For non-resident Indians (NRIs) looking to invest their foreign earnings in India, an FCNR (Foreign Currency Non-Resident) account is a popular option. This type of account allows NRIs to park their foreign currency deposits in India and earn higher interest rates compared to their home country. In this blog post, we will explore what FCNR accounts are, how they work, and the benefits they offer for NRIs. Also, check if it is a good NRI investment.

Read – FCNR Deposit with Forward Cover

What is the FCNR account for NRI?

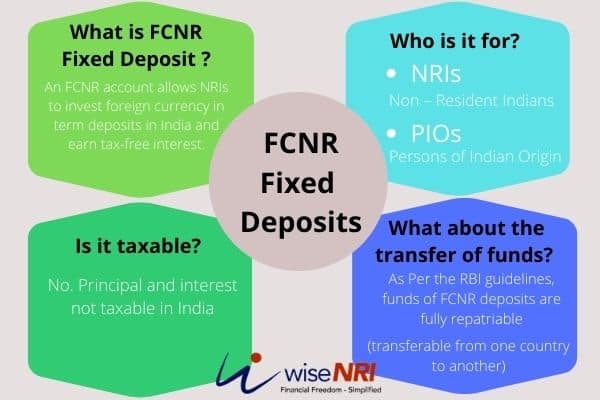

FCNR stands for Foreign Currency Non-Resident account. It can be opened by NRIs and PIOs. It is similar to a Fixed Deposit (Term Deposit accounts ) but it is a Fixed Deposit wherein money can be deposited in foreign currency and interest can be earned on the same.

The FCNR Deposit Account scheme was introduced with effect from May 15, 1993, superseding FCNR (A) where exchange rate dangers were borne by RBI impacting its balance sheet. FCNR account for NRI can be opened with all the Indian banks or its division to invest in India by depositing currencies that are designated, on which you can earn interest. These balances can thus be maintained by Non-resident People of Indian Nationality or Indian origin.

What are the key features of the FCNR Deposit Account?

The key features of FCNR account –

- It is a fixed deposit (Term deposit accounts) that can be opened by non-resident Indians.

- Usually, the tenure of an FCNR ranges from 1 year to 5 years.

- Can be opened as a joint with another NRI

- The FCNR Deposit interest rate is determined by the bank based on the ceiling determined by RBI.

- The NRI can avail of the nomination facility for this account. The nominee can be an NRI or a resident Indian.

- The FCNR can be continued till its maturity date if the status of the account holder changes from NRI to Resident Indian.

Must Read – Can NRI open joint account with resident indian

Why should I have a dollar deposit in India?

- An FCNR deposit is a useful account to invest money in as a regular interest rate is paid.

- There is no currency fluctuation risk as the amount invested and the amount paid back in terms of principal and interest is in the same designated foreign currency.

- Interest earned on FCNR deposits in India is exempt from income tax.

- If you are a Non- Residents Indian, you can invest your earnings which might be in foreign currency in an FCNR without any exchange rate fees, and also get back your investment along with interest without any exchange rate fees.

Which currencies are allowed in the FCNR account?

The account can be opened by depositing money in foreign currency. Major currencies such as the Australian Dollar, Canadian Dollar, Japanese Yen, Euro, UK Pound, and US Dollar are allowed. The currency depends on the banks with which the account is being opened.

Any repatriation restrictions on Foreign Currency Non-Resident accounts?

The amount in the FCNR is freely repatriable. The amount can also be transferred to the nominee’s account without any charges or taxes in case of the death of the primary NRI account holder.

Best FCNR rates in India 2023

Below are the FCNR rates for NRIs offered by some of the top banks in India – 2023 (For comparison, I have also shared 2021 rates)

| Bank | Currency | Tenure | July 2021 | Mar 2023 |

| ICICI Bank | USD | >= 12 months < 15 months | 0.50% | 5.2% |

| ICICI Bank | GBP | >= 12 months < 15 months | 0.02% | 4% |

| HDFC Bank | USD | > 12 months <18 months | 0.01% | 5.4% |

| HDFC Bank | GBP | > 12 months <18 months | 0.01% | 4.1% |

| SBI | USD | >12 months< 24 months | 0.70% | 5.25% |

| SBI | GBP | >12 months< 24 months | 0.67% | 4.5% |

Read – What Is RFC Account?

What are the tax implications of income earned

- Interest income earned is tax-free in India.

- The amount that is transferred to the Resident Foreign Currency account or the Resident Rupee account after maturity is not taxable as well.

Are there any drawbacks

- It cannot be opened as a joint account with a resident Indian.

- Premature withdrawal is subject to penalty. It depends on the bank where the account is.

- The interest rate is usually lower than that of NRE/NRO deposit accounts.

Eligibility criteria for opening an FCNR account

To open an FCNR account, you must be a non-resident Indian (NRI) or a person of Indian origin (PIO) residing abroad. You must also be at least 18 years old, have a valid passport, and meet the bank’s Know Your Customer (KYC) requirements. Additionally, some banks may require a minimum deposit amount to open an FCNR account.

How do I open an account?

You can contact the bank and you require documentation such as Passport, Visa, KYC, FACTA declaration, identity proof and address proof for current residence, income documents may be required.

Loan Against FCNR Deposit

Usually, the FCNR holder can get a loan against this account subject to certain conditions. The loan can be taken for personal or business use.

It’s possible to use your own deposits and get funds from both Indian and overseas currencies.

Where do you avail of loans from the FCNR deposit account?

Ideally, it is possible to avail of a loan from your FCNR deposit anywhere on the planet. You’ll need to check on those banks’ policies prior to applying.

NRE Vs FCNR Account

NRIs can open bank accounts in Indian banks. These can be Non-Resident Ordinary Rupee (NRO) accounts, Non-Resident Rupee (NRE) accounts, and Foreign Currency Non-Repatriable account accounts.

Check – Status for NRE FD after return to India

An NRI can have fixed deposits in an FCNR or in an NRE account. Let us look at the key similarities and differences between the two –

Key Features FCNR account Vs NRE Fixed Deposit

An NRE FD is a fixed deposit account wherein the NRI makes deposits from overseas in an account in an Indian bank. The amount will be converted into Indian rupees.

This account is a fixed deposit account wherein the NRI invests in a foreign currency. Not all currencies are accepted Some of the common ones accepted are the Australian Dollar, British Pound, Canadian Dollar, Euro, Japanese Yen, and US Dollar, etc.

Interest

In the case of an NRE FD, principal and interest are credited to the NRE savings account. The amount can be freely repatriated.

At the time of maturity, principal and interest can be freely repatriated.

Must Check- NRE vs NRO Accounts – Difference Between NRE and NRO Accounts

Taxability FCNR & NRE FD

Interest earned on both NRE FD and FCNR is tax-free in India.

Currency risk

If the rupee depreciates further at the time of maturity and repatriation, you will lose value and money in an NRE FD.

There is not much of currency risk as you invest and withdraw in the same foreign currency

Joint Accounts

NRE FD and FCNR accounts can be opened with NRI as joint holders or an NRI and a resident Indian.

On Return to India

FCNR and NRE deposits can be closed immediately or can be allowed to run up to maturity.

They can be converted to Resident Foreign Currency Accounts after maturity till the individual has an RNOR status.

Many features are similar to both accounts. They primarily differ in currency and interest rates.

Is FCNR a Good Investment?

In the long term, you will see that Foreign Currency deposits & NRE FD returns will be more or less the same because the interest differential will take care of the Indian Rupee depreciation. You can consider Foreign Currency Non-Resident account for diversification… it can also be considered after periods of significant appreciation of the Indian Rupee in the short term.

In conclusion, FCNR accounts provide NRIs with a safe and secure investment option for their foreign currency deposits. With attractive interest rates, the convenience of online banking, and the ability to easily transfer funds between accounts, FCNR accounts are a valuable tool for NRIs looking to invest in India.

As always, it is important to carefully consider your investment goals and seek the advice of a financial advisor before making any decisions. With the right planning and strategy, an FCNR account can be a smart investment choice for NRIs looking to grow their wealth.

If you have any queries related to the FCNR account for NRI – please add them in the comment section.

Is FCNR repatriable?

Hey Denial,

Yes, FCNR (Foreign Currency Non-Resident) deposits are fully repatriable. Both the principal and interest earned on the FCNR deposit can be freely transferred outside India without any restrictions.

thanks. quite informative.

I have a question to ask!!

I am an NRI and have my NRO accounts in India in which I receive income from my Govt. pension, rent from a flat and interests on Savings. Invested in mutual funds also before coming overseas. How can I transfer my NRO bank account fund to overseas ( my account in Australia). thanks for your advice. regards.

devendra

Hi Devendra,

Before you proceed with the fund transfer, ensure that you have complied with all Indian tax regulations. After that Get in touch with your Indian bank where you hold the NRO account. Inform them about your intention to transfer funds to your overseas account in Australia.

I am a NRI from Qatar , whether is it possible to open a FCNR account in India as I am getting salary in Qatar Riyals.

Hi Ajith,

Yes, as an NRI residing in Qatar, you are eligible to open an Foreign Currency Non-Resident account in India.

Hi Ajith,

Yes, as an NRI living in Qatar, you are eligible to open an FCNR account in India.

Who will pay inward remittace charges for FCNR FD on maturity?

Hi Jayeshkumar,

The inward remittance charges for FCNR fixed deposits on maturity are typically paid by the recipient or the account holder.

Hi Jayeshkumar,

Different banks may have different policies regarding who pays the inward remittance charges upon maturity of an FCNR FD. Some banks might deduct the charges from the matured amount before transferring it to your designated account.

I lived in UAE for 2 years and maintained NRI status. But I have few FD which I Booked in the starting. So If I return back to India and become Indian Resident then what will happen to my FDs and interest. Do I need to pay tax on that?

Hi Anil

As per my knowledge when you will come back to India for 2 years you will maintain your RNOR status hence for that time the FDs won’t be taxable. After that FCNR FD and NRE FD will be taxable.

I need to transfer my NRI FD to FCNR account…can to please advise me appoximately how much amount is conversaion cost..? I need to paid any other extra or hidden charges..?

Hi Alex,

Kindly contact with your bank.

I was on NRI status from June 2019 to Jan 2023 and hv returned to India for good. I hv FCNR , which is expiring Jan 2024. Will interest on FCNR for FY 23-24 be taxable?

Hi Kantilal,

As per my knowledge it won’t be taxable.

I am permanent resident of Canada. I intend to sell my flat in India. What will be the formalities . Do I reqire to report to Canada Revenue Agency about the sale and also tax implications there?

Hello Gurmit,

As a permanent resident of Canada, you are required to report and pay taxes on your worldwide income to the Canada Revenue Agency (CRA). This includes any income earned from the sale of property in India. Therefore, you will need to report the sale of your flat in India to the CRA in your annual tax return.

Any tax on exchange of currency in RFC account

Hi Francis,

As per the Indian income tax laws, the exchange of foreign currency held in an RFC account is not taxable in India. This means that any gains or losses arising from the exchange of foreign currency in an RFC account will not be subject to tax in India. However, it is important to note that the tax laws may vary based on the country where the individual is a tax resident.

Is FCNR interest taxable after my status changes from RNOR to resident?

if your status changes from Resident but Not Ordinarily Resident (RNOR) to resident, the interest earned on your FCNR deposits will become taxable in India. It will be added to your total income and taxed at the applicable tax rate as per the Income Tax Act, 1961.

If we want to convert USD amount in FCNR account to INR what flexibilty we have to choose money exchange or we have to accept the rate offerd by Bank in which we did our FCNR FD?

The banks may offer slightly different interest rates depending on the current market conditions, You can check with your bank to see what options are available to you, and compare them with other money exchange services to determine the most cost-effective solution for your needs.

This article mentions that both NRE and FCNR deposits can continue for the NRI upon returning to India (who will be very likely become RNOR). However, while it is true that FCNR deposits can be continued (as allowed by FEMA rules), NRE deposits need to be either closed immediately or need to be re-designated as “resident or domestic” deposits if one prefers to continue them and the interest earned becomes taxable after the re-designation even for RNOR. FEMA rules do not allow continuation of NRE deposits once the person ceases to be NRI

Hello

NRIs can continue to hold FCNR deposits until maturity even after returning to India, while NRE deposits are converted into RFC accounts.

Hi, I am NRI residing in USA as Resident alien and working on H1B Visa. The interest earn on FCNR account is tax free in India. I would like to know if this is also tax free in USA? Since the interest earn will be in USD, do I need to show this earning while filing taxes in US?

Hi Rush,

Interest on FCNR account is not tax free in USA. You have to show that earning in US

It is taxable in USA, subject to DTAA rules between India and USA. Since no tax in India, it becomes taxable in USA under DTAA rules.

I have an nro account in India. Do I have to open a separate account for FCNR

Hi Angappan,

Yes you have to open a separate account for FCNR.

Can FCNR deposits be transferred to the NRE holder’s account before or after maturity

Hi Joni,

Yes it can be transferred to NRE account

Sir,I have a query about FCNR deposit with forward cover in Yen. I am an NRI from UAE and I am here for the last 35 years. I am planning to make FCNR deposit with forward cover. My question is Are FCNR deposit with forward cover fully tax free if the status is RNOR at the time of maturity? I understand interest on FCNR deposit is exempt from income tax if the status is NRI or RNOR.Is the gain on forward contract subject to income tax if the status is RNOR at the time of conversion?

I am an NRI presently and returning to India for good next year. I am looking for1) What will be NRE status called as and how long after return to India2) What will be the status called as RNOR, RFC?3) What will be status of NRE FDs?4) Tax on FDs thereafter?5) FCNR B Deposit if matures 2 years later? FCNR interest rates taxable ?6) FCNR on maturity money can be sent to son in US?

Hi Parul,

You can read the below mentioned articles for your queries.

https://wisenri.com/nre-fd-after-return-to-india/

https://wisenri.com/rnor-status/

https://wisenri.com/rfc-account/

Hello, I plan to open a FCNR account, do I also need a NRE account or can I directly fund my FCNR account from my overseas account to open a fixed deposit?

Hi Suraj,

You need a NRE account to open FCNR account

Interest earned on NRE FD is taxable as per the income tax slab, not tax free as mentioned in the article.

Hi Avi,

Interest on NRE FD is tax free in India.

FCNR account for EURO currency how much interest rate is applicable?

Hi Rajesh,

It depends bank to bank. currently it is near to 3.5%.

Hi Rajesh,

Every bank offers different interest rate. You can check that on their websites.

I need a CA. I am based in UK. Do I employ from India or or UK. Also I have downloaded form form15CA, how can I download FORM15CB?

Hi Anil,

You can contact wisenri for tax service.

Hi Anil,

You can download FORM 15CB from income tax websites. Also you can contact wisenri for a tax consultant.

I need to repatriate ruppies from NRO account to sterling UK pounds

Hi Anil,

You can only repatriate amount from NRE account to overseas bank acount.

Hi , If i open an FCNR account in an Indian bank can I transfer money from NRO account to my new FCNR account, and can I repatriate money from that FCNR account to a UK bank account

Hi Anil,

You can only transfer amount to FCNR account from NRE Account. Yes you can repatriate that amount to a UK bank account

Can I change my nre account to fcnr account

Hi Satnam,

No you have to open a separate FCNR account.

Thanks

Your site says you rquire a Visa to open FCNR account. Visa to India? And why?

Hi Arvind,

Visa to foreign country. Only NRI can open FCNR account that’s why Visa is required.

How can you transfer money from NRO or NRE to FCNR ACCOUNT ?

Hi Anil,

You have to consult with a CA for that.

Thank for your reply Saumya, Which country do i employ CA ?

I have NRE/NRO account with an Indian bank. Can I open FCNR account (US currency) using my NRO account balance (INR)? After the FCNR matures, can I transfer the money to my NRE account and repatriate the money to my bank abroad?

Thanks

Hi Rohan,

Yes you can do that.

I have an FCNR term deposit with SBI will they automatically renew the term deposit on maturity date, term is for one year

Hi Ragbir,

FCNR accounts can be renewed within 14 days after maturity, failing which, the bank will fix the interest rate on renewal. If renewed accounts are withdrawn before a fixed period, banks can take back the interest paid.

Can i open FCNR Account without coming to india

Hi Anil

Yes

If I will open FCNR account in your Bank, I am staying in Canada. My Question: Can I receive the FCNR money in canda back as when I wish.Pl answer either Yes or No only.Thanks , please respond as we all friends seating to Gether right now

Hi Suresh,

Yes, but with remittance charges.

How to send CAD to India

Hii Mr. Vijay

To send CAD to India you can open bank accounts in Indian banks. These can be Non-Resident Ordinary Rupee (NRO) accounts, Non-Resident Rupee (NRE) accounts, and Foreign Currency Non-Repatriable account (FCNR) accounts.

is wiseNRI a bank ?

Hi Shiv,

WiseNRI is not a bank. It’s a blog for NRI’s. for more details you can visit http://www.wisenri.com

As an NRI, I understand that FCNR FD is tax-free in India, however, how will it be treated in the US – as a short-term gain or as interest from a foreign bank account?

Hi Shubhang,

It will be tax-free in India but in the US it will be taxable as per the US tax laws.

How should i remit directly to FCNR FD from overseas, cause everytime i do remittance into my NRE account – the bank deposits in INR only.

I was an NRI for the last 30 years out of which last 17 years in the oil field with 35/35 rotation. All these years I stayed less than 182 days in India. This year may I lose the job and got my retirement benefits. I am not an NRI for this year whether I will have to pay tax for salary till MAY and benefits. Also whether I have to pay tax for my NRE and FCNR deposit interests for the financial year 2020-21.

Hi Sunny,

If you hold RNOR status and if you convert your FCNR into RFC then you will not have to pay any tax.

Which bank gives the best interest rates on FCNR deposits in India?

Hi Shiv,

You can check this on banks website.

After return from NRI how long we can maintain FCNR?

Hi Palaniappan,

As per my knowledge, FCNR can be maintained for 2 years after return to India.

Do NRIs have to pay capital gains on property even if there is no gain?And how is it calculated?

Hi Baiant,

As per my knowledge, there will be no tax if there is no gain. Capital gain is calculated as: Sales Value(Sell Value-Any transfer fee or brokerage)-Cost of Acquaisition(Purchase Cost+Cost of Improvement).

Interest of NRE Deposit taxable to RNOR?

Hi Eswaran,

As per my opinion, it is not taxable.

What is the rate of interest in this account for one year?

Hi Mr. Sethi,

Interest rate differs from bank to bank and Currency to currency, normally it would be around 0.50%-1%.

What is the status of FCNR,NRE deposits once one attains resident status?

Hi Eswaran,

As per my knowledge, FCNR account can be hold for 2 years after returning to India. NRE fds interest will be taxable if you are not an NRI or RNOR.

0.48, 0.75, 0.01 interest rates in 2020 ? Looks like banks are indirectly discouraging FCNR deposits

Hi Amar,

Yes, that’s possible. You may be surprised SBI is not even interested in NRE FD.

What is the tax implication on the interest from FCNR deposit if you have a RNOR stays ?

Hi Vinod,

FCNR is tax-free in the case of RNOR.

My wife returned to India in July19 after being NRI. my queries are :

1 ) When she become RNOR from NRI status ?? from July 19 itself or only after spending 181 days in India??

2) when she is obligated to convert her current NRE deposits / NRE account to RFC deposit or rupee a/c now itself or after spending 181 days in india??

4) Can she convert NRE deposits to RFC deposits after maturity which in some cases several years away.

3) underthese circumstances , since current NRE deposits can be continued till maturity what will be tax treatment for the interest earned either for NRE deposit or RFC deposit if we choose to convert so now itsef during RNOR or after that ( ROR ) ??

Please advise.

Hi,

Please refer https://www.wisenri.com/nre-fd-after-return-to-india

Hi, Barun

FCNR deposit can be allowed to run up to maturity. But, you might get contracted rate of interest till maturity.

On return to India, how long can i continue my FCNR deposit

Hi. Barun,

Please refer https://www.wisenri.com/nre-fd-after-return-to-india

Is FCNR deposit interest taxable in case of RNOR?

Hi Pandurang,

It’s tax-free.

Fema says the NRI upon becoming resident,has to redesignate FCNR as RFC and the interest thereafter is tax free.

RBI says, one can hold on to FCNR till its first maturity, even after the NRI becomes ROR, but it does not match with FEMA.

IT Act says, for 2-3 yrs NRI can be RNOR after returning, and thereafter Interest on FCNR, if continued till first maturity or RFC, if redesignated, as per FEMA or RBI, is taxable. Which one is more authentic and transparent. RBI, FEMA, or IT

Hi Ramdas,

As per Section 10 (clause 4(ii)) of the Income Tax Act, NRE interest is exempt from tax only for those who qualify as NRI as per FEMA. Since, as per FEMA, you become resident from day 1 of permanent return, you cannot hold NRE deposits. Even if you do ( as you said that RBI allows so ) the interest on such NRE deposits is taxable.

Besides FD deposit in FCNR is there any financial instrument risk free like( Gov. bonds which can be considered with interest rate higher then FD)

Hi Shankar,

Tax-free bonds are giving around 6% – available in the secondary market.

EUR FCNR interest is very low compare or even negligible to other currencies. Can i invest in USD from Europe, is any specific restrict in opening FCNR based on country you stay.

Hi Sara,

Yes, you can invest.

Can you tell us in which section of Income Tax law, it is mentioned that interest earned in FCNR account is tax free in India. Regarding NRE FD, it is there.

Hi Amiya Maji,

As per section 10(4) of the income tax act, interest earned on FCNR deposit is exempt from tax.

It’s not very easy to open FCNR account with few banks. The staff don’t know about this product. It’s a pity. They take long time & long procedure to open with few banks.

Hi Sartaj,

That’s true most bankers have no clue about NRI issues.