NPCI). It lets you make bank account-to-account transfers instantly with a single identifier (ID) which is the ‘Virtual Payment address’. By installing a UPI app on your mobile device, you can send money anytime, from anywhere.

UPI is versatile, supporting payments for utilities, in-store transactions, and more. While NPCI offers the BHIM app as a default UPI platform, several other apps like Google Pay, PhonePe, and Amazon Pay, along with bank-specific apps from institutions like ICICI and Deutsche Bank India, also provide UPI services.

Benefits for NRIs Using UPI

- Ease of Payments in India: NRIs can pay directly at local merchants or use UPI for online shopping and other transactions without needing a local bank account.

- Elimination of Currency Conversion Hassles: NRIs can hold funds in INR (Indian Rupees) and avoid fluctuating conversion rates when making everyday payments in India.

- Reduced Transaction Fees: Using UPI can often be more cost-effective than using international credit cards, which can involve higher fees and foreign exchange rates.

Connecting international numbers to UPI

Non-resident Indians holding an NRO/NRE account with an Indian bank and having a valid domestic (India) mobile number linked to the account can avail of UPI facilities. NRIs from select countries can also use UPI to make INR transactions using their international mobile numbers linked to NRE or NRO accounts. NRIs with mobile numbers from the countries — Singapore, Malaysia, Hong Kong, Australia, Canada, the United States of America, France, the United Kingdom, Oman, Qatar, Saudi Arabia, and the United Arab Emirates can use UPI without an Indian mobile number.

While most banks support UPI payments from NRO/NRE bank accounts that have an Indian mobile number associated with them, only some banks and apps currently allow international mobile numbers for UPI usage.

Banks that support the linking of international mobile numbers for UPI payments include:

| Sr. No. | Bank Name |

| 1 | AU Small Finance Bank |

| 2 | Axis Bank |

| 3 | Canara Bank |

| 4 | City Union Bank |

| 5 | DBS Bank Ltd |

| 6 | Equitas Small Finance Bank |

| 7 | Federal Bank |

| 8 | HDFC Bank |

| 9 | ICICI Bank |

| 10 | IDFC First Bank |

| 11 | IndusInd Bank |

| 12 | Punjab National Bank |

| 13 | South Indian Bank |

UPI apps that support linkage of international mobile numbers are:

| SR. No. | UPI App Name |

| 1 | Federal Bank (FedMobile) |

| 2 | ICICI Bank (iMobile) |

| 3 | IndusInd Bank (BHIM Indus Pay) |

| 4 | South Indian Bank (SIB Mirror+) |

| 5 | AU Small Finance Bank (BHIM AU) |

| 6 | BHIM |

| 7 | PhonePe |

The reviews on the apps that support international numbers are mixed. Many users complain of errors, frequent marketing pop-ups, and OTP issues. As this is a relatively new feature, it might take some time to stabilize and match the seamless experience of UPI transactions with Indian mobile numbers.

Read – NRE Vs NRO Accounts

Security Measures

- Two-Factor Authentication: UPI requires both device binding and mobile number verification, making it secure.

- Transaction Alerts and Limits: Banks often alert users of any high-value transaction, and NRIs can set up additional SMS/email notifications to stay informed.

- Enhanced Security Features on Apps: Most UPI apps provide features like PIN protection, biometric authentication, and periodic re-verification.

UPI transaction guidelines for NRIs

- With UPI, you can make payments up to ₹ 1,00,000 from NRO/NRE accounts if you have funds in your account.

- If a person is making a payment towards educational or medical service verified or registered with NPCI, then the UPI transfer limit is up to ₹ 5,00,000.

- Payments can be made to local merchants in India, Indian mobile numbers that have UPI enabled and Indian bank accounts.

- NRIs can link only one bank account to one UPI ID.

- Transfers to other NRO, Resident accounts are allowed from NRO accounts.

- Credits from other NRO/NRE accounts are allowed for NRO accounts. However, credits from Resident accounts are not permitted.

- Transfers to other NRO, NRE and Resident accounts are permitted from NRE accounts, but credits to NRE accounts are disallowed.

Must Read – Investment options for NRIs

FAQs – UPI for NRIs

With an increasing number of Non-Resident Indians (NRIs) taking an interest in Indian financial services, understanding how UPI functions for NRIs is essential. Below are five frequently asked questions (FAQs) that address common queries and clarify the intricacies of using UPI as an NRI.

1. What is UPI, and how does it work for NRIs?

UPI, or Unified Payments Interface, is a real-time payment system developed by the National Payments Corporation of India (NPCI), allowing instantaneous transfer of money between bank accounts through mobile devices. For NRIs, UPI functions similarly to how it works for residents, enabling them to send and receive money, pay bills, and make purchases. However, NRIs must link their NRI bank account with an Indian mobile number and UPI-enabled app to start using UPI services.

2. Can NRIs use UPI for transactions in India?

Yes, NRIs can utilize UPI for transactions in India. However, it’s important to note that NRIs can only use their NRE (Non-Resident External) or NRO (Non-Resident Ordinary) accounts to fund UPI transactions. This enables NRIs to easily make payments for various services such as utilities, school fees, or even e-commerce purchases while seamlessly managing their finances between countries.

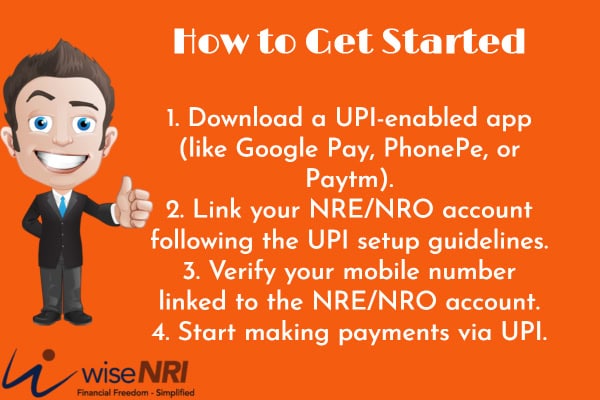

3. What are the requirements for NRIs to register for UPI?

To register for UPI, NRIs must fulfill certain requirements:

– An Indian Mobile Number: NRIs need a valid Indian mobile number linked to their NRI bank account. (many banks now allow international numbers)

– Bank Account: An NRE or NRO account with a bank that supports UPI services is mandatory.

– UPI-enabled App: NRIs must download any UPI-supported payment app, such as Google Pay, PhonePe, or Paytm, and link their bank account to access UPI functionalities.

4. Are there any restrictions or limitations on UPI transactions for NRIs?

Yes, there are certain restrictions that NRIs should be aware of. Transactions via UPI for NRIs are generally subject to limits imposed by banks and regulatory authorities, including daily transaction limits of Rs 1 Lakh and limitations on certain types of payments. Moreover, it is crucial for NRIs to stay updated on any regulatory changes that could affect their ability to use UPI services, as these policies can evolve.

5. How secure is UPI for NRIs, and what precautions should they take?

UPI is designed with a high level of security, using two-factor authentication and encryption to safeguard transactions. Nonetheless, NRIs should exercise caution and take additional measures to ensure the security of their financial information. This includes using strong passwords, enabling app-specific security features (like biometrics or PIN codes), and avoiding public Wi-Fi networks when making financial transactions. Regularly updating payment apps and monitoring bank statements for unauthorized transactions can further enhance security.

Check – Penalty of Not declaring NRI status

The ability to use UPI with international numbers offers NRIs a faster, more convenient alternative to traditional wire transfers for sending money to India. This feature not only reduces transaction costs but also eliminates the need to maintain an Indian mobile number for monetary transactions, making it easier for NRIs to manage their finances seamlessly from abroad.

In the rapidly evolving landscape of digital finance, the Unified Payments Interface (UPI) stands out as a groundbreaking innovation that has transformed payment systems in India. In case you have already started using UPI – please share your experience in the comment section.

Is Kenya phone number is allowed for UPI transactions?

I have freeze my NRE account in India but today by mistake I send 175 BHD money from Nafex to that account but how will I get my money back?

What is the UPI App for NRIs?

My brothers and I are NRIs. They would like to transfer all property, some agricultural, in my name. How do I go about doing this?

Does NRI send money with UPI to India from Saudi Arabia?