The Indian ex-pat community (i.e. Indians who live abroad or NRIs) is a very big one. They might be working abroad, studying in a foreign university, or running a business outside of India. Many Indians settle abroad post-retirement.

There have been some changes in the Income Tax Act for NRIs which have left many Non-Resident Indians somewhat confused that who is NRI? We attempt to explain the changes and their effects in this article.

Must Check – NRI Checklist

Who is NRI?

For this first, let us look at the definition of a resident as per the Foreign Exchange Management Act (FEMA) –

A person who resides in India for more than 182 days in the current financial year and

- does not work outside of India, does not conduct business outside of India nor remains outside India for an uncertain period for any other purpose.

- does not fulfill the condition that they stay in India or have come to India for employment, business, or any other such purpose which makes the number of days of stay uncertain.

A person who DOES NOT satisfy these conditions is treated as an NRI by the FEMA Act.

Who is OCI?

An individual is considered an Overseas Citizen of India (OCI) if –

- They are adults and satisfy one of the following conditions –

- They became a citizen of India on or after 26 Jan 1950

- They were eligible to become a citizen of India on 26 Jan 1950

- They belonged to a territory that became part of India after 15 Aug 1947

- They are a child or a grandchild or a great-grandchild of such a citizen

- A minor who is a child of an Overseas Citizen of India as per the conditions above is also considered an OCI

- A minor who has either parent as a citizen of India or both parents as citizens of India

- A person of foreign origin who has married a citizen of India or the spouse of an OCI Cardholder who is of foreign origin provided the marriage is registered and is existent for a continuous period of not less than two years. This is not applicable to persons who are or have been citizens of Bangladesh or Pakistan.

You have to consider the conditions mentioned above to decide on how you are going to undertake your banking activities and investments.

For example, if your status is ‘NRI’ based on the criteria above, and you want to invest in shares, you would need to open a Demat account under the Portfolio Investment Scheme (PIS) and not just the usual Demat account.

If you are classified as a Non-Resident Indian or OCI as per the definitions above, you cannot open a new PPF account.

There have been some amendments in the Income Tax Act about the taxation of income of NRIs.

Read More – About OCI

Who is NRI – Income Tax Act

Those who don’t fall under these definitions are NRIs.

Must Read – NRI Frequently Asked Questions And Answers

Indian Income below 15 Lakh

“An individual is a resident in India if he is in India for a period of : 182 days or more during the previous year.”

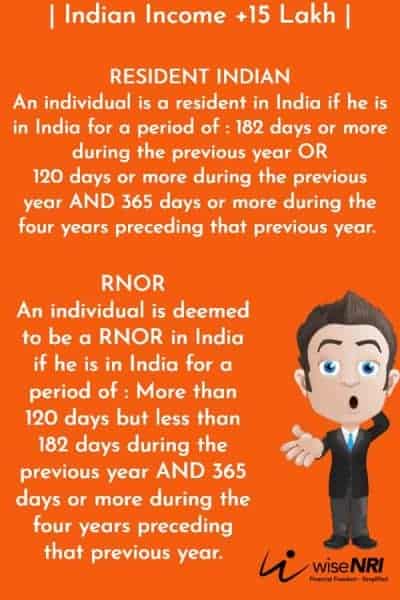

Indian Income above 15 Lakh

Who am I?

Let us look at the basics first. There are four status applicable to individuals –

The status Resident and Resident Ordinarily Resident are applicable to residents.

Resident & Not Ordinarily Resident(RNOR) and NRI apply to NRIs or NRIs who have recently returned to India.

We will look at Resident & Not Ordinarily Resident (RNOR) and NRI in more detail.

Read – Myths and Facts About NRI Status

Who is Non-Resident Indian

There are multiple scenarios to be considered –

Scenario 1

An Indian Citizen or Person of Indian Origin (PIO) who is outside India, comes to India to visit, and has his gross income (In India and abroad) from a business controlled or a profession set up in India NOT exceeding Rs. 15,00,000 during the previous year.

The individual is considered as a resident in India if they are in India for

182 days or more during the previous year.

They will have to file income tax returns as resident Indians.

Check – Penalty for not declaring nri status

Scenario 2

An Indian Citizen or Person of Indian Origin (PIO) who is outside India, comes to India to visit, and has his gross income (In India and abroad) from a business controlled or a profession set up in India exceeding Rs. 15,00,000 during the previous year.

The individual is considered as a resident in India if they are in India for

182 days or more during the previous year. OR

120 days or more during the previous year and 365 days or more during the four years preceding that previous year.

They will have to file income tax returns as resident Indians.

The individual is deemed to be a Resident but not Ordinarily Resident (R but not OR) in India if they are in India for a period of

More than 120 days but less than 182 days during the previous year AND 365 days or more during the four years preceding that previous year.

Scenario 3

An Indian Citizen who leaves India for employment abroad or leaves India as a member of the crew of an Indian Ship.

Ans: This person will be considered as a resident if they are in India for a period of 182 days or more during the previous year.

Must Check – Simple Tax Strategies for NRIs Everyone Should Know

Scenario 4

An Indian citizen who is in India for a period of 182 days or more during the previous year OR

for 60 days or more during the previous year AND 365 days or more during the

four years preceding that previous year is considered as a resident if they DO NOT satisfy the following conditions –

- Leaves India for employment abroad or

- Leaves India as a member of the crew of an Indian ship or

- As an Indian Citizen or as a Person of Indian Origin (PIO), resides in India and comes on a visit to India.

This can be applicable to Indians who have retired abroad

Scenario 5

Individuals satisfying the following conditions shall be deemed to be Resident but not Ordinarily Resident (R but not OR) in India.

- The person is a citizen of India and was a Non-Resident Indian for 9 out of the last 10 financial years. The person has stayed in India for less than or equal to 729 days in the 7 financial years preceding the current year.

- The person is not liable to tax in any jurisdiction/country for any reason

- The person has income in India and abroad from a business controlled or a profession set up in India exceeding Rs. 15,00,000 during the previous year.

There has been an exception for the financial year 2019-20 because of the COVID-19 pandemic

The time that an individual spent in India between 22 March 2020 and 31 March 2020 (or the date on which they left India before 31 March 2020) will not be taken into account when determining their tax residency. If an individual was quarantined on or after 1 March 2020, such a quarantine period (until 31 March 2020) will not count when determining their tax residency.

Some common questions

- I am an NRI who wants to buy a flat in a cooperative housing society in Delhi. What tax matters should I be aware of?

- I have been living with my family in the UAE for the last five years. I have a business in the UAE. I spend around one month in India on a yearly basis. Should I pay tax in India on my business income in UAE?

It is important to know your residency status for financial matters such as banking, investing, and filing IT returns.

If you have any questions regarding your Non-Resident Indian – add them in the comment section.

Can you help with tax?

(I am an OCI)

I am a non-resident for financial year 2023-24. I returned to India on Nov 5, 2023, after living many years in abroad continuously.

I have stayed in India since then. Pl let me know what my status for financial year is 2024-25.

Thanks!!!

My daughter working uk as nurse, opened bank accounts, her statutes as NRE or NRI?

Last financial year I was 120 days out of india in last finciacal year was out for more than 365 days

Hey Anil,

To provide you with accurate information, please provide additional details about your specific situation.

Dear Hemant,

Thanks so much for the excellent article!

Is there any clear definition of an “Indian ship”?

Deeply appreciate your generosity in sharing your precious time and vast knowledge; may God bless you abundantly ?

Hi Akbar Omar,

“Indian ship” is defined as a ship carrying Indian-flagged vessels & that is registered in India under the provisions of the Merchant Shipping Act, 1958, in India.

I am to live in another country as a retiree and will be staying out of India for more than 183 days this financial year, will I become a nri?

Hello Sanjay,

Yes, if you are staying outside of India for more than 183 days in a financial year (April to March), you are likely to be considered a Non-Resident Indian (NRI) for tax purposes.

I am taking a job in UAE wef 15.9.22 . Will this income be taxed in India . I was an NRI for 15 years for the period 2003 to 2018 . Please advice me on my tax status.

Hi Rajesh,

Please consult with your CA.

I am a NRI (PIO and Citizen of Singapore). I am tax assessee in India as I get income from my properties and interests on deposits. Now I have started investing in Treasury bills. I want to know how the discounts I get in the treasury bills will be taxed?

I am an OCI a British citizen and a defence pensioner receiving pension in India. During FY 2021-22 I have no stayed in India for a single day but stayed in India for 391 days in previous 4 years . Is my Statius for tax purposes NRI for AY 2022/33

Hi Harish,

As per my concern, your status should be NRI.

I try so many Bank in India I don’t get loan I am a nri

I am an Indian. 2 months back I got married in abroad with a foreigner.what should I do with my money in savings account in India. At the moment I can not change the account to nro account as I do not have the right documents yet and my surname is also changed. I tried to contact bank to close my account in India but they said I have to be present in person at the bank to. Close account. What should I do. Is there any time limit to close the savings bank account

Hi Pitu,

You can convert your resident a/c online by visiting the bank’s official website.

And you should convert your resident bank account as soon as possible.

I am an NRI and had no information on NRI rules and regulations until now. So I have done a few things which are not so legal and now want to correct

Hi Abhishek,

Yes, You will have to do things correctly as soon as possible.

You can drop your contacts here, we can connect and guide you accordingly.

Hi Latika,

We can connect over the email which is linked to the profile.

Thanks!

If I get PR status in Canada what are my legal and financial obligations in india

Hi Rewasharan,

You need to do nothing in that case.

I am an NRI living in Australia fore the last 6 years, I am a permanent resident of Australia but not a citizen. I understand that I currently dont qualify to buy agricultural land in India,however if I return to India and work there how long would I have to wait before purchasing an agricultural land.?

Hi Nikesh,

If you reside in India for more than 182 days then you will be considered as Resident Indian and then you can buy agricultural land.

Is it mandatory for a person to have residence permit of a country outside India in order to qualify to become NRI

Hi Saranjit,

Yes it is necessary to have residence permission of a country outside India.

Thanks for your response. Even if I live outside India on a visit visa for more than six months in a year.

If I am going to be a US citizen….am I still a NRI

Hi,

If you become a US citizen, you will be a NRI for the other countries.

I am in Germany since last 2 year’s but my job is not fixed here I am still a Indian employees so should I consider myself as a NRI.

what is the number of days for a person to be designated as NRI, I heard it is increase from 183 days

Hii Umair

You are considered an Indian resident for a financial year:

When you are in India for at least 182 days during the financial year

or,

You are in India for 60 days for the year in the previous year and have lived for one whole year (365 days) in the last four years

FD’S before becoming nri can be continued till matuirity or have to premature the same as becoming nri and what about savings account to do?

Hi Jatin,

You can convert your resident FD’s & Saving account into NRE FD’s & Saving account.

What changes are required to be carried out for a person’s bank accounts and other areas, who has recently acquired a PR status abroad?

Hi Rohit,

You need to change your KYC from resident to NRI as well as open or convert your resident bank accounts into NRE/NRO account.

Hi, I wanted to know what will be my resident status as per FEMA and Income Tax Act? I was in India till Nov 2020 and after that, my company, which is an Indian Company, has sent me for a foreign assignment outside India. The tenure of my assignment will be of 4 years. In such a case, what will be my resident status?

Hi Prakash,

As per FEMA act your resident status will become NRI immediately after leaving India. And As per Income Tax act if you spend less than 182 days in India in any FY your resident status will become NRI.

This is a general query for FILING the ITR.

1. I am NRI for past 10 years.

2. I have 5 years FCNR FDs and say get USD 5000 per year, that is say and interest of INR 3.5 lacs.

3. I have 5 NRE FDs. I earn interest of INR 4 lacs per year. And I earn INR 2 lacs per year on NRE Saving Account.

4. I have NRO FD and Saving account. I earn total interest of 1 lac per year.

5. I have NO other income in India (rent or shares etc.)

Is it mandatory to file ITR?

My taxable income is 1 lac per year from NRO FDs and NRO Saving accounts, which is less than the limit 2.5 lac per year.

But my total income from FCNR + NRE + NRO which is 10.5 lacs per year.

What happens if I was required to file ITR and I did not?

As such my Taxable income was always less than 2.5 lacs per year for all the time I am a NRI.

Hi Rakesh,

Interest on FCNR & NRE accounts /FD’s are tax free. But there is a TDS on NRO Account/FD. So you have to file ITR to claim refund of TDS if your total income in India is less than 2.5 lakh.

For 19-20 taxation purposes, my query is, from April to mid-June 2019, I was an India employee and since June I am in UK and UK employee. Will my income be global taxable in India. I have already paid my taxes in the UK.

Hi Abinash,

You don’t need to pay tax in India.

I was abroad during the current financial year from 01 April 2020 to 30 October 2020. What would be my Status in India. I am confused by the 240 days test. I do not have any resident income exceeding 15 lacs. I did not visit India during the Financial Year 19-20 i.e., 01 April 2019 to 31 March 2020.

Hi Shyam,

As you stayed less than 182 days in India so your status is now NRI.

Currently I am NRI and plan to return in two months .I stayed more than 10 years abroad.When I return what happens to my NRE FDs. Does it become taxable? I will be RNOR for two FY atleast.

Hi Natarajan,

You have to convert your NRE account to RFC account. In that case your NRE FD will be exempt.

I came to India in end March and got stuck till early September due to lockdown. How will this be treated in calculating residency? What will be the number of days required to be outside India in this year? Will it be proportionately reduced from 182 days?

Hi Nirjhar,

If you stayed less than 182 days in India your status will remain as an NRI.

I am NRI for the last 25 years and work outside. On 25th February 2020 I went on vacation to India and stuck up in India due to lockdown and no commercial flights were not operating. I left India on 18th Sept 2020. My job will be terminated on 31st December 2020 and go back to India on 15th January 2021. My question a) what will be the status for FY 2020-21 NRI? b) if I continue to stay abroad till 31st March 2021. I will be considered as NRI?

Hi Sunil,

You status will be RNOR.

click on below link to know more detail.

https://www.wisenri.com/rnor-status/

I work in Kenya and NRI but I have an income in India through a pension. Do I have to file an IT return?

Hi Sanjeev

Yes, you have to file Income tax return back in India

I came to NL on Sep14, 2019 to join my job here. I went back to India to bring my family (24 Oct 2019 – 15 Nov 2019). What will be my status for Income Tax dept India? Note: I was on holiday in Singapore for 15 days in April 2019, not sure if that matters. Regards

Hi Partha,

As you stayed more than 182 days in India your status will be considered as Indian Resident.

Hi

I have a query.NRIs are not allowed to submit form 15G. For 15G submission, we should consider NRI status as per FEMA or Income Tax.

Hi Suresh

As per my knowledge, NRI are not allowed to submit either 15G or 15H.

Hi Hemant,

I came to work outside India (NL) in Sep 14, 2019. I went back to India for 15 days in Nov 2019 to bring my family. I continue to work in NL.

What will be my status as per Income Tax department of India?

Note: I was on a holiday outside India for 15 days in April 2019, not sure if that’s relevant.

Regards

PS Dash